Market Overview: January 2025

This blog post will cover:

- Bitcoin Performance in January

- DeepSeek and Its Market Impact

- Trading Activity and Volumes

- Hype of the Month: Trump Token

- Is the Meme Coin Trend Over?

- Market Sentiment in January

- Conclusion

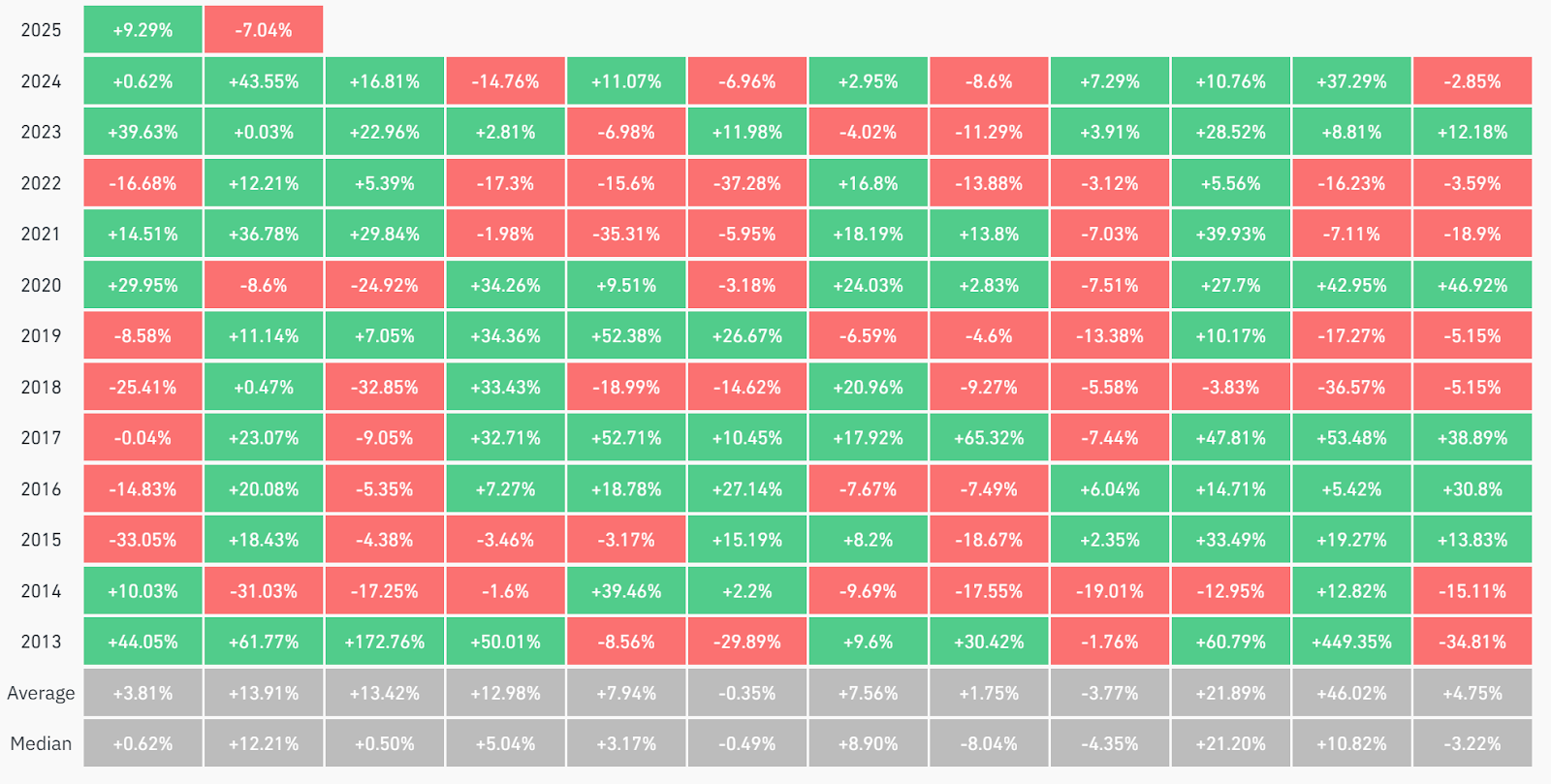

Traditionally, January lacks clear seasonal trends and is a month of mixed market dynamics. Over the past 12 years, Bitcoin has ended January six times in positive territory and six times in negative. January 2025 was a month of contrasts in the crypto market. Bitcoin reached a new all-time high, closing the month with a 9.29% gain, while most altcoins declined.

The biggest event of the month was the launch of the Trump token, which sparked enthusiasm among retail investors and led to a surge in trading volumes on decentralized exchanges, reaching record highs. Other key market drivers included Donald Trump’s inauguration, the U.S. Federal Reserve meeting, and the activity of the Chinese startup DeepSeek. In this review, we will take a closer look at the main trends and events of January, the performance of Bitcoin and altcoins, trading volumes, and other key aspects shaping the first month of 2025.

Bitcoin Returns History,Historical BTC Performance | CoinGlass

Bitcoin Performance in January

After a neutral December, in which Bitcoin lost over 2%, many expected January 2025 to bring a positive push, fueled by Donald Trump’s return to power. However, the month started weak, and by January 13, BTC had dropped to $89,000 before bouncing back and beginning a strong rally.

A week later, on January 20—Inauguration Day—Bitcoin hit a new all-time high of $109,588, gaining over 22% in just seven days. This powerful momentum once again confirmed the strength of the asset, which remains the flagship of the crypto market. For the remainder of the month, BTC traded within a narrow range and ultimately closed January at $102,429.

Source: Cryptorank, Bitcoin 30 Day Chart

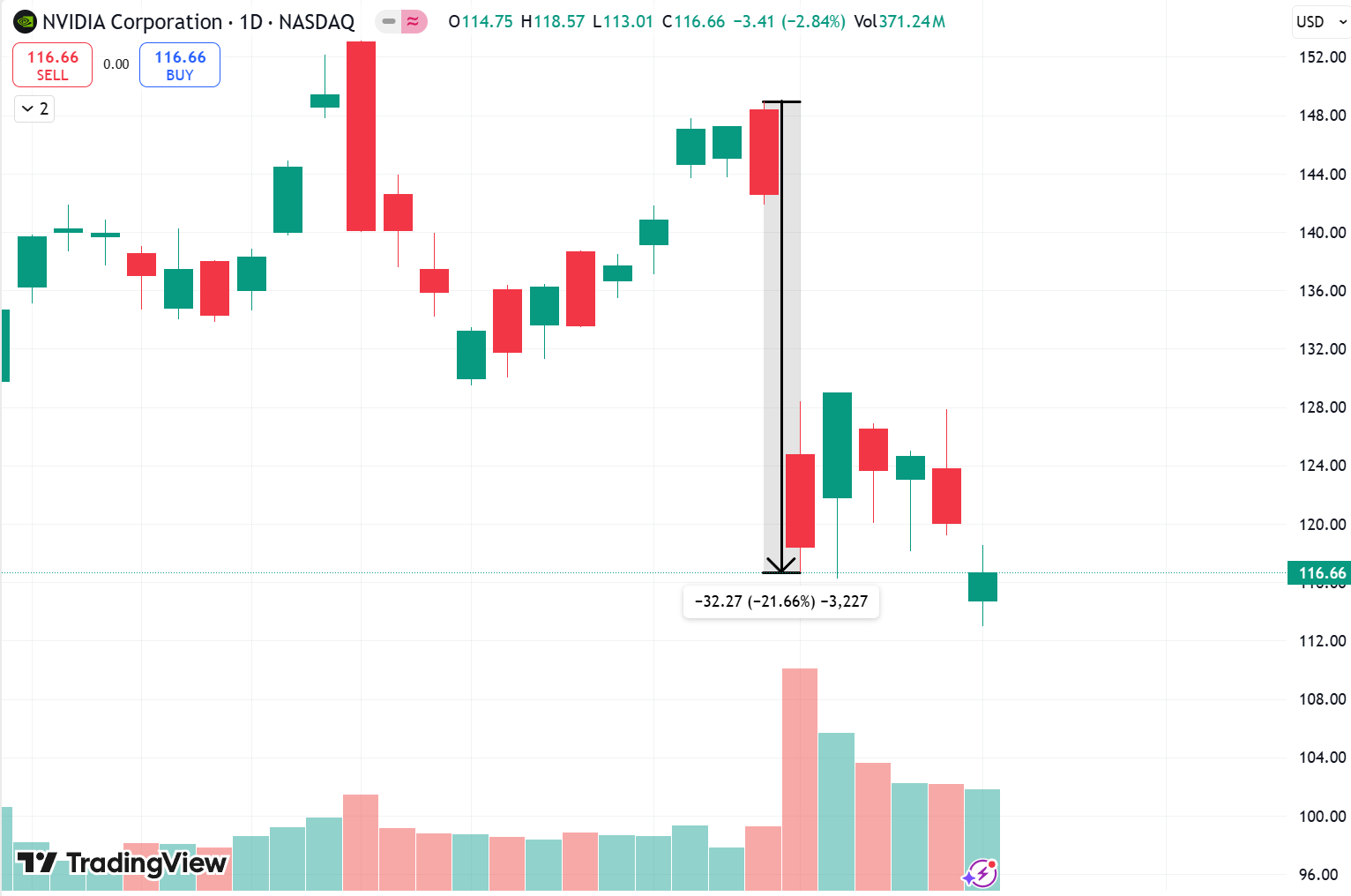

Top Gainers and Losers of January

Top Gainers

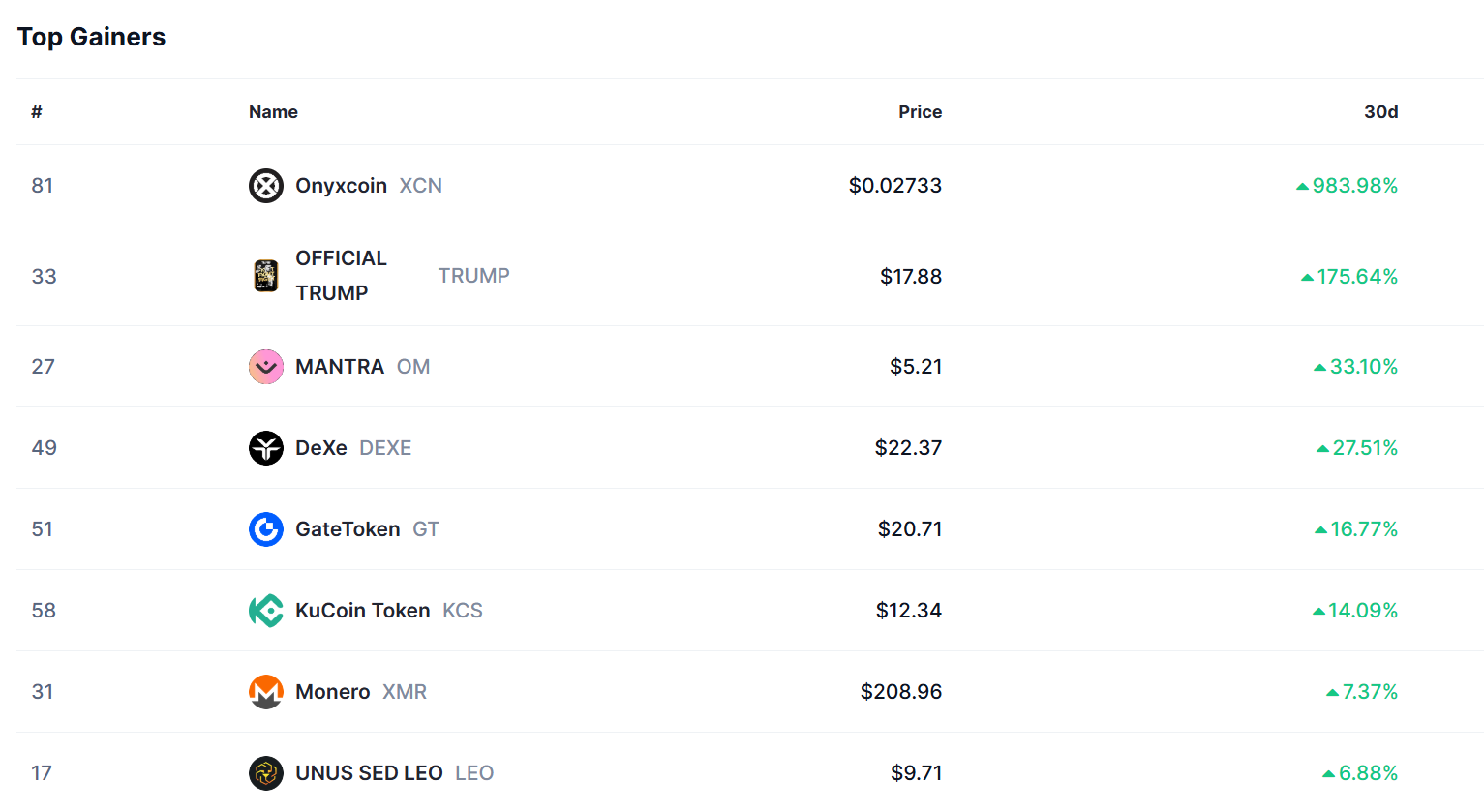

Despite overall pressure on the altcoin market, some tokens recorded significant gains.

Onyxcoin (XCN) was the top performer, soaring by +963.98%. The project provides infrastructure for building financial services, with the XCN token used for governance and service discounts.

Official Trump (TRUMP) meme coin gained significant attention in January, which we’ll discuss in detail below.

Biggest Losers

The biggest underperformer of the month was Official Melania Meme (MELANIA), a meme coin linked to Donald Trump's wife. After an initial surge, it quickly entered a correction phase, ending the month down 80.27%.

Other major losers:

Virtuals Protocol (VIRTUAL): -68.07%

Pudgy Penguins (PENGU): -67.51%

Dogwifhat (WIF): -64.74%

Floki (FLOKI): -55.05%

The decline of meme coins is particularly notable, as they showed impressive growth in 2024. However, December 2024 and January 2025 revealed their weakness, highlighting the high volatility and speculative nature of these assets.

Top gainers & losers. Source: Coinmarketcap

DeepSeek and Its Market Impact

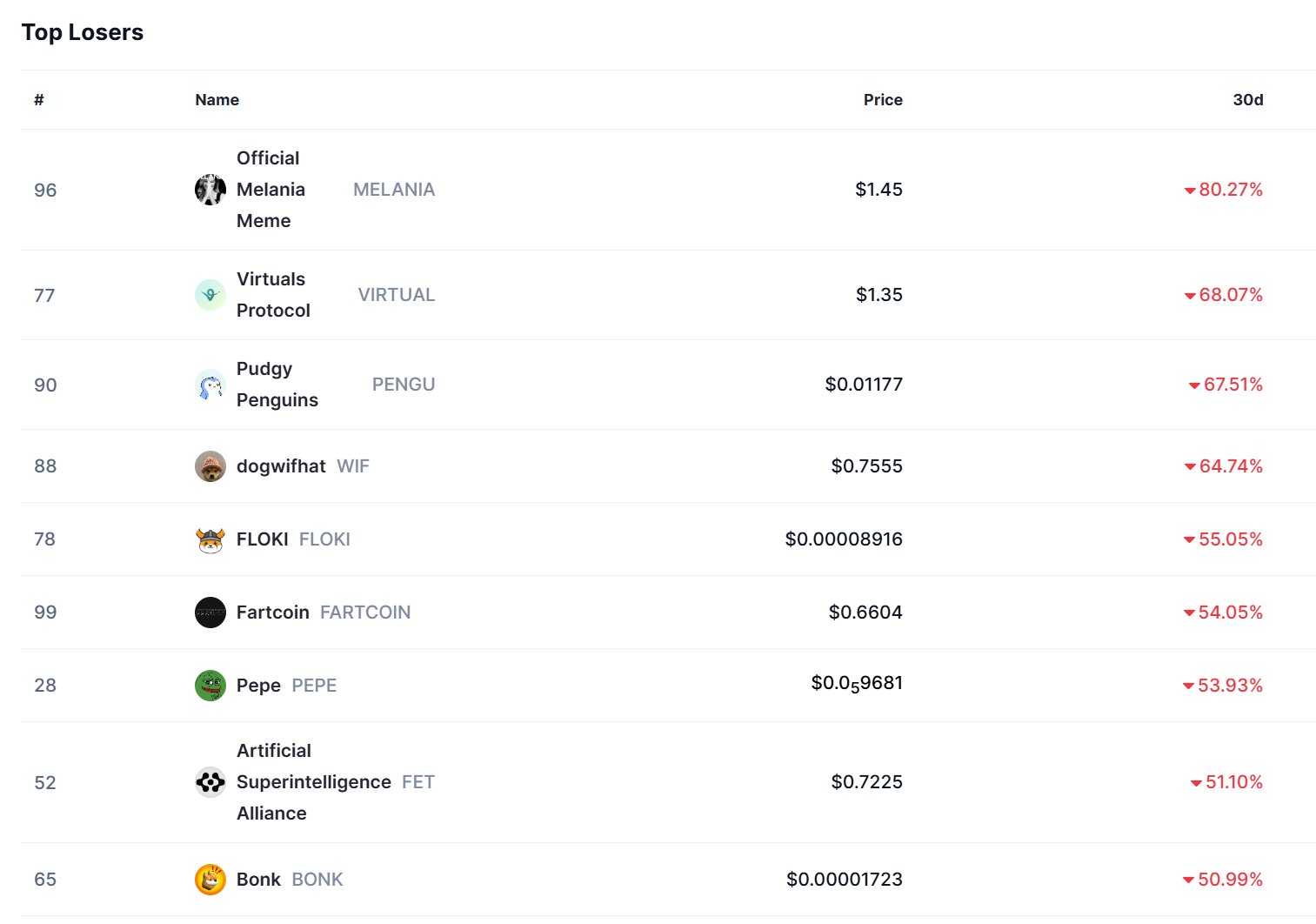

One of the key reasons for the altcoin downturn, especially in the AI sector, at the end of January 2025 was news about the Chinese startup DeepSeek. The company unveiled a powerful open-source AI model, developed with minimal costs—around $10 million, compared to the tens of billions invested by OpenAI.

DeepSeek proved that creating advanced AI models can be much cheaper than expected, raising concerns about the profitability of massive AI investments made by tech giants like NVIDIA, Microsoft, and Google.

A standout feature of DeepSeek is its ability to operate on smartphones without expensive GPUs, dealing a heavy blow to the GPU market, one of NVIDIA’s main growth drivers. In reaction to this, NVIDIA's stock plummeted over 20% in just two trading days, marking one of the sharpest drops in its history.

The tech sector decline also affected cryptocurrencies. Bitcoin, which often correlates with tech stocks, fell 8% in a day, while AI-related altcoins lost between 20% and 25%. This served as yet another reminder of the importance of portfolio diversification in highly volatile conditions.

NVIDIA Corporation. Source: Tradingview

Trading Activity and Volumes

Centralized exchanges (CEX)

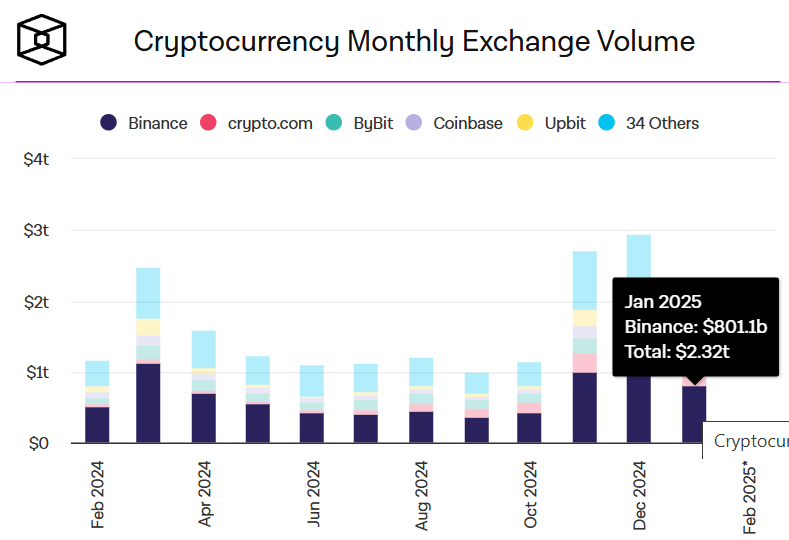

Most of 2024 was characterized by low trading volumes on centralized exchanges. However, volumes began surging toward the end of the year, reaching a peak of $2.71 trillion in November and $2.94 trillion in December—a strong indicator of renewed market interest.

While January 2025 did not see a sharp increase, it maintained the positive momentum from late 2024, with trading volumes reaching $2.32 trillion—significantly above the 2024 average despite the traditional holiday slowdown in financial markets.

Spot Trading Volume on CEX. Source: The Block

Decentralized Exchanges (DEX)

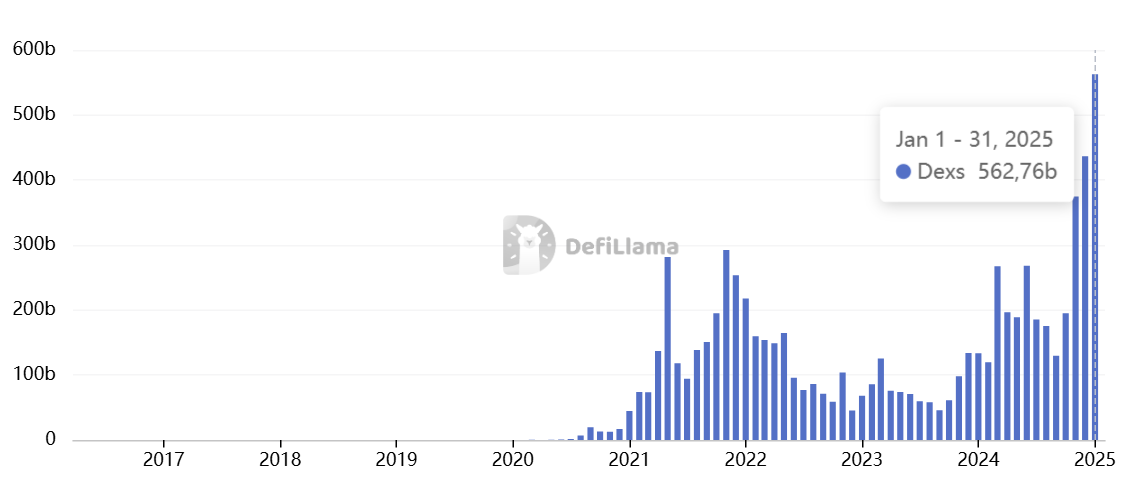

Trading activity on decentralized exchanges (DEX) in January 2025 broke all historical records, reaching an all-time high of $562.76 billion. The surge in volume was driven by the hype surrounding tokens associated with President Trump and his wife, Melania. Initially, these tokens were traded exclusively on DEXs before later appearing on centralized exchanges.

Spot Trading Volume on DEX. Source: DefiLlama

The growing trading volumes confirm that interest in cryptocurrencies continues to strengthen. At the same time, the market infrastructure is becoming more mature, offering users a wider choice between centralized and decentralized platforms.

Hype of the Month: Trump Token

On January 18, just two days before the U.S. presidential inauguration, an event occurred that could be a turning point for the crypto market. A post appeared on Donald Trump's official Twitter account announcing the launch of his own meme coin. This marked the first time in history that a sitting U.S. president had openly endorsed a cryptocurrency, instantly sparking a wave of excitement.

From the moment of its launch, the token immediately captured the attention of the entire crypto market. Trading volume surged in the first few hours, setting new records and reaching $24 billion by the end of the day. Initially, trading took place exclusively on decentralized platforms, as the token had not yet been listed on centralized exchanges.

Over the next two days, the token’s price skyrocketed by more than 40,000%, starting at $0.18 and peaking at $75 on January 19. Its market capitalization exceeded $15 billion, placing the Trump token among the top 15 cryptocurrencies. However, following the meteoric rise came an equally sharp correction. By February, the token had lost over 75% of its peak value and is now trading below $20.

Source: Dexscreener

The Trump token was launched on the Solana blockchain, triggering an explosive rally in SOL. Since users first had to purchase SOL before exchanging it for Trump, demand for SOL surged, causing its price to jump nearly 25% in a single day, from $217 to $270.

The massive hype surrounding Trump’s token led to a liquidity rotation, with capital flowing from other assets into Trump, causing a decline in altcoins.

On January 19, following the launch of Trump’s token, his wife Melania introduced her own meme coin, Melania. Fueled by market euphoria, the token quickly entered the top 50 cryptocurrencies, reaching a market cap of $2.2 billion. However, its correction was even more brutal, with the price plummeting from $12 to $1.50.

The launch of an official meme coin by a sitting U.S. president is a historic precedent that could reshape the crypto market. Meme coins are evolving into legitimate financial instruments in the era of digital politics. It’s likely that other major public figures will follow suit and issue their own tokens in the future.

However, it’s crucial to remember that the faster the hype builds, the quicker it can collapse. Meme coins remain highly volatile, and trading them requires a cool-headed approach rather than emotional decisions.

Is the Meme Coin Trend Over?

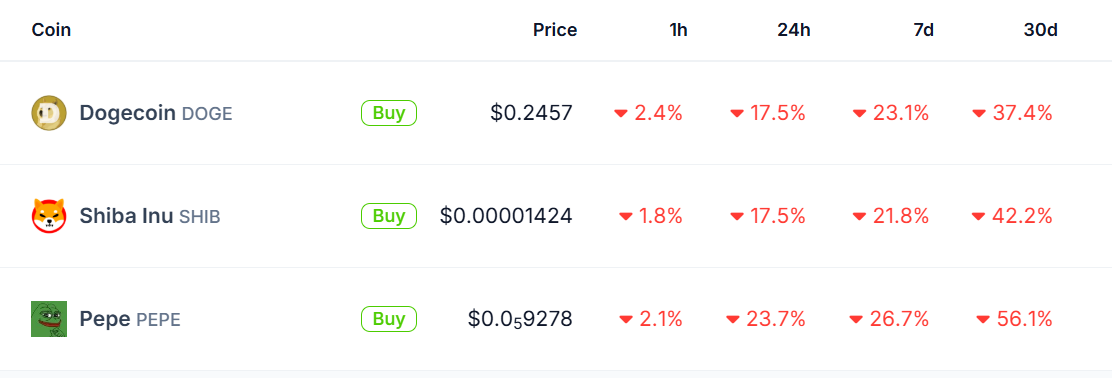

Throughout 2024, meme coins dominated the crypto market, delivering impressive results. However, toward the end of the year, their trend began to noticeably weaken. In December, many large-cap meme coins saw significant declines: DOGE dropped by 32%, SHIB by 20%, and PEPE by 17%. In January, the decline accelerated: DOGE fell by 37.4%, SHIB by 42.2%, and PEPE by 56.1%.

Source: Coingecko

Meme coins typically thrive on hype surrounding new launches. In January, a Trump-related meme coin was introduced, but the excitement in this segment was short-lived.

Meme coins tend to reflect retail investor sentiment—they surge rapidly in bull markets but experience sharper declines during downturns due to their speculative nature. If the crypto market regains strength, meme coins could once again attract attention, acting as an early indicator of retail activity returning.

It’s too early to make definitive conclusions. If meme coins remain weak in the next bullish wave, it may signal the end of their trend. For now, this appears to be a deep correction rather than the final phase.

Market Sentiment in January

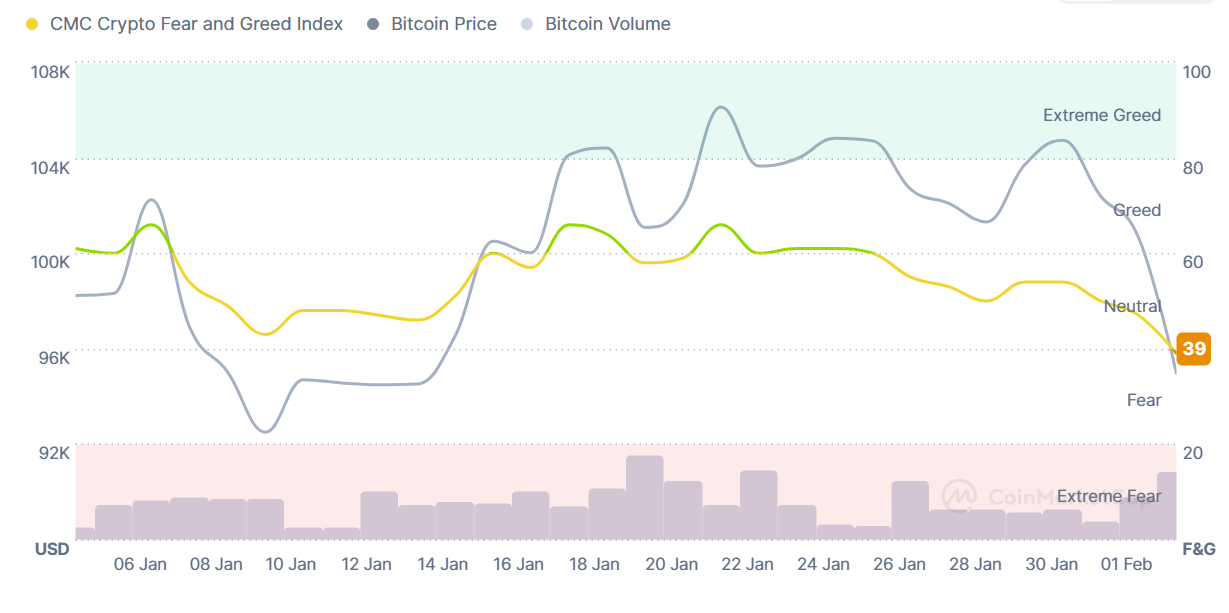

Market sentiment is an important leading indicator, as emotional peaks are often followed by cooling-off periods. Last month, until December 18, optimism prevailed in the market. However, the Fear and Greed Index then dropped to neutral, reaching 54.

January was mostly spent in the neutral zone, occasionally shifting into greed and approaching fear. Overall, market sentiment remained balanced. However, in the final days of the month, the index began to decline alongside Bitcoin’s price, moving into the fear zone. A dip into this area could signal either a temporary pause before the next growth phase or the start of a deeper correction.

Fear and greed index.Source: Coinmarketcap

FED Meeting

On January 29, 2025, the U.S. Federal Reserve kept the interest rate at 4.5%, in line with market expectations. The Fed also confirmed its plan to continue reducing its balance sheet by $25 billion per month.

During the press conference, Fed Chair Jerome Powell emphasized that the regulator is in no hurry to cut rates and wants to see real progress in lowering inflation before making further decisions. However, he noted that reaching the 2% inflation target is not a strict requirement for easing monetary policy.

Powell declined to comment on Donald Trump’s calls for an immediate rate cut but acknowledged the uncertainty surrounding Trump's proposed trade tariffs, stating that the Fed will closely monitor their economic impact.

He also confirmed that U.S. banks are allowed to work with crypto clients as long as they comply with risk management measures.

Overall, the Fed’s rhetoric was favorable for the crypto market, though it has yet to be reflected in asset prices. The full impact of this meeting may become evident over a longer timeframe.

Conclusion

January 2025 reaffirmed its status as a month of uncertainty but was successful for Bitcoin, which reached a new all-time high and closed the month in positive territory. Meanwhile, the altcoin market faced sharp declines, particularly in the meme coin and AI sectors.

Key events such as Trump’s inauguration and the launch of DeepSeek once again highlighted the strong connection between traditional and digital markets. Record trading volumes on DEX platforms indicate growing interest in decentralized exchanges, reinforcing the long-term trend of DeFi ecosystem expansion.

February, historically one of the most favorable months for crypto, will be a crucial test for Bitcoin’s continued uptrend and the performance of altcoins. Will BTC remain the driving force, or is a correction imminent? Will altcoins see a resurgence? We’ll find out soon.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.