Bitcoin's Journey to $100,000 Outlined by Glassnode

Glassnode analysts have released a detailed report on Bitcoin’s evolution and the remarkable milestones achieved by the cryptocurrency. From its genesis block to the long-anticipated $100,000 mark, Bitcoin (BTC) has transformed from a small Internet experiment into a key component of global financial infrastructure.

Key Highlights from the Report

A History

Throughout its history, the Bitcoin network has handled 1.12 billion transactions totaling $131.25 trillion in value. This highlights its increasing significance and use, with Bitcoin’s market capitalization at one point surpassing $2 trillion, even exceeding the value of silver.

Mining contributions

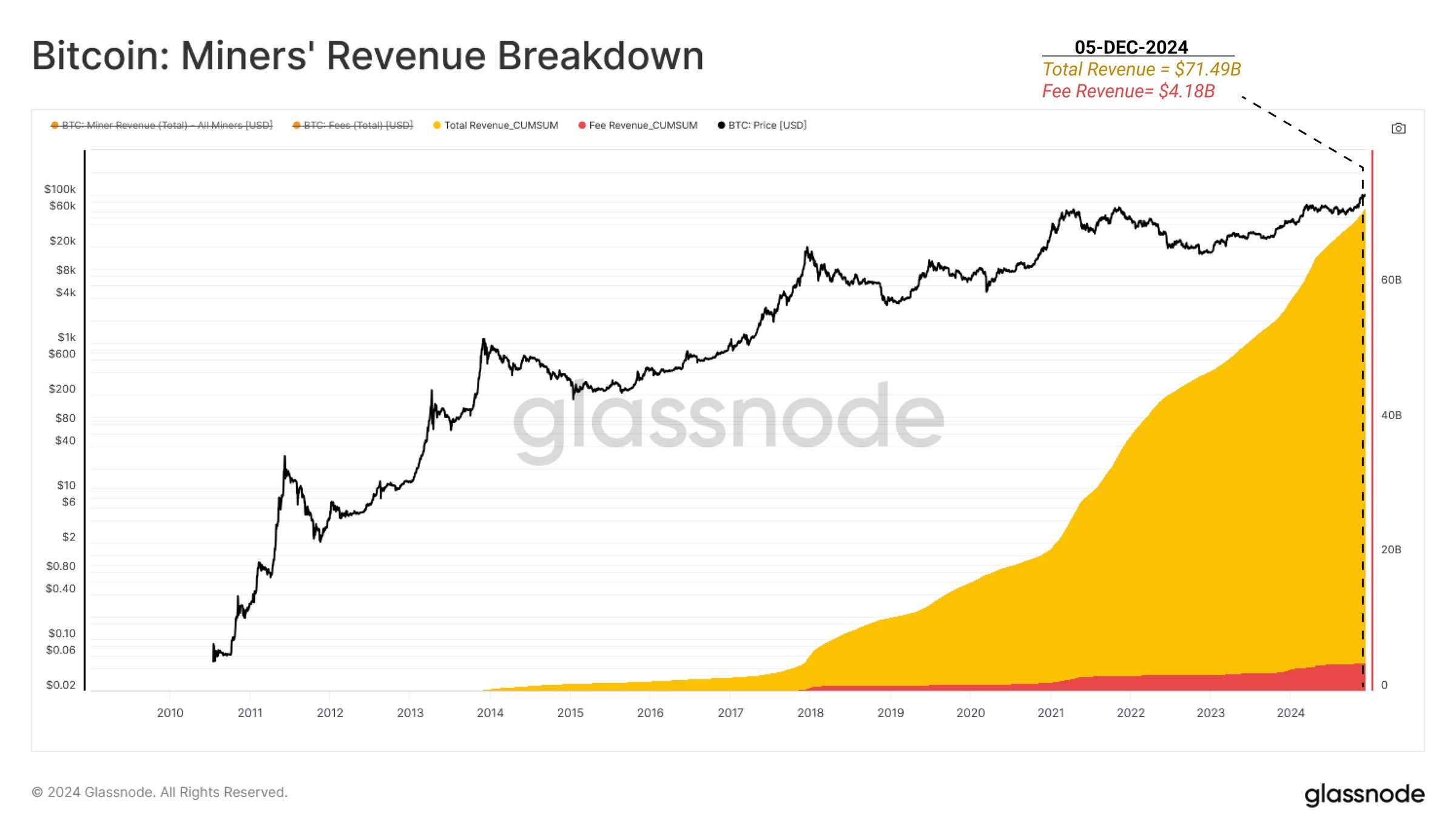

Source: Glassnode

In 5,256 trading days, miners have produced 19.79 million BTC (94.2% of the total 21 million supply). These efforts have generated $71.49 billion in revenue – $67.31 billion from block rewards and $4.18 billion from transaction fees.

Market and investor insights

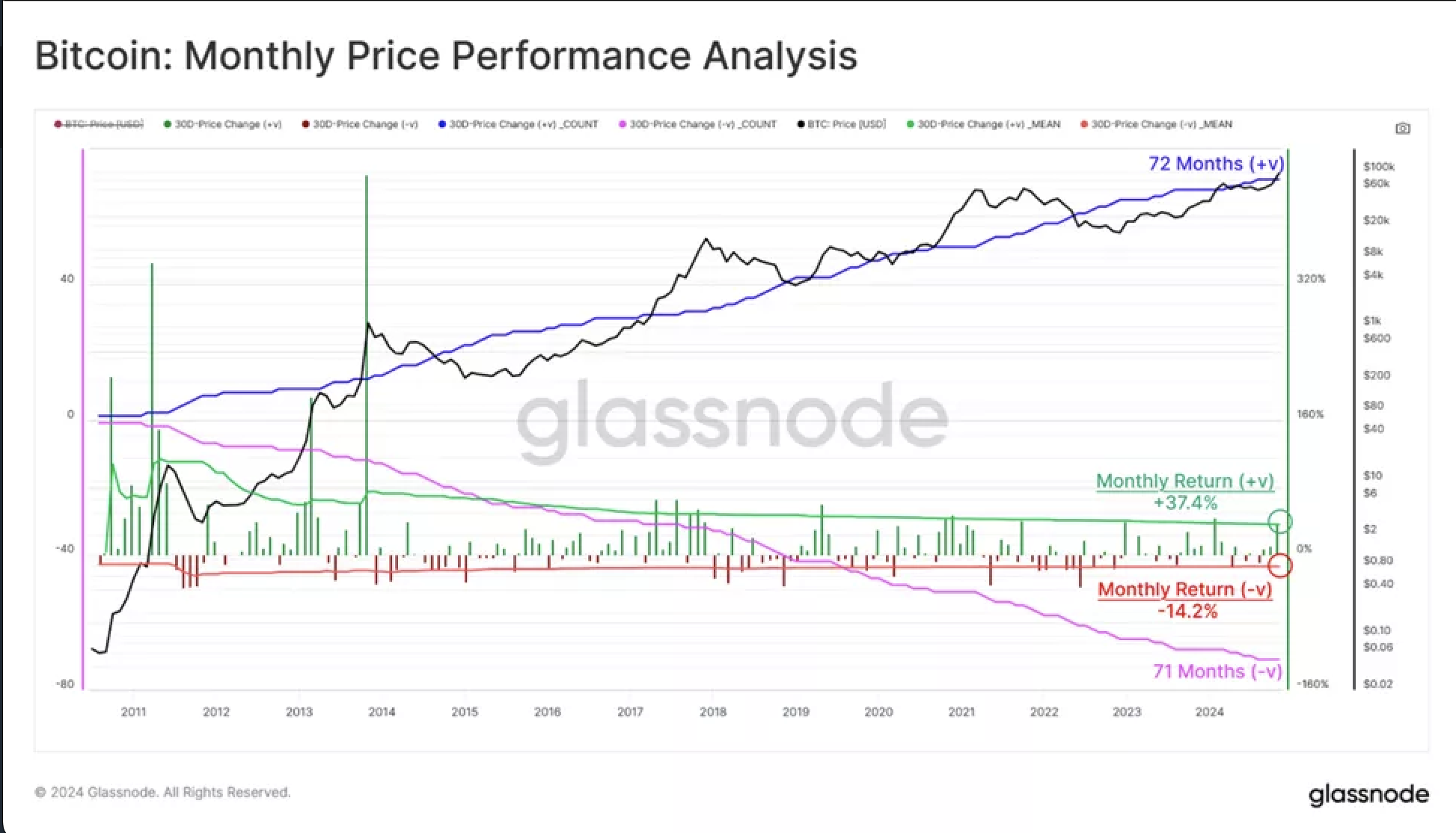

Source: Glassnode

Bitcoin has had 72 months where its value went up, with an average increase of 37.4%. On the other hand, it also had 71 months where its value dropped, with an average decrease of 14.2%. Overall, investors made $1.27 trillion in profits but lost $592 billion, leaving a net realized value of $750 billion.

Distribution of holdings

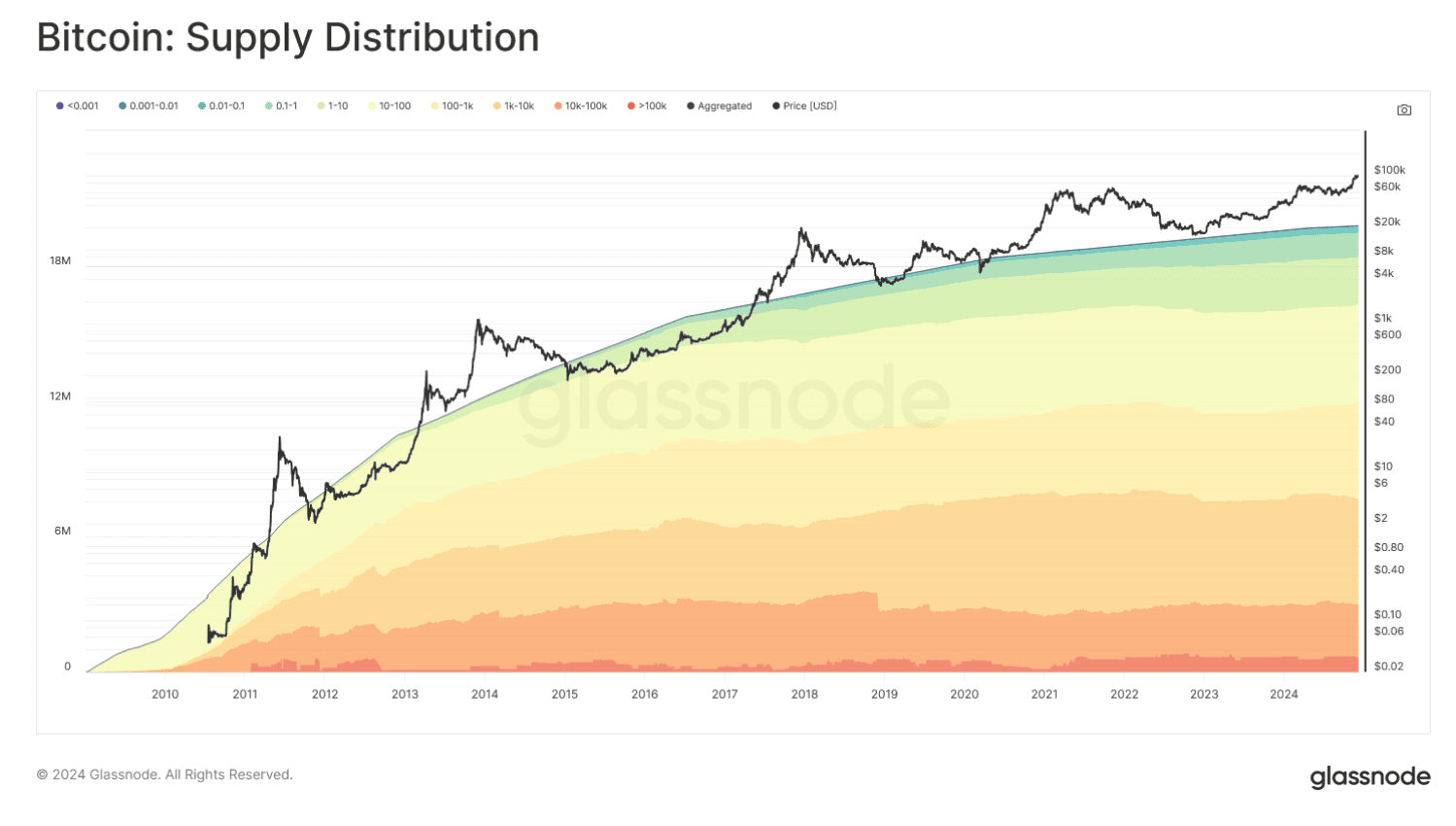

Source: Glassnode

According to the report, 82.1% of wallets control between 10 and 100,000 BTC or more. The majority of accounts holding over 1,000 BTC belong to institutional entities, such as exchanges, fund providers, and corporations..

Network growth and efficiency

The Bitcoin network has created 873,304 blocks so far, with the average time to mine a block now reduced to 9.6 minutes thanks to improvements in computational power. In fact, 37% of all the computational work in Bitcoin's history was done in 2024 alone, showing a massive growth in mining efficiency.

The Road Ahead

Glassnode’s analysis highlights Bitcoin’s ongoing institutionalization, with exchanges, ETFs, and other major players balancing individual ownership. This shift has provided liquidity and stability while preserving the decentralized ethos of the network. As Bitcoin achieves new milestones, its evolution remains a testament to the potential of blockchain technology and decentralized finance.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.