Weekly Crypto Market Wrap February 10-16, 2025

It’s been a wild week in the world of cryptocurrencies, though not necessarily in a good way. We saw the launch of tokens from the Central African Republic (CAR) and even the Argentine president. Despite all this, the total market cap of crypto remained unchanged, along with investor fear. Bitcoin dominance dropped by almost 1.5%, slowly giving altcoins some breathing room—though most of them are still near their historical lows. As for BTC itself, it remained relatively stable, moving sideways. Now, let’s dive into the details:

(Micro)Strategy stays true to its strategy – another 7,633 BTC acquired. Michael Saylor’s company made another big Bitcoin purchase, this time adding 7,633 BTC for $742 million. This brings Strategy’s total holdings to 478,740 BTC, with an average purchase price of $65,033 per BTC.

Abu Dhabi plays big – $436M invested in Bitcoin ETFs. While some are still debating whether to hold Bitcoin, the Abu Dhabi sovereign wealth fund (Mubadala Investment Company) has made a bold move, investing $436 million into Bitcoin ETFs. The oil-rich emirate seems to be hedging its bets. Who knows, in a couple of years, the sheikhs might be asking each other: "Are you still in oil, or have you moved to Bitcoin?"

Wisconsin pension fund: when grandma becomes a Bitcoin hodler. Think crypto is just for the younger generation? Think again—Wisconsin’s pension fund has allocated $321 million to Bitcoin ETFs. While traders argue about whether to buy or sell, conservative investors are entering Bitcoin—not through the spot market, but through funds. Just imagine a grandma saying: "I survived the 2022 bear market, and in 2026, my long position got liquidated."

SEC reviewing ETFs for SOL, XRP, and even DOGE—yes, DOGE! The U.S. Securities and Exchange Commission has received multiple ETF applications: VanEck, 21Shares, and Bitwise want to launch a Solana ETF. At the same time, Grayscale has filed for XRP and DOGE ETFs. A Solana ETF makes some sense, but a DOGE ETF sounds like a joke. However, given Elon Musk’s influence, it could become a reality. Just imagine: "Ladies and gentlemen, introducing the world’s first meme ETF."

14 U.S. states sue Elon Musk and Trump over DOGE. Attorneys General from 14 states have decided it’s time to crack down on DOGE. They have filed a lawsuit against Elon Musk and Donald Trump, accusing them of market manipulation.

DEX Jupiter to buy back and lock JUP tokens for 3 years. Starting February 17, Jupiter (JUP) will begin buying back its tokens using 50% of its revenue and locking them for three years. If this plan works, JUP could become a major gem in the crypto space. If not, someone will have the most expensive locker on the blockchain.

U.S. inflation higher than expected – 3% instead of 2.9%. The Federal Reserve is still struggling to control inflation, which came in at 3% for January, higher than the expected 2.9%. This means interest rates might not be cut as quickly as the market hopes. Bitcoin is holding steady for now, but if investors panic, they might flee to cash—potentially triggering another bear market.

Trump proposes tariffs on countries that restrict the U.S. Donald Trump has unveiled a plan for new tariffs against countries that impose restrictions on the United States. This could impact not only traditional markets but also the crypto industry, especially if the U.S. tightens control over financial flows.Trump’s relationship with crypto is a saga in itself. Back in 2019, he called Bitcoin a "scam", but now, some of his strongest supporters are crypto investors. Meanwhile, his TRUMP token is actively trading on exchanges.

SEC and CFTC resume crypto advisory committee meetings. U.S. regulators have decided to reconvene their crypto advisory committee. Typically, this means a lot of discussions and not much action.

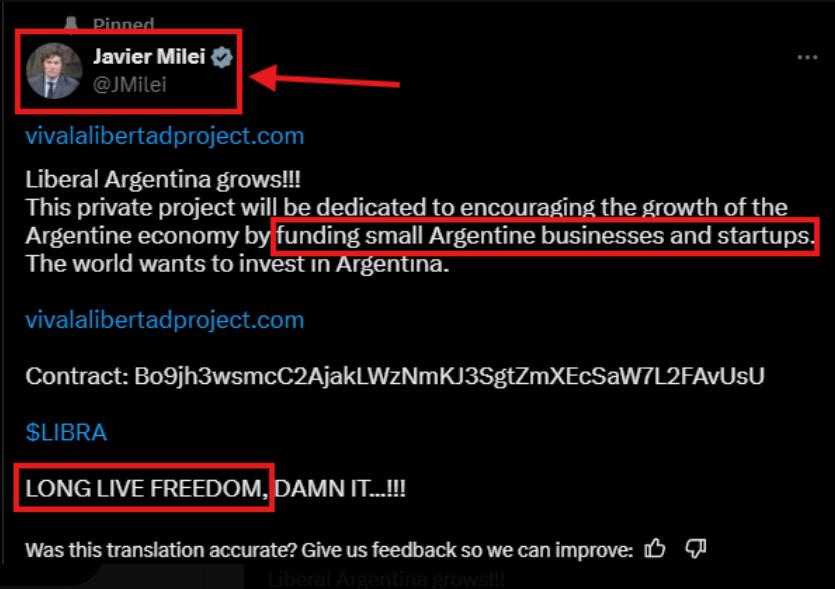

Presidents are getting into meme coins: CAR and Argentina’s token fails. The Central African Republic launched its official meme coin. Yes, you read that right—the country is now issuing meme coins. However, the token crashed just a few days after launch. Meanwhile, Argentine President Javier Milei endorsed the LIBRA token in a tweet. One day later, it plummeted 95%. Now, Argentinians have learned what a "political dump" looks like—and how a rug pull feels firsthand.

Upcoming major token unlocks:

MURA: $85.00m (1.7%)

FTN: $78.60m (4.7%)

MELANIA: $78.40m (41.4%)

QAI: $47.64m (10.9%)

MRS: $28.90m (11.9%)

IMX: $19.85m (1.4%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.