AVAX Liquid Staking on BENQI

Key Insights

- A look into Avalanche-based liquidity market tool

- BENQI’s advantages and opportunities are taken into account

- Instruction of how to use BENQI project is provided

What Is Benqi

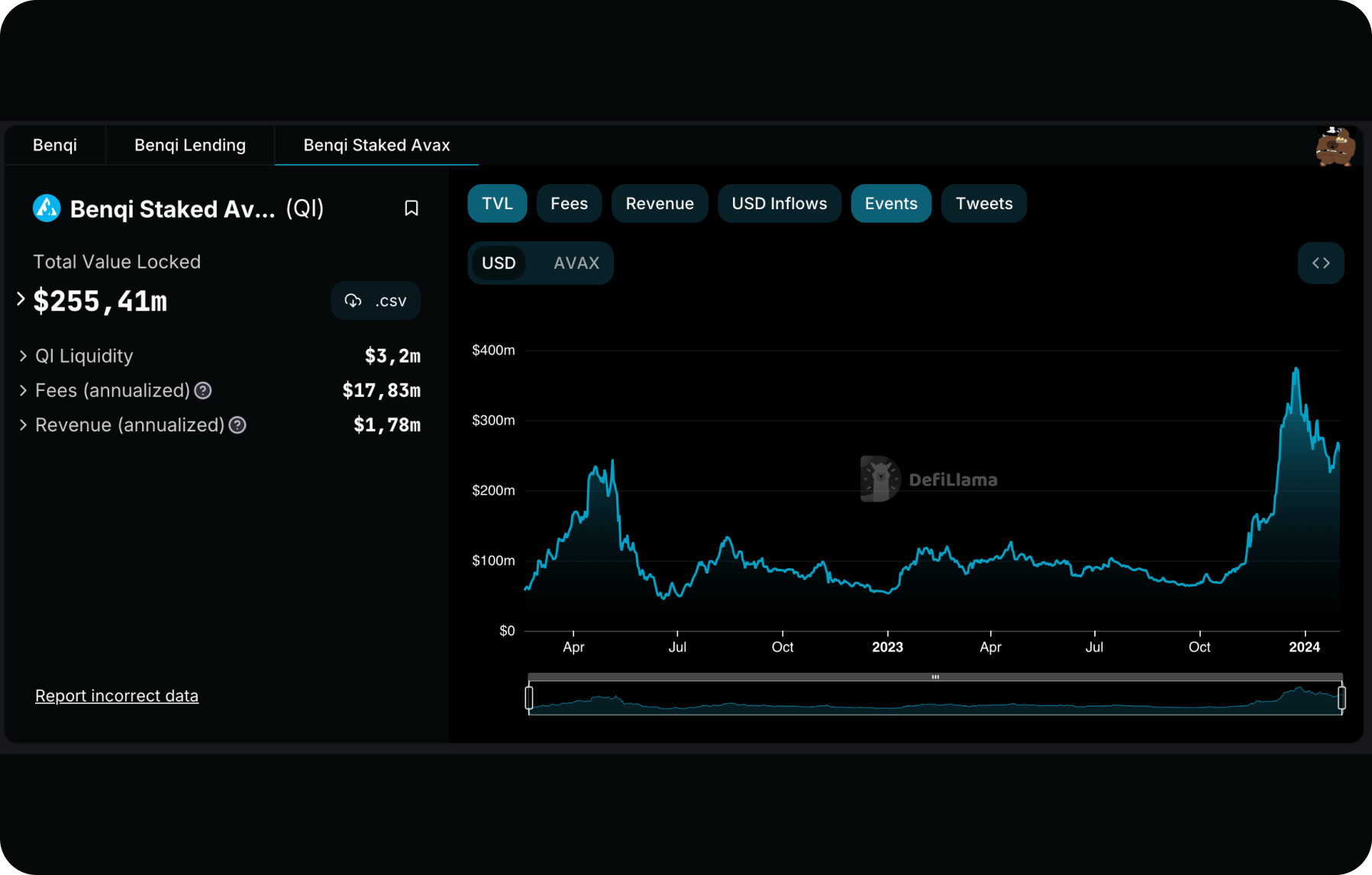

BENQI is a DeFi protocol on Avalanche that includes liquid staking and a liquidity market. Liquid staking allows efficient use of funds in staking through Avalanche validators without blocking assets or transfers between chains.

BENQI's liquidity marketplace provides the ability to lend and borrow crypto assets through smart contracts, providing users with income for asset allocation and access to collateralised borrowing without intermediaries.

How To Do Liquid Staking on BENQI

- Refill your Avalanche wallet with AVAX coins

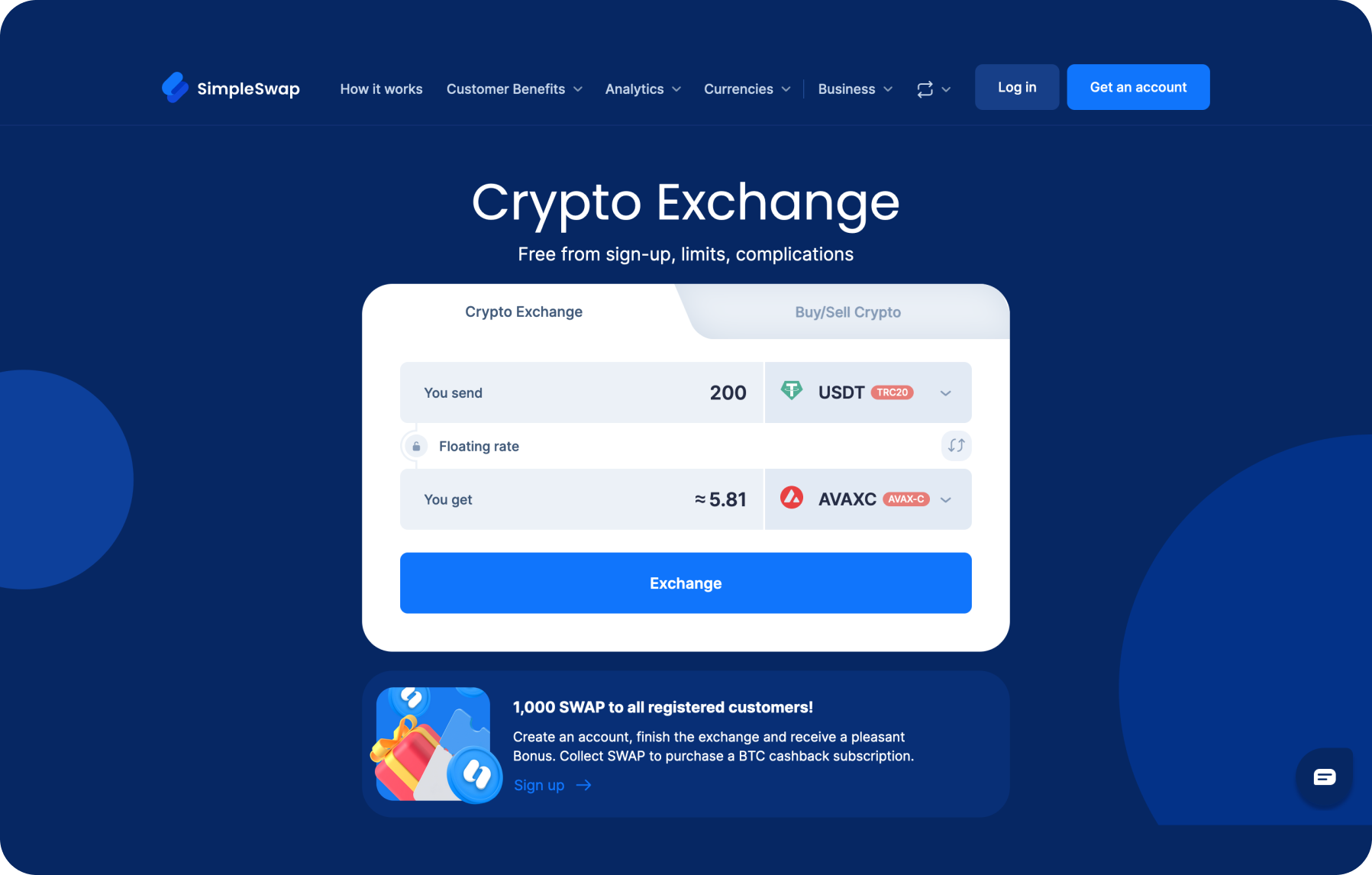

With the SimpleSwap cross-chain exchange, it's easy to swap assets on a great number of networks for AVAX coins, and can also be purchased for fiat.

Go to the Benqi website

- Click on the Apps button

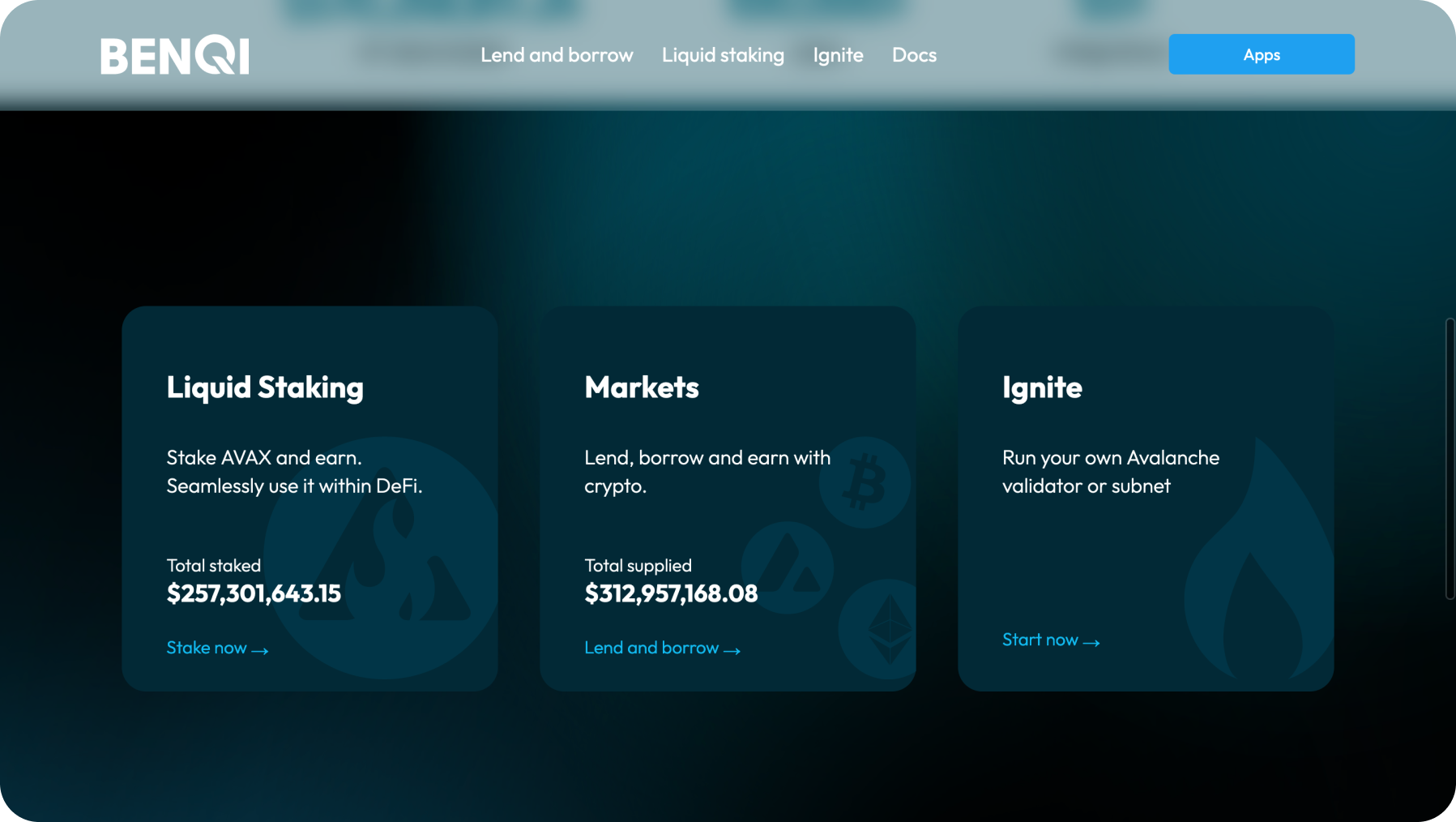

Scroll down the page and select Liquid staking.

Go to the page for Staking

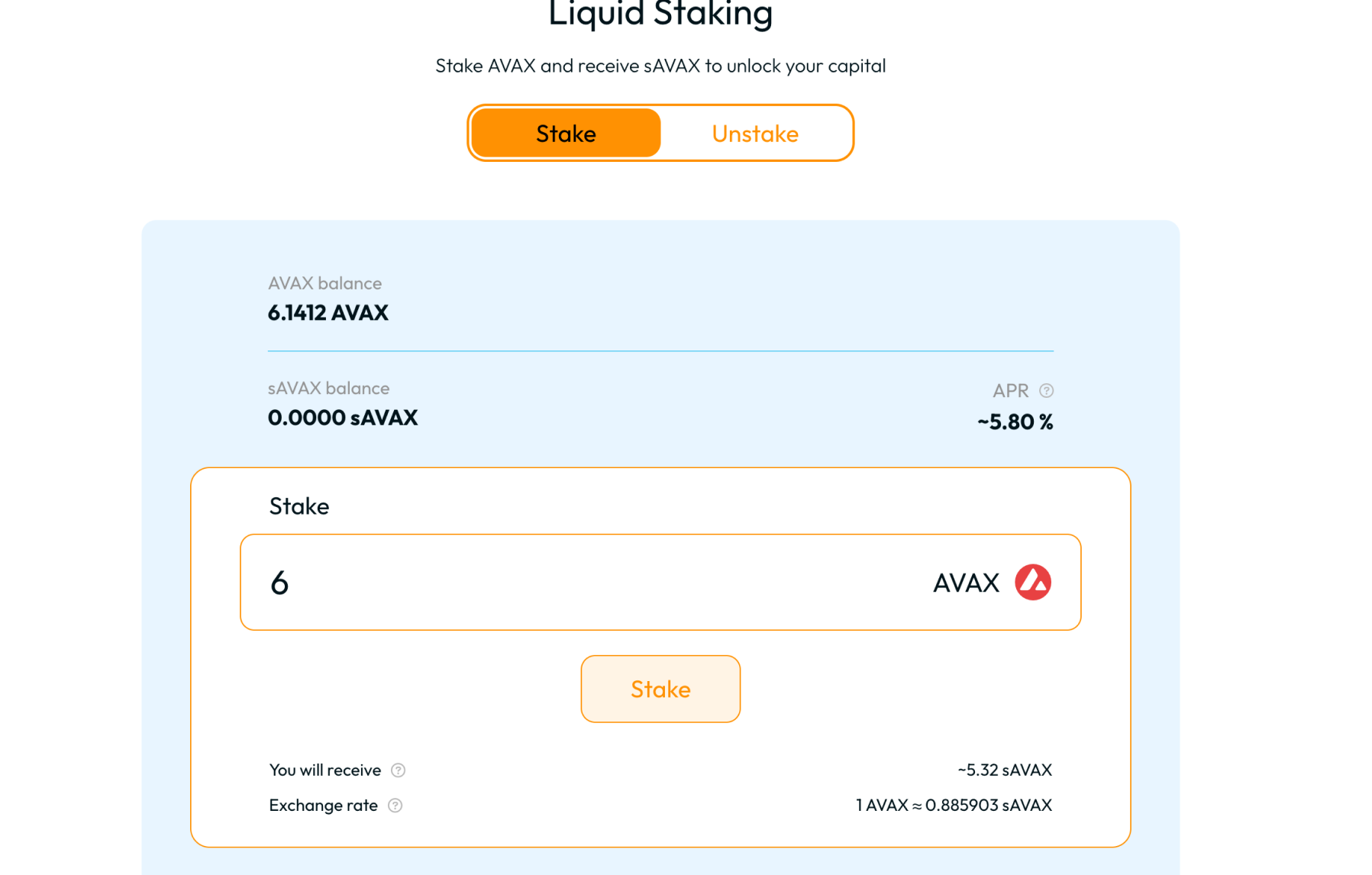

Select the necessary amount of AVAX and click Stake.

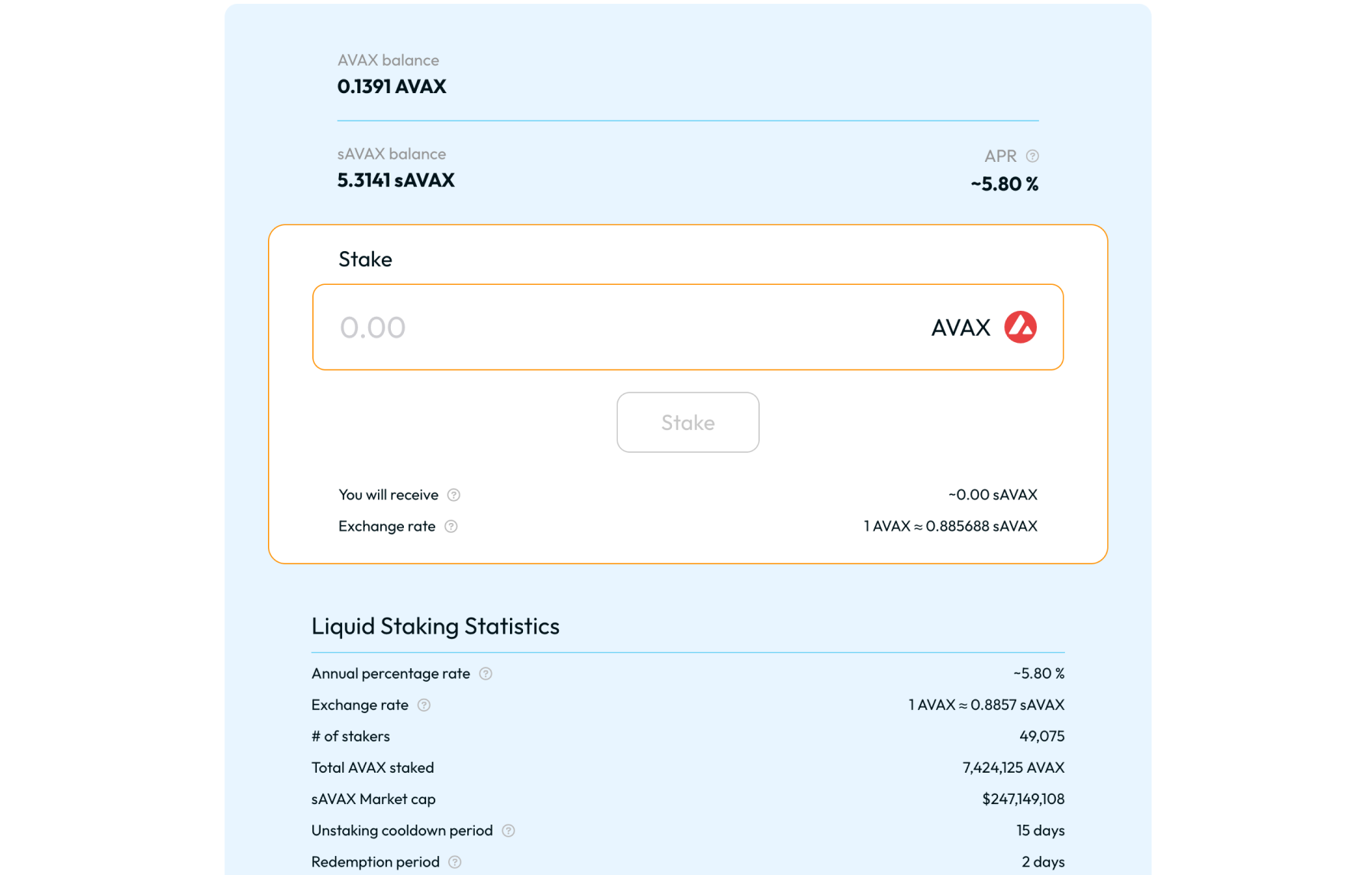

We've staked our AVAX at 5.8 per cent APR

Convert AVAX to sAVAX

Please note that the position will be unstacked for 15 days.

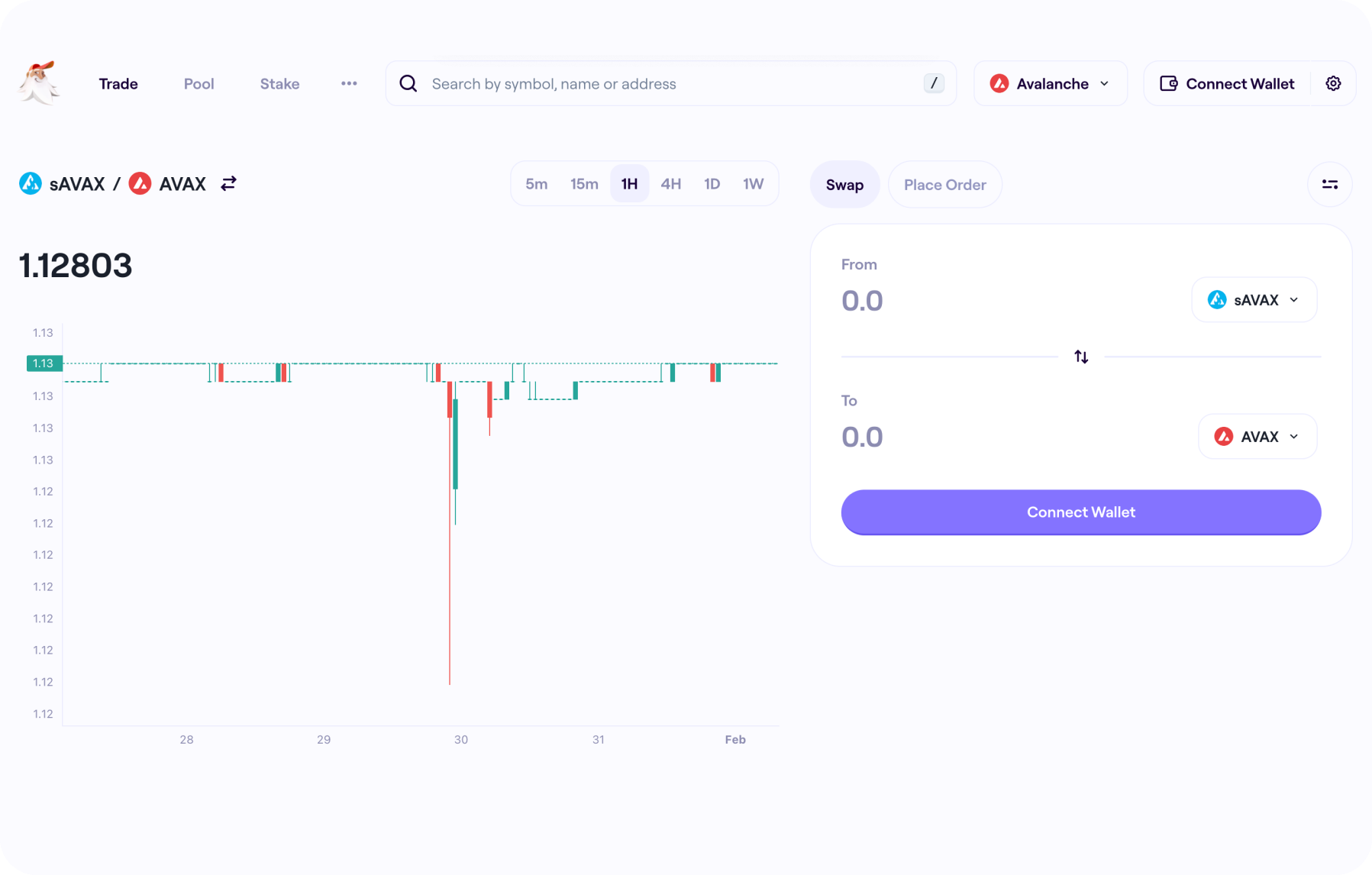

For a quick exchange of sAVAX to AVAX, please use Trader Joe XYZ.

Pay attention to the exchange rate skews that occur when a large participant leaves the pool, which is a good opportunity for small arbitrage.

Moreover, you can place your assets in the sAVAX to AVAX pool to get additional yield.

Summary

BENQI is an Avalanche-based DeFi tool that can be used in liquid staking on the liquidity market. It allows for lending and borrowing of crypto assets without intermediaries.

Via several simple steps, you can participate in liquid staking on the BENQI protocol.

Users can get all coins mentioned in this article on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.