Cryptocurrency Exchanges

This blog post will cover:

- Centralized crypto exchanges

- Decentralized crypto exchanges

- Instant crypto exchanges

- Peer-to-peer (P2P) crypto exchanges

Nowadays there is a great variety of cryptocurrencies and special services where it's possible to exchange one crypto to another. A person, who wants to exchange crypto, has several ways to do it. In this article, we will describe different types of crypto exchanges considering their advantages and disadvantages.

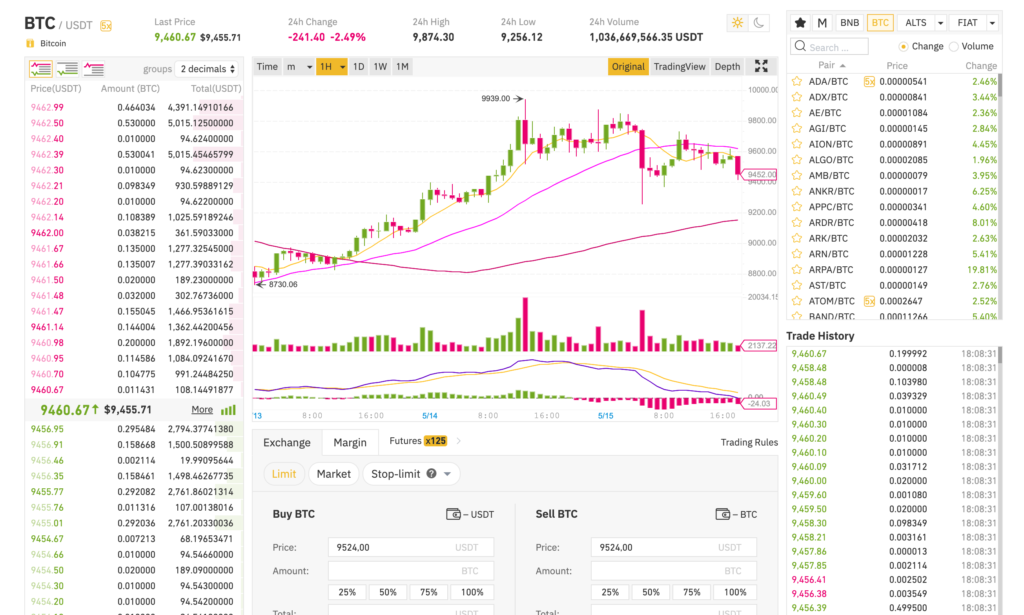

Centralized crypto exchanges

How does it work?

A centralized crypto exchange is the most widespread type of exchange services. The centralization means that each decision is made by the central authority, it also has a centralized software and all the operations are run through the same server.

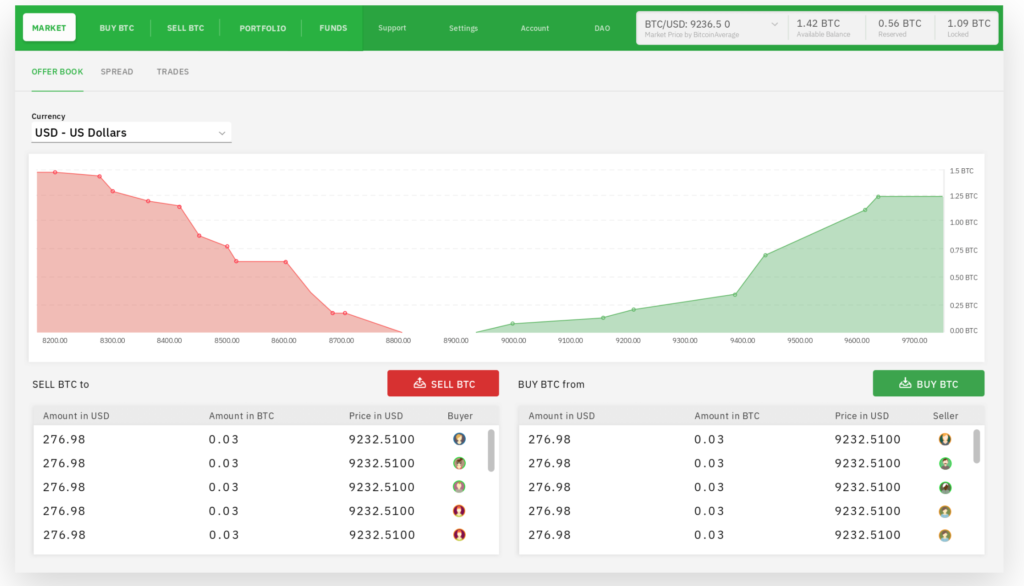

In general, the centralized cryptocurrency exchanges remind a traditional stock market. They give traders an opportunity to negotiate on the price of assets. Sellers place an ‘order’ for the amount of crypto they want to sell and estimate price. Buyers have two options: to choose from the orders which are already placed on the crypto exchange or to make their own ‘buy order’. The main function of the crypto exchange service is to connect matching offers.

What are the advantages and disadvantages?

Advantages:

- High speed and current prices.

- Enable users to interact with the market directly.

- High liquidity.

- Wide range of cryptocurrencies.

- Some cryptocurrency exchanges also provide an opportunity to make fiat money deposits.

Disadvantages:

- No control. Users do not really have control over their funds or orders they make. The lack of users’ control over funds leads to an increased risk of hackers attacks. They happen from time to time resulting in a loss of huge amounts of assets. The absence of control over orders means that they can be closed without preliminary notifications if the estimated time is over.

- Not anonymous. The current legislation makes it impossible to create this type of crypto exchanges anonymous, they are obliged to share some personal information.

- Withdrawal time. Sometimes withdrawal can take up to several days, which may seem inconvenient.

Who commonly uses centralized crypto exchanges?

The centralized cryptocurrency exchange is a good choice when someone operates big amounts of crypto assets. A trading volume of centralized crypto exchanges is estimated in millions of dollars. Also, it is a good service for traders who make a profit from exchange rate movements.

What are the examples?

The good examples of centralized crypto exchanges are Binance, Bitfinex, and Kraken.

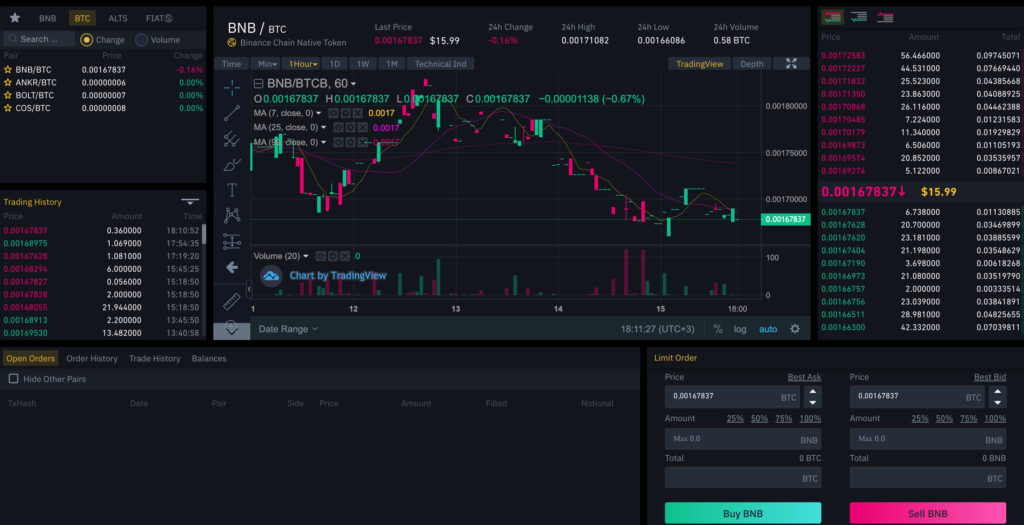

Decentralized crypto exchanges

How does it work?

Unlike centralized crypto exchanges, decentralized ones do not have one operator who makes all the decisions. They use smart contracts instead.

What are the advantages and disadvantages?

Advantages:

- No need to look for a way to conceal the identity.

- Control over funds and orders.

- Security. Blockchain technology increases the level of safety.

- Opportunity to find unpopular trading pairs. Since the trading volume of unpopular pairs is relatively low, big exchanges are not interested in listing them.

Disadvantages:

- Low liquidity and trading volume.

- Fees. Most of the actions require paying additional fees.

- Limitation of the number of trading pairs. Decentralized exchanges usually exist within the single blockchain. For example, Ethereum exchanges allow to trade ETH pairs only.

- Low speed. All the transaction information is fixed in a blockchain, which makes each transaction slower than it could’ve been.

Who commonly uses decentralized crypto exchanges?

When people want to have full control over their crypto assets and at the same time operate medium amounts of cryptocurrency they should consider using the decentralized crypto exchange service.

What are the examples?

The representatives of decentralized crypto exchanges are Etherdelta, IDEX, Binance DEX.

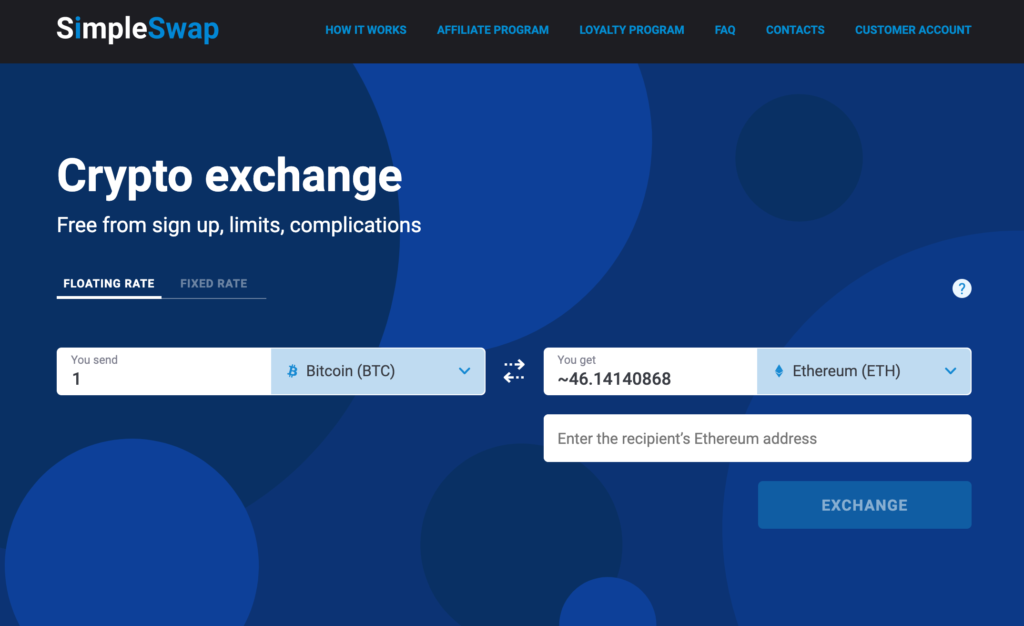

Instant crypto exchanges

How does it work?

An instant crypto exchange provides a simpler way to swap crypto. This type of cryptocurrency exchanges gives an opportunity not to deal with traders, but to trade straight with the service. Their main difference from other crypto exchanges is that they act as a nesting service for a number of exchanges. With the help of instant exchanges, users get access to trading pairs from different exchanges.

What are the advantages and disadvantages?

Advantages:

- Can protect your identity.

- A simple interface.

- Store assets wherever the user wants - instant crypto exchanges don't store users' funds on their service.

- Wide range of cryptocurrencies to exchange.

Disadvantages:

- The exchange process may take longer than with other exchange service types, so the speed is lower here.

Who commonly uses instant crypto exchanges?

In case there is a desire to deal with a big variety of trading pairs, people can benefit from this type of exchange. It is also perfect for customers who prefer simple and user-friendly interfaces.

What are the examples?

The SimpleSwap instant crypto exchange can serve as a good example here. ShapeShift and Changelly also should be mentioned.

Peer-to-peer (P2P) crypto exchanges

How does it work?

Unlike instant cryptocurrency exchanges that enable trading with a service, P2P crypto exchanges provide an opportunity for trading between individuals. They bring an exchange process to a level where there is no need for a third party. Even though the third party does not participate in the exchange process all the time, it may be involved in the case of an argument.

This type of trading requires an Escrow service that can hold the asset until the payment is made. P2P crypto exchanges play the role of such a service. Its software allows to connect buyers and sellers and to make sure that the deal is closed on both sides.

Moreover, P2P uses a technology that allows to simplify an exchange process, Atomic Swaps. It enables to make exchanges directly between blockchains with the help of Hash Timelock Contracts (HTLC). This type of contracts is needed to frame transactions with an estimated time. Within a certain time frame, both parties are expected to verify the transaction; if they don’t, the transaction does not happen.

What are the advantages and disadvantages?

Advantages:

- No censorship. Peer-to-Peer crypto exchanges do not have a central government, they are decentralized, this leaves no space for censorship.

- Transparency. All the transactions happen on a public ledger.

- Anonymity. Personal information is not stored on one server, it is distributed. Thus, all participants remain anonymous.

- Low costs. Costs of transactions may vary depending on the type of transaction and the number of parties involved, but it is still quite low.

Disadvantages:

- Low trading volumes. Usually, these exchanges have very limited trading opportunities. One of the reasons is that their aim so far is to get to a small audience.

- Transactions take a long time. P2P exchanges are not suitable for fast transactions.

Who commonly uses P2P crypto exchanges?

P2P cryptocurrency exchanges are quite new, so far they are used by enthusiasts who have the protection of their identity as a priority.

What are the examples?

Bitsquare and LocalCoinSwap may be mentioned as the examples here.

Since nowadays our most important values are simplicity, and an opportunity to choose, it seems that the instant crypto exchange services will become more and more popular. They provide a certain level of freedom with the possibility to exchange crypto assets with maximum comfort.

In that regard, it is worth drawing attention to some instant exchanges, such as SimpleSwap, as it is a user-friendly platform that supports more than 300 cryptocurrencies. There is no need to sign up or store funds on the service to make crypto exchanges.

You are always welcome to visit SimpleSwap and exchange crypto in the most convenient way.

Anyway, to choose the most suitable crypto exchange service it may be helpful to check reviews of customers who use it. There are special services such as Alternativeto, Cryptogeek, or Trustpilot which can help people to make an opinion on the cryptocurrency exchange.

It is important to consider several things: goals, speed, and amounts of crypto assets. This sort of filter will help to make a better decision.