What SEC Is and How It Affects Crypto

This blog post will cover:

- What is SEC?

- Genesis and Gemini

- Kraken

- Paxos and Binance

- Hydrogen Technology Corporation

- The reaction to SEC actions

- Conclusion

Lately, The US Securities and Exchange Commission (SEC), the financial regulator in the United States has been especially active in the crypto sphere. Some experts even dubbed this “the crypto crackdown”. Even though the regulator, led by Gary Gensler, started to get more into regulating crypto last year, 2023 saw an obvious increase in activity in this sphere.

Previously, we have discussed crypto regulation in regard to laws of several countries, today, we are going to look into the practical implementation of the existing rules in the US.

What is SEC?

Established during the Great Depression in 1934, the SEC is a federal agency that is responsible for supervising and enforcing regulations in the securities sector within the United States; this includes financial instruments (stocks, bonds, ETFs, etc.)

Whether cryptocurrencies should be regarded as securities or commodities (and overseen by a different agency) remains a topic of discussion.

The SEC's mission is to ensure equitable and effective markets and protect investors from scammers.

These are the regulator’s main functions:

- Inspections and examinations. The SEC checks the activity of broker-dealers, investment advisers, and other market participants.

- Enforcement. Those individuals or entities that break securities laws can be subjected to fines, confiscations, and even criminal charges.

- Establishing new rules and regulations. These are the rules related to securities: their registration, disclosure, and so on.

- Market monitoring. The SEC analyzes market activity to identify potential violations of securities laws. For instance, it monitors trading patterns, analyzes companies’ financial statements, etc.

Now we will have a look at some of the recent SEC activity connected to crypto.

Genesis and Gemini

In January 2023, the SEC filed a lawsuit against crypto companies Genesis and Gemini for allegedly offering unregistered securities in the Gemini Earn program through digital assets. The lawsuit seeks to force the firms to pay fines and stop such activity.

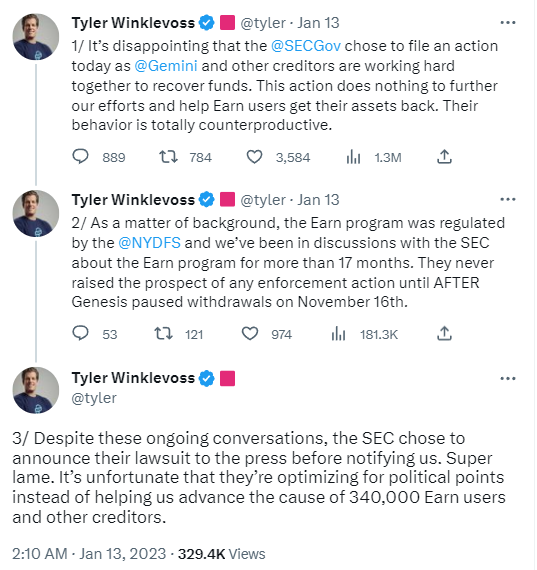

In light of the challenges faced by both companies following the FTX downfall, Tyler Winklevoss, who co-founded Gemini, expressed disappointment with the regulator's decision, deeming it "counterproductive." Genesis was severely impacted by these issues and subsequently filed for bankruptcy on January 20, 2023.

Kraken

In February 2023, Kraken, the cryptocurrency exchange, found itself in a situation somewhat similar to the aforementioned case. The exchange's staking program came under scrutiny from the Commission which accused it of running an unregistered trading platform for security-based swaps.

The company stopped offering crypto staking services to clients from the US. It also paid a $30 million settlement.

Paxos and Binance

Paxos, the issuer of Binance’s stablecoin BUSD, was sued by SEC in February 2023 for allegedly selling unregistered securities. The lawsuit focuses on the way BUSD was initially distributed, as Paxos used a private placement to sell tokens to a small group of investors before making them available to the wider public.

Hydrogen Technology Corporation

The court hearing between the SEC and Hydrogen Technology Corporation concluded on April 20, 2023, marking the end of the lawsuit involving allegations of crypto price manipulation by the company. The firm and its ex-CEO were ordered to pay $2.8 million in penalties and restitution as a consequence.

In September 2022, the SEC initiated the case, claiming that Hydrogen Technology Corporation engaged in a manipulation scheme to boost sales of its native token HYDRO, resulting in the firm receiving over $2 mln. Now the tokens have to go through the Howey test and then if they receive the SEC’s approval, the company and its ex-CEO will have an opportunity to start selling crypto again.

The reaction to SEC actions

The financial regulator's actions often generate controversy, even within the US political structure. On April 18, 2023, the House Financial Services Committee held a hearing where the head of SEC, Gary Gensler, was questioned by Republicans for more than 4 hours. The committee expressed the opinion that enforcing laws designed for traditional markets on crypto companies is counterproductive, while Gensler maintained that it is necessary.

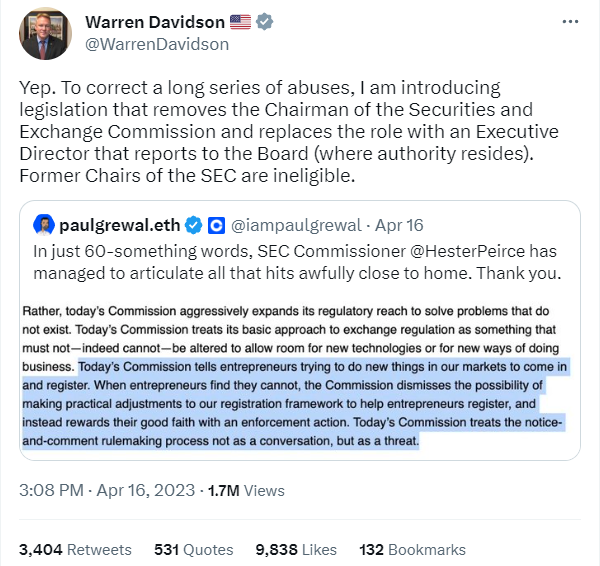

The House Committee also mentioned that such measures will make crypto firms relocate driving assets and talent away from the country, but the regulator’s representative was not convinced. Meanwhile, US Representative Warren Davidson went as far as calling SEC actions “abuse” and plans to prepare a bill to fire Gary Gensler.

Conclusion

These are some of the most noticeable events of the last couple of months, but the actual scope of the SEC’s activity is much wider. Soon, its attention will turn to banks that deal with stablecoins, according to the agency. This flurry of regulatory activity which is rightfully called the “crypto crackdown” already influenced other American governmental bodies to restrict the control over crypto.

While some people believe that such robust measures can reduce the customers’ and investors’ risks, the argument that it is more likely to stifle innovation and make blockchain businesses move their operations to other countries is just as valid.