What is Cardano (ADA) and What to Expect

This blog post will cover:

- What is Cardano (ADA)

- Cardano (ADA) price, supply and Market cap

- How does Cardano work?

- Blockchain Cardano (ADA) operates on

- What Makes Cardano Unique?

- Who created Cardano?

- History of Cardano

- Is Cardano better than Ethereum?

- How Is Cardano (ADA) Different To

- Advantages of Cardano

- Disadvantages of Cardano

- How Is The Cardano Coin Secured?

- How To Use Cardano (ADA) cryptocurrency

- Cardano Roadmap

- Future of Cardano

- The Bottom Line

- FAQ

Disclaimer: SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.

Cardano, a popular platform with its native token created in 2017 by Charles Hoskinson, is recently becoming popular. It uses a proof-of-stake consensus mechanism, which means you can earn rewards by staking your ADA tokens. This article will explore the question of what Cardano is, what does Cardano do, its history, price, and future of the coin.

Key Takeaways

- Cardano aims to solve some of the challenges faced by previous generations, such as scalability, interoperability, and sustainability.

- Cardano’s native cryptocurrency, ADA, plays a critical role in maintaining and operating the network. You can buy, sell, or trade ADA on various platforms, or use it to pay for transactions, stake it to earn rewards, or delegate it to a stake pool operator.

- Cardano cannot be mined since it’s not part of the proof-of-work consensus. You can only stake it by simply keeping your Cardano wallet (like Daedalus) online. You’ll get a certain percentage of your already owned ADA coins as payment.

- Cardano is developed based on extensive academic research and uses a unique proof-of-stake consensus mechanism known as Ouroboros. Cardano’s network is built on a secure infrastructure designed to protect users from various forms of fraud and malicious attacks.

What is Cardano (ADA)

Cardano is a blockchain platform that aims to create a more secure, scalable, and sustainable foundation for decentralized applications, systems, and societies. It seeks to achieve this by prioritizing interoperability, scalability, and sustainability through a layered architecture that separates accounting and computation.

It is the first blockchain to be based on peer-reviewed research and developed through evidence-based methods. Cardano's development is guided by a rigorous academic approach and peer-reviewed research, emphasizing security and scalability in the design of its blockchain. The platform utilizes a proof-of-stake consensus algorithm, known as Ouroboros, which allows users to participate in the network and earn rewards by staking their ADA cryptocurrency.

In addition, Cardano places a strong emphasis on compliance and regulatory transparency, making it an attractive option for businesses and institutions looking to implement blockchain solutions while adhering to regulatory standards. It also has a strong focus on providing accessibility to its platform. Cardano purpose is to empower individuals and communities with limited access to traditional banking services through its secure and efficient financial infrastructure.

Cardano’s native cryptocurrency is called ADA, and has the following interesting features:

- ADA can be used to send and receive value on the Cardano network, as well as to pay for transaction fees and network operations.

- ADA holders can participate in the governance of the Cardano network by voting on proposals and updates.

- ADA holders can also stake their coins to help secure the network and earn rewards in the process.

- ADA has a fixed maximum supply of 45 billion tokens, with a current circulating supply of about 35 billion.

Cardano (ADA) price, supply and Market cap

| Price | $0.33442679 |

| Market Cap | $11,683,151,191.18 |

| Circulating Supply | 35 Billion ADA |

| Trading Volume | $203,446,939.16 |

How does Cardano work?

Cardano is a decentralized proof-of-stake blockchain designed to be a more efficient alternative to proof-of-work networks. It was one of the first blockchains to implement the Ouroboros proof-of-stake consensus algorithm, which is often described as more energy-efficient than the proof-of-work consensus used by Bitcoin. Cardano’s initial mainnet went live in September 2017, enabling ADA transactions over a federated network using the Ouroboros consensus mechanism. The network employs a smart contract framework called Plutus, which allows the use of the Haskell programming language to write applications. To answer the question of what is ADA crypto - it is the native asset of the Cardano blockchain, and it plays a critical role in maintaining and operating the network

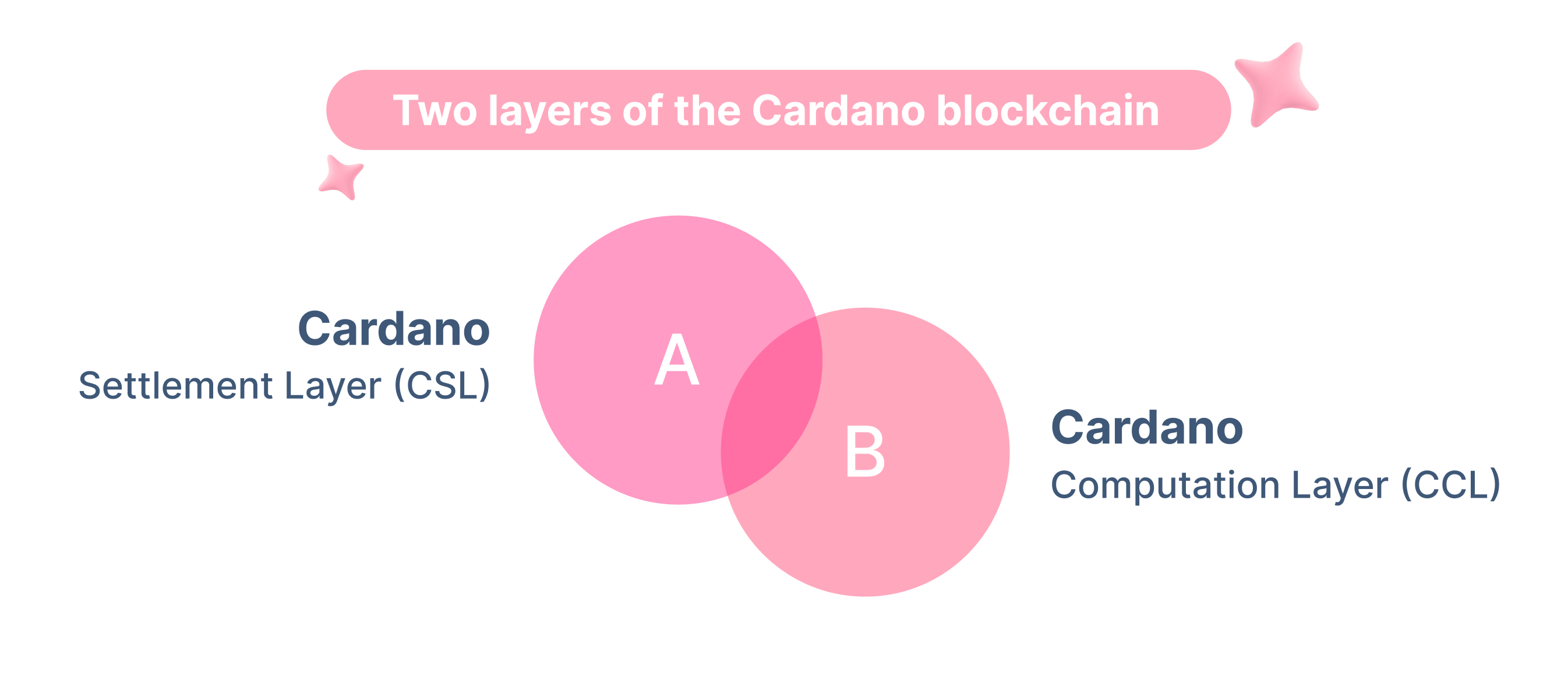

To understand what the future of the project looks like, it's best to start with the basics and explore what is Cardano coin. Cardano uses a unique architecture that employs a dual-layer system, which is distinct from most other blockchain platforms. Its settlement layer (CSL) allows ADA token holders to send and receive transactions almost instantly at low fees, while its computational layer (CCL) serves as the foundation of the rest of Cardano’s functionality. Some of the key components of Cardano’s architecture are:

Ouroboros

This is the proof-of-stake consensus protocol that powers Cardano. Ouroboros is designed to be more energy-efficient and secure than the proof-of-work protocol used by Bitcoin and Ethereum. Ouroboros divides time into epochs and slots, and selects a set of validators (called slot leaders) to produce blocks in each slot. Validators are chosen based on the amount of ADA they stake, and they receive rewards for their participation.

Plutus

This is the smart contract platform that runs on the CCL. Plutus allows developers to write smart contracts in the Haskell programming language, which is known for its high-level of security and reliability. Plutus also enables interoperability between smart contracts and other off-chain systems, such as oracles and sidechains.

Marlowe

This is a domain-specific language that simplifies the creation of smart contracts for financial applications. Marlowe is designed to be accessible to non-programmers, such as financial experts and auditors, who can use a graphical interface to build and verify smart contracts. Marlowe also provides a library of templates and examples for common financial contracts, such as escrow and swaps.

PoS

Cardano uses a proof-of-stake consensus mechanism called Ouroboros, which is more energy-efficient and scalable than proof-of-work. Ouroboros divides time into epochs and slots, and selects a slot leader to produce a block at each slot. The slot leader is chosen based on the amount of stake they have or delegate. Ouroboros also uses cryptography and game theory to ensure the security and fairness of the protocol.

PoW

The Proof of Work algorithm is a consensus mechanism used in cryptocurrency mining. Simply put, it requires miners to solve complex mathematical problems to check and record transactions in a blockchain.

Blockchain Cardano (ADA) operates on

The platform operates on its own Cardano blockchain, which is composed of two layers: the Cardano Settlement Layer (CSL) and the Cardano Computational Layer (CCL). The CSL is responsible for handling the basic transactions of ADA tokens, while the CCL supports the execution of smart contracts and other advanced features. The two layers are connected by a set of protocols that ensure compatibility and security. The advantage of this architecture is that it allows for greater flexibility and scalability, as well as separation of concerns. For example, the CSL can be updated without affecting the CCL, and vice versa. Moreover, the CCL can support different types of smart contracts and computation models, depending on the needs of different users and applications.

What Makes Cardano Unique?

Cardano is a third-generation blockchain platform that aims to solve some of the challenges faced by previous generations, such as scalability, interoperability, and sustainability. Cardano is unique in several aspects:

- Research-based development

Cardano is based on scientific research and peer-reviewed papers. It follows a rigorous and transparent process of design, testing, and implementation. Cardano is constantly evolving and improving through collaboration with academic institutions, industry partners, and community members.

- Layered architecture

Cardano has two separate layers: the Cardano Settlement Layer (CSL) and the Cardano Computation Layer (CCL). The CSL handles the transactions and the ledger, while the CCL handles the smart contracts and the applications. This separation allows for more flexibility, security, and innovation.

- Smart contract platform

Cardano supports smart contracts and decentralized applications through its CCL. Cardano’s smart contract framework is called Plutus, which is based on the Haskell programming language. Plutus allows for high assurance and formal verification of smart contracts, reducing the risk of errors and bugs. Cardano also supports other programming languages and frameworks, such as Marlowe, Glow, and IELE.

Who created Cardano?

Cardano was created by Charles Hoskinson, one of the co-founders of Ethereum. He is also the CEO of IOHK, the company that leads the development of Cardano. It's sometimes hard to say exactly when did Cardano start, as Hoskinson envisioned it as a more advanced and sustainable blockchain platform that would deliver more value and innovation to the world.

History of Cardano

Cardano’s history can be divided into five stages, each corresponding to an era of its roadmap:

Byron

This was the first stage of Cardano’s development, which began in 2015 and lasted until 2020. During this stage, Cardano launched its mainnet and its native cryptocurrency, ADA. The main focus of this stage was to establish the foundation of the network and the community.

Shelley

This was the second stage of Cardano’s development, which started in 2020 and ended in 2021. During this stage, Cardano transitioned from a federated network to a decentralized network, where users could stake and delegate their ADA to help secure and operate the network. The main goal of this stage was to achieve scalability, security, and decentralization.

Goguen

This is the current stage of Cardano’s development, which began in 2021 and is expected to end in 2023. During this stage, Cardano will introduce smart contract functionality and enable the creation of decentralized applications (dApps) on its platform. The main objective of this stage is to enable innovation, interoperability, and utility.

Basho

This will be the fourth stage of Cardano’s development. During this stage, Cardano will improve its performance and scalability by implementing sidechains, sharding, and other optimization techniques. The main aim of this stage is to enhance resilience, throughput, and reliability.

Voltaire

This will be the final stage of Cardano’s development, which is scheduled to begin at the end of 2023. During this stage, Cardano will establish a self-sustaining and democratic governance system, where users can propose and vote on the future direction of the network. The main purpose of this stage is to ensure sustainability, inclusiveness, and accountability.

The major stakeholders of Cardano

Cardano has three major stakeholders that are responsible for different aspects of its development and operation:

- IOHK: This is the company that leads the research and development of Cardano. It is headed by Charles Hoskinson and employs a team of engineers, scientists, and experts from various fields. IOHK is contracted to work on Cardano until 2020.

- Cardano Foundation: This is the non-profit organization that oversees the legal and regulatory aspects of Cardano. It also promotes the adoption and awareness of Cardano among the public and the industry. It is based in Switzerland and governed by a council of members.

- EMURGO: This is the commercial arm of Cardano that supports the growth and development of the Cardano ecosystem. It provides technical, financial, and strategic support to projects and businesses that want to build on Cardano. It is based in Japan and has offices in several countries.

Is Cardano better than Ethereum?

Ethereum is a blockchain platform that supports smart contracts. It’s primarily used to build decentralized applications (dApps). Cardano, however, is considered to be a third-generation blockchain that builds upon the technology pioneered by Ethereum. Let’s take a closer look at the key differences of the two crypto giants — Cardano and Ethereum:

| Feature | ADA | ETH |

| Scalability | 15 TPS | 15 TPS |

| Governance | Ouroboros PoS. Voting for software and protocol updates | Similar to BTC, with additions (Eth Foundation) |

| Development complexity | New Simon + Plutus + Solidity languages | Solidity language |

| Timeline | CSL is live with limited features | Scalability improvements might take long |

| Other features (identity, authentication, file storage) | Reference libraries, verification tools | Intentionally avoided |

| Adoptability | Readable addresses, Cardano debit card | Not newbie-friendly, losing keys is catastrophic, fees |

| Market position | Backed by IOHK, significant hype and community | First mover advantage + many developers + money behind the project |

How Is Cardano (ADA) Different To

Cardano differs from other popular cryptocurrencies in several ways:

Bitcoin crypto

Bitcoin is a digital currency that was the first blockchain-based cryptocurrency. It doesn’t support smart contracts and its primary purpose is to be used as a digital currency.

Fantom crypto

Fantom was made for the DeFi users, this service has many features for profit generation. Cardano has a strong academic support being a great option for researchers. These two concepts are different, but both have a chance for a bright future.

Litecoin crypto

Like Bitcoin, Litecoin is a digital currency without smart contract functionality. It’s often considered as silver to Bitcoin’s gold. Cardano, on the other hand, supports smart contracts and has its own unique proof-of-stake consensus mechanism.

Advantages of Cardano

The several advantages of Cardano are:

- Fast Transactions: Cardano's focus on scalability and efficiency enables it to process transactions swiftly, ensuring a seamless user experience and facilitating quick and reliable transfers of value across the network. As a result, this increases the cardano transactions per second.

- Low Transaction Fees: The implementation of the proof-of-stake consensus mechanism allows Cardano to maintain minimal transaction fees, making it an attractive option for users seeking cost-effective and efficient blockchain transactions.

- Energy Efficiency: Cardano's adoption of the proof-of-stake model contributes to its energy-efficient operations, reducing the environmental impact associated with traditional proof-of-work-based cryptocurrencies. This emphasis on sustainability aligns with growing global concerns about the ecological footprint of blockchain technologies.

- Strong Development Team: With a robust team of experienced developers and industry experts led by Charles Hoskinson, Cardano benefits from a strong leadership core that emphasizes research-driven development and the implementation of innovative solutions, ensuring the platform remains at the forefront of technological advancement in the blockchain space.

Disadvantages of Cardano

Despite all the benefits of Cardano, it also has some disadvantages:

- Software Imperfections: As Cardano continues to evolve and expand its features, there remains the possibility of encountering software imperfections or bugs that could affect the platform's performance and user experience. While the team actively works to address any issues, the presence of such imperfections could potentially impact the network's stability and reliability.

- Competition: Cardano operates in a highly competitive environment within the blockchain and cryptocurrency space. With numerous projects vying for market dominance and user adoption, Cardano faces the challenge of differentiating itself and maintaining its competitive edge, especially as the industry continues to evolve rapidly with new technological advancements and innovations.

- Volatility: Despite its technical strengths, Cardano, like all cryptocurrencies, is susceptible to market volatility. Fluctuations in the value of ADA, the native cryptocurrency of the Cardano network, can be influenced by various factors.

How Is The Cardano Coin Secured?

Cardano is generally considered a safe investment based on how cardano works and other factors, benefiting from a robust infrastructure and a reputable team with a strong track record in the blockchain industry. The platform prioritizes security and user protection through advanced cryptographic protocols and security measures designed to safeguard transactions and user data from potential threats and malicious attacks. The adoption of Zero-Knowledge Proofs underscores Cardano's commitment to privacy and data protection, allowing users to conduct transactions securely without compromising sensitive information. While market volatility remains a concern, Cardano's security measures and commitment to maintaining a secure and efficient network contribute to its overall safety and reliability as a blockchain platform.

How To Use Cardano (ADA) cryptocurrency

Cardano is a blockchain platform that hosts the ADA cryptocurrency. To those of us who uses Cardano blockchain, you need to have ADA, which you can buy on various cryptocurrency exchanges. Once you have ADA, you can use it for various purposes such as staking, where you can earn rewards by participating in the network’s consensus mechanism. You can also use ADA to participate in decentralized applications (dApps) built on the Cardano platform.

Buying Cardano (ADA)

If you want to become an owner of the Cardano cryptocurrency- head to SimpleSwap and follow these instructions:

- For example, you want to swap BTC for ADA. Select the currency you want to exchange (e.g. BTC) in the first drop-downlist. Then enter the amount you want to swap.

- Select ADA in the second drop-down list. You’ll see the estimated amount that you’ll get after the exchange.

- Click the Exchange button.

- Enter the Recipient's Address. ADA will be sent. Be careful and make sure you use the correct address.

- Create the exchange.

- You will see the Bitcoin deposit address. You need to transfer the necessary amount of BTC to this address to start the BTC to ADA exchange.

How to Stake Cardano (ADA)

Staking Cardano (ADA) involves actively participating in the network's proof-of-stake consensus mechanism by holding and delegating your ADA tokens to a stake pool. To engage in staking and earn rewards, one will usually need to acquire ADA tokens, which can be purchased from various cryptocurrency exchanges and platforms that support Cardano. Then, you will need to decide on the staking pool and stake ADA. This process involves linking a wallet to the chosen stake pool and authorizing the delegation of ADA tokens to the pool's staking process.

Mining Cardano (ADA)

Cardano cannot be mined since it’s not part of the proof-of-work consensus. You can only stake it by simply keeping your Cardano wallet online. You’ll get a certain percentage of your already owned ADA coins as payment.

Cardano Roadmap

Cardano’s future development and growth plans are quite ambitious. Charles Hoskinson, the co-founder of Cardano, expects 2024 to be the "Mithril age of Cardano". This was after Cardano’s development update revealed significant growth for the project over the past year. According to Hoskinson, the protocol will be up and running without interruption since epoch 425. Additionally, he believes that the full node bootstrapping time will be reduced to under 20 minutes.

In the past year, there has been a substantial increase of 24.8 million Cardano transactions, 44 more Cardano projects have been launched, the number of native tokens has surged by 2.9 million, and about 6,687 smart contracts have been introduced. On average, it is expected that the value of Cardano might be around $$0.316.

These plans and predictions indicate that Cardano is poised for significant growth and development in the coming years. However, like all cryptocurrencies, ADA’s price is subject to market volatility and other factors, so these predictions should be taken with a grain of caution.

Future of Cardano

Cardano is a blockchain platform that has been gaining significant attention due to its unique features and potential. The future of Cardano looks promising, with several developments on the horizon. Charles Hoskinson, the co-founder of Cardano, has called it the foundation of trust for the crypto industry. The platform is expected to continue its growth and innovation, posing a challenge for other blockchain platforms like Ethereum. Cardano’s price is also showing increased activity, sparking bullish predictions about the coin’s future. According to some price predictions, the value of Cardano’s native cryptocurrency, ADA, could potentially reach $4.75 by 2025.

However, it's important to remember that the question of should I buy Cardano will always need to be approached with caution, after one performs all the necessary research and ensures the circumstances are right.

The Bottom Line

After attempting to have a glimpse and learn about Cardano, one can say that the platform aims to solve some of the challenges faced by previous generations, such as scalability, interoperability, and sustainability. It is developed based on extensive academic research and uses a unique proof-of-stake consensus mechanism known as Ouroboros. Cardano’s native cryptocurrency, ADA, plays a critical role in maintaining and operating the network. With its strong development team, innovative technology, and growing ecosystem, Cardano presents a compelling case for the future of blockchain technology.

FAQ

Here are some answers about ADA you might find useful.

What layer is Cardano?

Cardano operates using a two-layer structure, consisting of the Computation Layer (CCL) and the Settlement Layer (CSL), making it a third-generation platform. As a layer 1 blockchain, Cardano functions completely autonomously, meaning it can securely settle all transactions on-chain.

How decentralized is Cardano?

Cardano is a decentralized proof of stake (PoS) blockchain designed to be a more efficient alternative to proof of work (PoW) networks. Cardano’s oversight is decentralized and shared by the Cardano Foundation, IOHK, and EMURGO.

What blockchain is Cardano on?

Cardano is a public blockchain platform. It is open-source and decentralized, with consensus achieved using proof of stake.

What is Cardano ADA crypto used for?

ADA, the native coin of the Cardano network, is used for staking, settling payments, and governing the network. ADA tokens fuel the Cardano platform much like ETH tokens fuel the Ethereum platform. They’re used to pay transaction fees and are staked by validators (and delegators) who want to help maintain the security and stability of the network in exchange for earning rewards.

What is Cardano ADA transaction speed?

When the Cardano chain was first tested in 2017, it was able to process as much as 257 transactions per second (TPS)7. However, other sources suggest that Cardano’s transaction speed reaches 1000 TPS8 or that it can handle up to 250 transactions per second.

Who is the owner of ADA Cardano?

Cardano was founded in 2017 by cryptocurrency developers Charles Hoskinson and Jeremy Wood9. The company behind its development is called Input-Output Hong Kong (IOHK), which is managed by Charles Hoskinson.