DeFiLlama Yield Optimization

Key Insights

- DeFiLlama enables granular analysis of opportunities across decentralized protocols through aggregated TVL, yield, and strategic insights.

- Yield comparison tools allow easy evaluation of return potential across strategies like staking, lending, and liquidity pools. The delta neutral optimizer finds optimal lend-borrow-farm bundles to maximize yield from customizable strategies.

- DeFiLlama allows investors to quantify, evaluate, and capitalize on the evolving DeFi ecosystem.

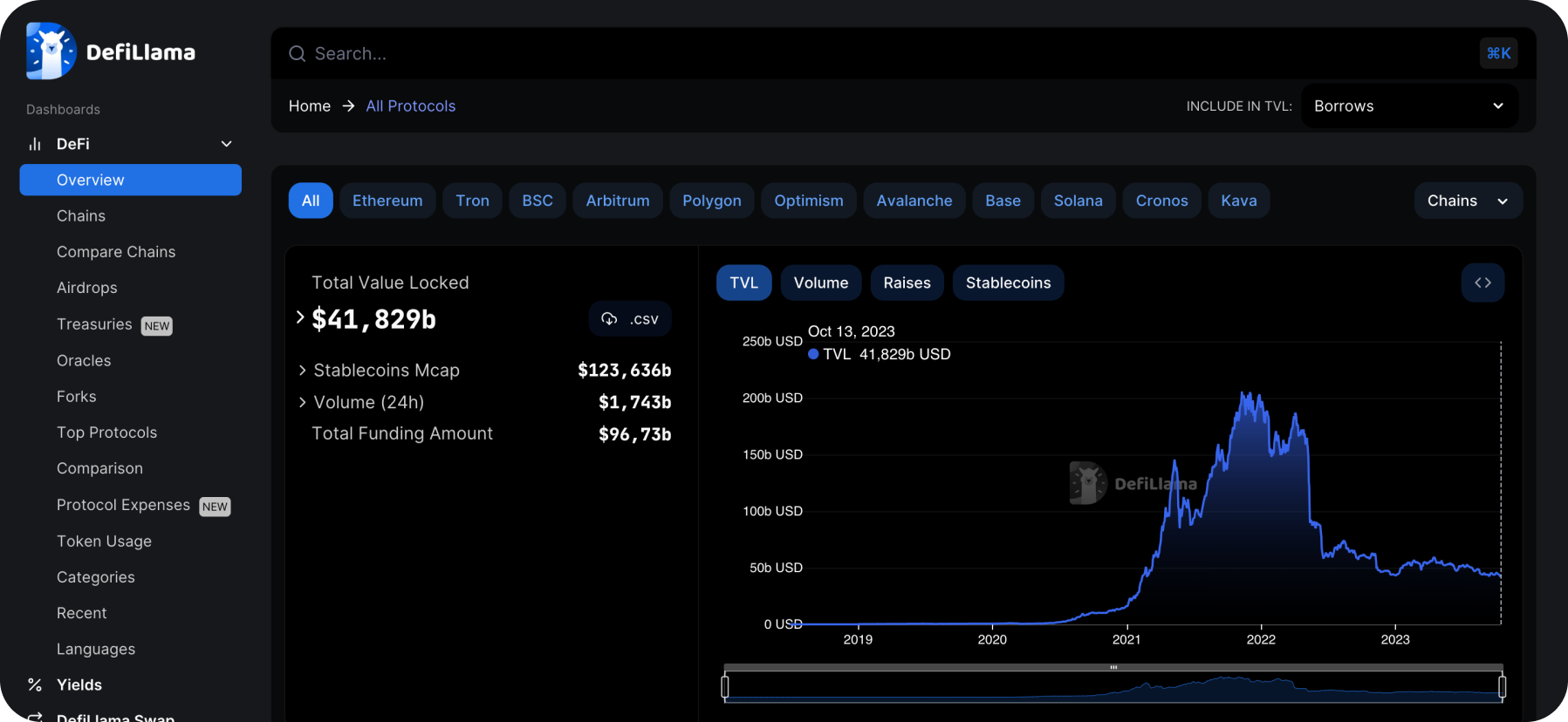

What Is DeFiLlama

DeFiLlama is a data analysis platform in decentralized finance that provides the information and metrics needed to fully understand and monitor key aspects of the DeFi ecosystem. It collects data on DProjects and protocols, allowing investors and researchers to closely monitor various aspects of the industry.

One of the main features of DeFiLlama is the ability to aggregate and analyze data on which projects are attracting the most attention and which are showing growth in total value locked (TVL).

Another significant aspect is providing an overview of DProjects' returns in the market. So users can compare different platforms in terms of profitability and makes it easier to choose the most suitable strategies for investment.

How to Use DeFiLlama

DeFiLlama Yields

- Go to the Yields section

On the DeFiLlama platform, the Yields section is a comparison table that displays information about the yield of various decentralized financial projects and protocols. It’s possibility to evaluate DProjects according to the criterion of potential profitability.

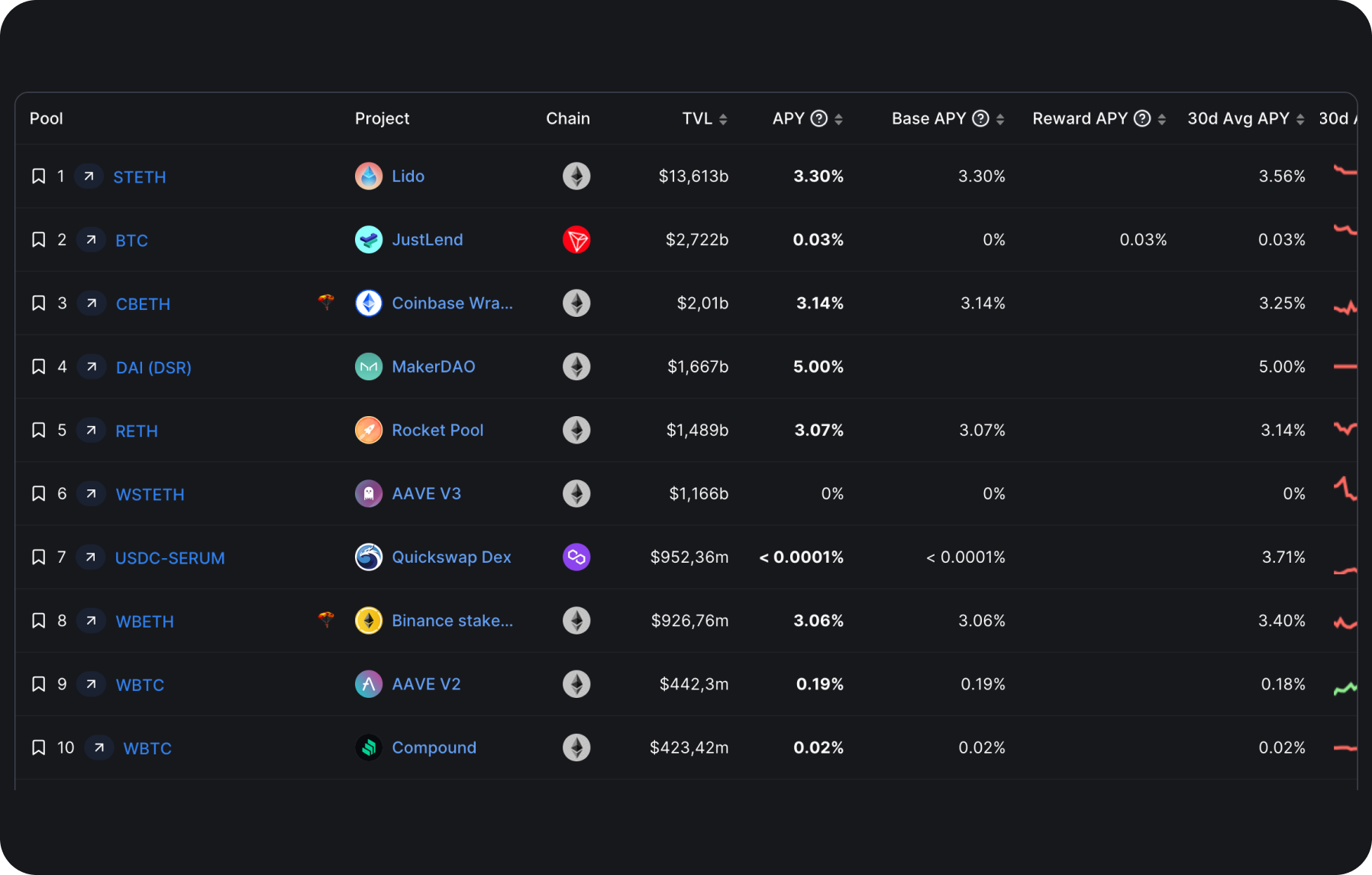

DeFiLlama Pools

- Go to the Pools subsection

The Pools subsection under Yields on the platform is a list of pools used by a range of DeFi projects to generate income. These pools are associated with distinct strategies such as farming, liquidity provisioning and staking.

In the Pools subsection, users can find the following information:

- Protocol Name

Here, the name or identifier of the concrete DeFi project is specified.

- Assets in the pool

This indicates which assets can be used to participate in this pool.

- Yield

This parameter shows the current yield that the user can get by investing in this pool. It is expressed as a percentage.

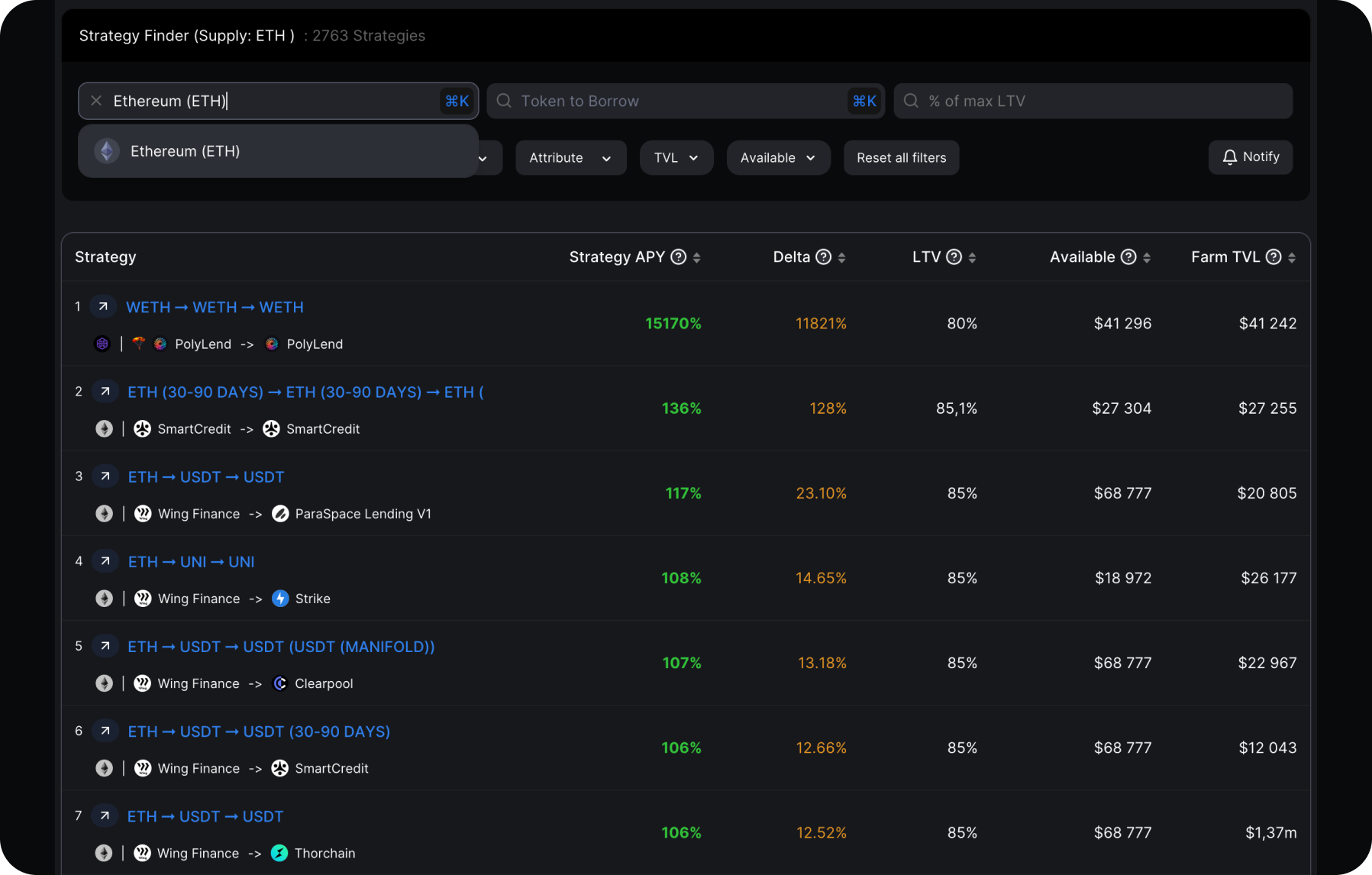

Delta Neutral

- Go to the Delta Neutral section

This section provides information about DeFi strategies that combine three basic steps: lend assets (lend), borrow other assets (borrow) and participate in the farming process (farm) to maximize returns. In this section, the user can track such bundles of strategies for different assets or pools.

In the Delta Neutral section, users can find the following info:

- Asset Selection

The user selects the asset of interest for which they want to apply a “lend-borrow-farm” strategy.

- Strategy Search

The tool offers data on strategies that include lending assets, borrowing other assets using collateral, and engaging in farming to maximize returns.

- Calculation of Total Return

The tool calculates the total annual percentage yield (APY) for each strategy by considering the yield of each of the stages: lend, borrow and farm.

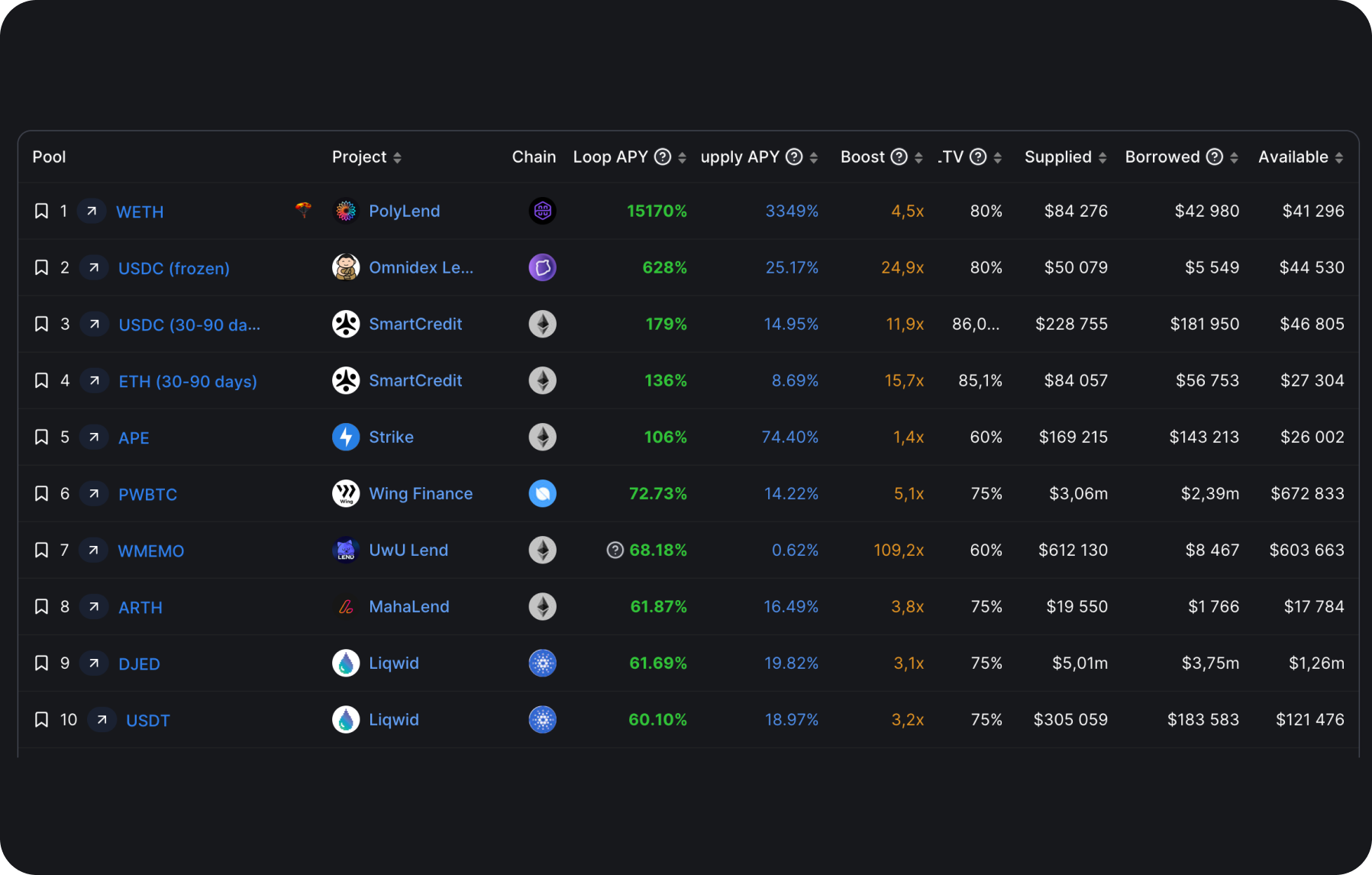

Leveraged Lending

- Go to the Leveraged Lending section

The Leveraged Lending section presents info about leveraged lending strategies in the DeFi industry. In this section, the user can learn about the annual percentage yield (APY) for such strategies.

In the Leveraged Lending section, users can find the following information:

- Asset Selection

The user selects the DeFi asset or pool of interest for which they want to apply the strategy and get returns.

- Strategy Search

The tool contains data on strategies that involve leveraged lending of assets to maximize returns.

- Calculating total return

The tool calculates the total annual percentage yield (APY) for each strategy.

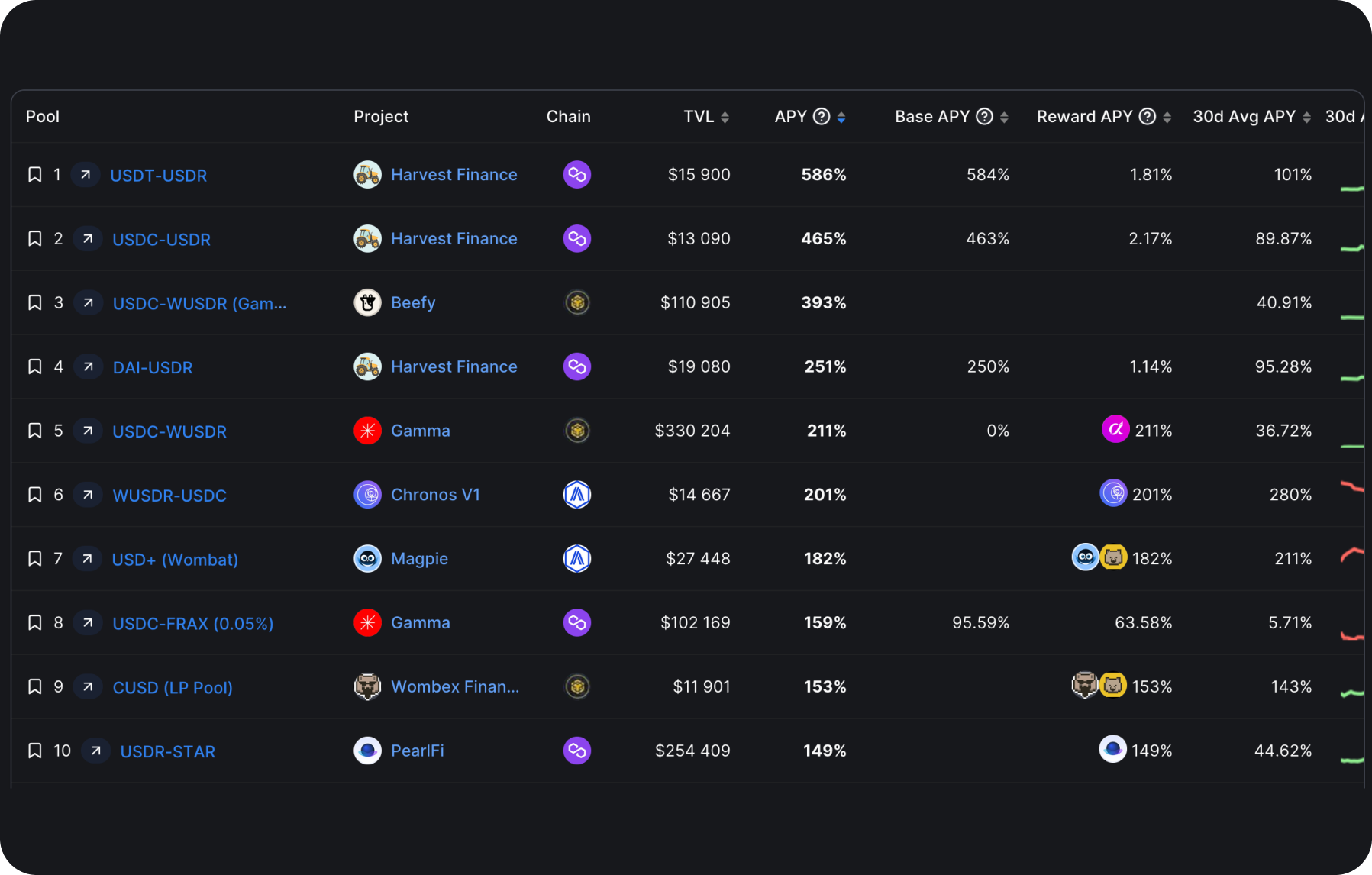

Stablecoin pools

- Go to the Stablecoin pools section

The Stablecoin pools section is a list of pools used in various DeFi projects to generate revenue. These pools are associated with different strategies such as farming, liquidity provision and staking.

In the Stablecoin pools section, users can find the following information:

- Protocol Name

The name or identifier of a particular DeFi project is listed here.

- Assets in the pool

This indicates which specific stablecoins can be used to participate in this pool.

- Yield

This parameter displays the current yield that the user can get by investing in this pool. The yield is expressed as a percentage.

Summary

DeFiLlama offers investors and researchers a powerful analytical tool to gain insights into the sector of decentralized finance.

With its broad market coverage and analytical capabilities, the platform serves as a valuable one-stop research center for anyone seeking to deepen their understanding of the evolving DeFi landscape.

Users can get all coins mentioned in this article on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.