Meteora: DeFi Hub on Solana

Key Insights

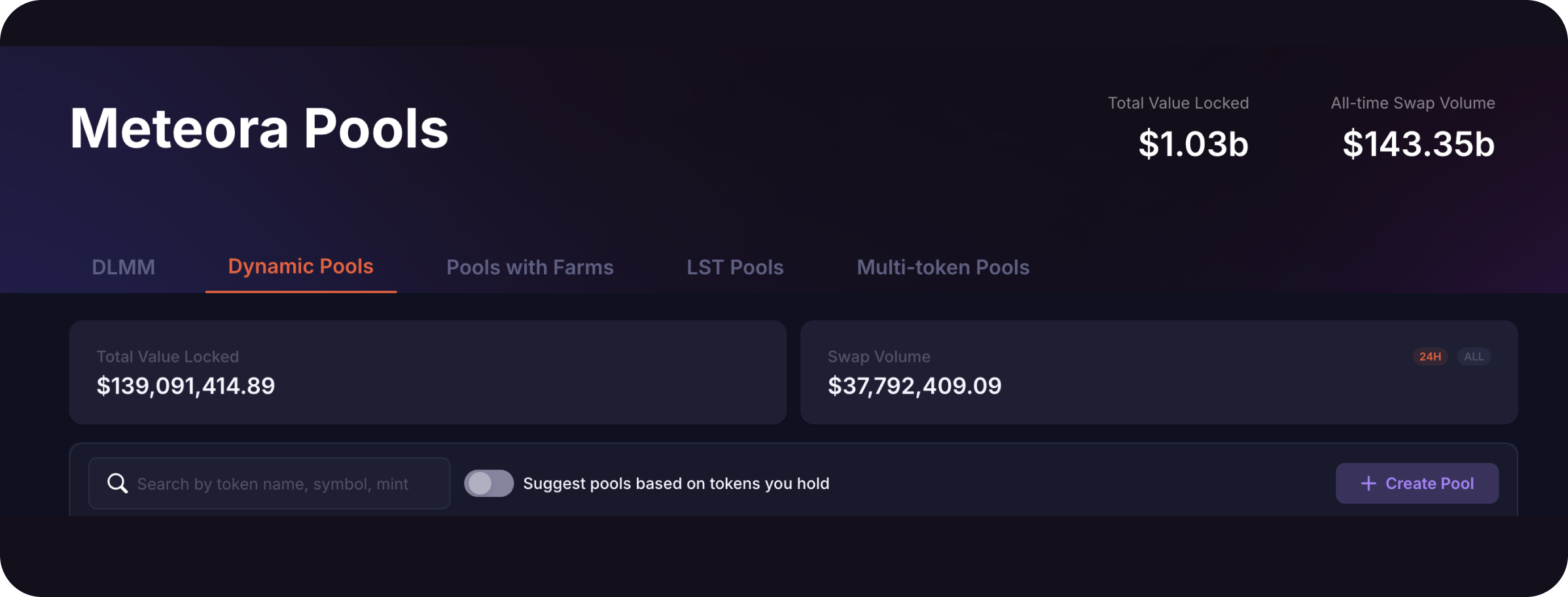

- Meteora is an innovative decentralized exchange (DEX) and DeFi hub utilizing dynamic liquidity management through features such as DLMM pools, dynamic vaults, and specific pools for meme coins, making it a significant player in the Solana ecosystem, ranking 9th in it with $1.1B TVL.

- Meteora provides a comprehensive solution for investors looking to optimize returns passively by the use of DLMM pools that offer a unique approach to liquidity management by allowing liquidity provider to focus their capital within specific price ranges, and dynamic vaults, which continuously rebalance assets across different lending protocols to maximize yields.

- A standout feature of Meteora is its facilitation of meme coin trading and liquidity provision, as, with the popularity surge of meme coins initiated by high-profile personalities (TRUMP coin, MELANIA coin), Meteora has positioned itself to capitalize on this trend by creating dedicated liquidity pools with features such as liquidity locking and dynamic fees.

What is Meteora DEX

Meteora is an innovative DEX and DeFi hub running on the Solana blockchain, offering DeFi users new primitives in providing liquidity and generating revenue from the DEX protocol. Meteora's main goal is to attract TVL to Solanaand provide a stable source of income for users.

The Meteora crypto protocol introduces innovative mechanics such as DLMM pools (dynamic liquidity management module), pools for stablecoins, dynamic vaults, and minting meme coins with automatic liquidity locking. Meteora's competitive advantages make it one of the leading DeFi protocols in the Solana ecosystem, as well as a platform for trading meme coins and providing liquidity to various pools.

Meteora was founded in 2021 in Singapore and was originally called Mercurial. However, the project rebranded, changing its name to Meteora and token ticker (was MER, became MET) and in 2023 released its product as a decentralized exchange with advanced liquidity provisioning capabilities to the market. Meteora has been backed by several large investors such as Delphi Venture, HTX Venture, Signum Capital, and Alliance DAO.

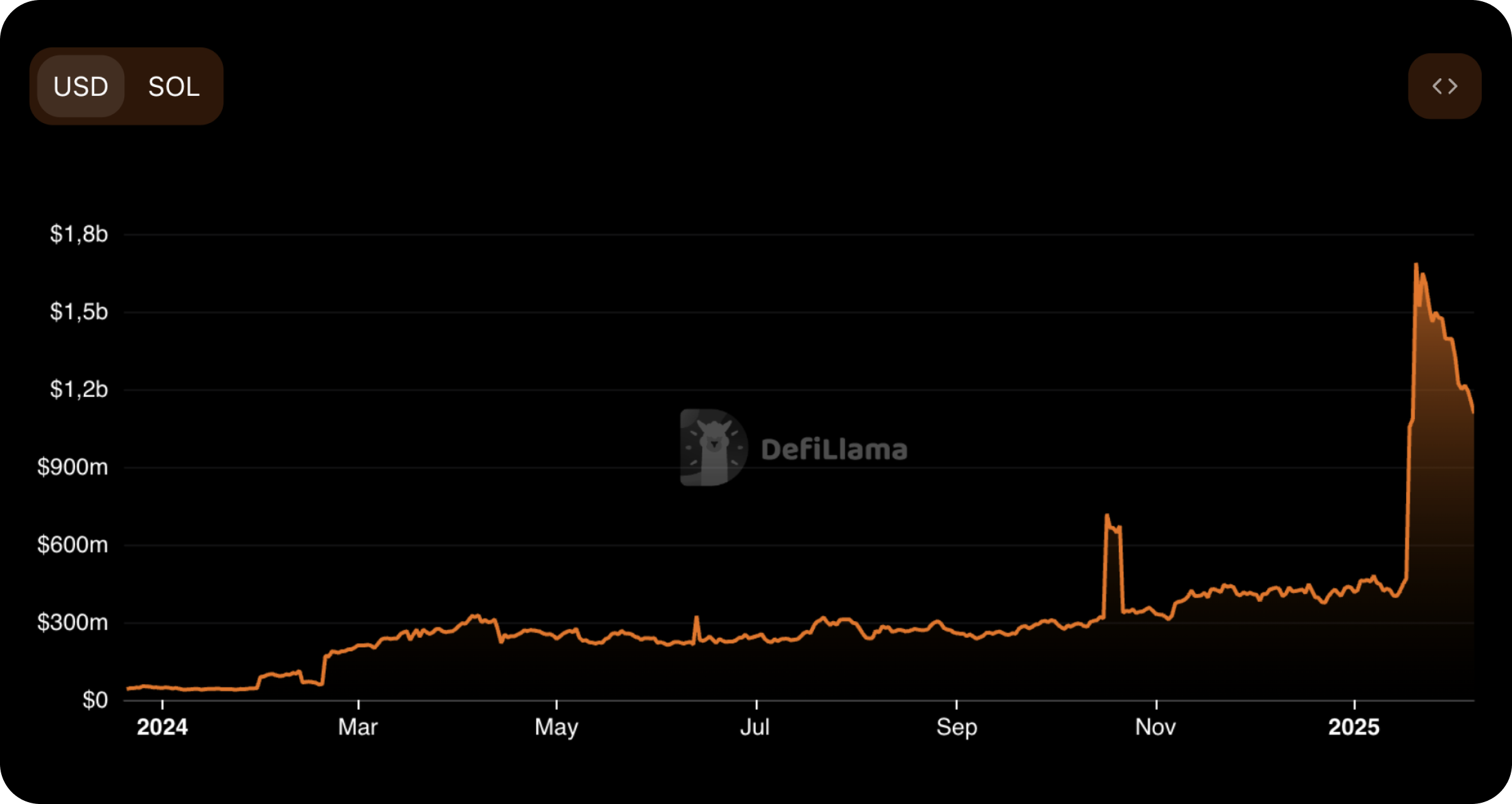

Meteora is currently ranked 9th in the Solana ecosystem in terms of total value locked in protocol (TVL) at $1.1B. It should be noted that Meteora's TVL generally showed moderate growth during 2024, but in January 2025, this figure skyrocketed. The driver of this dramatic growth was the launch of meme coins by US President Donald Trump and his wife, Melania Trump. Meteora has become the primary platform for users looking to buy both TRUMP coin and MELANIA coin, as well as for liquidity providers supplying assets to liquidity pools with these tokens.

To gain more insight into the meme coin market we advise you to read our comprehensive piece on all things meme coin here.

TVL of Meteora. Source: DefiLlama

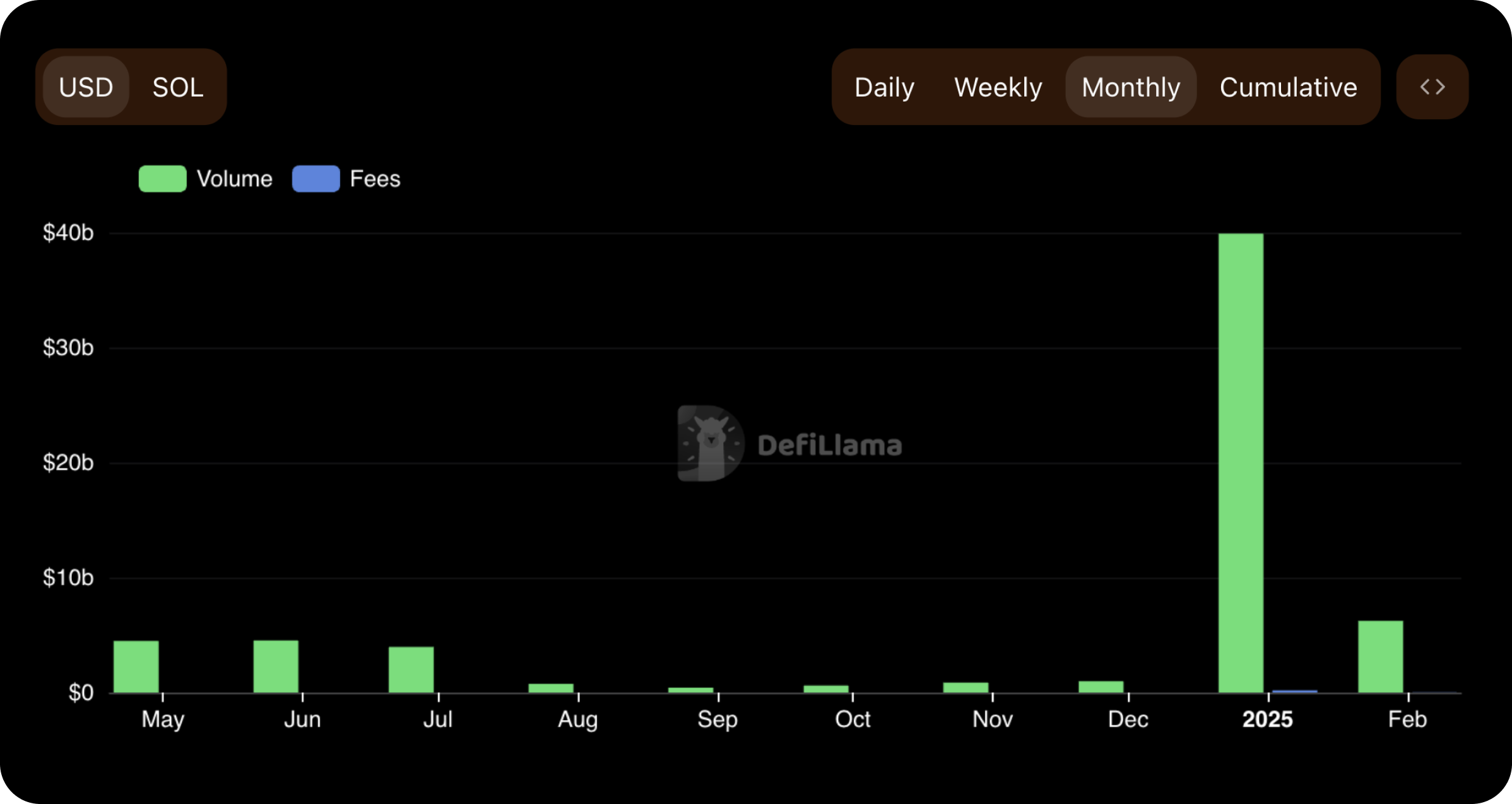

January was also a record month for Meteora crypto protocol in terms of trading volume and commissions earned. Both of these indicators set records: trading volume reached almost $40B and commissions of the protocol reached $195M.

Meteora trading volumes and commissions. Source: DefiLlama

Meteora DEX: Key Features

Now let's break down the key features and mechanics of the Meteora crypto platform.

Dynamic Liquidity Market Maker (DLMM)

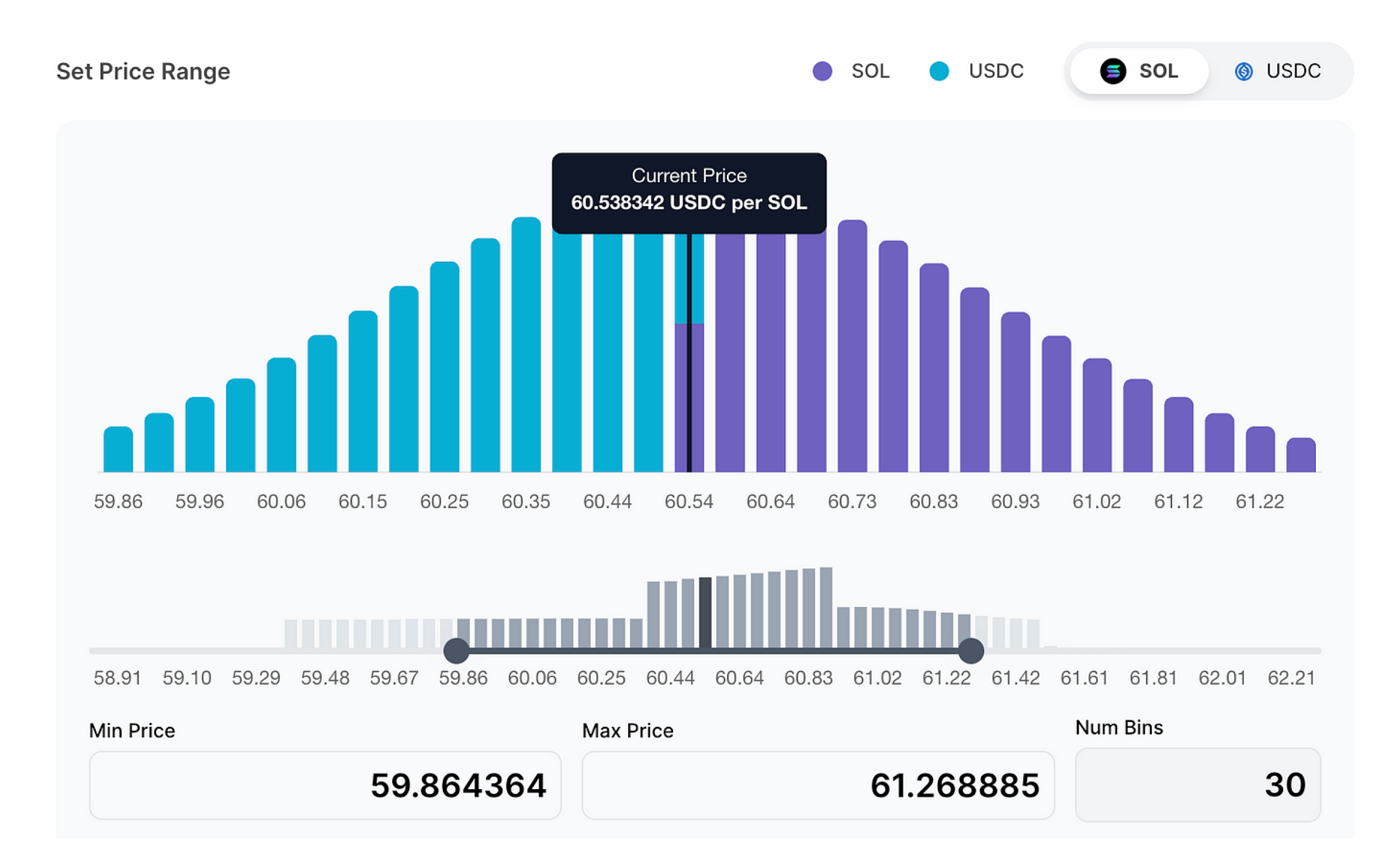

DLMM introduces a new type of concentrated liquidity pools that provide greater variability in liquidity providers' strategies and an improved liquidity concentration model, allowing for higher and more predictable returns. On the other hand, new projects have the ability to increase the liquidity of their tokens using these pools.

DLMM consists of discrete price bins with zero slippage, each providing liquidity for a specific price range. Assets provided to a particular price bin are used for exchanges within the price range specified for the bin. Exchanges that take place in one bin are executed without slippage. The liquidity for token exchanges in the DLMM pool is made up of all available price bins.

Schematics of DLMM pool operation. Source: Meteora Documentation

In addition to the absence of slippage, DLMM pools provide a better concentration of liquidity, which increases the profitability of liquidity providers' strategies, and also allow for a dynamic commission model, where commissions increase with increased trading activity in the pool and high volatility.

Compared to traditional automated market makers (AMMs) models used by other popular exchanges, DLMM pools of Meteora have the following advantages:

Low slippage values

Improved liquidity concentration in price bins allows exchanges to execute with little or no slippage

Improved capital efficiency

Liquidity providers have the ability to place liquidity in specific price bands, which improves the efficiency of the capital used in the LP strategy

Dynamic commissions

Dynamic commissions allow liquidity providers to remain profitable during times of increased volatility and cover impermanent losses.

Flexibility for liquidity providers

DLMM pools allow liquidity to be provided in a single token without the need for two tokens of equal proportions.

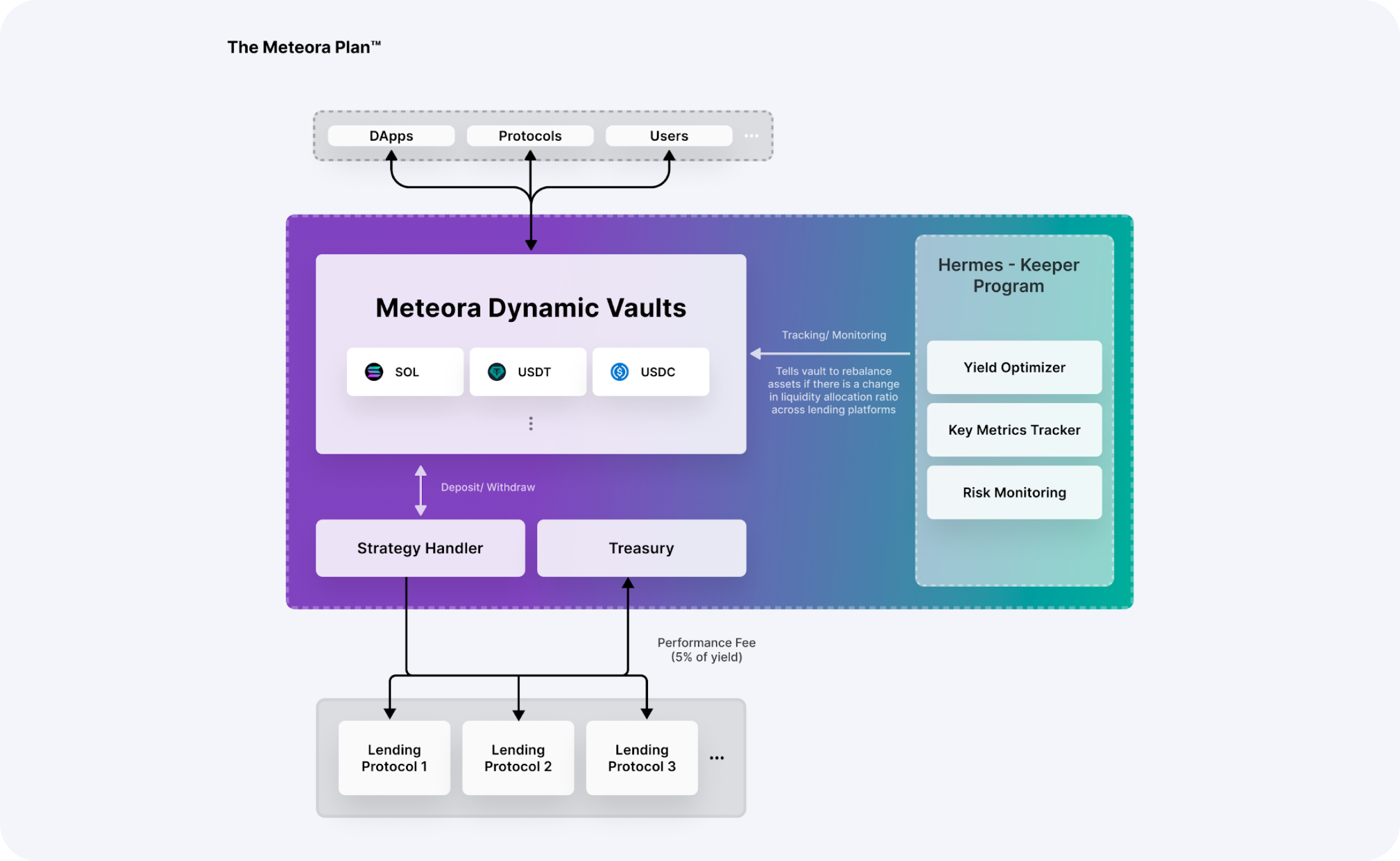

Dynamic Vaults

An innovative yield mechanism in DeFi in which asset rebalancing occurs every few minutes between leading lending protocols to maximize investor funds while maintaining availability. Liquidity pools allow users and partner protocols to deposit and withdraw assets into the vault at any time. Funds deposited into the vault are allocated among the lending protocols based on monitoring of their interest rates, protocol security audits, and other parameters.

Schematics of dynamic vaults operation. Source: Meteora Documentation

Dynamic Vaults consist of three main components:

Individual assets

At the infrastructure level, each Meteora Dynamic Vault holds such assets as stablecoins or SOL. Most of these assets are allocated to lending protocols to generate yield.

Keeper - Hermes

Off-chain system for monitoring the yield and risk parameters of the lending protocols to maximize the efficiency of the capital used in the Meteora vaults. Hermes is responsible for yield optimisation, protocol analysis and risk monitoring.

SDK Module

Meteora is developing its own SDK and API to simplify the integration of dynamic vaults into protocols and wallets. Using the API, protocols can easily manage liquidity in vaults, adding or withdrawing it as they see fit.

Dynamic Vaults allow Meteora to supply liquidity providers with new revenue streams beyond trading commission rewards. One of the differences between pools on Meteora and standard AMM DEX pools, is the integration with Dynamic Vaults, which allows assets deposited in the pool to be used to increase returns. Thus, liquidity providers to Meteora pools, also called Dynamic AMM Pools, receive returns from trading commissions, interest rate in lending protocols, and additional rewards for liquidity mining.

Dynamic Meme Coin Pools

One of Meteora's main features are liquidity pools optimized for running and trading meme coins. It is the availability of such an offering that has made Meteora one of the main hubs for launching and trading meme coins on Solana. For example, Meteora has been one of the main beneficiaries of the TRUMP coin and MELANIA coin launches, initiated by US President Donald Trump and his wife, Melania Trump respectively, as the main liquidity pools for trading them have been created on Meteora.

Meme coin pools are similar to other Dynamic Pools, but have some features that allow for better meme coin trading and liquidity provision. For example, meme coin pools have a liquidity lock option where token creators or liquidity providers can permanently lock their assets in the pool while receiving commissions and revenue from Dynamic Vaults.

Liquidity locking can be an important step for a successful meme coin launch, as it builds trust in the eyes of the community and provides the necessary initial liquidity to trade the token.

Other features of Dynamic Meme coin Pools include.

Dynamic fee

It is set by protocols at 0.15%-15% and is subject to change depending on market conditions.

Protocol fee

20% of commissions are sent to the protocol and are part of revenue of Meteora or sent to partners such as trading bots.

Availability for analysis

Like other pools, Dynamic meme coin pools are tracked on DEX activity monitoring platforms such as DEXScreener, Birdeye, DexTools.

How to Become a Liquidity Provider on Meteora

In order to become a liquidity provider and earn commissions you need to select the trading pair in which you want to provide liquidity.

Go to the Meteora official page.

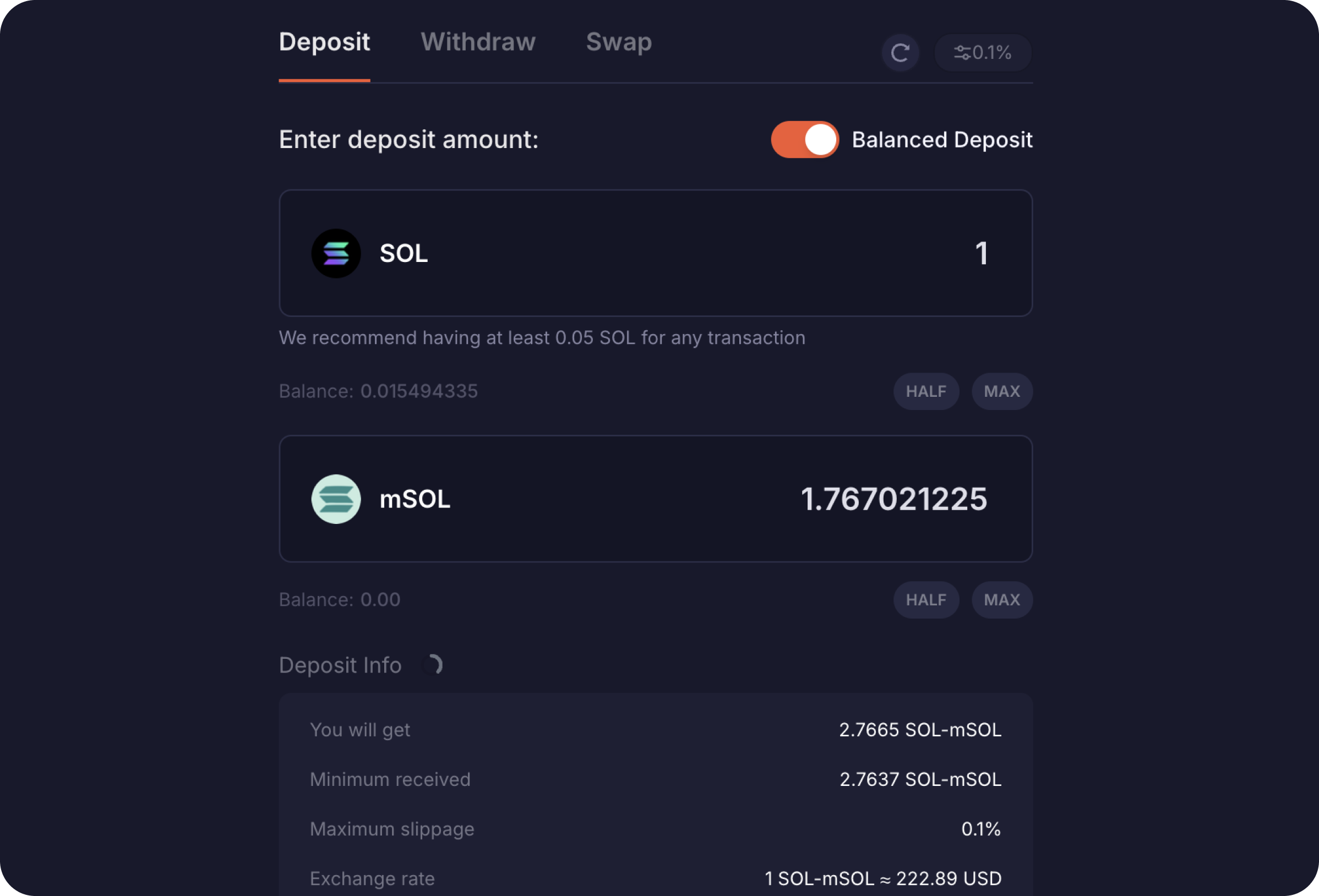

Select the pool in which you want to participate as a liquidity provider.

You will need tokens to participate, such as USDC, SOL and others. You can buy them quickly and with minimal commission on SimpleSwap.

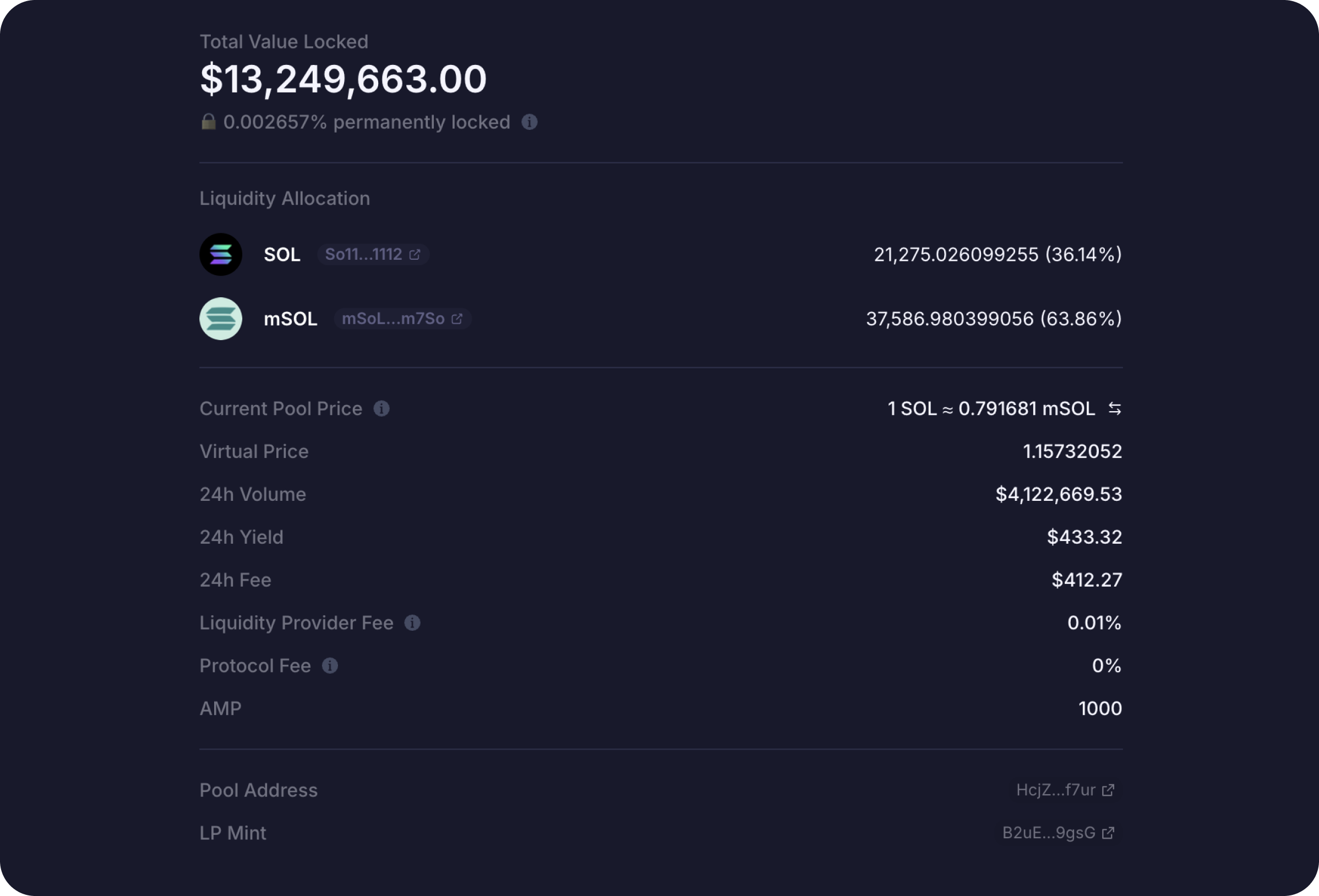

Go to the page of the selected pool, study the information about TVL, trading volumes and commissions in the liquidity pool.

If you are happy with everything, select the number of assets you want to provide to the pool, set the price range in which you want to provide liquidity and confirm the transactions in your wallet.

Done! You have become a liquidity provider on Meteora and have started to earn a return on your commission. Don't forget to periodically check your position and rebalance (move your liquidity to an active price range) if necessary.

Summary

This article effectively showcases Meteora as a pioneering DEX and DeFi hub on the Solana blockchain, emphasizing its advanced liquidity management systems and specialization in meme coin markets.

With robust features like Dynamic Liquidity Market Maker (DLMM) pools, dynamic vaults, and tailored pools for meme coins, Meteora offers enhanced capital efficiency, optimized returns for liquidity providers, and innovative trading solutions.

The strategic introduction of meme coins has notably increased Meteora's total value locked and trading activity, affirming its significant position in the Solana ecosystem.

By creatively blending technological advancements with market trends, Meteora stands out as a dynamic and influential player in the DeFi landscape.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.