Market Overview: February 2025

This blog post will cover:

- Bitcoin Performance in February

- Long Squeeze and Record Liquidations on February 3

- Market Manipulation and Accusations

- Trading Activity and Volume

- Top Gainers and Losers

- The Libra Token Scandal

- Bybit Exchange Hack: Timeline of Events

- Market Sentiment in February

- SEC and Cryptocurrency Regulation

- Conclusion

February has traditionally been one of the most favorable months for Bitcoin and the crypto market. However, this year unfolded differently. The month began with a sharp crash, followed by the collapse of a token backed by Argentina’s president, and ended with Bybit suffering a $1.5 billion loss due to a major hacker attack. February concluded with another wave of decline. As a result, Bitcoin lost 17.39% of its value, while Ethereum dropped 31.95%, marking its worst February performance in trading history.

In this review, we will analyze key events and trends of the month, Bitcoin and altcoin price movements, trading volumes, and other critical factors. We will also attempt to answer the pressing question: Has the market lost its recovery potential, or are there new opportunities for growth ahead?

Historical BTC Performance. Source: CoinGlass

Bitcoin Performance in February

After Bitcoin reached a new all-time high of $109,588 on January 20, its price began to decline gradually. February opened at $102,430, but by February 3, Bitcoin had dropped to $91,230, losing over 10% in the first few days. This triggered a severe crash in altcoins and massive liquidations, which we will discuss later.

Following this decline, Bitcoin traded within a relatively narrow range of $94,000 - $99,000 until the end of the month, occasionally absorbing liquidity. However, on February 24, another wave of sell-offs began, pushing Bitcoin down by over 18%, reaching a local low of $78,260 on February 28.

Bitcoin 30-Day Chart. Source: Cryptorank

Long Squeeze and Record Liquidations on February 3

As mentioned earlier, February started with a sharp market decline. On January 31, while Bitcoin was trading above $105,000, former U.S. President Donald Trump announced new import tariffs on goods from Mexico, Canada, and China. In response, Canada imposed a 25% tariff on $155 billion worth of American goods. This created uncertainty and anxiety in financial markets, but since traditional markets were closed for the weekend, the crypto market absorbed the full impact.

Long Squeeze and Liquidations

The market saw reduced liquidity over the weekend, intensifying selling pressure from February 1 to 3. The peak of the decline occurred on February 3, triggering a mass cascade of long position liquidations (long squeeze). Bitcoin’s dominance index temporarily surged to a four-year high above 64%, reaffirming that in times of market turbulence, capital tends to flow into more liquid assets. Bitcoin fell to $91,230, while Ethereum crashed to $2,100. Several altcoins lost 20-30% of their value within 30 minutes. Overall, altcoins declined by an average of 40-50% between February 1 and 2.

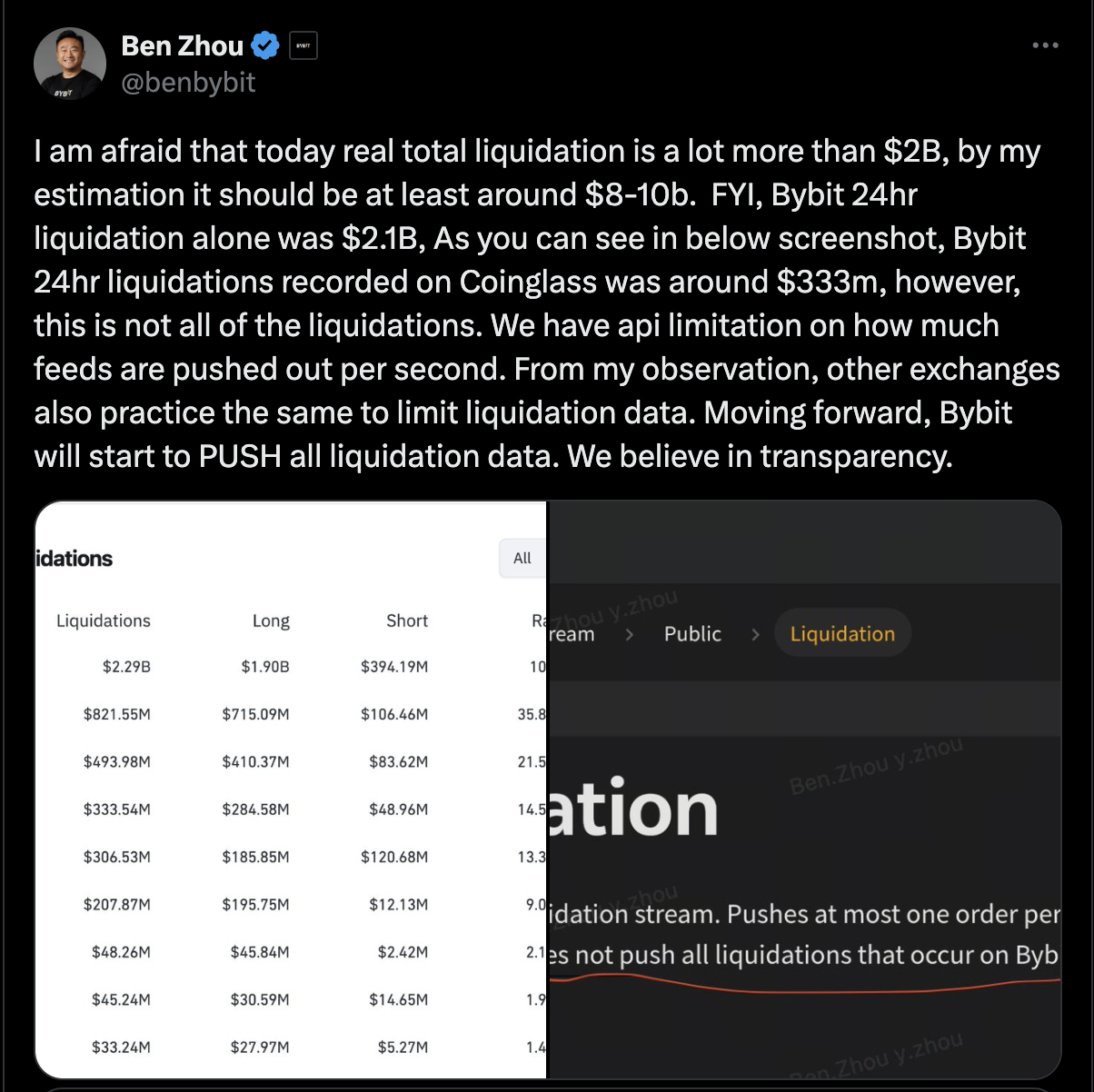

According to Coinglass, daily liquidations reached $2.2 billion, with nearly all liquidated positions being long. However, Bybit CEO Ben Zhou disputed these figures, stating that Bybit alone liquidated $2.1 billion. He estimated that total market liquidations were closer to $8-10 billion.

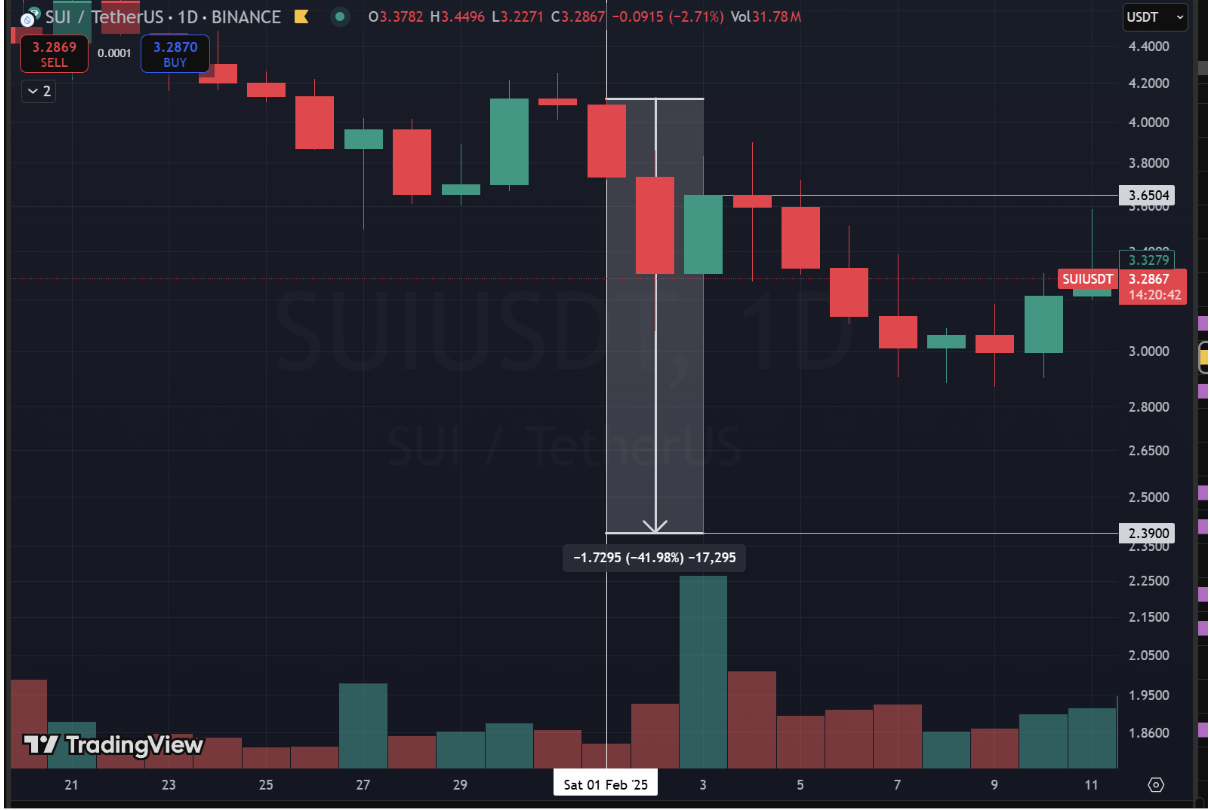

On the SUI/USDT chart, SUI lost nearly 42% in value, dropping to $2.39. However, following the long squeeze, the asset saw aggressive buying, closing at $3.65 on February 3, reflecting a recovery of over 50% from its local bottom.

SUI/USDT. Source: Binance

Market Manipulation and Accusations

Following the crash, the market searched for culprits. Market maker Wintermute was at the center of allegations, with the community blaming them for exploiting the weekend’s low trading activity, Chinese New Year holidays, and overall negative sentiment to manipulate the market.

Wintermute was actively trading BTC, ETH, and SOL while engaging with major exchanges like Coinbase and Binance (with a trading volume of $34 billion on Binance in January). Users accused the market maker of mass selling on open markets, buying back assets via OTC desks after liquidations, and hunting stop-loss orders. In response, the company's CEO issued an official denial.

Regardless of the accusations, this crash reaffirmed that the crypto market remains young and highly volatile. Its growing correlation with traditional finance means that global economic events increasingly impact digital assets.

Under such conditions, trading with high leverage remains extremely risky. The long squeeze on February 3 vividly demonstrated that even the most resilient assets can drop by 10-20% within minutes, while altcoins can lose up to 50% in just a couple of days.

Trading Activity and Volume

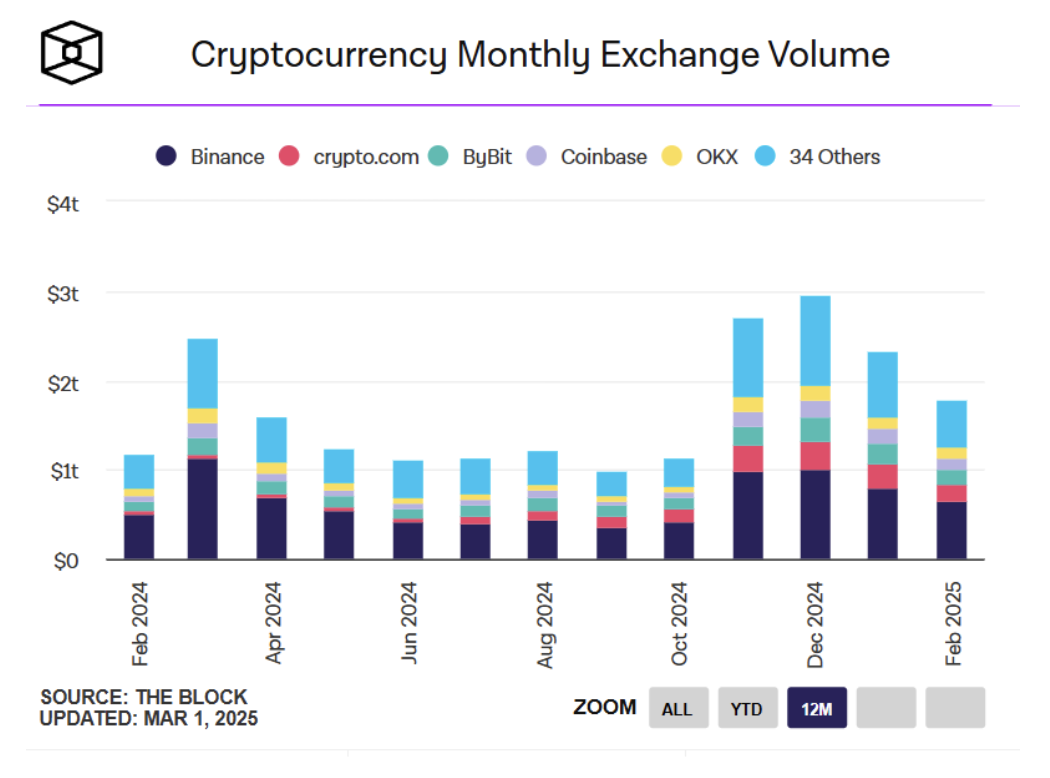

Trading volumes on centralized exchanges (CEX) in February 2025 remained above the 2024 average, reaching $1.77 trillion. However, a clear decline has been observed since the peaks of late 2024: $2.94 trillion in December, $2.32 trillion in January, and $1.77 trillion in February. This decrease can be attributed to falling asset prices, particularly Bitcoin and altcoins, which have significantly declined. As a result, retail investor interest has waned, leading to lower trading volumes.

Market participants are psychologically subdued, with investors and traders uncertain whether the market has entered a bearish phase or if this is just a deep correction before a new growth cycle.

Spot Trading Volume on CEX. Source: The Block

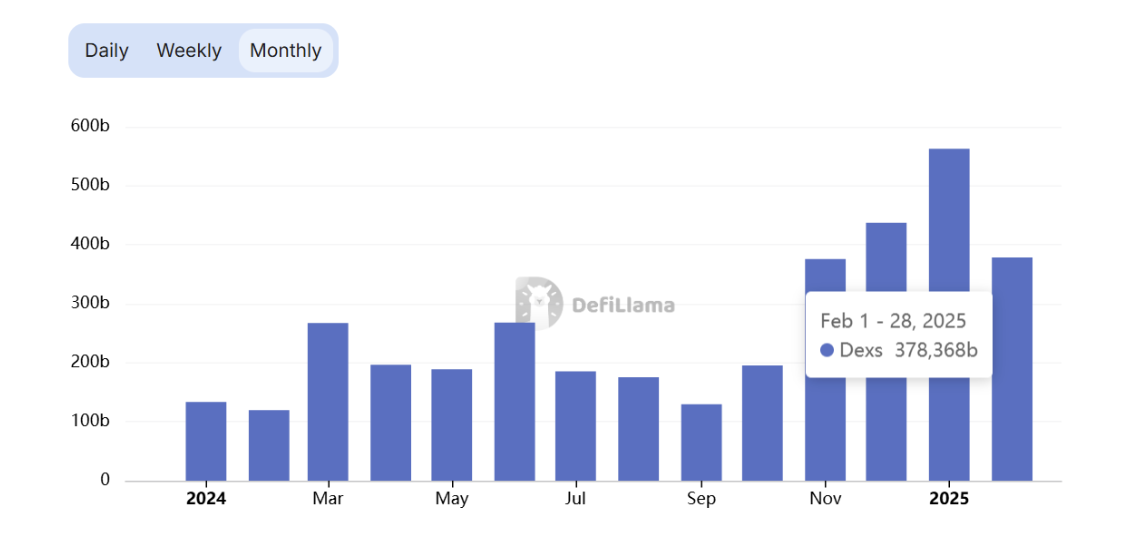

In contrast, trading volume on decentralized exchanges (DEX) remained high, totaling $378 billion in February. This demonstrates sustained interest in cryptocurrencies despite heightened volatility. The market infrastructure continues to mature, offering users more advanced DEX platforms and trading tools.

Spot Trading Volume on DEX. Source: DefiLlama

Top Gainers and Losers

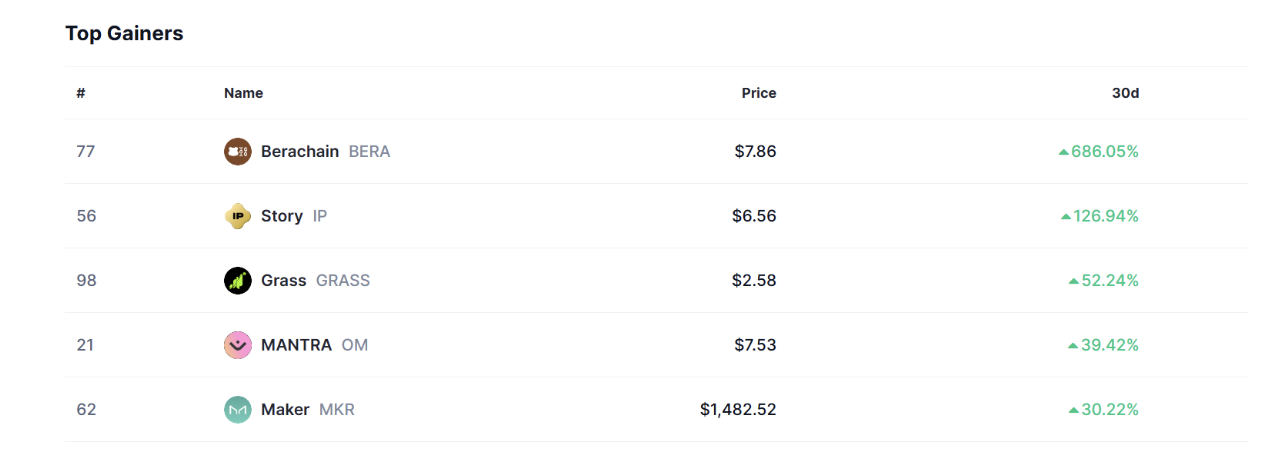

Despite the overall market decline, some tokens saw substantial gains:

Berachain (BERA) +686.05% – A new project with a unique Proof of Liquidity consensus mechanism. You can read a detailed breakdown of the project here.

Story (IP) +126.94%

Grass (GRASS) +52.24%

MANTRA (OM) +39.42%

Maker (MKR) +30.22%

Top Gainers. Source: Coinmarketcap

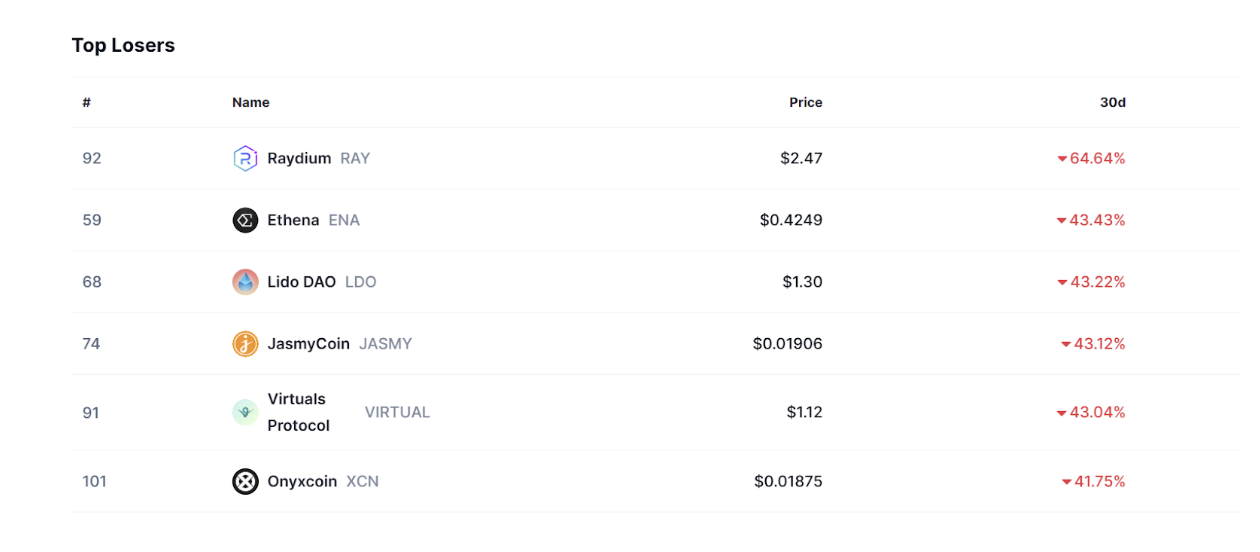

The biggest underperformer of February was the RAY token, associated with the Raydium DEX on the Solana blockchain. Overall, the Solana ecosystem faced significant pressure due to the scandal surrounding the fraudulent Libra token, which we will discuss later.

Other major losers of the month:

Ethena (ENA) -43.43%

Lido (LDO) -43.22%

JasmyCoin (JASMY) -43.12%

Virtuals Protocol (VIRTUAL) -43.04%

Onyxcoin (XCN) -41.75%

Top Losers. Source: Coinmarketcap

Notably, neither the top gainers nor the biggest losers were dominated by a specific sector, indicating that February’s market movements were largely driven by investor sentiment rather than fundamental factors such as hacks, regulatory pressure, or external events.

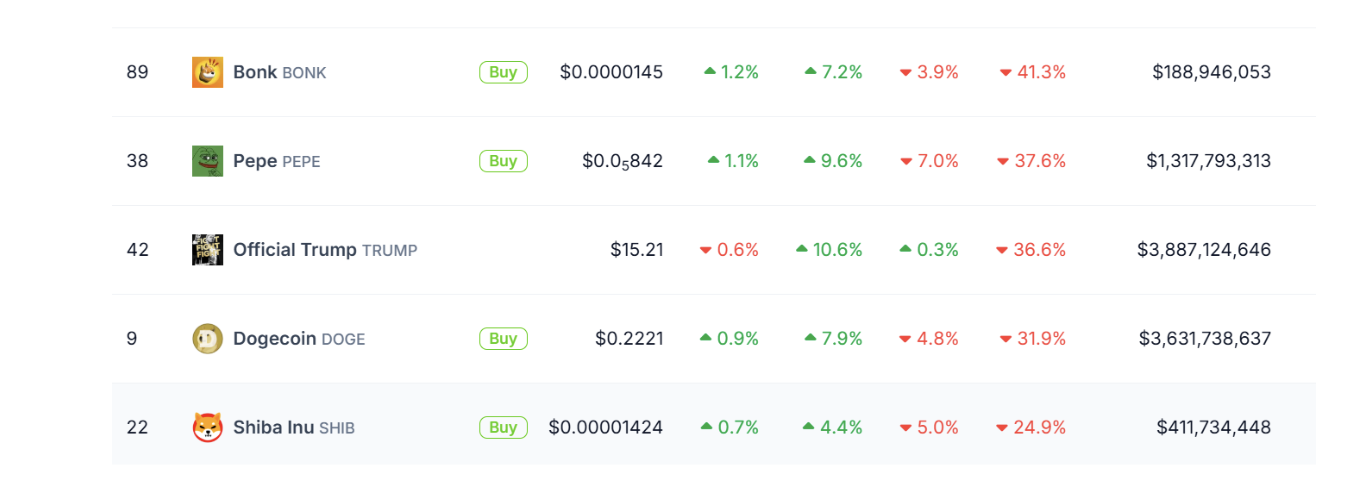

Meme Coins

Meme coins, which had shown negative performance in previous months, continued their decline in February. High-market-cap projects suffered the most: BONK lost over 41%, PEPE 37.6%, TRUMP 36.6%, DOGE 31.9%, and SHIB 24.9%. Their decline reflected the overall state of the market.

Source: Coingecko

In 2024, meme coin growth was driven by hype around the Solana blockchain and the mass launch of meme tokens on it. In 2025, there are currently no clear catalysts for a similar wave, but there is a possibility that BNB Chain, Ethereum, or other blockchains could generate new market trends.

It is too early to conclude that the meme coin trend is over. Their future will depend on the broader market’s recovery. If altcoins start to rebound, liquidity could flow back into meme coins. However, without a strong catalyst for growth, their prospects remain uncertain.

The Libra Token Scandal

February, like January, was marked by a controversial token, but this time it came not from the U.S. president but from Argentina’s President Javier Milei. However, the story unfolded quite differently.

On February 15 at 17:01 (EST), Milei posted and pinned a tweet stating, "This private project will be dedicated to encouraging the growth of the Argentine economy by funding small Argentine businesses and startups." There were no doubts about the authenticity of the post, as Argentine politicians widely shared the news.

Following the announcement, the LIBRA token skyrocketed to a $4.5 billion FDV. However, shortly after, eight wallets linked to the project’s team withdrew $57.6 million in USDC and 249,671 SOL ($49.7 million). These funds were obtained through liquidity manipulation and fees.

Essentially, this was a classic scam where a team launches a token, attracts attention, drives up the price, and then drains liquidity, leaving regular investors with a rapidly depreciating asset. Milei later deleted the tweet and claimed he was unaware of the project, blaming political opponents for setting him up.

LIBRA's 96% crash. Source: Dexscreener

The Libra token was launched on the Solana blockchain, similar to Trump and Melania’s meme coins in January. However, while SOL was rising during the Trump-related launches, the situation turned out differently this time. The negative sentiment, community outrage, and the $49 million SOL withdrawal from Libra led to a sharp decline. Over four days, SOL lost 20%, coming under severe pressure.

This case once again proves that even if a post comes from a high-ranking government official, blind trust is not advisable. Do Your Own Research (DYOR) remains a key principle when dealing with cryptocurrencies. It is unlikely that the Argentine president was aware of the impending scam, but his attempt to highlight economic growth resulted in a scandal. The LIBRA situation serves as a clear example of how easily assets can be inflated and how quickly millions can vanish.

Bybit Exchange Hack: Timeline of Events

On February 21, the crypto industry witnessed its largest hack to date. This time, the incident involved Bybit, the second-largest exchange by trading volume, which lost nearly $1.5 billion in a hacker attack.

It is crucial to remember that customer funds were safe and the exchange itself was not hacked. Only one of the company's cold multisig wallets was compromised by the attackers, protecting user funds. Ben Zhou, the CEO of Bybit, said that the hackers had taken over the exchange's cold wallet and transferred all of its Ethereum to an unidentified address. The funds were soon distributed to several new wallets.

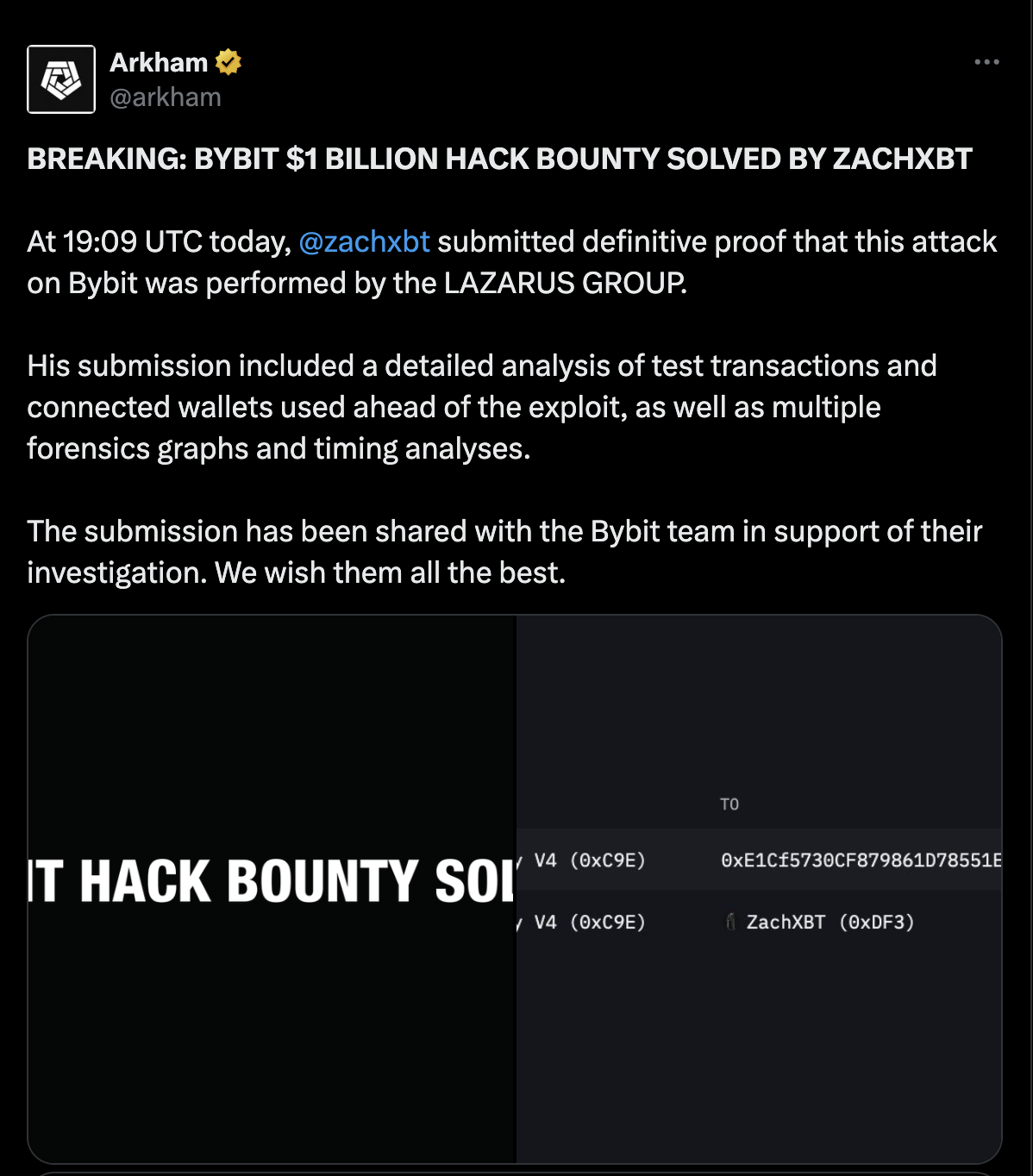

Arkham Intelligence reported that there is evidence linking the attack to the Lazarus Group, a notorious North Korean hacking organization. They were also suspected of the previous largest crypto hack on the Ronin Network in 2022, which resulted in a $620 million theft.

Exchange and Community Response

Bybit’s CEO Ben Zhou promptly addressed the situation, emphasizing that the exchange has sufficient reserves. According to him, while the $1.5 billion loss was unfortunate, it was not critical, as Bybit still held over $3 billion in USDT on its cold wallets.

The exchange faced an unprecedented number of withdrawal requests, processing over 350,000 transactions within 10 hours of the attack. This played a crucial role in restoring user trust, demonstrating that Bybit could withstand such an incident without harming its customers.

Major crypto investors and organizations helped stabilize the situation. Huobi co-founder Du Jun transferred 10,000 ETH to Bybit and pledged not to withdraw it for a month. Other supporters included Conflux, Mask Network, Bitget, MEXC, Solana Foundation, TON Foundation, Tether, and more.

How Hackers Laundered the Funds

ZachXBT claims that the Lazarus Group started laundering the funds after moving 5,000 ETH to a new address. They first transferred assets using the centralized mixer eXch before using Chainflip to convert them into Bitcoin.

Bybit requested eXch to freeze the stolen funds, but the platform refused to cooperate, stating that Bybit had previously blocked user funds received from eXch. The hackers then switched strategies, converting ETH into USDC through Uniswap before withdrawing in BTC via Chainflip.

Chainflip reported detecting attempts by the hackers to cash out the stolen funds in Bitcoin through their platform. In response, developers disabled parts of their front-end services. However, given Chainflip’s decentralized structure with 150 nodes, completely shutting down the protocol was impossible.

Hackers also tried using other services to launder funds. The 15,000 cmETH withdrawal was blocked, and the stolen funds were sent to a recovery account, according to the mETH Protocol team. The CEO of Tether declared that $181,000 USDT connected to the hack had been frozen by the business.

Bybit launched a Bounty Recovery Program, offering a 10% reward for successfully retrieved funds. If all funds are recovered, the payout could reach up to $140 million.

Lessons from the Bybit Hack

By February 24, Ben Zhou confirmed that Bybit had fully replenished the stolen ETH, and a new audit confirmed 100% backing of customer assets on a 1:1 model. Panic subsided, users returned, and the platform resumed normal operations.

Bybit survived the largest attack in crypto history, proving its financial resilience. This case demonstrated that even well-reputed exchanges are vulnerable to attacks. Despite the substantial loss, Bybit did not halt withdrawals, showing a high level of stability.

This event reinforced Bybit’s reputation, integrity, and liquidity, preventing further panic. The response from the crypto community and major companies showed that the industry is maturing, with participants willing to support one another.

Regardless of how reliable an exchange may be, it is always crucial to follow the golden rule of crypto security: trade on exchanges, but store your main assets in personal wallets.

Market Sentiment in February

Market sentiment is an important leading indicator, as periods of euphoria are often followed by cooling phases. January 2025 remained largely neutral, but in February, the situation deteriorated sharply.

The Fear and Greed Index spent most of the month in the "fear" zone and dropped into "extreme fear" by the end of the month. The last time such low levels were observed was in May 2022, during the collapse of the Terra (LUNA) ecosystem.

These indicators reflect a deeply pessimistic market sentiment, comparable to a capitulation phase. Historically, such extreme fear levels have often preceded market reversal points. Whether this pattern will hold true this time remains to be seen.

Fear and Greed Index. Source: CoinMarketCap

SEC and Cryptocurrency Regulation

February was a crucial month for crypto market regulation. The leadership change at the SEC, following Donald Trump's return to the U.S. presidency, marked the beginning of a new approach to the industry. The new SEC Chairman, Mark Uyeda, stated in one of his first interviews that the SEC should end its war against the crypto industry and establish clear regulatory guidelines.

In February, the SEC made several key decisions that signaled this policy shift:

Dropped legal proceedings against Uniswap Labs (February 25).

Ended its investigation into Robinhood (February 24).

Dismissed the lawsuit against Coinbase (February 21), allowing a review of the status of certain tokens previously classified as securities.

Additionally, in February, the SEC approved its first yield-bearing stablecoin. Figure Markets was granted permission to issue the YLDS stablecoin, registered as a security. This marks a significant step toward integrating cryptocurrencies into the traditional financial system.

The SEC also held discussions with the Chia Network team to address crypto regulations and fraud prevention. Furthermore, the commission announced the formation of a Cybersecurity and Emerging Technologies Unit (CETU) to focus on investor protection and combating fraud.

In February, Grayscale and CoinShares submitted applications to launch multiple cryptocurrency ETFs, including those for LTC, ADA, XRP, DOGE, and DOT, highlighting growing institutional interest in cryptocurrencies.

All these developments indicate a shift in the SEC’s stance on cryptocurrencies. In the long term, this could strengthen institutional investors' confidence and accelerate the industry's growth.

Conclusion

February was one of the most challenging months for the crypto market. The Libra token scam, mass liquidations, and the Bybit hack pushed the market into a state of depression, reflected in the Fear and Greed Index reaching its lowest levels since May 2022.

Despite these setbacks, the crypto market continues to evolve, and its long-term prospects remain promising. It is important to remember that the market reflects overall social sentiment, and conditions could shift dramatically in March.

The upcoming month is expected to be eventful, with the first-ever White House crypto summit featuring Donald Trump on March 7 and the Federal Reserve’s key interest rate decision on March 19. These events could have a significant impact on the market.

A single negative month like February is not enough to change the overall trajectory of the crypto industry. It is crucial to focus on long-term trends rather than succumb to short-term panic.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.