Weekly Crypto Market Wrap April 7-13, 2025

After weeks of chaos — from crushing tariffs to market crashes and bear-driven panic — the crypto market finally found a moment of calm. While it’s too early to call it a reversal, there was a whiff of optimism in the air… until Sunday arrived. That’s when OM collapsed by -93% in a matter of hours.

What’s even more remarkable? The market barely flinched. It seems crypto veterans have reached a new level of resilience — $5.5 billion wiped out in an evening, and no major panic. Now let’s break down what happened over the past week:

Trump Hits Pause on Tariffs. In a surprising move, Donald Trump suspended tariffs for 90 days, sparing items like computers, smartphones, and chips. While it may seem like a typical trade war tactic, the markets — especially tech and crypto — took it as a positive signal. Fewer tariffs = better hardware access = improved mining and decentralization. Or at least, one less thing to worry about.

China Hits Back — Tariffs Now 125%. China wasn’t having it. In response, Beijing raised tariffs on U.S. goods to a staggering 125%, covering a wide range of imports. The message? “Flinch and lose.” Markets are now bracing for what might be a calm before another storm.

Paul Atkins Becomes SEC Chairman. The U.S. Senate confirmed Paul Atkins — a known free-market libertarian and former SEC Commissioner — as the new head of the SEC. Could this mark the start of a more crypto-friendly era at the top of U.S. financial regulation? Hope is in the air.

Ripple vs SEC: 60-Day Timeout. In the never-ending courtroom saga, Ripple and the SEC were granted 60 days to seek a resolution. Could this finally bring closure to one of crypto’s longest legal battles? XRP holders are watching closely.

Hong Kong Plans New Crypto Regulations. Hong Kong’s government has announced a review of its crypto laws. While it may sound bureaucratic, the outcome could dramatically reshape the city’s position as a top Asian crypto hub — depending on how investor-friendly the new rules are.

U.S. Inflation Cools to 2.4%. Finally, some macro relief. Inflation in the U.S. fell from 2.8% to 2.4%, easing pressure on the Fed and boosting hopes for less aggressive monetary policy. More liquidity = potential upside for risk-on assets like crypto.

EU Also Hits Pause on Tariffs. The European Union has joined the tariff truce, delaying its countermeasures by 90 days. The markets took it as a collective decision to “not fight until summer.” A temporary breather, but no one expects this calm to last.

Trump Signs Executive Order Freeing DeFi from IRS Reporting. Game-changer: Trump signed an executive order removing DeFi brokers from IRS reporting obligations. In plain English: DEXs can now breathe easier. No wonder the market celebrated.

FTX Cancels $2.5B in Claims — 392K Requests Gone. FTX just voided 392,000 claims, worth $2.5 billion, from users who failed KYC. The already slim hopes for recovery just got slimmer. Even in death, FTX keeps disappointing.

CZ Is Now a Crypto Advisor in Pakistan. Surprise appearance: Changpeng Zhao (CZ) is back in the news — this time as a strategic advisor to Pakistan’s Crypto Council. Whether it's symbolic or strategic, Pakistan seems serious about entering the crypto game.

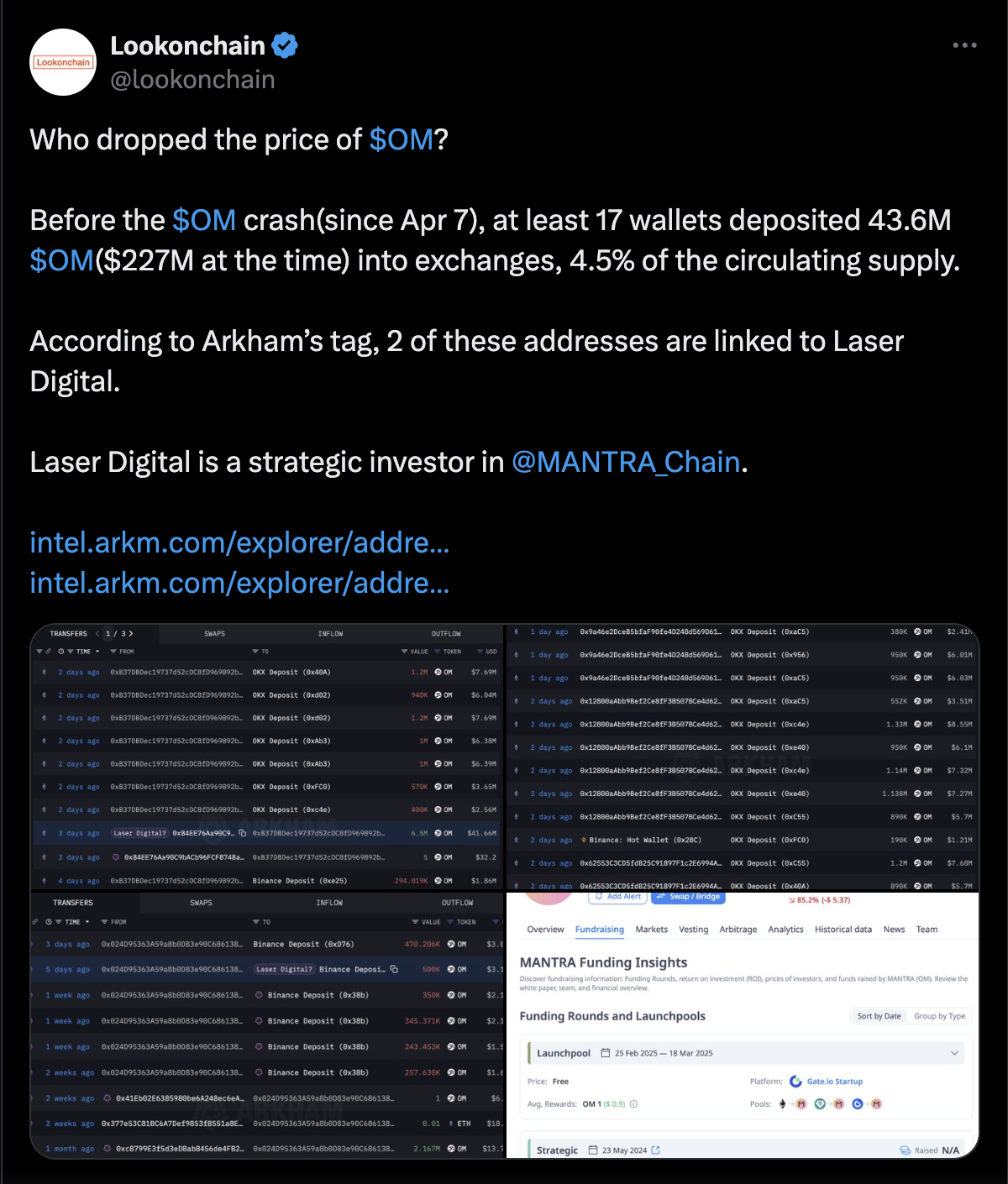

OM Token Collapses 93% in One Night. Sunday brought the biggest shocker of the week: the OM token (from RWA project Mantra) lost 93% of its value, wiping out $5.5 billion in market cap. What we know:

1. 17 wallets moved 4.5% of total supply to exchanges before the drop

2. Two of those wallets are allegedly tied to Laser Digital (which denies any connection)

Whether it was insider dumping or panic sell-off, confidence in RWA tokens just took a major hit.

Upcoming major token unlocks:

TRUMP: $337.20M (20.3%)

FTN: $81.00M (4.7%)

CONX: $77.12M (377.9%)

QAI: $50.04M (3,972.0%)

zKJ: $34.94M (25.8%)

ARB: $28.38M (2.1%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.