Market Overview: March 2025

This blog post will cover:

- Key Events of the Month

- Bitcoin Performance in March

- Ethereum Performance in March

- Trading Activity and Volumes

- Top Gainers and Losers

- Meme Coins

- Market Sentiment in March

- What to Watch in April

- Conclusion

March is traditionally considered a neutral month for Bitcoin, as historically it has shown both positive and negative results exactly six times each. However, this year played out against the bulls, with the month ending in decline, tipping the balance in favor of the bears. After a tough February, the community had hoped for a trend reversal, but major events — including the crypto summit featuring Donald Trump and the Federal Reserve’s policy meeting — failed to change the trajectory.

As a result, Bitcoin lost 2.3% of its value in March, while Ethereum plunged by 18.69%. For Ethereum, March set a new negative record. Following its worst February, ETH completed its worst quarter ever, declining for three consecutive months. The fall in both ETH and BTC had a negative impact on the entire cryptocurrency market.

In this review, we’ll examine the key events and trends of the month, Bitcoin and altcoin price movements, trading volumes, and other important factors. We’ll also attempt to answer the main question: does the market still have a chance at recovery and new growth opportunities?

Historical BTC Performance. Source: CoinGlass

Key Events of the Month

These events shaped the market sentiment throughout March and were clearly reflected in price charts.

Crypto Summit & U.S. Crypto Reserve

At the beginning of the month, Donald Trump signed an executive order to create a U.S. crypto reserve. Prior to that, he mentioned ADA, XRP, SOL, BTC, and ETH on his social media platform, sparking significant discussion across the market. Market participants anticipated that details about which assets would be included in the reserve and how it would be formed would be revealed at the March 7 summit. However, no specifics were provided — no asset list, no purchasing plan.

From Trump’s statements, a few key points emerged, though without a clear implementation mechanism:

"Make America the crypto capital of the world."

The crypto reserve will be based on the 200,000 BTC already held by the U.S.

A full audit of the U.S. government’s crypto holdings will be conducted.

The government will consider acquiring additional BTC.

A stablecoin bill should be ready by August.

Fueled by summit expectations, the market rallied at the start of the month, but a predictable correction followed. The lack of concrete actions disappointed investors, and once again the old market adage proved true: “buy the rumor, sell the news.” This led to a decline in Bitcoin, which we’ll analyze in more detail below.

Federal Reserve Interest Rate Decision

On March 19, 2025, the U.S. Federal Reserve concluded its latest monetary policy meeting, leaving the benchmark interest rate unchanged in the 4.25% – 4.50% range. This decision was fully in line with most analysts' forecasts.

Despite being widely anticipated, Bitcoin and the broader crypto market responded positively. BTC closed the day at $86,850 (+5%), marking a 10-day high. This indicates that investors interpreted the Fed’s decision as a positive signal, reducing short-term risks of monetary tightening.

A key takeaway from the Fed’s statement was the announcement that it would slow the pace of Quantitative Tightening (QT) starting April 1. This move eases liquidity pressure in the financial system, creating more favorable conditions for capital markets, including crypto.

Additionally, the Fed lowered its U.S. GDP growth forecast for 2025 from 2.1% to 1.7%, and for 2026 from 2% to 1.8%, signaling an expected economic slowdown. This increases the likelihood of rate cuts in the future, which would benefit risk assets.

As a result of the Fed’s comments, market participants began pricing in a potential rate cut as early as June. This scenario creates bullish conditions, as monetary easing typically boosts liquidity and investor interest in risk-on assets like cryptocurrencies.

Durov’s Release and Its Impact on TON

On August 24, 2024, Telegram founder Pavel Durov was arrested in Paris. The news had an immediate impact on the TON token. Starting the day at $6.70, TON dropped to $5.92 by market close — losing over 11% of its value. At one point, the decline exceeded 20%.

The negative sentiment surrounding Durov’s arrest continued to pressure TON, and by September 5, the token had fallen to $4.50. Over the next six months of uncertainty, TON traded within the $4.50 – $7 range. By February 2025, amid broader bearish market conditions, TON dropped further to $2.35.

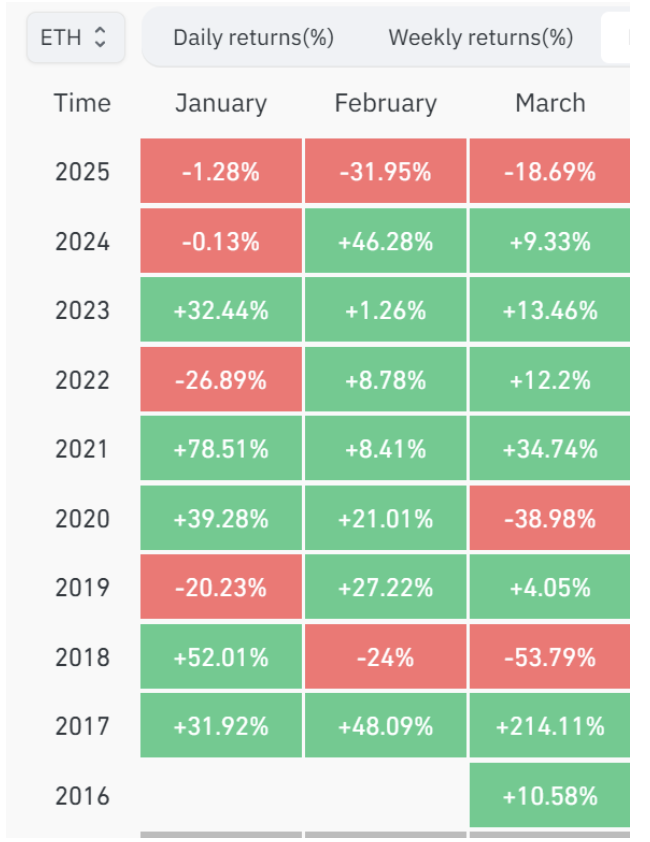

On March 15, news broke that Pavel Durov had been released and had returned to the UAE. TON immediately reacted, rallying more than 22% in a single day — opening at $2.92 and closing at $3.58.

TON/USDT Chart. Source: CoinMarketCap

This situation clearly demonstrates how dependent cryptocurrencies are on news flow, especially when it involves key project figures. It underscores the importance of real-time news monitoring for investors.

Durov’s release could be a turning point for TON, particularly if he actively re-engages in the project’s development. The token currently trades significantly below its peak levels, but if the project team capitalizes on the renewed optimism to strengthen the ecosystem, this could become a catalyst for further growth.

TON isn’t the only project facing such challenges. One of the most notable examples in crypto history is Ripple’s battle with the SEC. There have also been several instances — like Tornado Cash — where founder issues or regulatory pressure significantly impacted token prices. In most cases, successful resolution led to recoveries and explosive growth.

Durov’s release is an important step toward stabilizing the project and raises hopes that TON could begin reclaiming its market position.

The HyperLiquid Attack: Event Breakdown and Consequences

On March 26, the decentralized exchange HyperLiquid was hit by an exploit that affected its Hyperliquidity Provider (HLP) fund. The attacker used a low-liquidity token, JELLYJELLY, to exploit vulnerabilities in the platform. You can find more details about HyperLiquid in our in-depth review.

Timeline of Events

A trader opened a massive $8 million short position on JELLYJELLY, causing the token’s price to crash.

The trader then intentionally removed margin, triggering liquidation. The short was absorbed by the HLP pool, which automatically takes over liquidated positions.

On other exchanges, the trader began aggressively pumping the token, causing its price to spike by 500% within an hour.

JELLYJELLY/SOL Chart. Source: Dexscreener

Within an hour, the token's market cap soared from $10 million to over $50 million, dramatically increasing HLP's unrealized losses.

Binance and OKX noticed the unusual volatility and quickly listed futures for JELLYJELLY, further amplifying the frenzy.

A new wallet opened a large long position on HyperLiquid, instantly profiting ~$8.2 million.

At the peak of the pump, HLP’s unrealized loss reached nearly $12 million. Meanwhile, the HYPE token dropped almost 25% amid the panic.

HyperLiquid intervened swiftly. Through a validator vote, it delisted the JELLYJELLY futures contract. The price was adjusted, enabling the protocol to close the position with a $700,000 profit — avoiding a significant loss. Affected users (excluding suspicious wallets) were automatically compensated. User funds in the HLP pool remained safe, although questions about HyperLiquid’s decentralization arose.

Community Reaction

HyperLiquid’s delisting decision sparked debate about the platform’s decentralization. While validators formally approved the move, the action appeared to be centralized intervention.

Analysts like ZachXBT criticized the double standards, noting that the exchange avoided losses by canceling trades — undermining the principles of decentralized platforms.

Gracy Chen, CEO of Bitget, called HyperLiquid’s actions immature and unethical. She pointed out that the exchange operates more like an offshore CEX without KYC/AML requirements, posing risks to users. Forced position closures erode trust, and the combination of unlimited position sizes and pooled storage could lead to more exploits.

Takeaways and Lessons Learned

This incident highlighted that even decentralized exchanges may intervene to preserve platform stability. While HyperLiquid managed to avoid losses, the forced delisting raised concerns about how decentralized the protocol truly is.

Key insights include:

Low-liquidity asset manipulation remains a serious threat.

Liquidity pools are vulnerable if liquidation mechanisms aren’t well-designed.

Auto-liquidation systems must be improved to detect and mitigate extreme price anomalies.

DeFi protocols must strike a balance between decentralization and user safety.

HyperLiquid’s quick response protected users from multi-million dollar losses. The event serves as a critical signal to the DeFi industry that risk management and liquidation mechanics require ongoing refinement.

Bitcoin Performance in March

Following February’s sharp decline, where Bitcoin lost 17% of its value, March opened with a recovery attempt. In the first few days of the month, BTC climbed to $95,000. However, this growth was short-lived, and by March 11, the price had fallen below $77,000.

One of the growth drivers was anticipation surrounding the March 7 crypto summit. However, investors were left disappointed by the lack of concrete announcements regarding potential Bitcoin purchases for the U.S. crypto reserve. The absence of specifics led to a swift decline in optimism and a subsequent price drop.

In the second half of the month, Bitcoin gradually recovered, reaching $88,700. Yet, by the end of March, it came under renewed pressure. Ultimately, BTC closed the month at $82,550, posting a monthly loss of 2.3%.

The market remains in a state of uncertainty. One contributing factor was Trump’s discussion of new tariffs, which took effect on April 2. These measures pose risks not only to the crypto market but also to traditional financial markets, reinforcing bearish sentiment among investors.

Bitcoin (BTC) Chart. Source: Cryptorank

Ethereum Performance in March

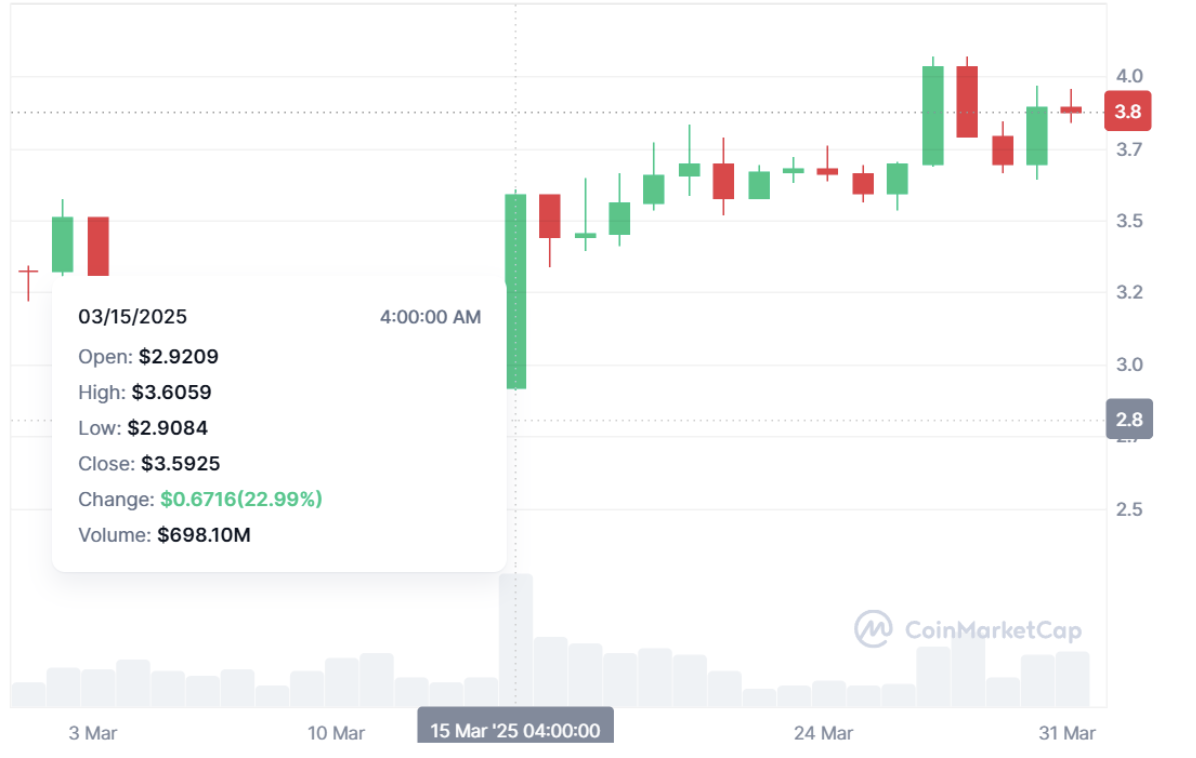

March was particularly unfavorable for Ethereum. At the start of the month, ETH was trading around $2,236, but it ended the month at $1,821 — losing 18.69% of its value. Overall, Ethereum dropped 45.68% in Q1, making it one of the worst-performing quarters in its history. Moreover, this marked the first time Ethereum declined for three consecutive months at the start of a calendar year.

Ethereum’s Historical Monthly Performance in Q1. Source: Coinglass

Analyzing the reasons behind this significant decline, several key factors stand out:

1. The Impact of February’s Long Squeeze

As noted in the previous overview, early February saw a major long squeeze triggered by mass liquidation of leveraged positions. This resulted in a broad market crash and a sharp drop in total crypto market capitalization. Ethereum, as one of the leading assets in the DeFi space, faced additional pressure from forced position closures across many platforms.

2. The Bybit Hack

In February, the crypto exchange Bybit was hit by a massive hack, during which $1.5 billion worth of ETH was stolen. This became the largest crypto theft in history and shook investor confidence. Further downward pressure on ETH came from the hackers themselves, who began aggressively offloading the stolen ETH via decentralized exchanges, flooding the market with additional supply.

3. General Weakness Across the Crypto Market

Throughout March, the crypto market remained weighed down by global macroeconomic uncertainty. Trump’s renewed push for tariffs and increasing trade tensions continued to affect market sentiment. The crypto space experienced a broad correction amid declining liquidity. In this negative environment, Ethereum lacked any strong fundamental catalysts to support its price.

Ethereum’s poor performance in Q1 2025 can be attributed to the accumulation of these bearish factors. The key question now is whether we’ll see a recovery in Q2 or if downward pressure will persist.

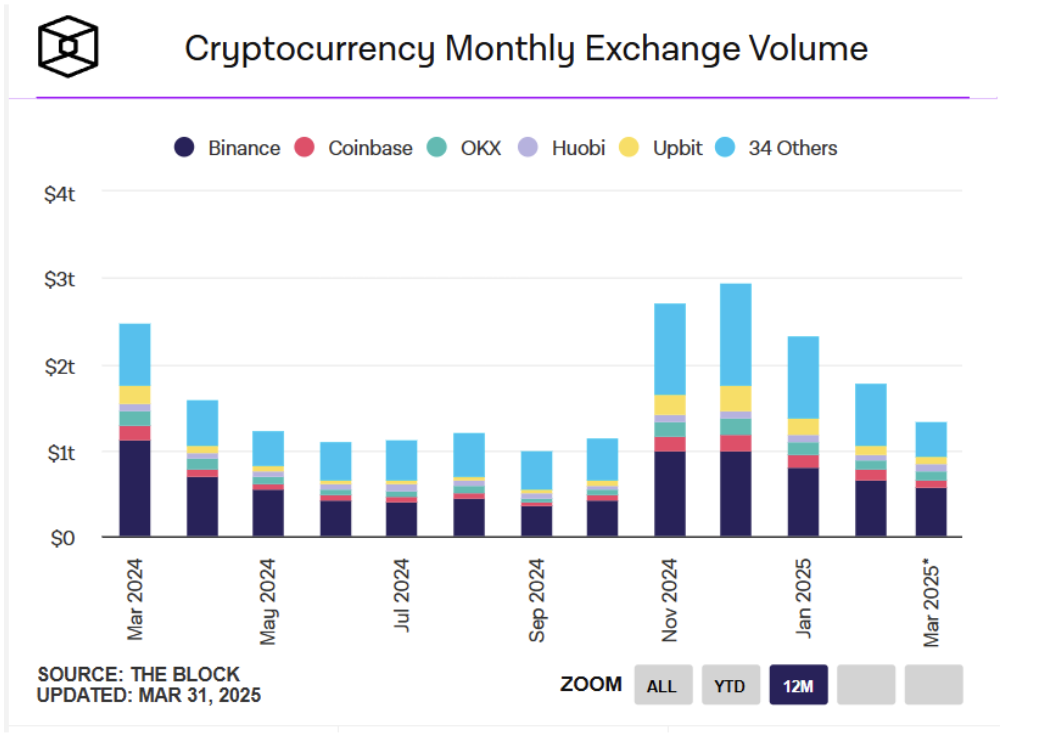

Trading Activity and Volumes

Trading volumes on centralized exchanges in March 2025 totaled $1.38 trillion, remaining above the 2024 average. However, the year-to-date trend shows a steady decline in activity: $2.32 trillion in January, $1.77 trillion in February, and $1.38 trillion in March.

Several factors contributed to this decline:

Leading cryptocurrencies saw significant losses in March, dampening interest from traders and long-term investors.

High volatility earlier in the year led to major liquidations, prompting many participants to adopt a wait-and-see approach.

The market remains in a holding pattern as it’s unclear whether we are in a prolonged correction or entering a full-fledged bear market.

Spot Trading Volume on CEX. Source: The Block

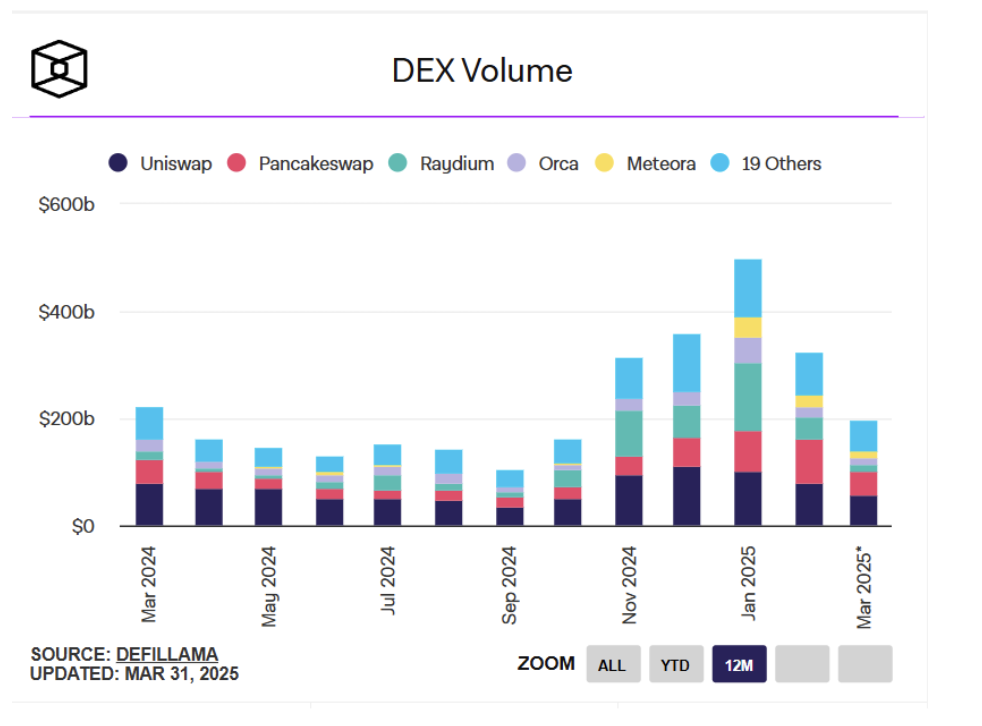

Trading volume on decentralized platforms in March amounted to $198.7 billion — the lowest figure for 2025 so far. However, activity remains relatively strong, highlighting continued interest in cryptocurrencies and DeFi products.

Despite the overall market decline, there are a few positive takeaways:

Users are still actively utilizing DEX platforms, showing high levels of DeFi adoption.

Even amid falling liquidity and uncertainty, DEXs continue to generate significant trading volume, underscoring their growing role in the crypto ecosystem.

Spot Trading Volume on DEX. Source: The Block

Top Gainers and Losers

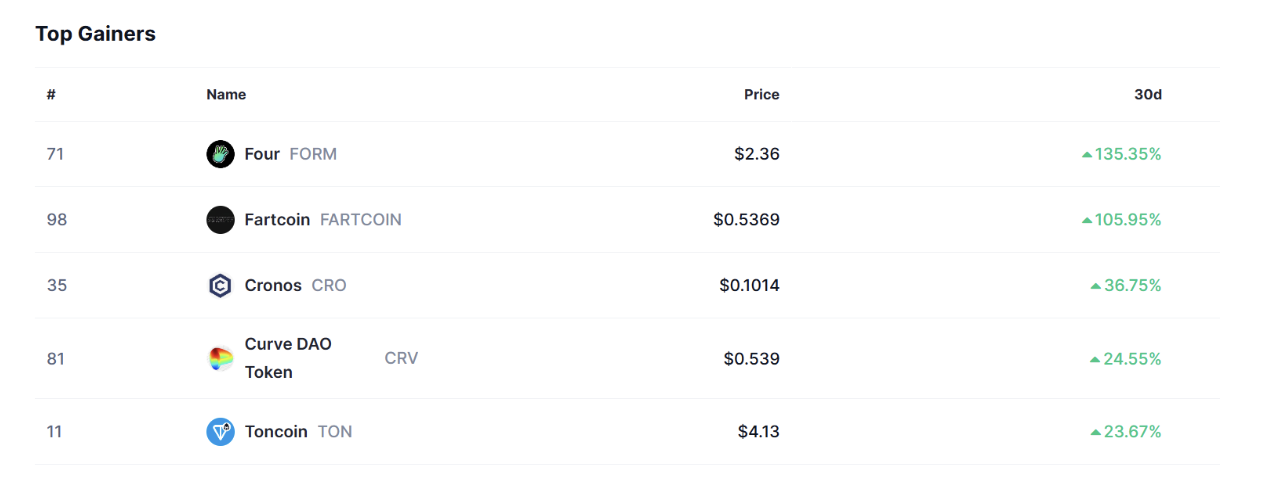

Despite the broader market decline in March, several tokens managed to post impressive gains:

Four (FORM): +135.35% – A token from the BinaryX ecosystem, which includes DAO and gaming projects.

Fartcoin (FARTCOIN): +105.95% – A meme token that unexpectedly gained traction among traders.

Cronos (CRO): +38.75% – The native token of the Crypto.com ecosystem.

Curve DAO Token (CRV): +24.55% – A leading DeFi token that managed to grow despite market correction.

Toncoin (TON): +23.67% – The Telegram-linked cryptocurrency rallied following Pavel Durov’s release.

Top Gainers & Losers. Source: CoinMarketCap

It’s worth noting that only two assets posted gains above 100%, highlighting the market’s reduced volatility in March. During high-activity periods, dozens of tokens often surge by hundreds or even thousands of percent. But amid current market fear, overall activity has cooled significantly.

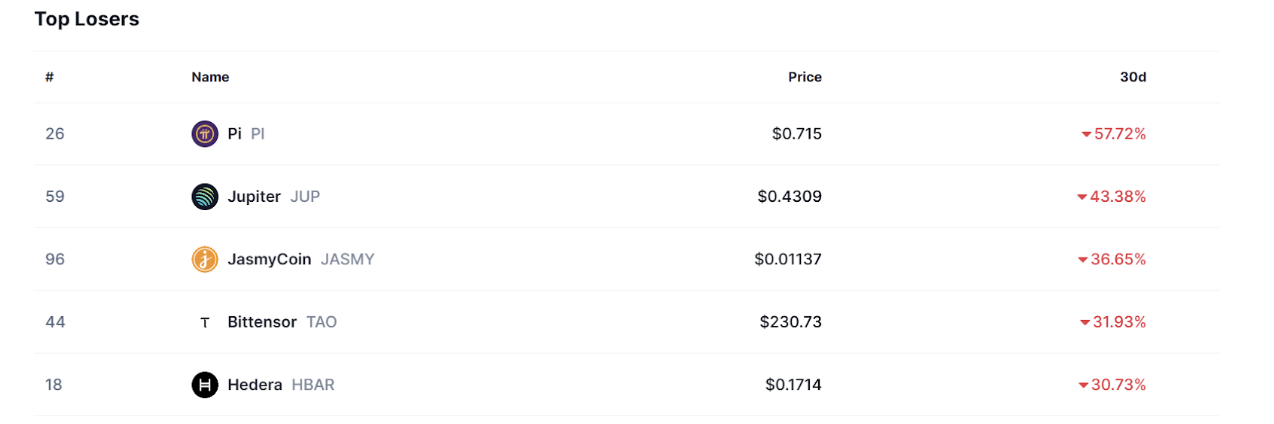

Among the worst-performing tokens in March were:

Pi Network (PI): -46.82% – A social crypto project that suffered a serious trust decline.

Jupiter (JUP): -43.38% – A prominent DeFi token on the Solana blockchain.

JasmyCoin (JASMY): -38.65% – A Japan-based project focused on IoT.

Bittensor (TAO): -31.93% – An AI and machine learning-related project.

Hedera (HBAR): -30.73% – An enterprise-oriented blockchain affected by overall altcoin weakness.

Top Gainers & Losers. Source: CoinMarketCap

Interestingly, there was no clearly dominant sector among either the gainers or losers. The top movers included projects from diverse categories: DeFi, AI, gaming, and meme coins. This indicates that asset performance in March was driven more by general market sentiment than by specific fundamentals.

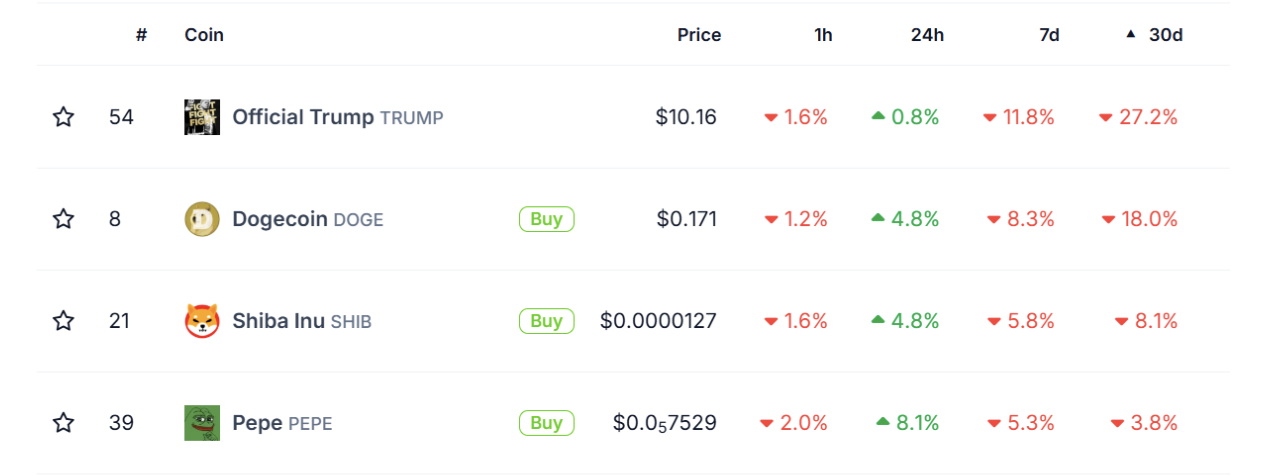

Meme Coins

Meme coins, which had been on a downtrend in recent months, continued to decline with the broader market in March — but performed relatively better and didn’t make the top losers list. Larger-cap meme tokens were hit the hardest:

Source: Coingecko

Their decline reflects the overall state of the market, but it’s notable that meme coins showed more resilience in March. This may be due to the reduced presence of speculative capital, as many traders had already taken profits during the 2024 highs. Additionally, major meme coins like DOGE, SHIB, and PEPE have high liquidity and strong communities, which help reduce volatility during downturns.

In 2025, there have been no new catalysts to trigger another rally in the meme sector, but historically, meme coins have often served as early indicators. In 2024, they rallied strongly before the broader market, then crashed earlier as well. Currently, the entire market is still declining — Ethereum alone lost over 18% in March — yet some meme coins are holding up well.

It’s too early to say whether the market is bottoming out and heading for recovery in April, but there are signs. If meme coins begin recovering ahead of the broader market, it could signal a return of liquidity to altcoins. A key confirmation would be rising trading volumes and renewed interest in major tokens — not just a slowdown in the decline.

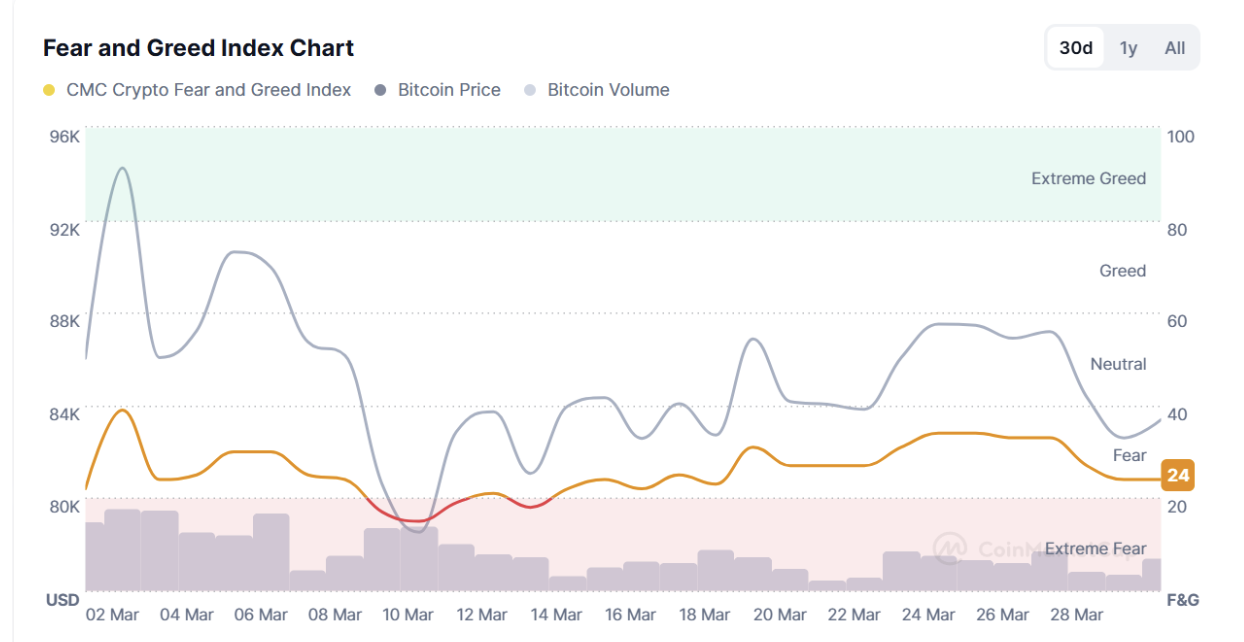

Market Sentiment in March

Market sentiment is a key leading indicator, as periods of fear are inevitably followed by phases of euphoria — and vice versa. February 2025 was dominated by fear, and by the end of the month, the market had fallen into the "extreme fear" zone. The last time such low levels were recorded was back in May 2022 during the Terra (LUNA) ecosystem collapse.

March also remained within the fear zone, occasionally dipping into extreme fear. This signals deep pessimism among participants, comparable to a capitulation phase. The longer the market stays in this state, the more investors exit.

It's worth noting that bearish sentiment is an inherent part of market cycles. Historically, such high levels of fear often preceded turning points that led to renewed growth. The only question is how long this phase will last this time.

Fear and Greed Index. Source: CoinMarketCap

What to Watch in April

March left more questions than answers, which makes April even more intriguing — and potentially a pivotal month for the crypto market. Here are the key triggers that could shape its direction:

Trump Tariffs: Their implementation could increase market volatility, as new trade barriers would impact not just traditional assets but also crypto through its growing correlation with equities. If the measures are softer than expected, it could ease pressure on BTC and altcoins. On the flip side, rising economic tensions may push risk assets lower.

Inflation Data (U.S. CPI): If the Consumer Price Index exceeds expectations, the likelihood of a Fed rate cut will decrease — negatively impacting demand for BTC and other risk-on assets. If inflation prints come in lower, market optimism may rise.

U.S. Crypto Reserve Announcements: If the Trump administration releases details about plans to purchase BTC for national reserves, this could become a strong bullish catalyst.

Technical Outlook for BTC and ETH

If Bitcoin manages to hold above $89,000 in the first half of April (e.g., a weekly close above that level), it could open the path to $95,000 and beyond. If negative news continues and the correction deepens, key support lies in the $75,000 – $72,000 range. A breakdown below this could accelerate the downtrend.

A recovery above $2,000 for Ethereum would be an important psychological signal. However, to confirm bullish continuation, ETH needs to break and hold above $2,200, which would indicate strong buyer momentum and improve altcoin market dynamics.

Conclusion

March 2025 was a difficult month for the crypto market. Bitcoin lost 2.3%, and Ethereum dropped 18.69%, closing out its worst quarter in history.

The market faced multiple pressure points: the aftermath of the $1.5 billion ETH hack in February, unfulfilled expectations from the crypto summit, and macroeconomic uncertainty tied to discussions around new tariffs. Trading volumes on both CEX and DEX continued to decline, and market participants largely remained on the sidelines.

The HyperLiquid exploit highlighted the vulnerabilities of decentralized exchanges and reignited debates about the true degree of decentralization. Still, despite the overall downturn, the DeFi sector showed resilience, with projects like CRV ending the month in the green.

The core question raised in February remains unresolved: Is this an extended correction or the start of a full-fledged bear market? For now, the market remains in a state of uncertainty, but subtle signs — such as the relative resilience of meme coins — may hint at an upcoming recovery.

April will be a critical month to determine whether the crypto market is ready for a reversal or if downward pressure will persist.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.