Market Overview: November 2024

This blog post will cover:

- Bitcoin Market Dynamics in November

- Altcoin Performance in November

- Bitcoin Dominance

- Trading Activity and Volumes

- Market Sentiment in November

- The Ongoing Trend of Memecoins

- AI Agents and Memecoins

- Telegram Apps Trend

- Revival of Retro Drops

- Expectations for December

- Conclusion

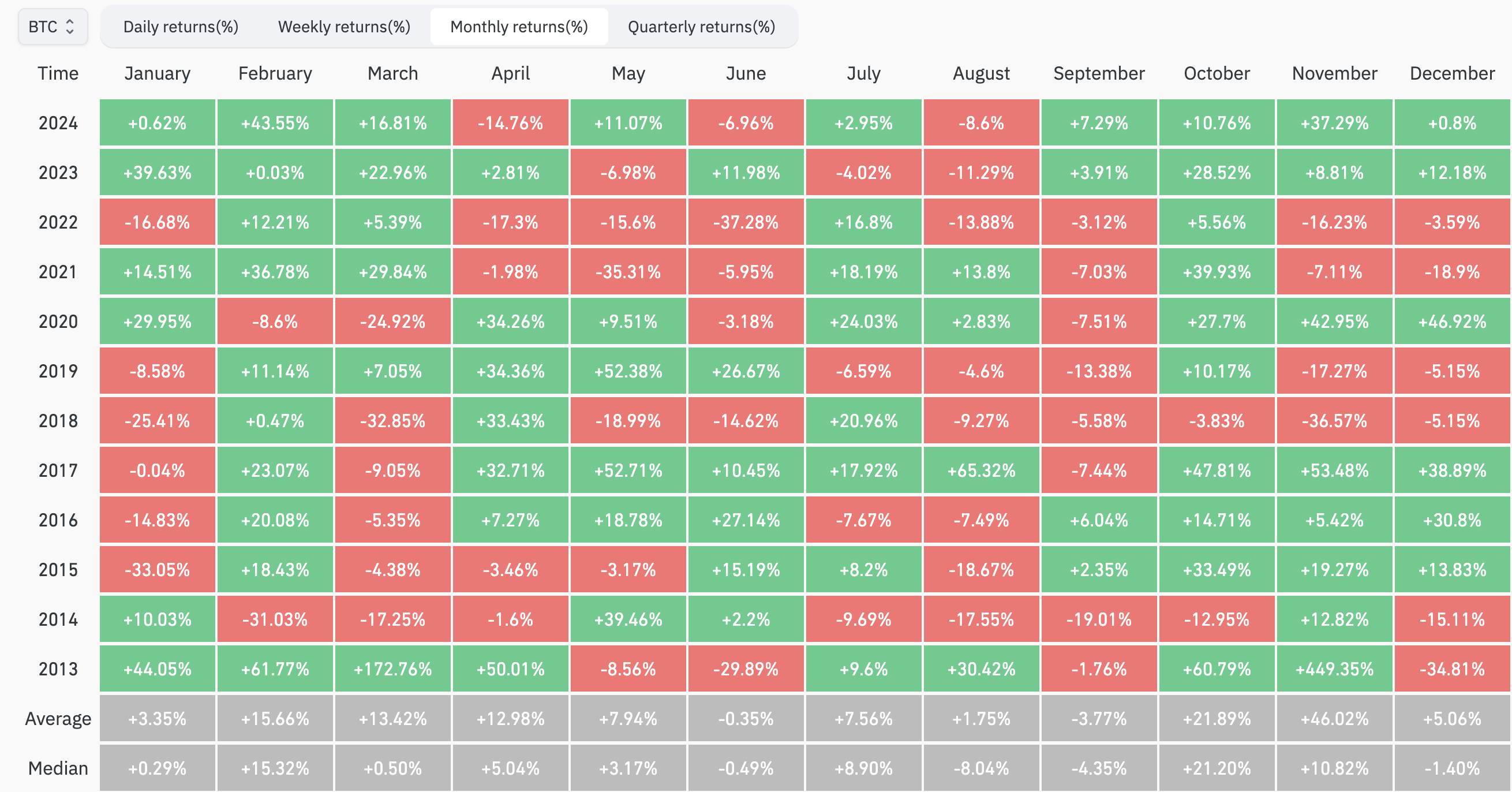

Historically, November has always been considered one of the most favorable months for the cryptocurrency market. Out of 11 completed Novembers in Bitcoin's history, the cryptocurrency ended the month in profit 7 times, while 4 times it resulted in losses. However, November 2024 turned out to be so successful that it exceeded the expectations of most market participants. The victory of Donald Trump in the U.S. presidential election became the primary catalyst for the rally, which many analysts have dubbed the "Trump Rally."

Bitcoin closed November with a 37.29% increase, marking the second-best performance of the year after February's growth. Events such as the Federal Reserve's interest rate decision and the U.S. presidential election, which we highlighted in our October review, indeed had a significant impact on the market, serving as key drivers of its growth.

In this review, we will take a detailed look at the main trends of November, the movement of Bitcoin and altcoins, changes in BTC dominance, trading activity and volume dynamics, and much more.

Historical Bitcoin Performance. Source: CoinGlass

Bitcoin Market Dynamics in November

November began with tense anticipation of the U.S. elections, which took place on November 5. Before the results were announced, Bitcoin dropped from $70,200 to $66,800, reflecting caution and nervousness among market participants. However, as the first voting results emerged and Donald Trump's victory was confirmed, the cryptocurrency market began to rise sharply. This rapid surge was soon labeled the "Trump Rally."

Within two weeks, Bitcoin reached a new all-time high of $99,588, recorded on November 22. The month closed at $96,407, showcasing the following performance metrics:

37.29% growth from the opening price

49.01% increase from the month's lowest to highest value.

These results once again highlighted Bitcoin's strength, particularly in November, which has historically been a favorable month for the crypto market.

Bitcoin 30-Day Chart. Source: Cryptorank

Altcoin Performance in November

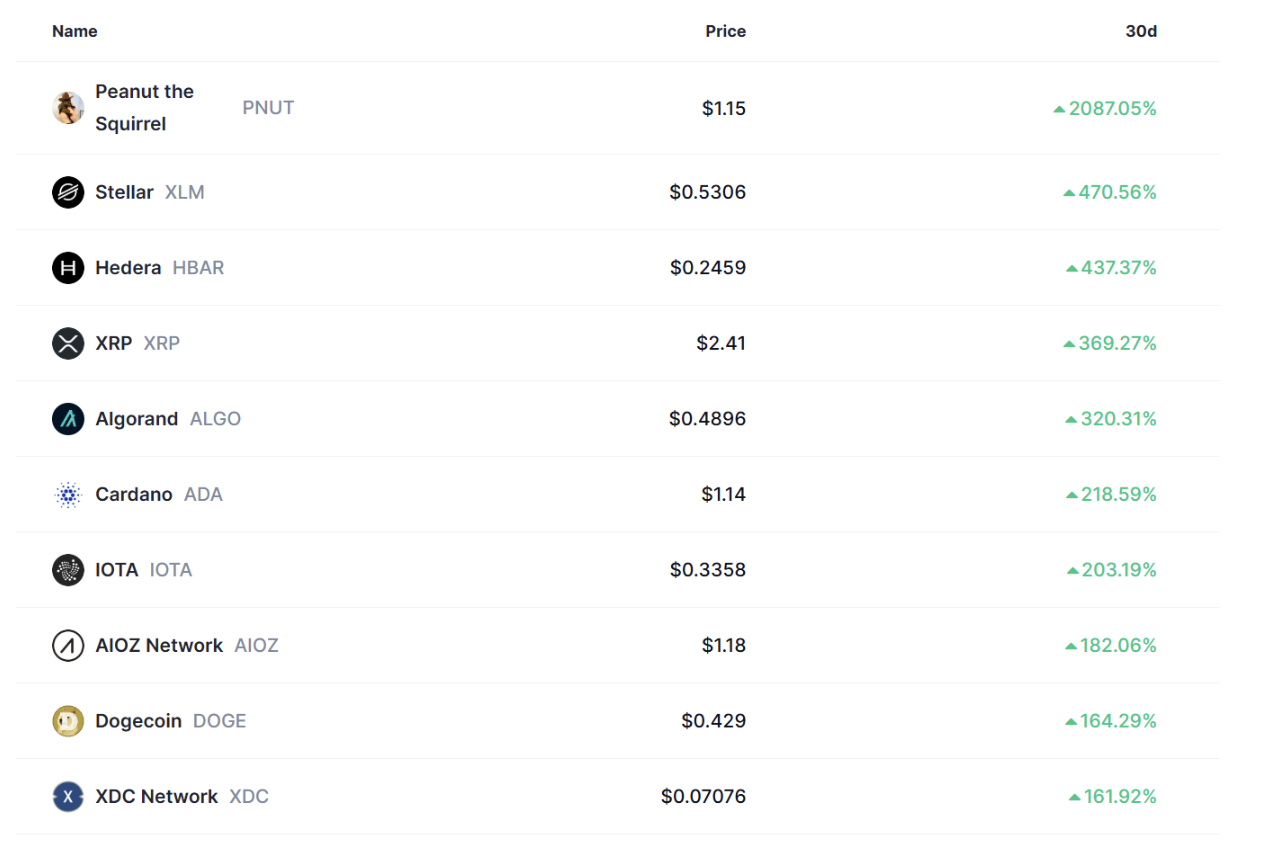

Alongside Bitcoin's upward trend, several major altcoins also demonstrated strong growth. Among the top 100 cryptocurrencies, the following stood out:

Peanut the Squirrel (PNUT): +2087.05% (more details about this token are provided below)

Stellar (XLM): +470.56%

Hedera (HBAR): +437.37%

XRP (XRP): +369.27%

Algorand (ALGO): +320.31%

Top 10 Crypto Asset Performance in November. Source: CoinMarketCap

Bitcoin Dominance

In November, the altcoin market began to revive, with many assets, as seen in the examples above, showing impressive performance. This was accompanied by a decline in Bitcoin's dominance, which decreased from 60.27% to 57.24% by the end of the month. This reduction allowed altcoins to unlock their potential and attract investor attention.

In our October review, we noted that Bitcoin's dominance was approaching the 0.618 Fibonacci level, which could trigger a reaction. As expected, this level acted as a local reversal point, creating conditions for improved altcoin dynamics.

While it is too early to talk about a full market reversal, the current trend indicates that Bitcoin's dominance has weakened, providing altcoins with more opportunities for growth. If this decline in dominance continues into December, it could pave the way for new records for many assets. It will be crucial to monitor developments in the coming weeks to assess the potential strengthening of the altcoin season.

Bitcoin Dominance Chart. Source: TradingView

Trading Activity and Volumes

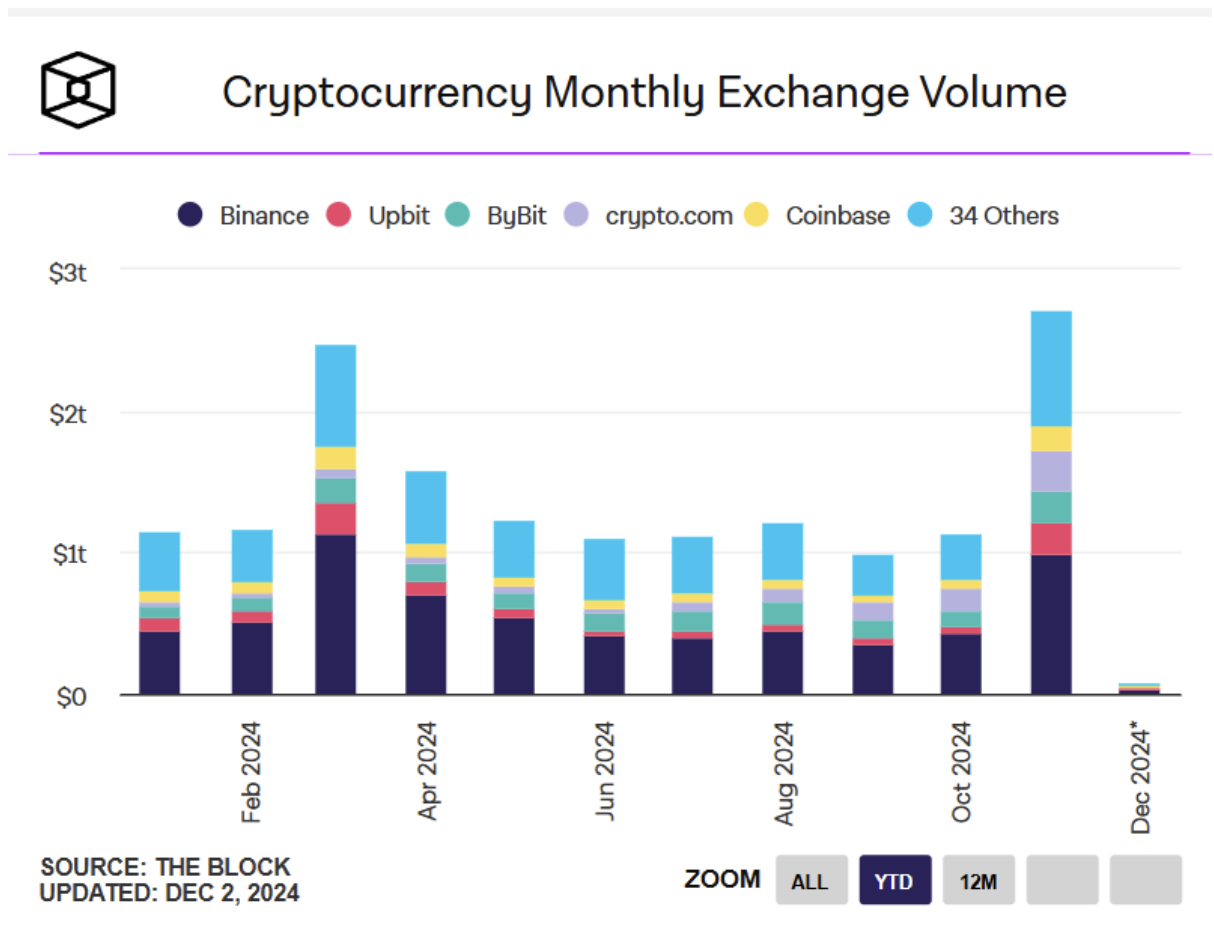

In November, spot trading volumes reached record levels, making it the most successful month of the current year. On centralized exchanges (CEX), the total trading volume amounted to $2.71 trillion, surpassing February's peak of $2.48 trillion. In October, volumes began to increase only toward the end of the month, signaling a possible growth for November. This prediction was validated, and the November results vividly illustrated the return of high interest in the market.

Spot Trading Volume on CEX. Source: The Block

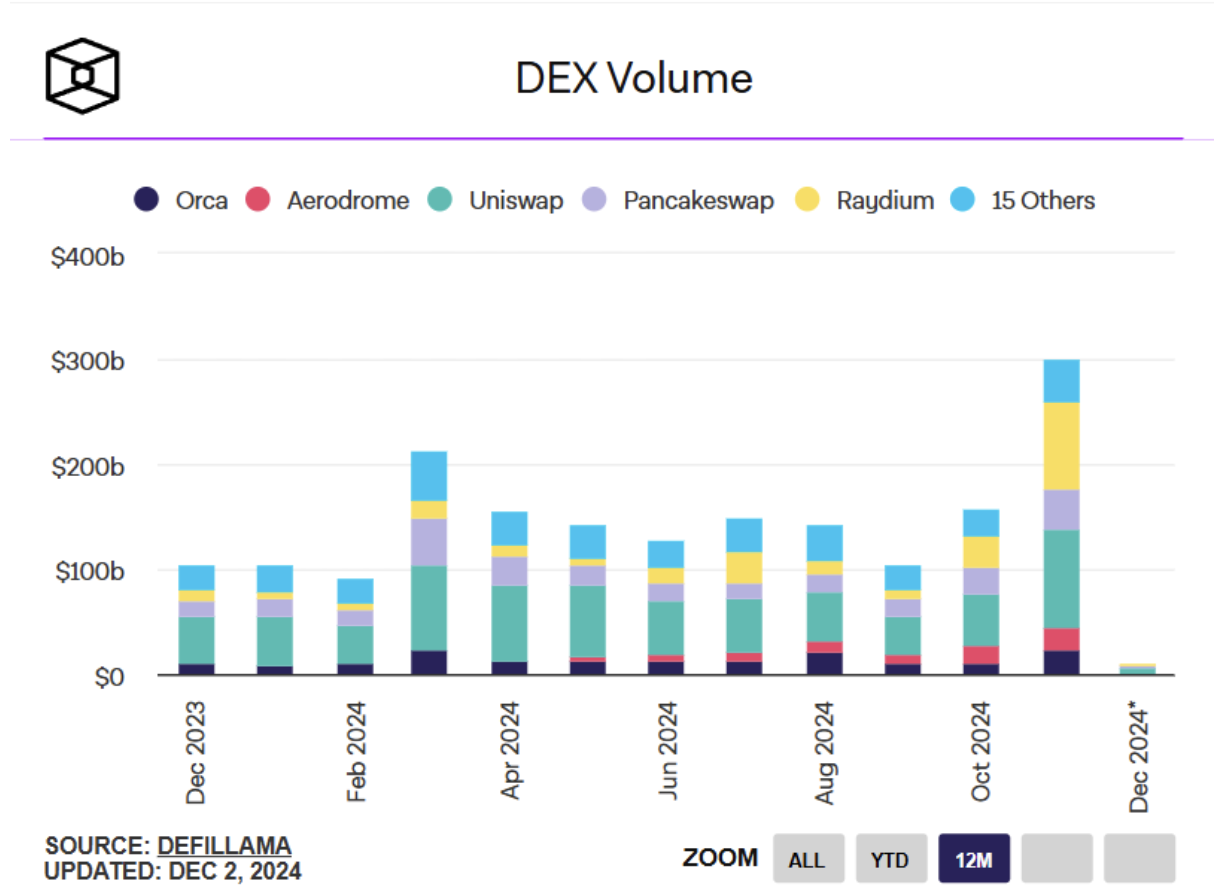

On decentralized exchanges (DEX), trading activity also hit an annual high. The trading volume for November reached $300 billion, marking the highest figure of 2024 so far. The growing interest in DEX can be attributed to several factors:

Sustained demand for decentralized platforms as an alternative to centralized solutions. This is particularly relevant in light of increasing attention to regulations and privacy issues.

Development of DEX infrastructure, enhanced user interfaces, implementation of low-fee solutions, and increased liquidity.

Spot Trading Volume on DEX. Source: The Block

The record figures for November indicate that interest in cryptocurrencies continues to strengthen, and the market infrastructure is becoming increasingly mature, offering users more choices between centralized and decentralized platforms.

Market Sentiment in November

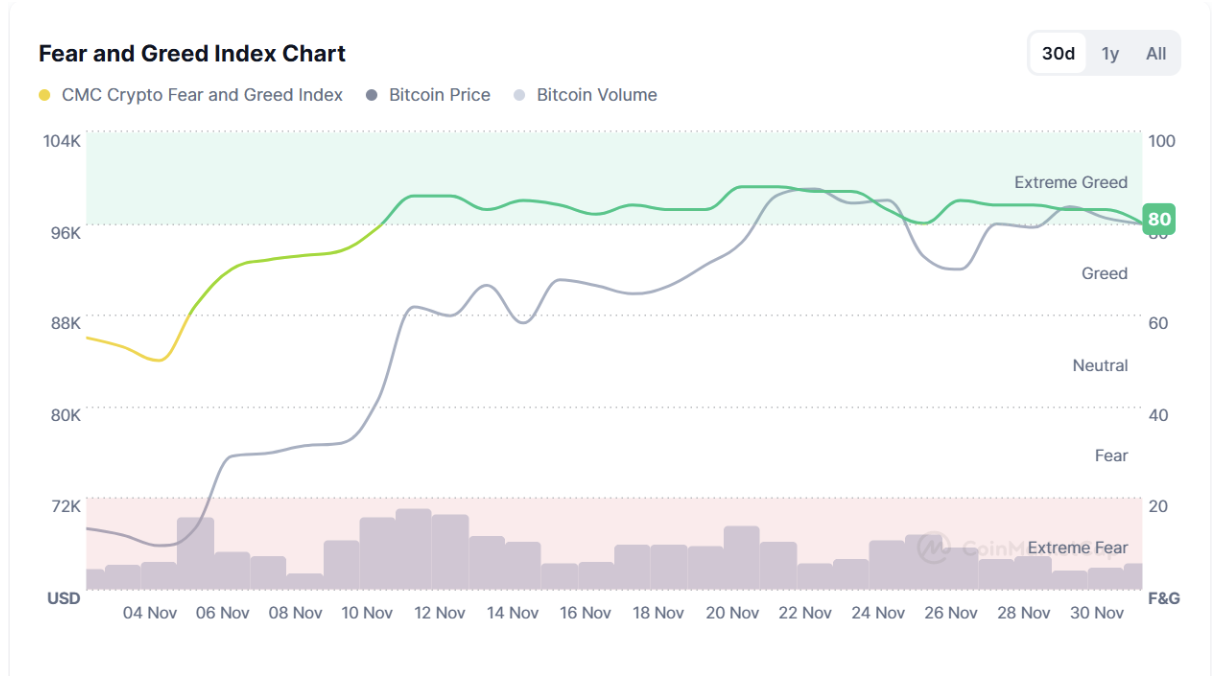

November was marked by positive sentiment in the cryptocurrency market, as clearly demonstrated by the Fear & Greed Index. Here are the key stages of its dynamics:

Pre-election Phase. The index was in the neutral zone, reflecting cautious optimism among market participants.

Post-election Surge. Donald Trump's victory triggered a spike in activity, and the index exceeded 60 for the first time this month, entering the greed zone.

Bullish Trend. Amid Bitcoin’s upward momentum and positive news, on November 11, the index reached the extreme greed zone (above 80).

Sustained Optimism. The index remained in the extreme greed zone for most of November, indicating persistent optimism and a willingness among investors to take risks.

This increase was accompanied by rising prices for Bitcoin and altcoins. Market participants' sentiments played a key role in maintaining the bullish trend, reinforcing prospects for further growth. The Fear & Greed Index continues to be an important indicator of the emotional state of the cryptocurrency community.

Fear and Greed Index. Source: CoinMarketCap

The Ongoing Trend of Memecoins

Memecoins continue to take center stage in the cryptocurrency market, showcasing incredible performance. Among the top gainers of November was the memecoin Peanut the Squirrel (PNUT), whose emotional backstory catalyzed its rapid rise.

Inspired by the story about a squirrel named Peanut, who gained notoriety following a tragic euthanasia incident, PNUT was launched in early November 2024 on the Solana blockchain. The memecoin quickly gained popularity due to widespread support on social media, especially after Elon Musk mentioned it on X (formerly Twitter).

Within two weeks of its launch, PNUT achieved a market capitalization of $2 billion. Its price surged over 100 times, from $0.023 to $2.47 at its peak. By the end of November, the token was trading around $1.15, with a market capitalization of $1.15 billion, ranking 86th in the top 100 cryptocurrencies according to CoinMarketCap.

PNUT/SOL on Raydium. Source: Dexscreener

PNUT further solidified its popularity with a listing on Binance on November 11, giving a new boost to interest in the token. This rise was so rapid that PNUT quickly became a symbol of the Trump Rally, reflecting market optimism following Donald Trump's electoral victory.

Alongside PNUT, other memecoins such as DOGE, BONK, and PEPE also demonstrated steady growth in November.

Thus, the memecoin trend remains relevant, with projects like PNUT evolving into not only financial instruments but also symbols of global sentiment within the crypto community. The memecoin sector continues to attract new investors due to active community support and high growth rates, confirming the significance of memecoins as a phenomenon in the cryptocurrency market.

AI Agents and Memecoins

In November 2024, there was a significant rise in the popularity of integrating memes and artificial intelligence, capturing the attention of the entire crypto community. AI agents that utilize memes to create content on platforms like X (formerly Twitter) and Discord became a major trend in the industry. This phenomenon manifested in various forms, including the generation of tokens with AI (such as GOAT), as well as using memes as marketing tools to promote crypto projects.

AI technologies are actively integrated with memes, opening up new opportunities for user engagement and token popularization. The influence of AI agents on the creation and dissemination of memes has the potential to change the dynamics of internet marketing, ensuring viral distribution and high recognition among users. These innovative approaches help projects reach a new level of popularity and attract a broader audience.

The cumulative market capitalization of AI-supported memecoins has already surpassed $9 billion, with daily trading volumes approaching $2 billion, confirming the growing interest in this trend and its importance for the crypto industry. We will continue to monitor this direction and report on how the crypto community adapts memecoins and AI in its strategies and offerings.

Top AI Agents Coins by Market Cap. Source: CoinGecko

Telegram Apps Trend

In November 2024, cryptocurrencies and tokens associated with mini-apps in Telegram continued to evolve, despite some challenges. In our October review, we noted the unsuccessful launch of the token X Empire (X), which lost over 50% of its value in just a few days, disappointing many users.

However, the situation improved in November. The token X made a comeback, demonstrating impressive growth from $0.000032 to $0.0006, achieving a new all-time high (ATH) with a gain of 1746% in just a couple of weeks. This resurgence inspired other tokens in the ecosystem, such as HMSTR, NOT, and DOGS, which also exhibited positive dynamics, helping to regain interest and hope for the trend's stability.

X/USDT Performance. Source: CoinMarketCap

The TON ecosystem and mini-apps in Telegram continue to be significant players in the crypto space. These technologies deserve close attention; therefore, we will keep monitoring their development and inform you of important events and updates.

Revival of Retro Drops

November 2024 became a landmark month for drop hunters due to one of the largest airdrops in the cryptocurrency industry, conducted on the Hyperliquid platform. The volume of distributed HYPE tokens exceeded $1.2 billion, and the total capitalization at launch reached $4 billion. Within a few days, the token's price skyrocketed from $3.3 to $10, and it has since stabilized at around $8, with a market capitalization of $2.25 billion. This event generated significant attention for the platform and revived interest in airdrop hunting, which could play an important role in market development.

HYPE/USDT Performance. Source: CoinMarketCap

Among the features of this airdrop, it is noteworthy that 31% of all tokens were distributed among active users based on accumulated points. Some participants received substantial amounts, which drew renewed attention to the platform and created expectations for further significant airdrops. Such promotions remain an important marketing tool for blockchain platforms seeking to attract new users and strengthen their audience.

Expectations for December

Traditionally, December is associated with increased activity in financial markets due to holiday spirit and rising consumer spending. The year-end Christmas rally, often observed in the last weeks of December, could support a positive trend in the cryptocurrency market. The emotional component of investors plays a key role, as the desire to increase profits before the New Year encourages many to invest more actively.

In December, another Federal Reserve meeting is scheduled for December 18. This year, the Fed has cut interest rates twice by 0.5% (in September and November), which has positively impacted risky asset markets, including cryptocurrencies. If the Fed decides again to ease monetary policy, this could heighten investor interest in crypto assets.

Historically, December in the cryptocurrency industry has often shown neutral or moderately negative results. However, in years when November ends with strong growth, December has also proven successful. Given the positive backdrop of November 2024, the likelihood of continued growth in December is quite high.

Conclusion

November 2024 was a remarkable month for the cryptocurrency market. Donald Trump's victory in the U.S. elections initiated the "Trump Rally," resulting in an impressive 37.29% rise in Bitcoin. The leading cryptocurrency updated its historical highs, coming close to the $100,000 mark. This surge not only boosted confidence in the market but also attracted attention from both institutional and retail investors.

The decline in Bitcoin's dominance led to a rise in altcoins, potentially signaling the imminent start of a new altcoin season. Record trading volumes on both centralized and decentralized exchanges indicated a growing interest in cryptocurrencies.

The Fear & Greed Index reached an extreme greed level not seen since early 2022, reflecting high optimism and investors' willingness to take risks in anticipation of further growth. However, it is essential to consider that such levels often signal market overheating.

The strong results from November create a favorable environment for the continuation of the bullish trend into December. Key factors remain the upcoming Fed meeting and potential changes in monetary policy, as well as the traditional Christmas rally, which could amplify investor activity amid holiday enthusiasm.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.