DeFi Report 2024-2025

Key Insights

- The study aimed to comprehensively analyze the DeFi sector’s evolution, focusing on metrics like Total Value Locked (TVL), trading volumes, user growth, and revenue trends. A mixed-methods approach combined qualitative analysis (trend identification, regulatory impacts) with quantitative analysis (TVL growth, DEX trading volumes, institutional investments). Special emphasis was placed on Real-World Asset (RWA) tokenization, assessing its integration into DeFi protocols and its role in bridging decentralized and traditional finance. The methodology included tracking key players (e.g., Lido DAO, Aave) and evaluating geographic revenue leaders (e.g., the U.S., India).

- The article categorizes DeFi projects into five core types: Lending protocols (e.g., Aave) for overcollateralized loans, DEXs (e.g., Uniswap) enabling permissionless trading, Derivatives platforms (e.g., Hyperliquid) offering leveraged trading without intermediaries, Liquidity farming/staking (e.g., Lido DAO) to optimize capital efficiency, and RWA tokenization (e.g., MakerDAO) for integrating traditional assets like bonds and real estate.

- DeFi is reshaping traditional finance via the following ways. Asset tokenization: Institutions like JPMorgan and BlackRock tokenize bonds, stocks, and funds, enhancing liquidity and accessibility (e.g., Franklin Templeton’s blockchain-based mutual fund). Hybrid financial tools: Stablecoins (e.g., PayPal’s PYUSD) and RWA collateralization (e.g., MakerDAO’s $948M in tokenized Treasuries) bridge DeFi and TradFi. Institutional adoption: Major firms use DeFi for unsecured loans, cost-efficient asset management, and cross-border payments (e.g., Visa’s USDC integration).

- egulatory alignment: New frameworks in the U.S. and EU legitimize DeFi, attracting institutional capital and fostering innovation in prediction markets and decentralized insurance.

Introduction

DeFi offers users access to financial services without intermediaries, such as banks and payment systems, by utilizing blockchain, smart contracts, and crypto assets. This sector encompasses lending, staking, derivative platforms, decentralized exchanges (DEX), tokenization of real-world assets (RWA), and a variety of other innovative solutions.

Advantages of DeFi

No Intermediaries

Users interact directly, eliminating reliance on traditional financial institutions.

Transparency and Security

All transactions are recorded on the blockchain and are available for audit, while smart contracts ensure automatic execution of terms.

Accessibility

Participation in DeFi is available to any user with internet access and a crypto wallet, without the need for KYC or permissions.

Global Reach

DeFi platforms operate on the blockchain and are not constrained by geographical or legal barriers.

Innovative Financial Tools

DeFi continuously expands user capabilities through new liquidity models, lending, derivatives, and tokenization.

DeFi Adaptation and Key Trends of 2024

The year 2024 has become a turning point for DeFi for several reasons:

Regulation

The introduction of new legislative norms in the US, EU, and Asia is structuring the market, reducing regulatory risks, and attracting institutional capital.

Growth of RWA (Tokenization of Real-World Assets)

DeFi is increasingly integrating with traditional finance through the tokenization of stocks, bonds, real estate, and commodities. In 2024, the volume of tokenized assets exceeded $16.7 billion.

Institutional Investments

Major global financial corporations, such as BlackRock, JPMorgan, and Franklin Templeton, continue to explore and implement DeFi solutions, using blockchain for asset management.

Expansion of Staking and Restaking

New protocols, such as EigenLayer, have popularized liquidity redistribution mechanisms and improved the security of the DeFi ecosystem.

Boom in Derivative DEXs

Platforms allowing users to trade derivative instruments (futures, options) without KYC or intermediaries have shown significant growth. In 2024, the trading volume of derivative DEXs increased from $33.3 billion to $342 billion(+872%).

New Models of Stablecoins

DeFi is actively developing in the direction of yield-bearing stablecoins (USDe, USD0). This incentivizes users to move capital from traditional finance into the DeFi space.

Thanks to these factors, DeFi is no longer a niche product but is becoming a fundamental part of the global financial infrastructure.

Main Objectives of the Report

The goal of this research is to gain a comprehensive understanding of the DeFi sector, its current state, development prospects, and investment activity, as well as to conduct an in-depth study of the tokenization of real-world assets (RWA). The main objectives are described below.

Examine the main areas of DeFi, such as lending, DEX, derivatives, liquidity farming, and tokenization.

Analyze changes in the DeFi sector over recent years: trading volumes, TVL (Total Value Locked), and the number of users.

Identify the key trends in DeFi in 2024 and provide a brief description of each.

Analyze the impact of DeFi on traditional financial systems.

Determine the top 10 DeFi projects by TVL, describe their key features, evaluate their achievements in 2024, and assess the total funds raised by each.

Analyze investment dynamics, including the number and size of funding rounds, identify key investors, and determine their specialization and influence on projects.

Assess the prospects for the tokenization of real-world assets.

Describe the main segments of the RWA market and conduct a detailed analysis of real-world asset tokenization, including bonds, loans, funds, commodities, stocks, and real estate.

Methodology

To analyze the state of the DeFi sector and its individual areas in 2024, a qualitative and quantitative analysis of the following characteristics was conducted:

The total value locked (TVL) in DeFi protocols, its historical dynamics, and changes in 2023-2024.

Historical dynamics of trading volumes on decentralized exchanges and changes in 2024.

Dynamics and changes in trading volumes on leading decentralized derivative exchanges.

Growth of active users in DeFi protocols, historical dynamics, and the number of DeFi users at the end of 2024.

Dynamics of total revenues of DeFi protocols, historical changes in DeFi sector revenues per user.

Countries leading in terms of DeFi protocol revenues.

This report provides a detailed analysis of investment activity in the DeFi sector, including:

Investment funds most actively investing in the DeFi space.

Analysis of investments in DeFi projects with the largest amounts of funds raised, as well as the top 10 DeFi protocols, their investors, tokenomics, and achievements in 2024.

The report also examines the most notable trends in the DeFi segment in 2024 and explores the impact of DeFi on traditional financial markets.

Special attention in the report is given to the analysis of the development of the RWA segment and its integration with DeFi protocols. An assessment is provided of the total value of RWA assets used in DeFi, as well as the market value of various RWA integrated into DeFi, such as tokenized bonds, private loans, and real estate. The report includes an overview of all major RWA segments and the largest DeFi protocols working with RWA or integrating them into their services. Particular focus is given to the segment of stablecoins using RWA as collateral.

DeFi’s Impact on Traditional Financial Systems

Decentralized finance is one of the largest sectors in the crypto industry. The goal of DeFi is to create an alternative to the existing financial system that is more transparent, democratic, and accessible to all users through the use of blockchain technology, particularly smart contracts.

The main areas of DeFi include:

Lending Protocols

Lending protocols allow users to borrow and lend assets at interest. Borrowers do not need to undergo KYC or creditworthiness checks. However, almost all loans in DeFi are overcollateralized, meaning borrowers must provide collateral exceeding the desired loan amount. The lack of solutions for unsecured loans for a wide range of users remains a significant challenge for DeFi lending protocols.

Decentralized Exchanges (DEX)

DEXs enable token exchange and trading through user wallets, requiring no registration (except for wallet signatures), KYC, or custody of user funds. Almost any token with liquidity on a DEX can be exchanged. The downsides of DEXs include complex interfaces and lengthy exchange processes, where users must sign multiple transactions for simple token swaps.

Derivatives

A major and rapidly growing sector of DeFi in 2024. Derivative DEXs allow users to trade crypto derivatives, such as perpetual futures and options, with leverage and interfaces similar to centralized exchanges (CEX). Many derivative DEXs have implemented a "one-time approval" feature, eliminating the need to sign transactions for each trade.

Liquidity Farming

One of the foundational sectors of DeFi. Liquidity farming powers DEXs, as liquidity providers supply assets to pools that serve as the source of liquidity for trades. Liquidity farming also includes staking, where users provide liquidity to lending protocols or lock governance tokens.

Tokenization

Tokenization of assets and Real World Assets (RWA) is a promising and fast-growing sector of DeFi. Real-world assets can be transferred to the blockchain and traded as tokens or NFTs, opening vast opportunities for DeFi. For example, tokenized U.S. Treasury bonds, one of the world's most reliable investment instruments, are already being traded.

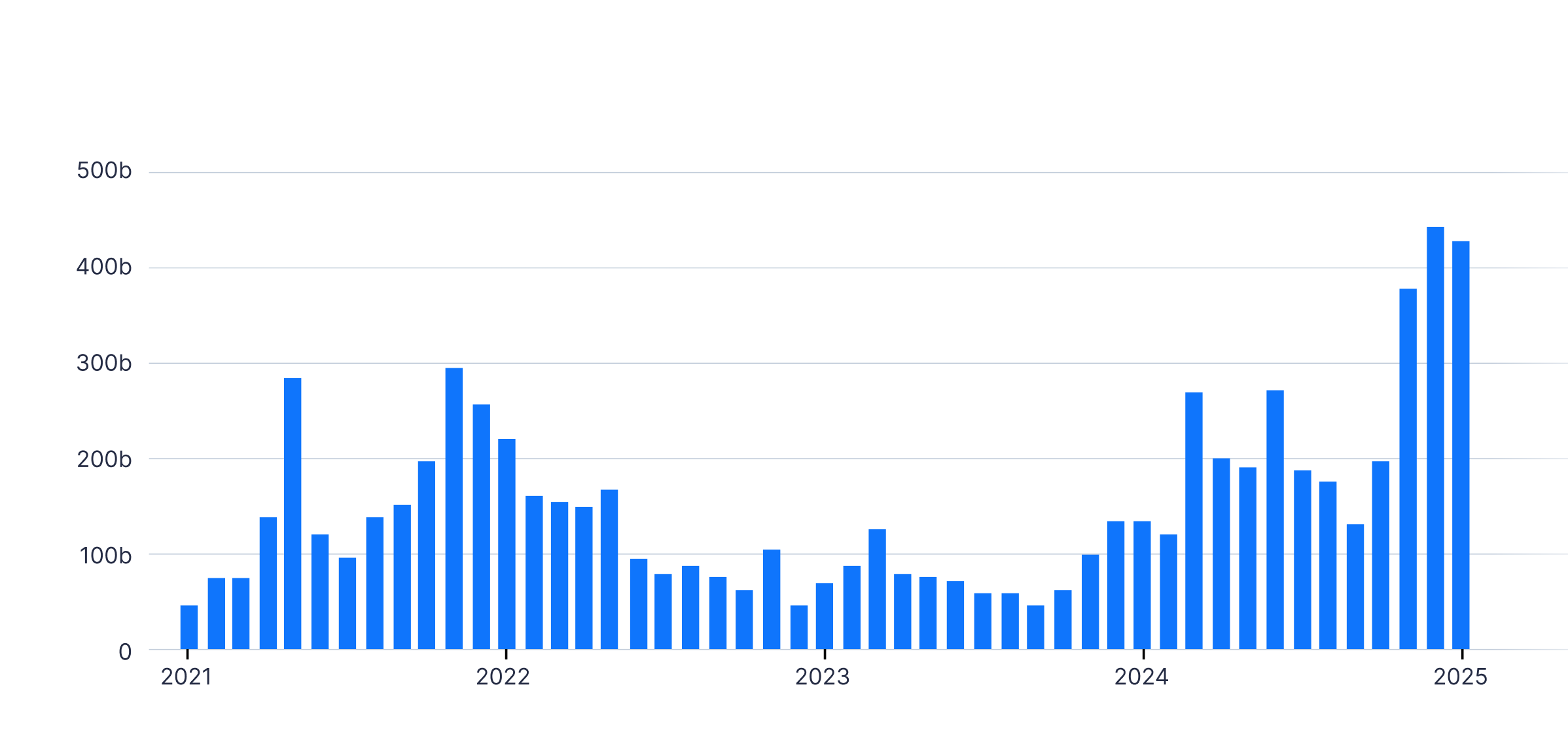

Growth of DeFi Projects

DeFi protocols saw explosive growth in TVL (Total Value Locked) in 2021, reaching a peak of $302 billion. In 2022−2023, TVL declined, hitting a low of around $65 billion. Growth resumed in October 2023 and continued into 2024, with TVL increasing from $112 billion to $257 billion (+129%). This is the highest level since May 2022, though still below the 2021 peak.

DeFi Protocol TVL Growth. Source: DefiLlama

Ethereum remains the largest DeFi hub, accounting for about 63% of total TVL, though its share is declining. At the beginning of 2024, Ethereum's share was 71.8%. Its main competitor, Solana, has significantly increased its share over the past year and now holds 10% of the total DeFi ecosystem TVL. Low transaction costs, innovative DeFi protocols, and the meme coin trading boom are the primary drivers of Solana's TVL growth.

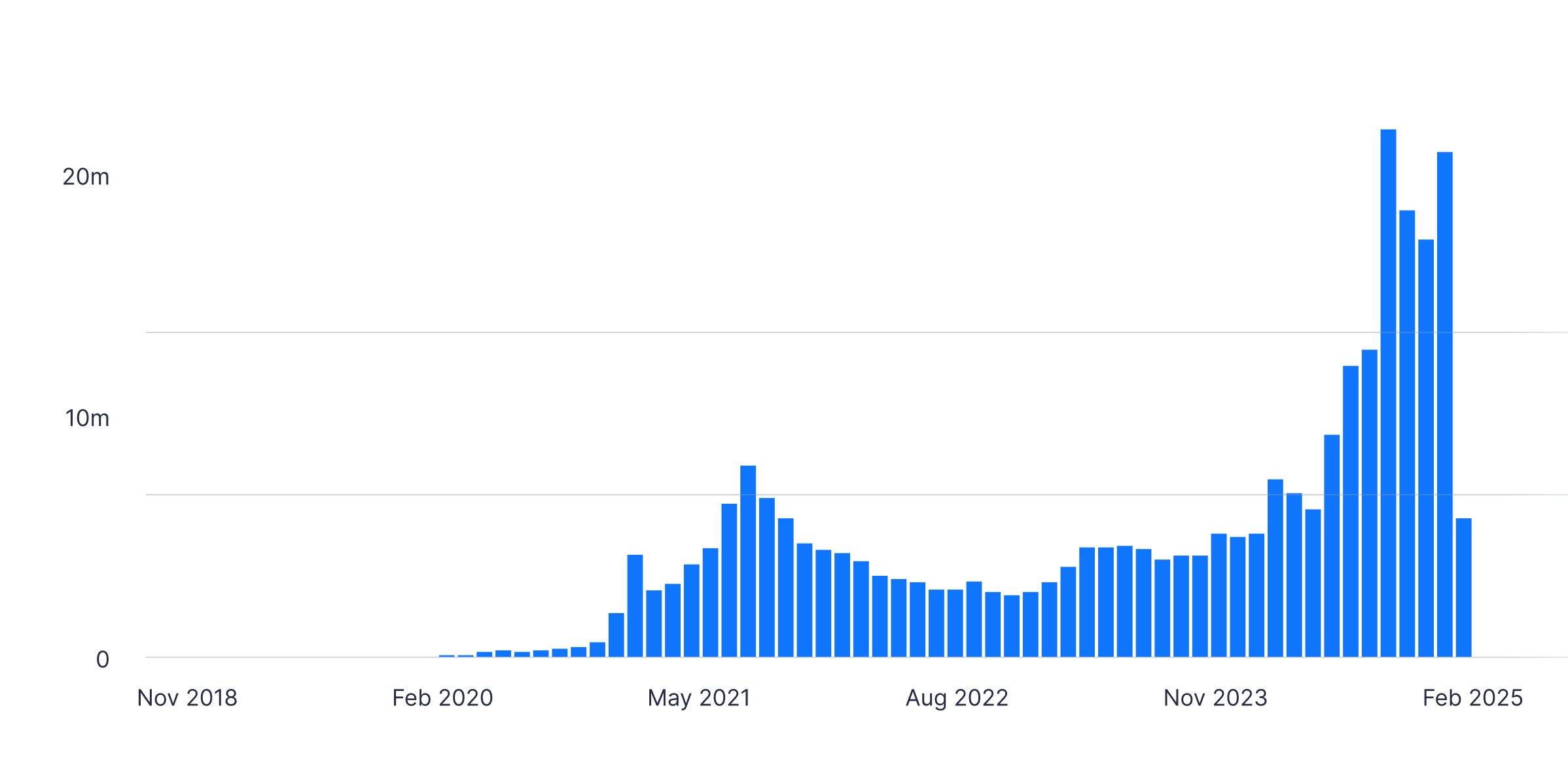

Trading Volumes

DEX trading volumes generally follow TVL dynamics and market trends, declining during bear markets and rising during bull markets. After the 2021 peak, DEX volumes fell in 2022-2023. Gradual growth began in September 2023 and continued into 2024.

Peak volumes were recorded at the end of the year, with December seeing an all-time high of $438 billion (compared to $134 billion in December 2023). By January 2025, DEX trading volumes had already reached $425 billion and are likely to set a new record by the end of the month. This surge is primarily driven by the hype around official meme coins launched by U.S. President Donald Trump and his wife, Melania Trump.

DEX Trading Volumes. Source: DefiLlama

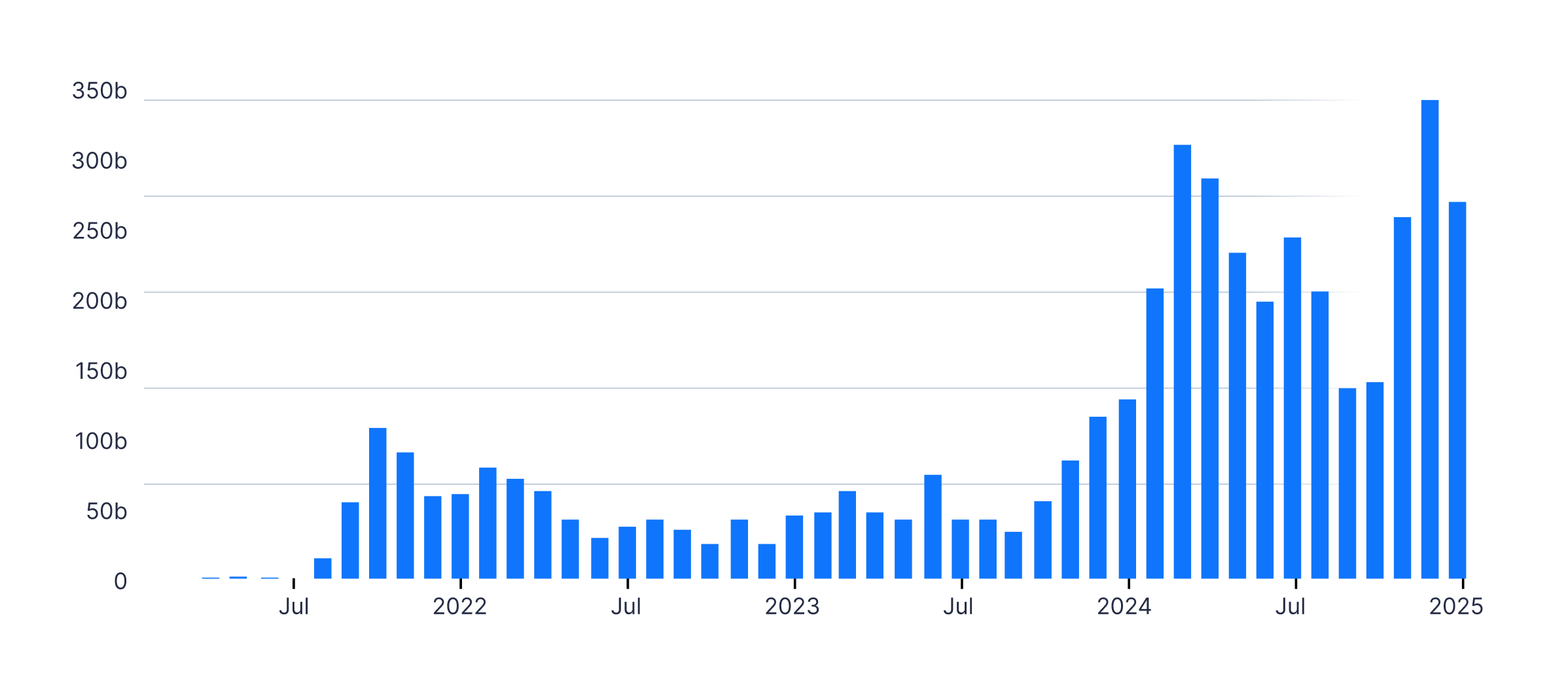

Derivative DEX trading volumes have also seen explosive growth since fall 2023, rising from $33.3 billion to a record$342 billion in December 2024 (+872%). Derivative DEXs are becoming increasingly user-friendly, offering fast trade execution, deep liquidity, and leverage — all without KYC or custodial asset storage. Although volumes have slightly declined in recent months, derivative DEXs remain one of the fastest-growing sectors in DeFi in 2024.

Derivative DEX Trading Volumes. Source: DefiLlama

Notably, the Hyperliquid protocol has become the largest derivative DEX, accounting for 39% of trading volumes. Hyperliquid's success is attributed to its innovative approach, built on its own L1 blockchain, HyperVM, customized for derivative DEX needs and capable of processing up to 100,000 orders per second.

The use of HyperVM and its proprietary token standard for spot trading pairs positions Hyperliquid as a leading derivative DEX and a competitor to centralized exchanges offering derivative trading.

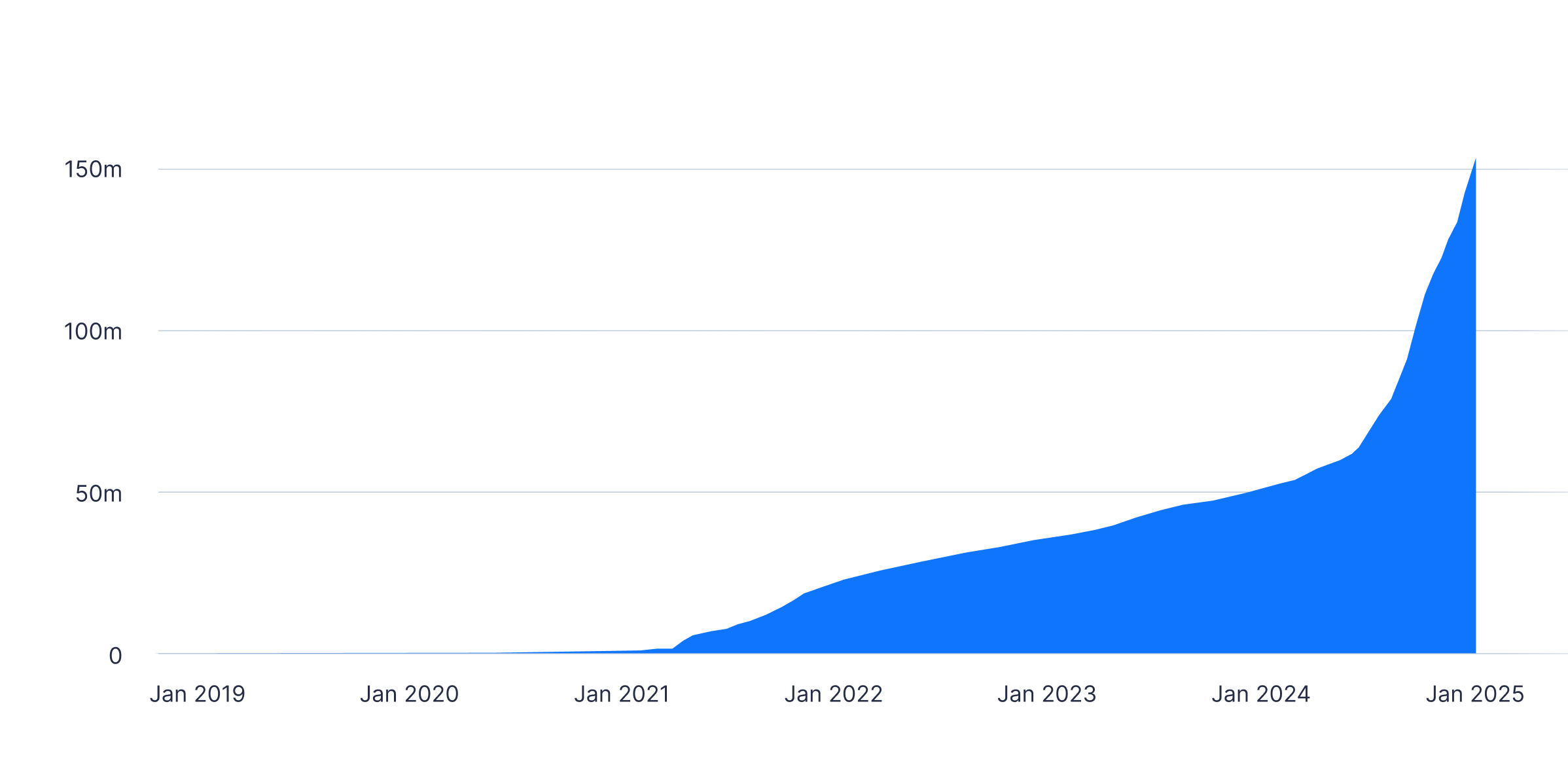

Number of Users

The number of unique users is a key metric for assessing the DeFi sector. This metric reached its peak in 2024, with the total number of DeFi protocol users reaching 151 million by the end of the year, a 196% annual increase.

Monthly active users peaked at 22 million in September 2024, more than double the 2021 peak of 7.5 million.

DeFi User Count. Source: Dune (Active Users = Unique Addresses)

Revenues

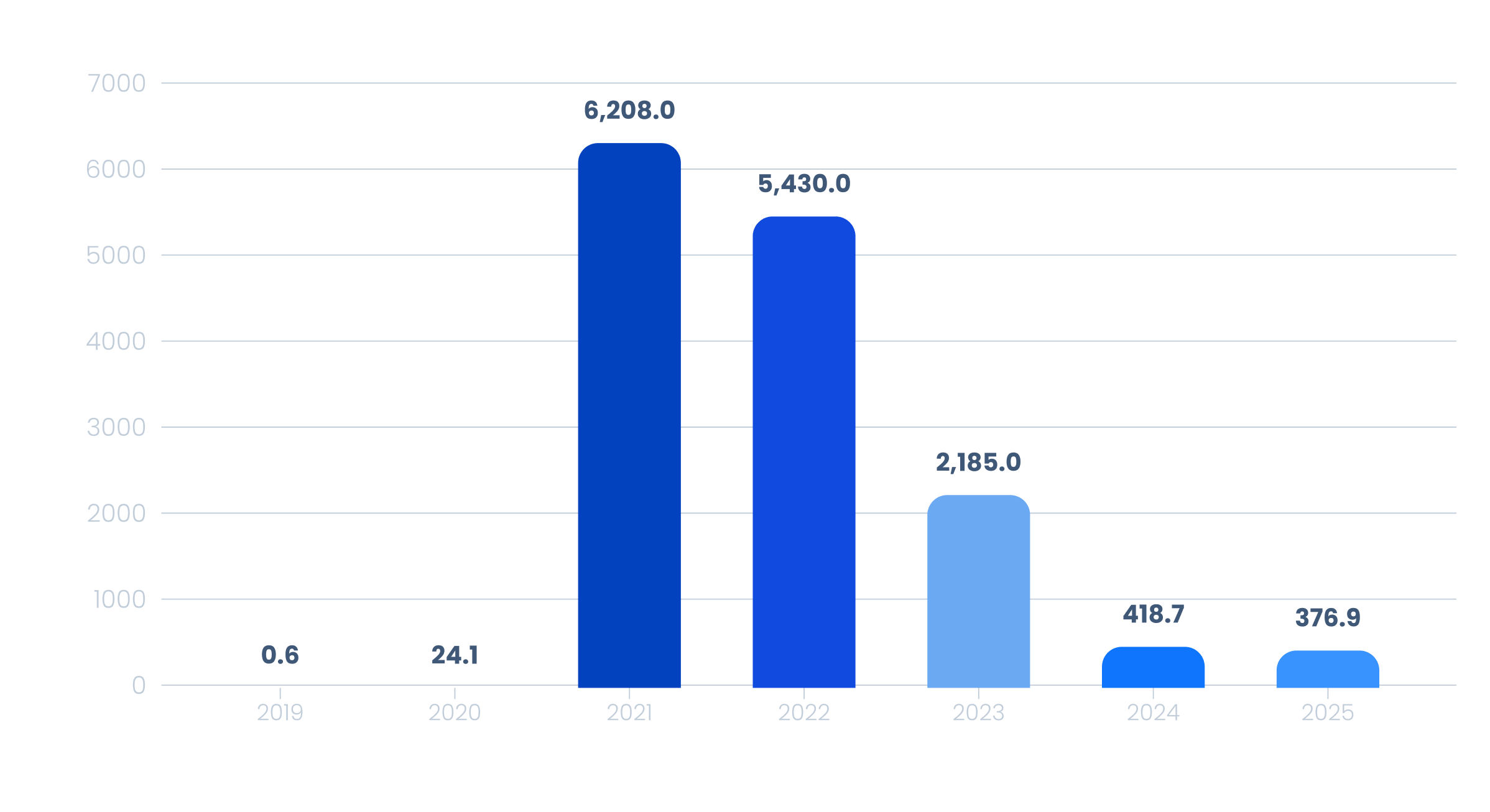

Despite the growth in users and trading volumes, DeFi protocol revenues are declining. Total DeFi sector revenue in 2024 was $419 million, compared to $6.2 billion in 2021.

DeFi Protocol Revenues. Source: Statista

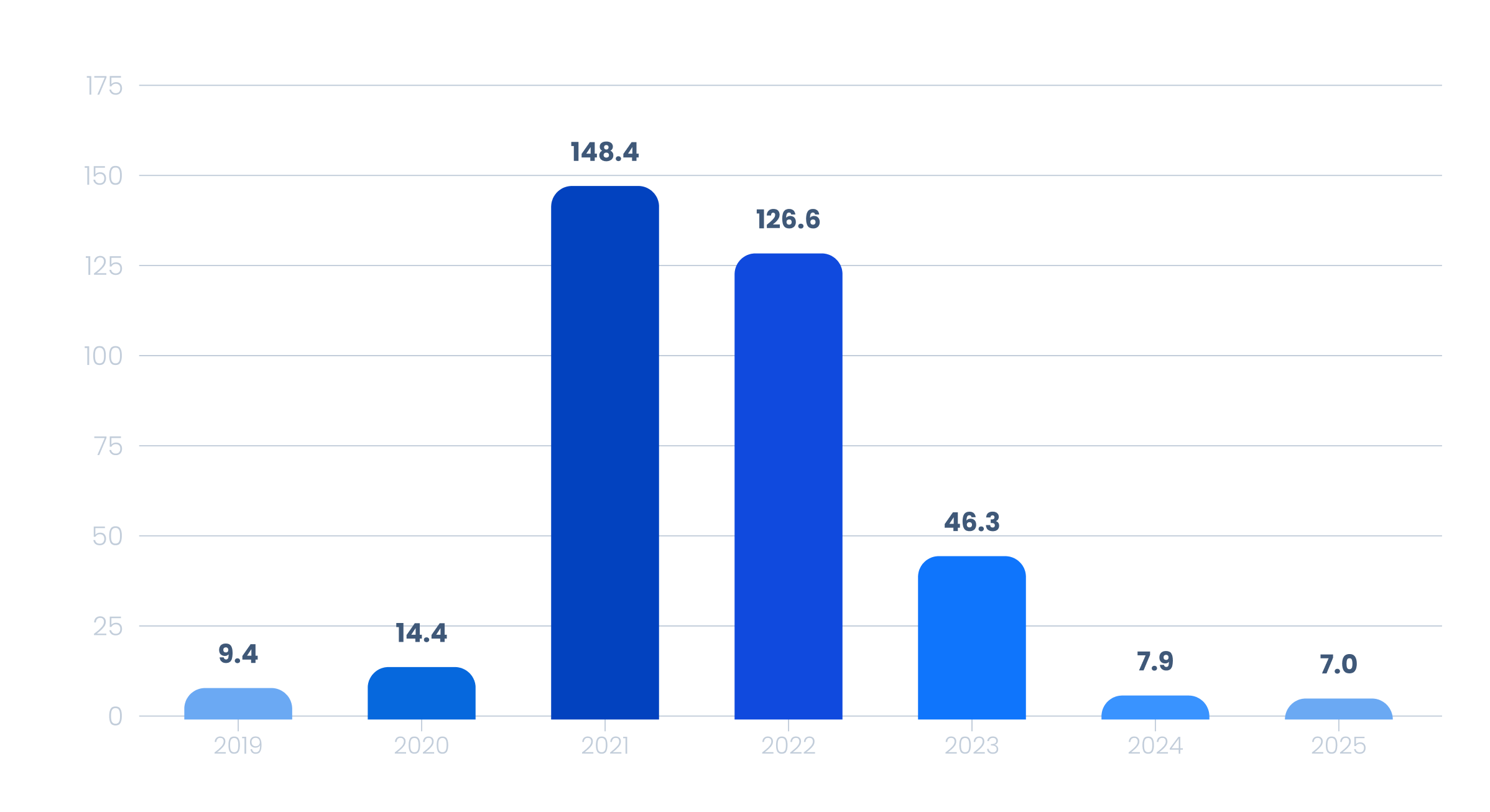

Revenue per user has also declined. In 2021, it was $148, dropping to $7.9 in 2024 and $7 in 2025. This decline is due to the growing number of users and lower DeFi protocol yields, which were below U.S. Treasury bond yields during the bear market.

DeFi Revenue per User. Source: Statista

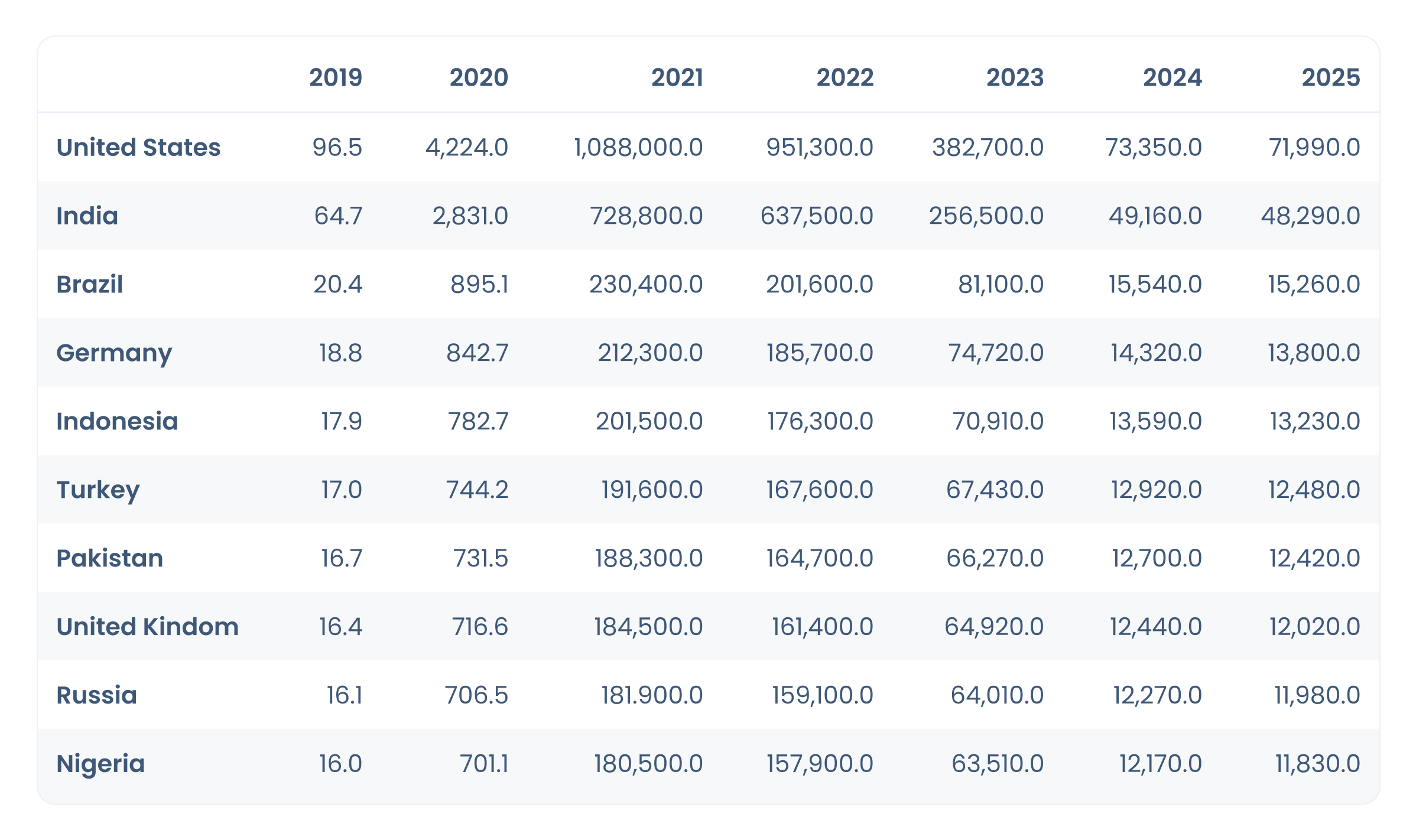

The top five countries by DeFi protocol revenue are the United States, India, Brazil, Germany, and Indonesia. The U.S. leads in 2024 with projected DeFi revenues of $73.3 million. With the election of a pro-crypto president and administration, the U.S. is likely to strengthen its leadership in this sector.

Top 10 Countries by DeFi Protocol Revenue. Source: Statista

DeFi Projects: Financing and Key Investors

Major DeFi Investors

Key venture capital players, such as Andreessen Horowitz (a16z), Polychain Capital, Paradigm, and Blockchain Capital, are actively investing in the decentralized finance sector.

Their support demonstrates a strategic commitment to developing protocols that set standards for the new financial landscape. Together, these players are laying the foundation for further growth in DeFi, supporting industry leaders, and driving the adoption of new financial solutions.

These funds are notable for their investments in projects that define key trends in DeFi:

Lido DAO

The market leader in liquid staking, enabling users to earn staking rewards without losing liquidity.

Uniswap

The largest decentralized exchange (DEX), setting standards for automated trading.

Aave

A leading lending protocol, offering fully decentralized loans and deposits.

EigenLayer

An innovative restaking project, optimizing the use of locked assets in the Ethereum ecosystem.

The DeFi sector also attracts attention from other prominent investment firms and institutional investors, including:

Binance Labs

Jump Trading

Delphi Digital

Dragonfly Capital

Coinbase Ventures

ParaFi Capital

Electric Capital

North Island Ventures

OKX Ventures

ConsenSys

Stani Kulechov (Aave founder)

These investors and venture firms not only provide funding but also actively contribute to the development of infrastructure, technological solutions, and new approaches to financial services, enabling DeFi to expand and succeed in new areas.

Their involvement in DeFi projects helps increase their value and popularity while fostering a more mature and secure ecosystem.

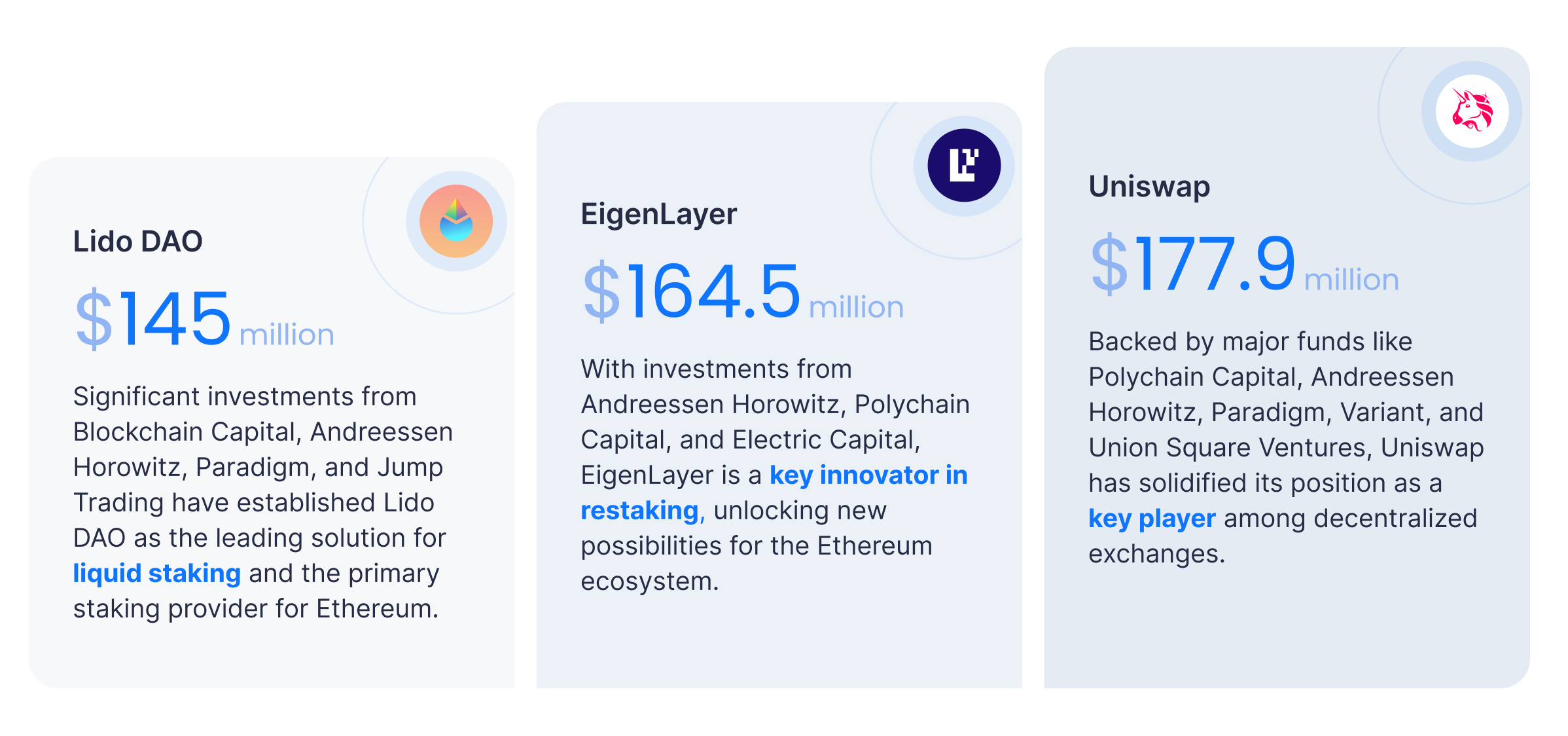

Projects with the Largest Funding

Uniswap

$177.9 million. Backed by major funds like Polychain Capital, Andreessen Horowitz, Paradigm, Variant, and Union Square Ventures, Uniswap has solidified its position as a key player among decentralized exchanges.

EigenLayer

$164.5 million. With investments from Andreessen Horowitz, Polychain Capital, and Electric Capital, EigenLayer is a key innovator in restaking, unlocking new possibilities for the Ethereum ecosystem.

Lido DAO

$145 million. Significant investments from Blockchain Capital, Andreessen Horowitz, Paradigm, and Jump Trading have established Lido DAO as the leading solution for liquid staking and the primary staking provider for Ethereum.

Top-10 DeFi Projects

Below are descriptions of the 10 largest DeFi projects, their key funding rounds, major investors, and their key achievements in 2024.

Lido DAO (LDO)

Lido remains the largest liquid staking protocol, allowing users to stake Ethereum, Solana, Polygon, and other assets. Its unique model provides liquid tokens like stETH, which can be used in other DeFi protocols while retaining staking rewards.

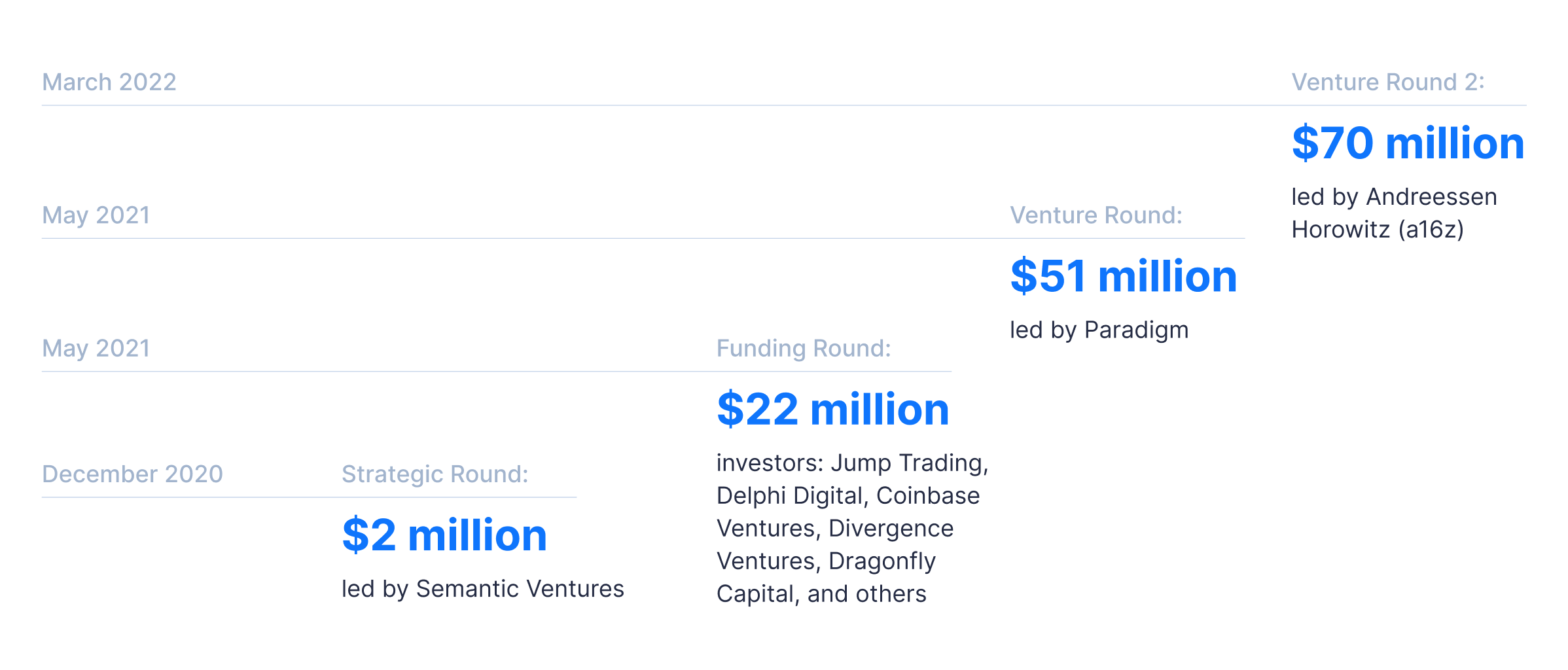

Total funds raised: $145 million (Cryptorank and Dropstab).

Key funding rounds

March 2022, Venture Round 2: $70 million, led by Andreessen Horowitz (a16z).

May 2021, Venture Round: $51 million, led by Paradigm.

May 2021, Funding Round: $22 million, investors: Jump Trading, Delphi Digital, Coinbase Ventures, Divergence Ventures, Dragonfly Capital, and others.

December 2020, Strategic Round: $2 million, led by Semantic Ventures.

Key investors

Andreessen Horowitz (a16z): A venture giant actively investing in the crypto industry.

Paradigm: Specializes in Web3 infrastructure and blockchains.

Jump Trading: A major market maker and investor in the crypto industry.

Delphi Digital: An investment fund focused on analytics, tokenomics, and crypto project development.

Stani Kulechov: Angel investor, founder of Aave, supporting DeFi and Web3 projects.

Semantic Ventures: A venture fund specializing in Web3 projects.

Dragonfly Capital: A venture fund focused on crypto and blockchain investments.

Coinbase Ventures: The investment arm of Coinbase, targeting crypto startups.

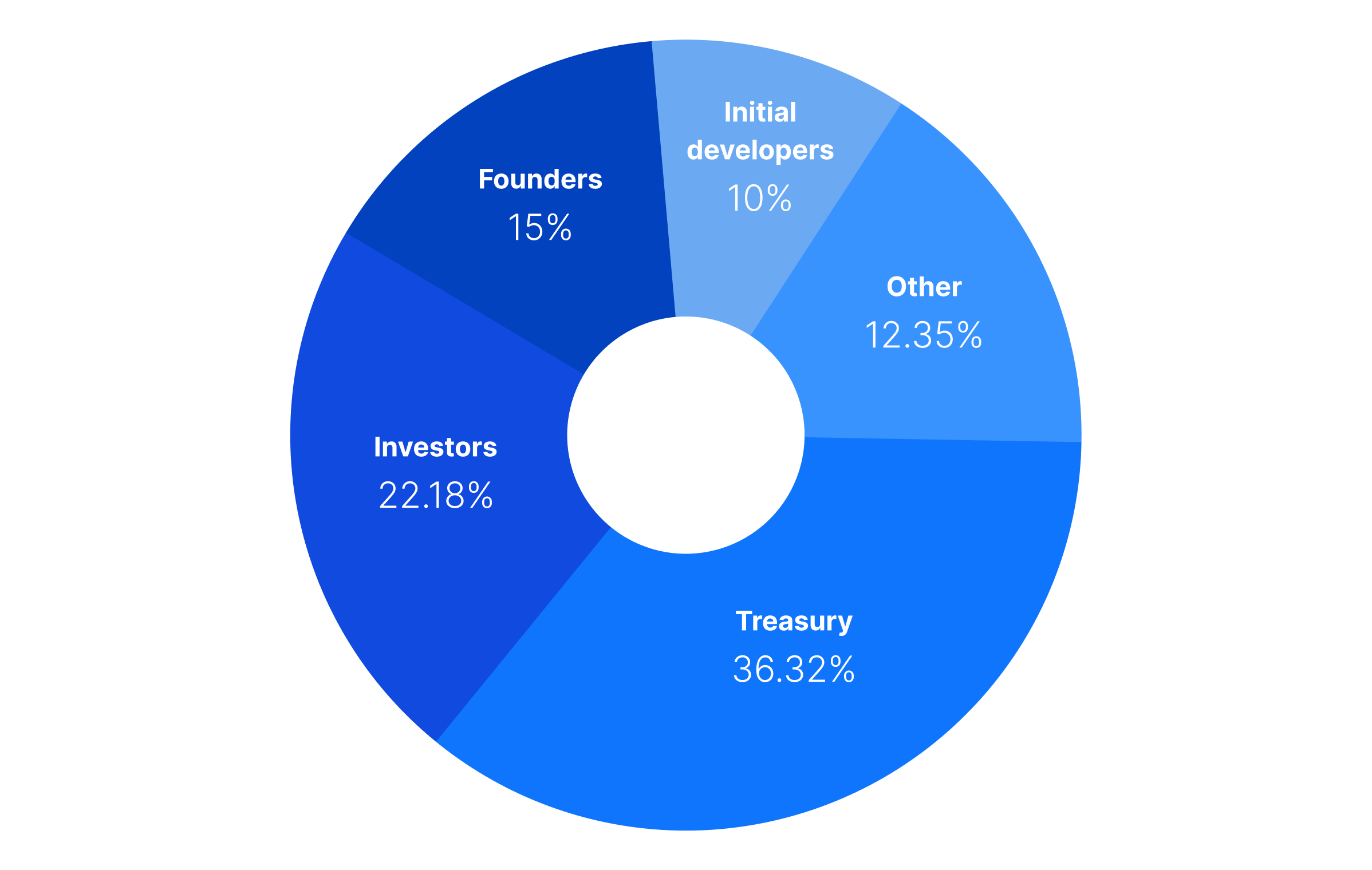

The investors' share amounts to 22.18% of the total LDO tokens.

Key achievements in 2024

Implementation of Distributed Validator Technology (DVT), increasing staking decentralization.

Expanded integration with major DeFi protocols, including Curve, AAVE, and Balancer.

Smart contract upgrades to enhance platform resilience and security.

Increased popularity of stETH as a base asset in DeFi, with growing liquidity on major platforms.

Lido plays a key role in the Ethereum ecosystem, promoting widespread user participation in staking.

AAVE (AAVE)

AAVE remains a leading platform for lending and borrowing, offering access to a wide range of crypto assets. The protocol actively introduces new mechanisms to enhance platform resilience and flexibility.

Total funds raised: $49.3 million (Cryptorank).

Key funding rounds

October 2020, Undisclosed: $25 million, investors: Blockchain Capital, Standart Crypto.

July 2020, Undisclosed: $3 million, investors: Framework Ventures, Three Arrows Capital.

July 2020, Undisclosed: $4.5 million, led by ParaFi Capital.

October 2017, ICO: $16.2 million.

October 2017, Pre-sale: $600,000.

Key investors

Blockchain Capital: One of the leading venture funds in the crypto space, specializing in blockchain startups.

Framework Ventures: A fund supporting Web3 and DeFi projects.

ParaFi Capital: A venture fund focused on DeFi, blockchain, and crypto investments.

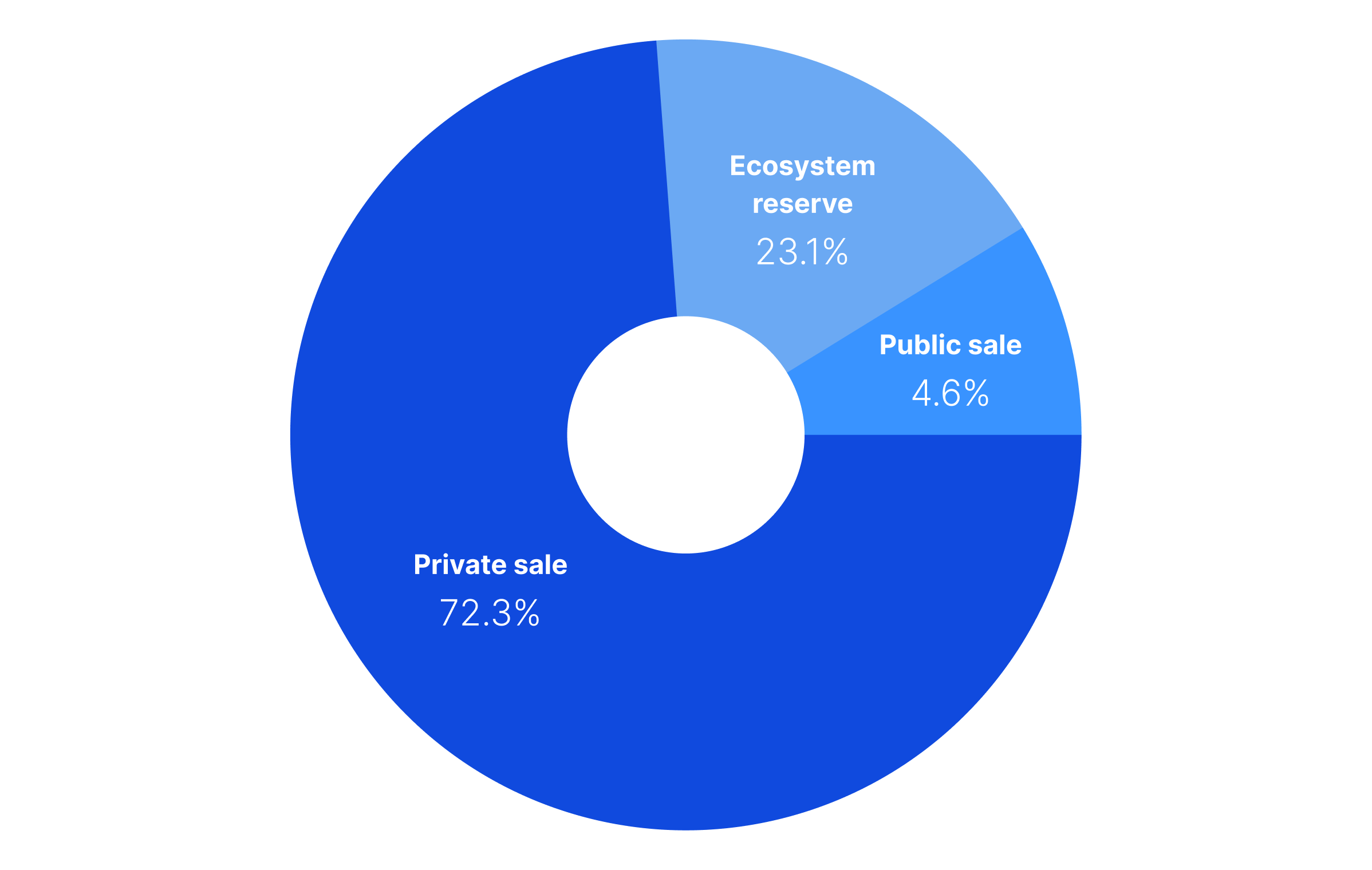

The investors' share amounts to 72.3% of the total AAVE tokens.

Key achievements in 2024

Launch of the AAVE V4 pool, offering advanced features like asset access management via governance tokens.

Integration of Layer 2 solutions (Optimism, Arbitrum) to reduce transaction costs and increase speed.

Expansion of flash loan functionality, making the protocol attractive to professional traders and arbitrageurs.

Implementation of decentralized insurance solutions to protect user funds.

AAVE strengthens its position as a multi-chain protocol, providing access to assets on Ethereum, Polygon, Avalanche, and other networks.

EigenLayer (EIGEN)

EigenLayer is an innovative platform for Ethereum staking redistribution. The project allows to use staked ETH to secure third-party protocols like oracles, bridges, and other DeFi applications.

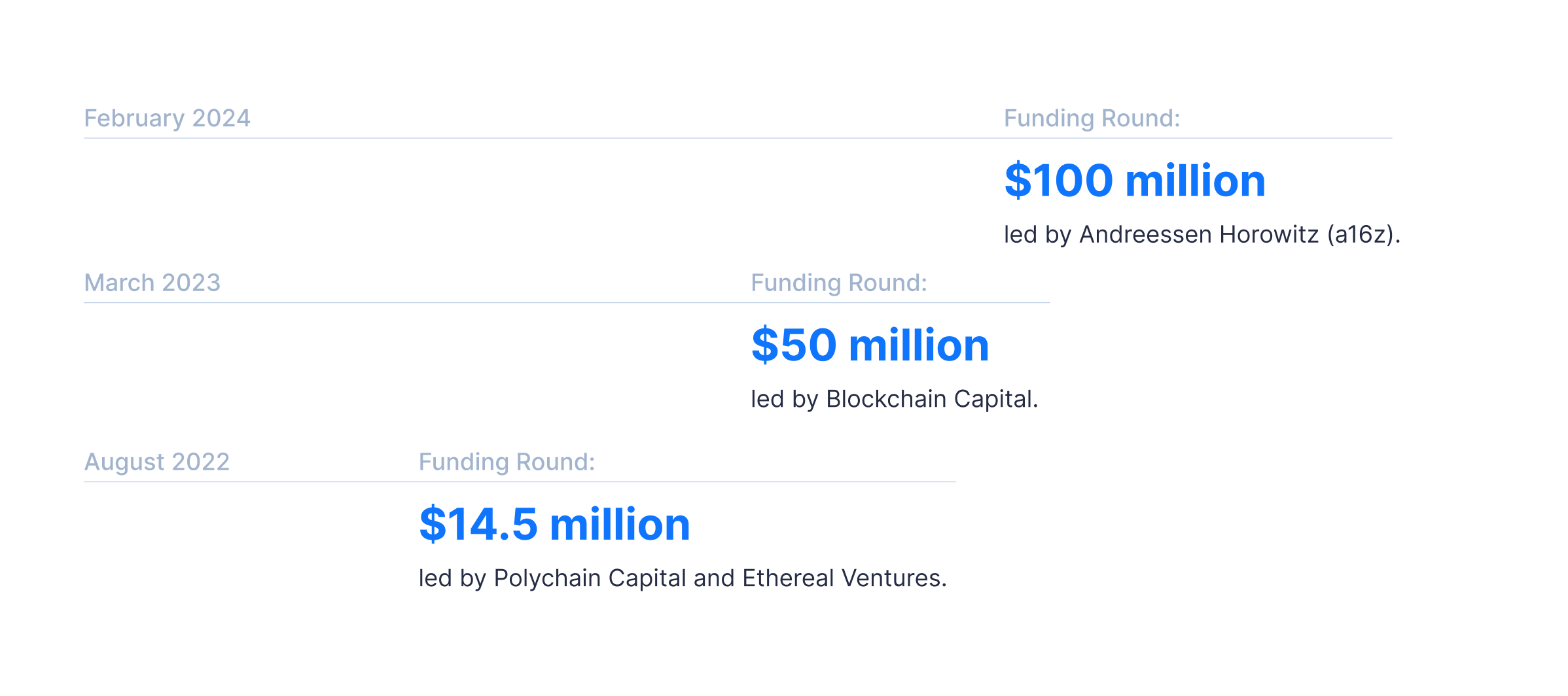

Total funds raised: $164.5 million (Cryptorank and Dropstab).

Key funding rounds

February 2024, Funding Round: $100 million, led by Andreessen Horowitz (a16z).

March 2023, Series A Round: $50 million, led by Blockchain Capital.

August 2022, Seed Round: $14.5 million, led by Polychain Capital and Ethereal Ventures.

Key investors

Blockchain Capital: One of the leading venture funds in the crypto space.

Polychain Capital: A fund focused on blockchain and crypto investments.

Electric Capital: A venture fund supporting crypto and blockchain projects, actively investing in DeFi.

Andreessen Horowitz (a16z): A venture giant investing in the crypto industry.

Coinbase Ventures: The investment arm of Coinbase, targeting crypto startups.

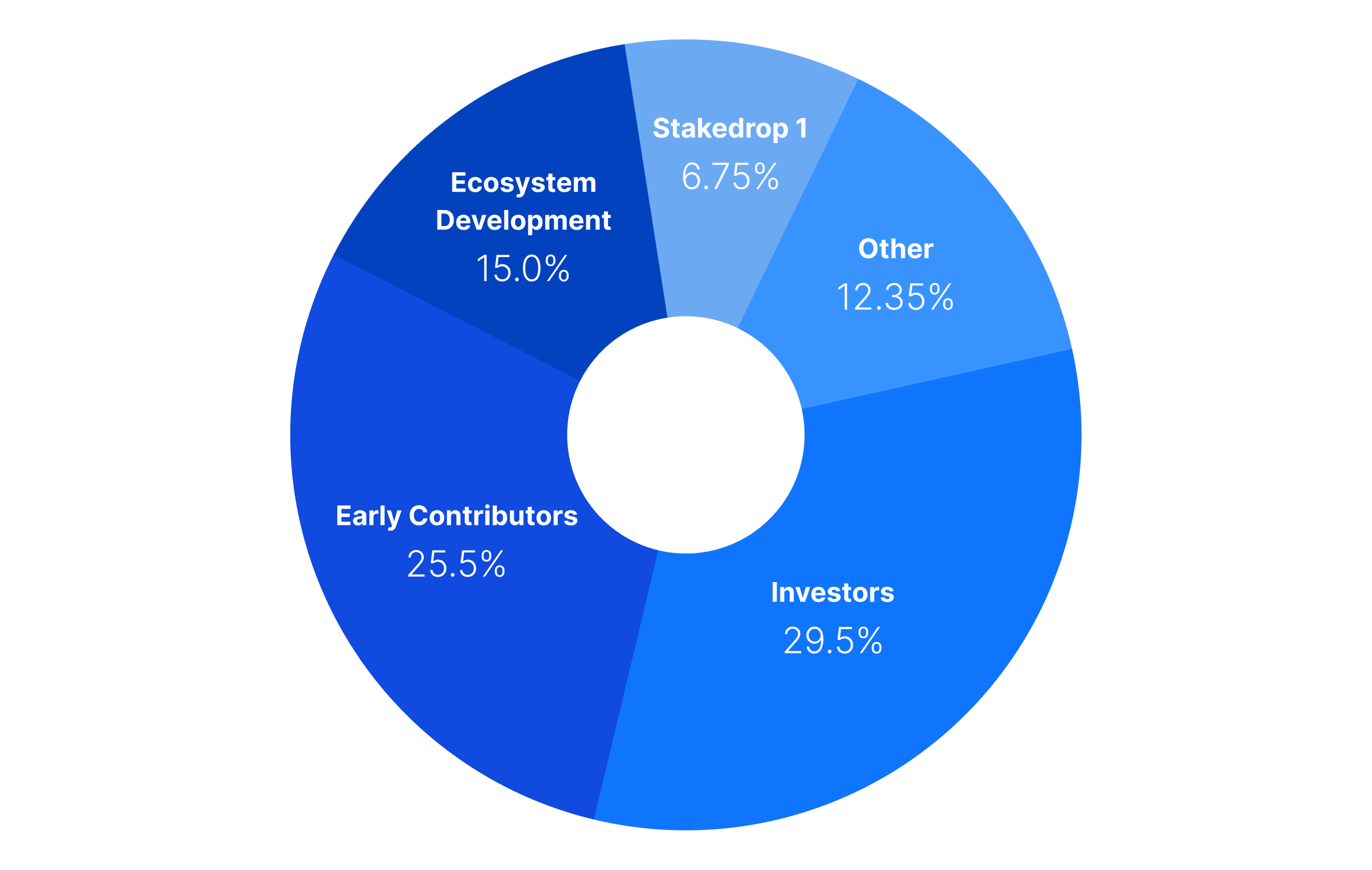

The investors' share amounts to 29.5% of the total EIGEN tokens.

Key achievements in 2024

Expanded partnerships with major DeFi projects, including integrations with Chainlink oracles and decentralized bridges.

Enhanced attack prevention mechanisms through restaking, including multisig and real-time data verification.

Increased validator yields by redistributing earnings among EigenLayer-connected projects.

The project is shaping a new staking model, enabling secure scaling of the Ethereum ecosystem.

Etherfi (ETHFI)

Etherfi is a decentralized staking protocol that gives users full control over their private keys while retaining the benefits of liquid staking.

Total funds raised: $32.3 million (Cryptorank and Dropstab).

Key funding rounds

February 2024, Series A Round: $27 million, led by CoinFund.

February 2023, Funding Round: $5.3 million, led by Chapter One Ventures.

Token distribution

March 2024, Binance Launchpool: 20 million tokens allocated for pre-distribution via Binance Launchpool. The platform allows users to stake cryptocurrencies and get tokens of new projects.

Key investors

CoinFund: A leading venture capital fund specializing in investments in cryptocurrencies and blockchain startups, providing support at all stages of development.

Stani Kulechov: Angel investor, founder of Aave, supporting DeFi and Web3 projects.

Bullish: A venture fund focused on blockchain projects.

Chapter One Ventures: An investment fund focused on supporting and developing startups in the field of cryptocurrencies.

North Island Ventures: A fund supporting crypto and blockchain projects.

ConsenSys: A leading company in the blockchain space, creating and promoting Ethereum-based solutions.

OKX Ventures: The investment arm of OKX, supporting blockchain, crypto, and DeFi startups.

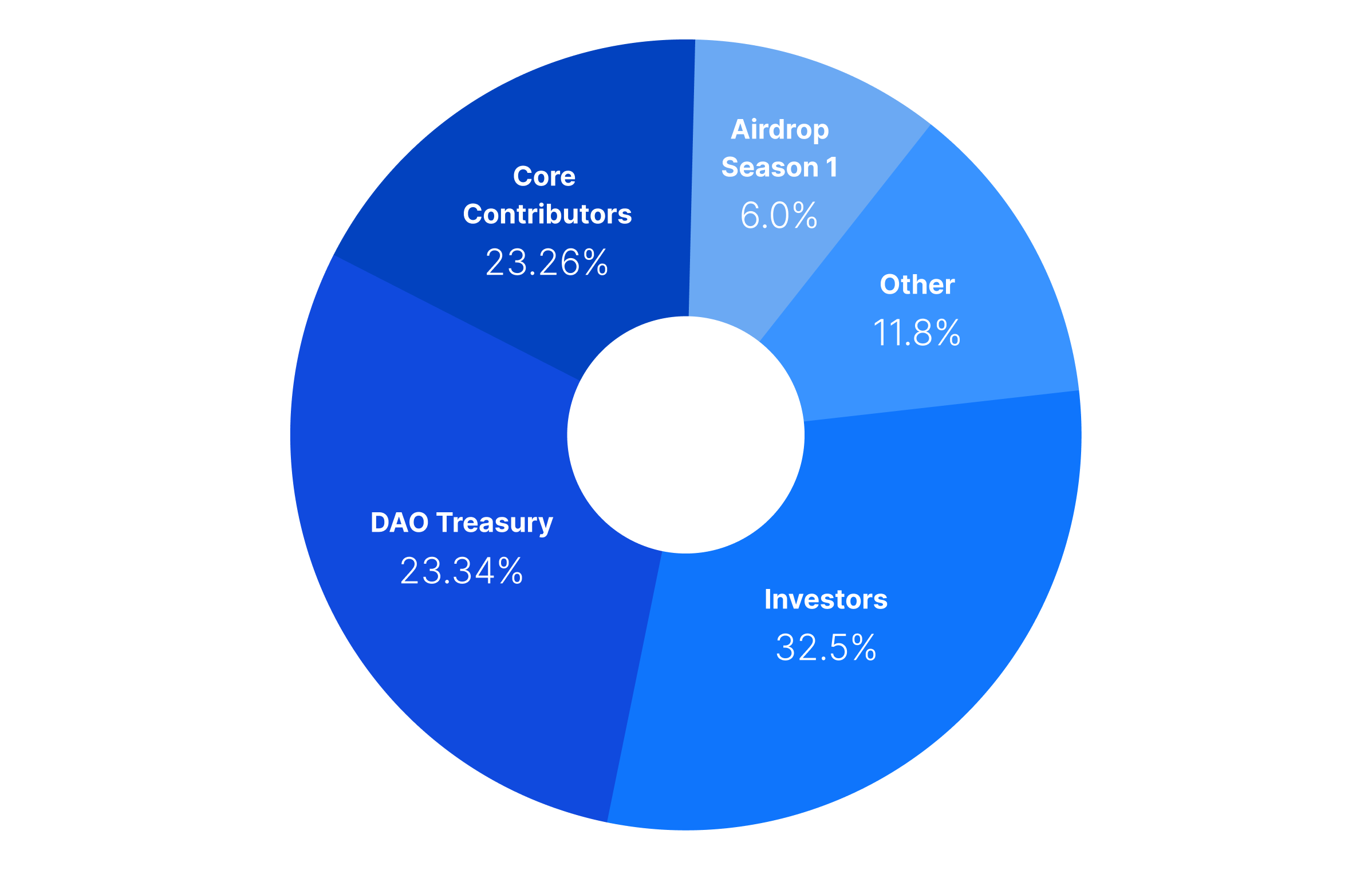

The investors' share amounts to 32.5% of the total ETHFI tokens.

Key achievements in 2024

Development of tools for institutional investors, including custodial solutions and APIs for staking management.

Expanded integrations with decentralized applications like Uniswap and Curve for staking token usage in DeFi.

Simplified interface and reduced entry barriers for retail users.

Ether.fi actively works on increasing decentralization, making asset management transparent and secure.

Ethena (ENA)

Ethena is developing a new type of Ethereum-backed stablecoin, pegged to the dollar through hedging via derivatives.

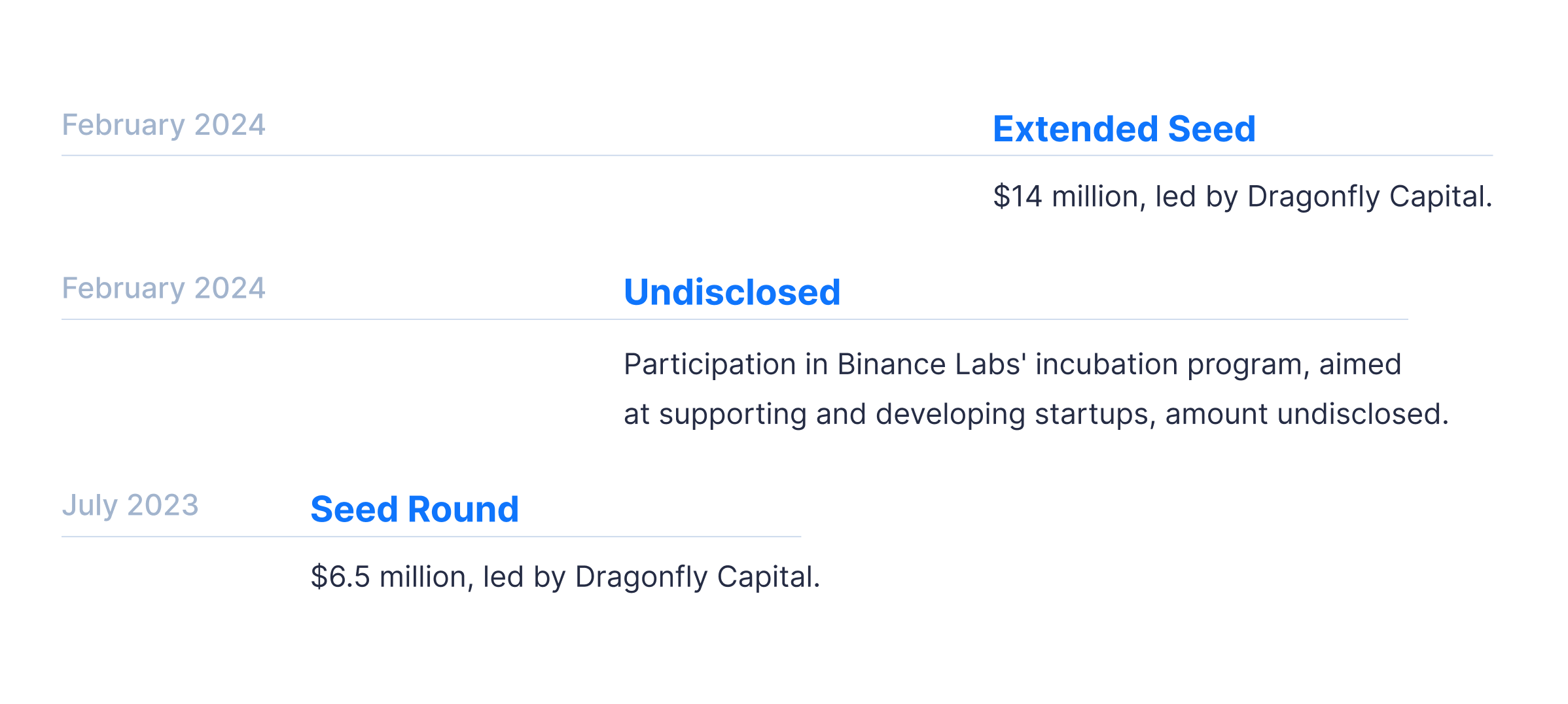

Total funds raised: $20.5 million (Cryptorank and Dropstab).

Key funding rounds

February 2024, Extended Seed: $14 million, led by Dragonfly Capital.

February 2024, Undisclosed: Participation in Binance Labs' incubation program, aimed at supporting and developing startups, amount undisclosed.

July 2023, Seed Round: $6.5 million, led by Dragonfly Capital.

Token distribution

April 2024, Bybit Launchpool: 15 million tokens allocated for sale via Bybit Launchpool, a platform allowing users to receive tokens in exchange for staking cryptocurrencies.

March 2024, Binance Launchpool: 300 million tokens allocated for sale via Binance Launchpool, a platform providing early access to tokens of promising startups.

Key investors

Dragonfly Capital: A venture fund specializing in crypto and blockchain projects.

Binance Labs: The investment arm of Binance, supporting blockchain, crypto, and DeFi startups.

Delphi Digital: An investment fund focused on analytics, tokenomics, and crypto project development.

Lightspeed Venture Partners: A major venture fund actively investing in the crypto industry.

Cobie (Jordan Fish): A well-known angel investor and crypto influencer, popular in the cryptocurrency community.

OKX Ventures: The investment arm of OKX, supporting blockchain, crypto, and DeFi startups.

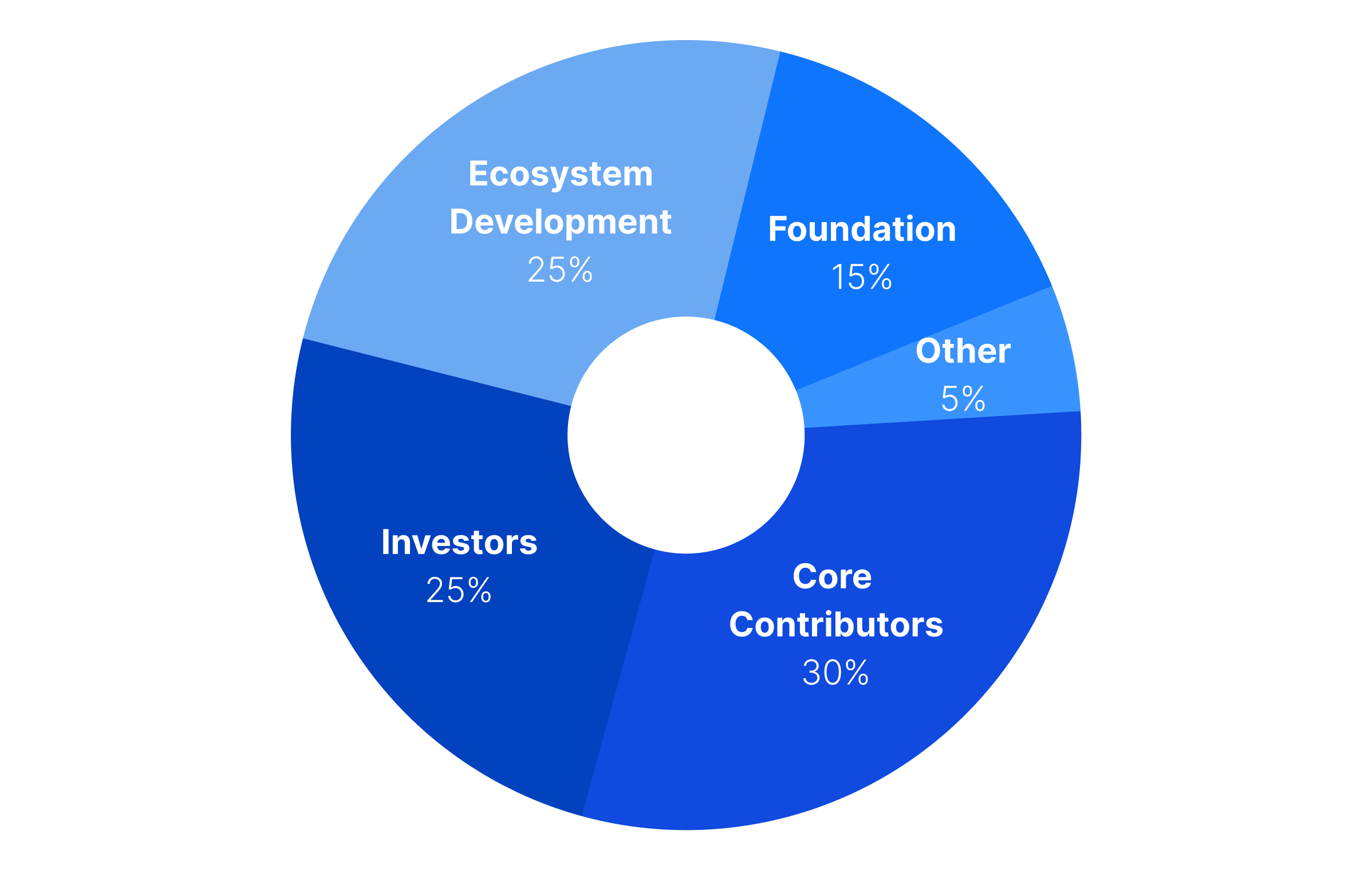

The investors' share amounts to 25% of the total ENA tokens.

Key achievements in 2024

Implementation of a model using futures and options to minimize underlying asset volatility.

Increased liquidity through partnerships with major DEXs like Uniswap and SushiSwap.

Launch of educational programs explaining the unique mechanics of the stablecoin.

Ethena offers an innovative approach to stablecoin creation, combining decentralization and reliability.

Binance staked ETH

Binance Staked ETH is a simplified way to participate in Ethereum staking through the Binance's centralized platform.

BETH is the token Binance uses for staking Ethereum. It is not a DeFi protocol, so investment amounts and investors are not specified.

Key achievements in 2024

Increased APY (Annual Percentage Yield) through staking infrastructure optimization.

Deep integration with the Binance ecosystem, including the use of bETH in Binance's DeFi services.

Security system updates ensuring a high level of user protection.

Binance Staked ETH continues to attract retail and institutional users due to its reliability and ease of use.

Uniswap (UNI)

Uniswap remains the largest decentralized exchange, enabling seamless asset trading.

Total funds raised: $177.9 million (Dropstab).

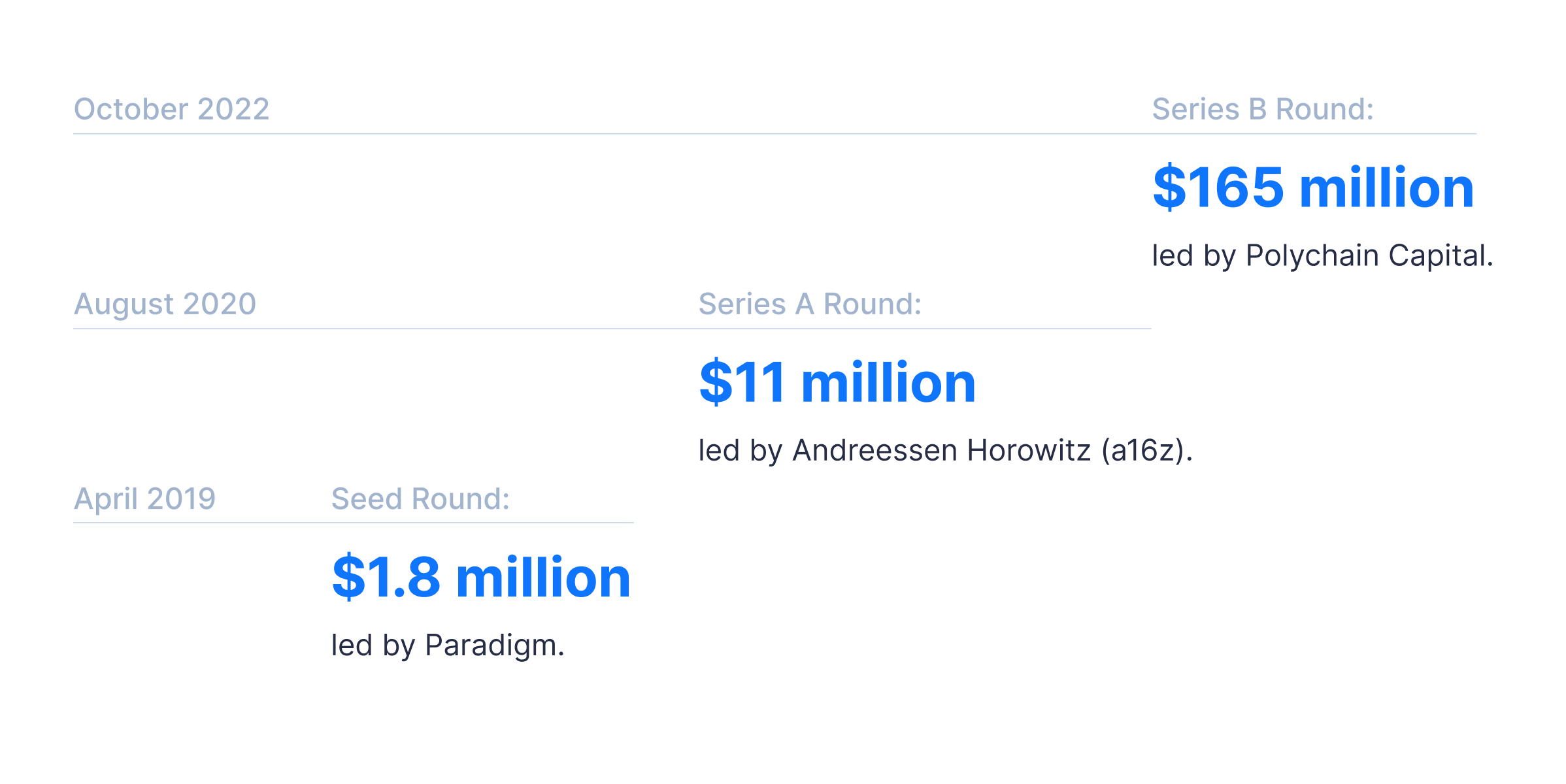

Key funding rounds

October 2022, Series B Round: $165 million, led by Polychain Capital.

August 2020, Series A Round: $11 million, led by Andreessen Horowitz (a16z).

April 2019, Seed Round: $1.8 million, led by Paradigm.

Key investors

Blockchain Capital: One of the leading venture fund in the crypto space, specializing in investing in blockchain startups.

Polychain Capital: A fund focused on blockchain and crypto investments.

Andreessen Horowitz (a16z): A venture giant actively investing in the crypto industry.

Paradigm: A venture fund specializing in Web3 and blockchain infrastructure.

Variant: A venture fund investing in crypto, blockchain, and Web3 startups.

Union Square Ventures: One of the most renowned venture funds in the U.S., actively supporting blockchain and crypto projects.

ParaFi Capital: A venture fund specializing in DeFi, blockchain, and crypto investments.

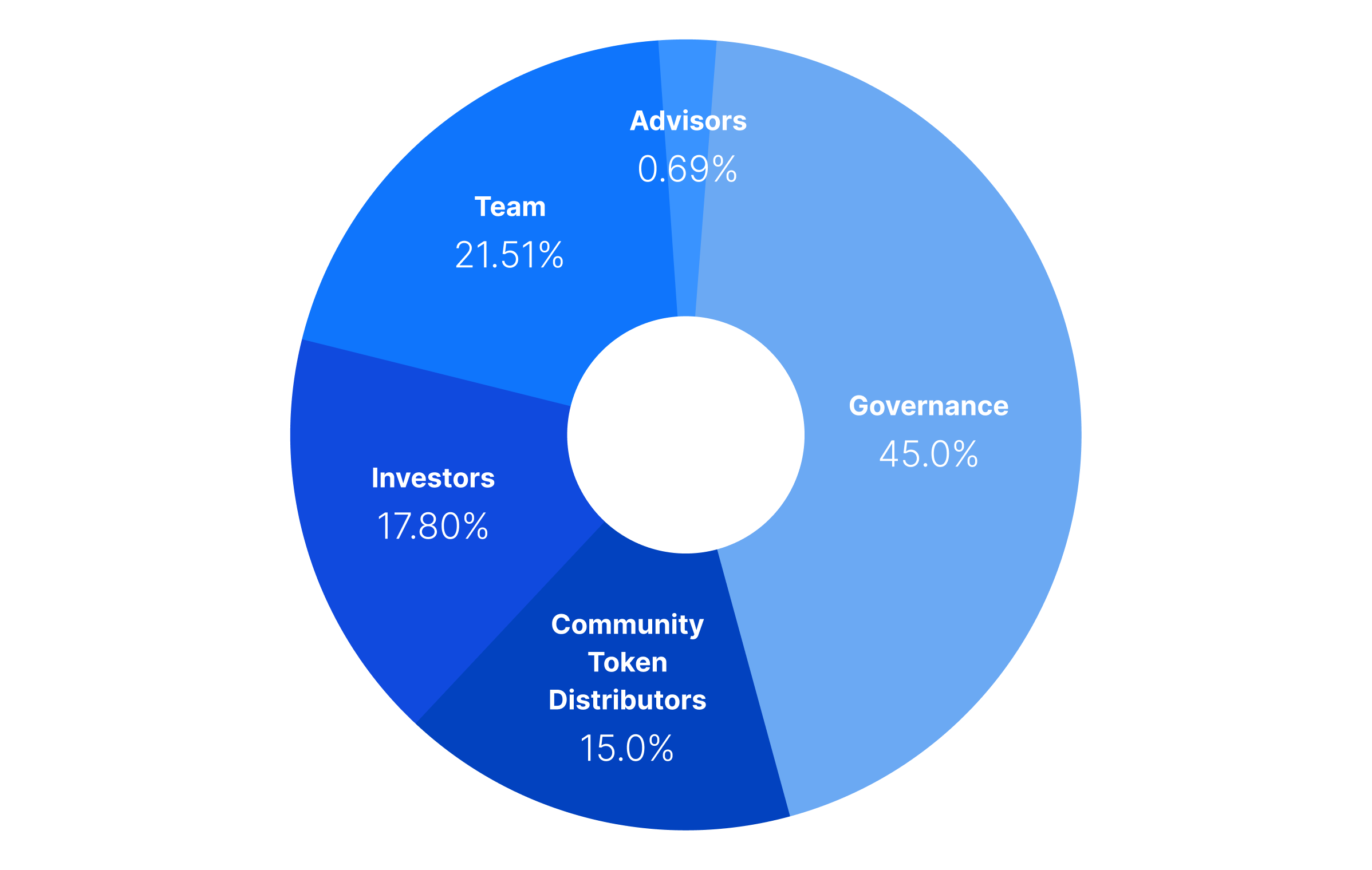

The investors' share amounts to 17.80% of the total UNI tokens.

Key achievements in 2024

Expansion of limit order functionality and improvements to Automated Market Maker (AMM) algorithms.

Integration of Layer 2 solutions to increase transaction speed and reduce costs.

Launch of liquidity incentive programs to attract new users.

Uniswap continues to play a key role in providing liquidity for the entire DeFi ecosystem.

JustLend (JST)

JustLend is the primary lending protocol in the TRON ecosystem, offering low fees and high transaction speeds.

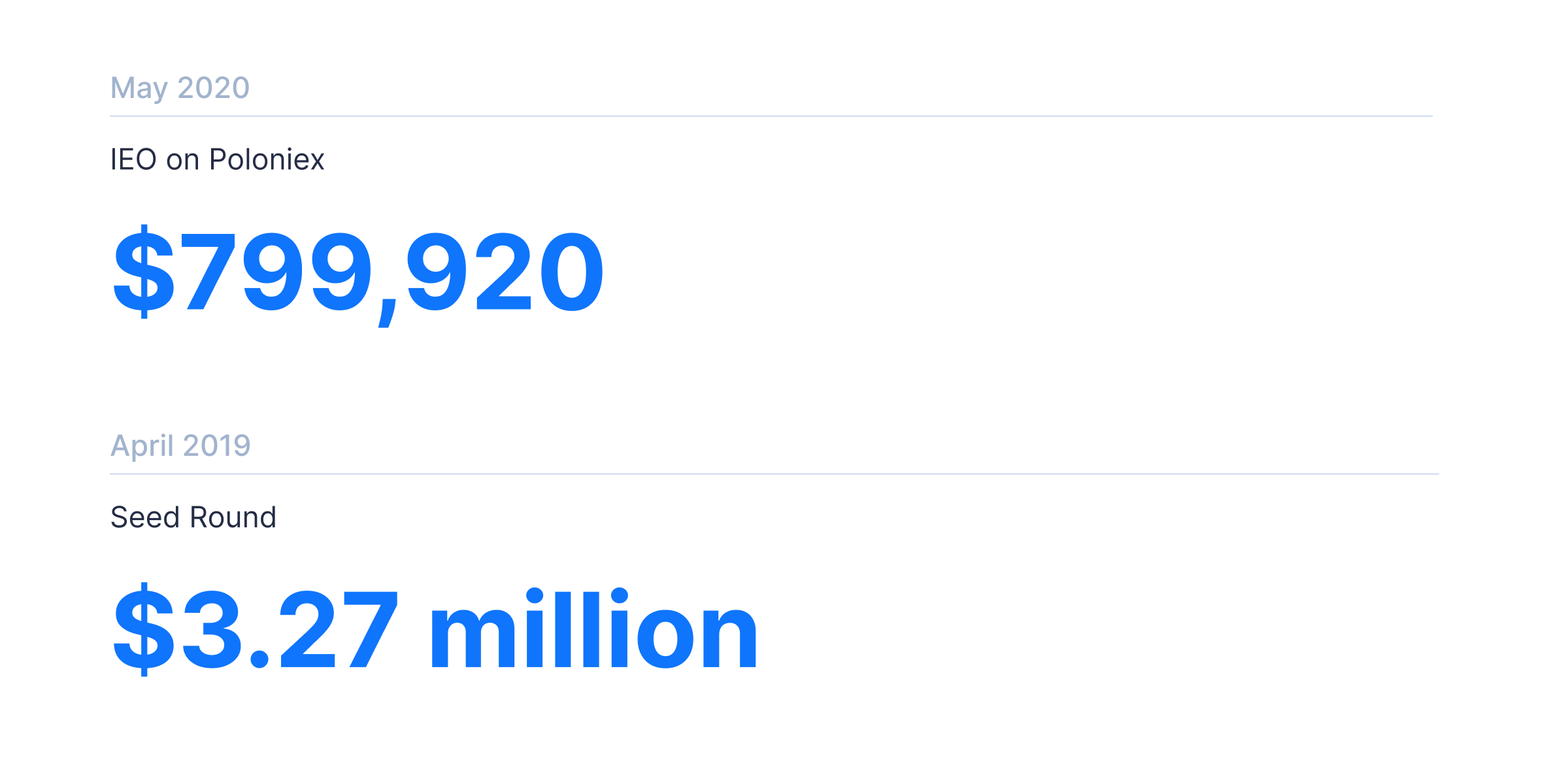

Total funds raised: $4.87 million (Dropstab).

Key funding rounds

May 2020, IEO on Poloniex: $799,920.

April 2019, Seed Round: $3.27 million.

There is no public information on major investors.

Key TRON ecosystem participants

TRON Foundation: The key organization supporting the development of the TRON blockchain and related protocols.

Justin Sun: Founder of TRON and initiator of a number of strategic projects, including JustLend.

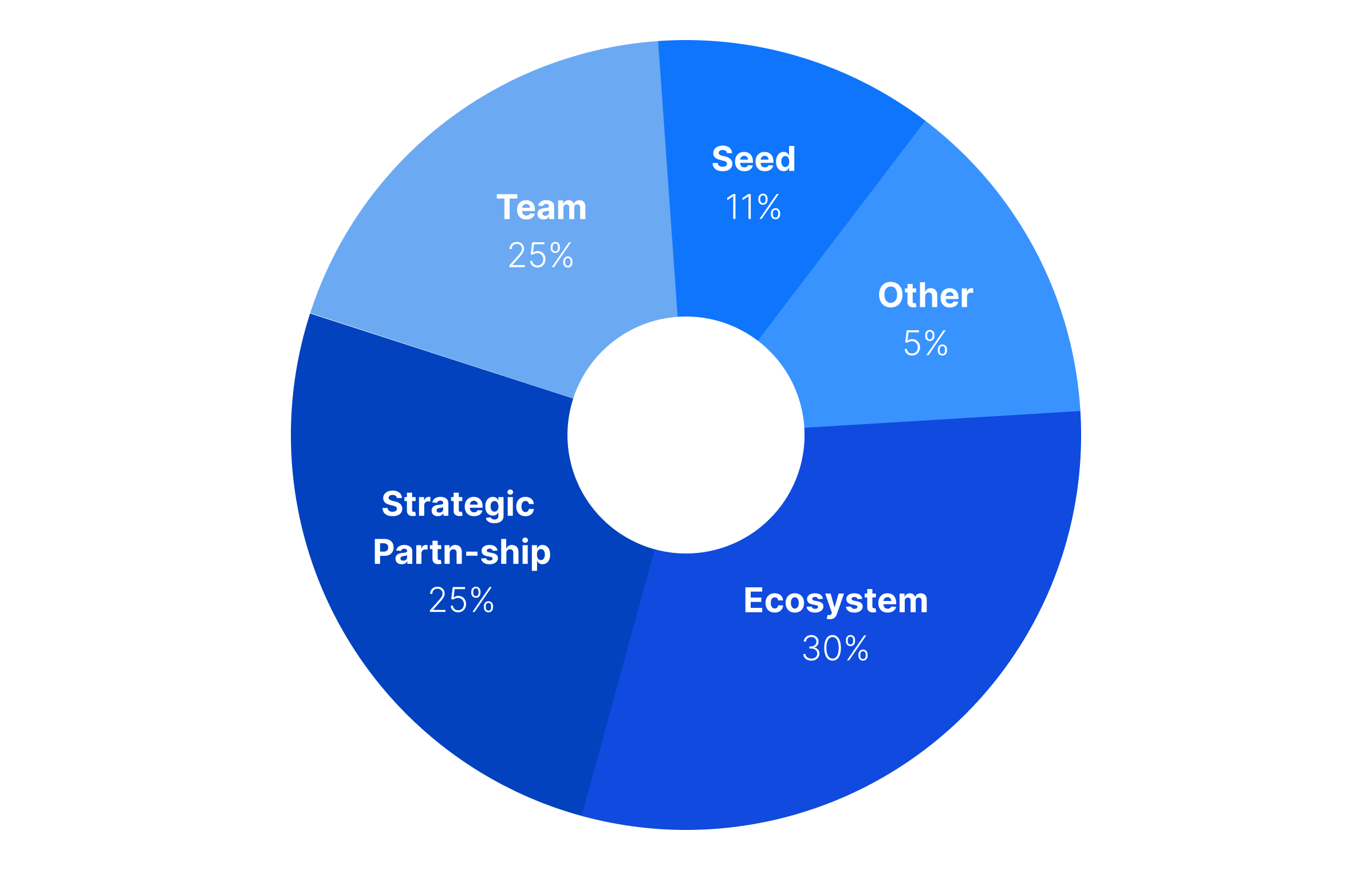

The investors' share amounts to 11% of the total JST tokens.

Key achievements in 2024

Addition of new assets for lending, including tokens from the TRON ecosystem and other blockchains.

Increased yields for liquidity providers through reward programs.

Improved risk management algorithms, reducing the likelihood of defaults.

JustLend remains a vital part of the TRON ecosystem, supporting its DeFi segment growth.

Babylon

Babylon is a decentralized protocol that enables the creation of investment communities and fund management through DAO.

Total funds raised: $101.3 million (Dropstab, Cointime)

Key funding rounds

January 2025, Strategic Round: $5.3 million, investor: BingX Labs.

May 2024, Funding Round: $70 million, led by Paradigm.

February 2024, Funding Round: Amount undisclosed, investor: Binance Labs.

December 2023, Series A: $18 million, led by Polychain Capital.

Key investors

Polychain Capital: A fund focused on blockchain and crypto investments.

Paradigm: A venture fund specializing in Web3 and blockchain infrastructure.

Binance Labs: The investment arm of Binance, supporting blockchain, crypto, and DeFi startups.

Framework Ventures: A fund supporting Web3 and DeFi projects.

OKX Ventures: The investment arm of OKX, supporting blockchain, crypto, and DeFi startups.

BingX Labs: The investment arm of BingX, supporting promisisng blockchain, crypto, and Web3 startups.

The project doesn't have any tokens yet.

Key achievements in 2024

Implementation of automated portfolio management strategies, minimizing asset management costs.

Expanded partnerships with DeFi protocols offering additional hedging tools.

Increased transparency in fund management through advanced analytics tools.

Babylon promotes the democratization of DeFi investing.

Pendle (PENDLE)

Pendle allows users to tokenize future asset yields and trade them on secondary markets.

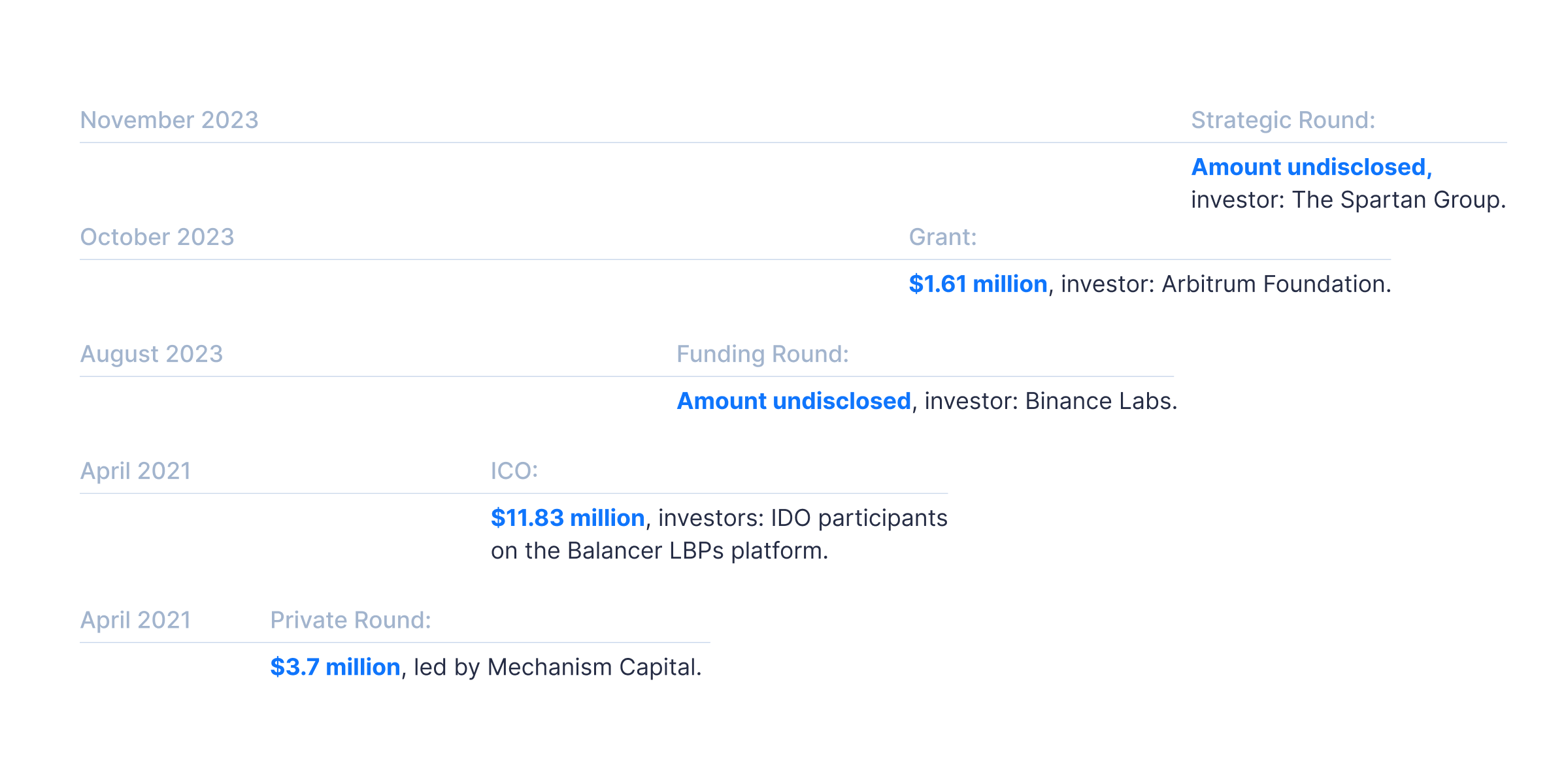

Total funds raised: $17.14 million (Dropstab and Cryptorank).

Key funding rounds

November 2023, Strategic Round: Amount undisclosed, investor: The Spartan Group.

October 2023, Grant: $1.61 million, investor: Arbitrum Foundation.

August 2023, Funding Round: Amount undisclosed, investor: Binance Labs.

April 2021, IDO: $11.83 million, investors: IDO participants on the Balancer LBPs platform.

April 2021, Private Round: $3.7 million, led by Mechanism Capital.

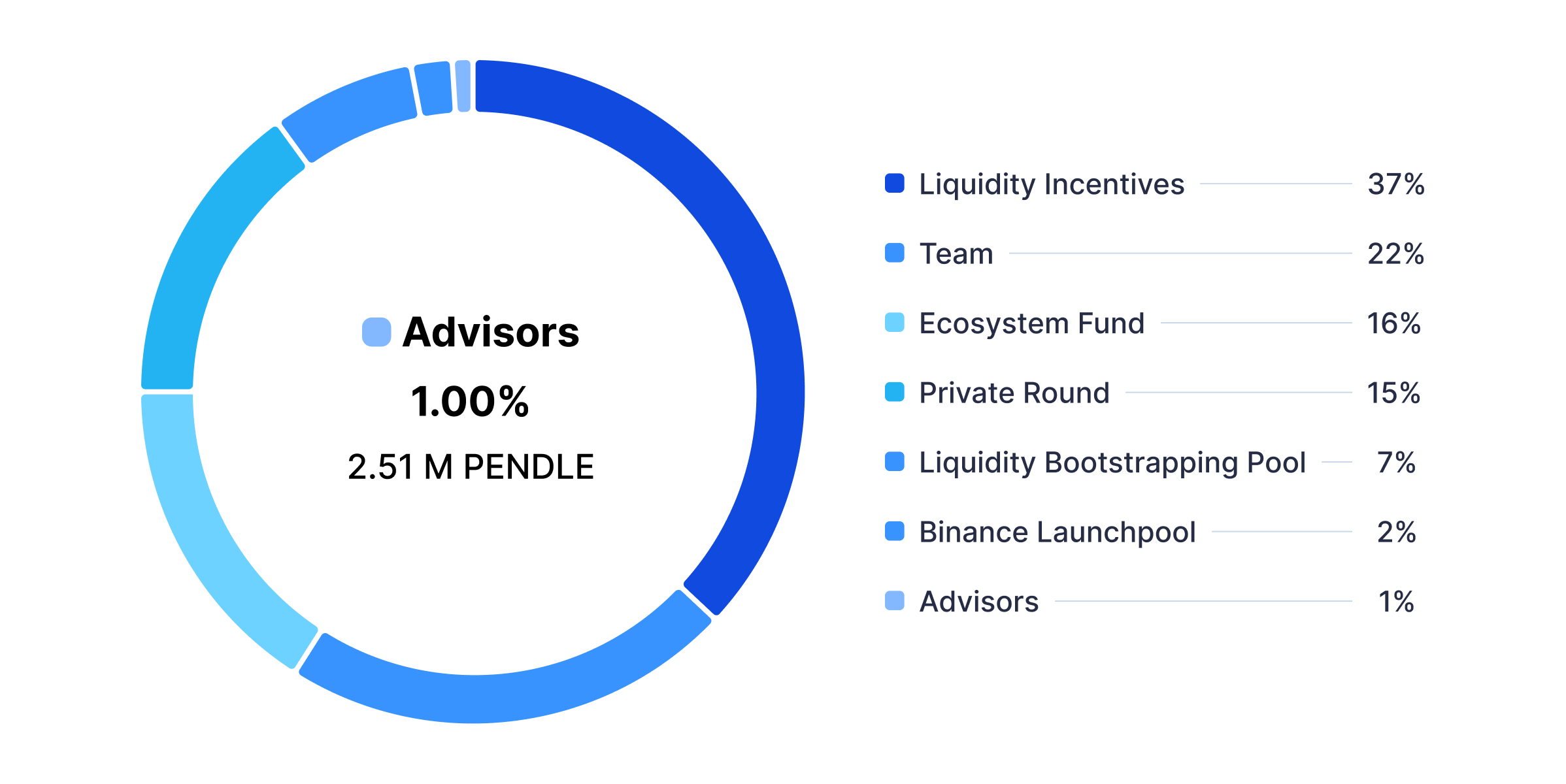

Token distribution

July 2023, Binance Launchpool: 5.02 million tokens allocated for sale via Binance Launchpool, a platform providing early access to tokens of promisisng startups.

Key investors

Binance Labs: The investment arm of Binance, supporting blockchain, crypto, and DeFi startups.

The Spartan Group: An investment and consulting fund specializing in crypto and blockchain projects.

Mechanism Capital: An investment firm focused on crypto and DeFi.

HashKey Capital: An international investment fund supporting blockchain, crypto, and DeFi startups.

The investors' share (Private Round) amounts to 15% of the total PENDLE tokens. Other sources of funding, such as grants and fundraising rounds, are not listed in the project's tokenomics, but may still account for a fraction of the share.

Key achievements in 2024

Launch of new pools for fixed-yield assets.

Integration with leading DeFi protocols like AAVE and Compound to expand user capabilities.

Improved interface and analytics, making the platform user-friendly even for beginners.

Pendle is actively shaping a new market segment, offering unique yield management tools.

Decentralized financial protocols continue to play a key role in the development of the crypto industry, attracting significant investments from major venture funds and institutional investors. The analysis of the top 10 DeFi projects by funds raised demonstrates their resilience, potential, and strategic importance for the blockchain ecosystem.

The success of these top DeFi projects confirms their pivotal role in shaping the future of decentralized finance. DeFi remains one of the most dynamic sectors in the crypto industry, driving innovation and setting new standards.

Key DeFi Trends of 2024

DeFi continued to evolve in 2024, with innovations reshaping security, trading, and asset tokenization. Below are some of the key trends and developments that defined the year.

Restaking

The development of restaking solutions has strengthened the crypto-economic security of blockchains and protocols, improved capital efficiency, and lowered security costs. Restaking expanded primarily on Ethereum, though other blockchains, such as Solana, also introduced solutions in this area. The largest restaking protocol, EigenLayer, currently ranks third among all DeFi protocols by TVL with $15.2 billion.

Derivatives DEXs

Trading volumes on derivatives DEXs surged, offering an alternative to CEXs. In 2024, trading volume on derivatives DEXs grew from $128 billion to $342 billion. These platforms provide deep liquidity and a user-friendly interface similar to CEXs and, at the same time, eliminate the need for KYC procedures and custodial asset storage.

Yield-Bearing Stablecoins

Another trend was the emergence of new stablecoins that generate yield for holders through mechanisms such as funding rate arbitrage and tokenized RWAs. Examples include USDe by Ethena and USR by Resolv. They both are backed by crypto assets used in delta-neutral strategies, generating yield for holders. Another example is USD0 by Usual, backed by RWAs like tokenized US Treasury bonds and reverse repo agreements, with yield generated from these assets.

DeFi Expansion and Bitcoin

This past year, Bitcoin’s blockchain further integrated into DeFi through restaking, DEXs, and lending protocols. Solutions like Babylon, Corn, and Solv Protocol enabled BTC integration into the DeFi ecosystem without using bridges or wrapped assets.

Prediction Markets

Decentralized platforms allowing users to bet on events, from Bitcoin’s price to US election outcomes, gained massive popularity in 2024. For example, total bets on the US presidential election on Polymarket reached $3 billion.

DeFi’s Role in the Future of Traditional Finance

Traditional finance continues to explore blockchain technology. In this section, we will analyze some ways in which it happens.

Asset Tokenization

In 2023, JPMorgan started working with tokenized assets, including bonds and stocks, enabling blockchain-based trading. DeFi is also being tested for traditional asset trading and lending markets through Project Guardian, a collaboration with Singapore’s financial authorities. RWA tokenization continues to expand, now covering bonds, stocks, commodities, and real estate.

Blockchain in Asset Management

In 2024, Franklin Templeton launched the OnChain US Government Money Fund (FOBXX), a US-regulated mutual fund that uses blockchain to record transactions and store assets.

Unsecured Loans

DeFi protocols offer unsecured loans to institutional borrowers, giving traditional financial institutions access to DeFi liquidity while streamlining and reducing the cost of borrowing.

Stablecoins and TradFi

With USDC's integration into Visa, the company’s clients can now make payments across multiple blockchains using the stablecoin. The launch of PayPal's PYUSD similarly enables on-chain transactions within the platform.

RWAs as Collateral

MakerDAO integrated RWA, such as the US Treasury bonds and tokenized real estate, as collateral for the DAIstablecoin. In 2023, MakerDAO added $500 million worth of RWA reserves; currently, RWA-backed collateral stands at $948 million.

RWA Segment Overview

Attention to the RWA Segment

This report pays special attention to the RWA segment, as it appears to be one of the most interesting and promising areas of development for DeFi in the next few years. RWA are increasingly used by DeFi protocols as collateral, for investment and speculative purposes.

Overall, the introduction of RWA into DeFi is a logical step towards the integration of DeFi into the traditional financial and banking system, which opens up huge opportunities for DeFi protocols. The use of RWA assets increases the global liquidity of the DeFi sector and helps attract new investments and users to DeFi protocols. The integration of RWA seems a logical step towards the institutionalization of DeFi, the emergence of services available to traditional investors and ordinary users.

An example of the importance of RWA assets are stablecoins, the financial base of the entire crypto market. The vast majority of leading stablecoins use RWA as collateral. This shows the importance of the segment for DeFi and its big role in the development of the industry and its growth in the coming years. That's why we paid special attention to this area and conducted a deeper analysis of trends in it and the leading projects involved in the integration of DeFi and RWA.

RWA in the crypto industry are tangible, physically existing assets and objects the key characteristics and values of which are transferred to the blockchain; they become tradable on-chain through a process called asset tokenization. This includes stocks, bonds, commodities (e.g. precious metals, oil, wheat, etc.), artwork, and real estate. Tokenization broadens DeFi yield opportunities, simplifies ownership, and enhances liquidity of traditionally illiquid assets.

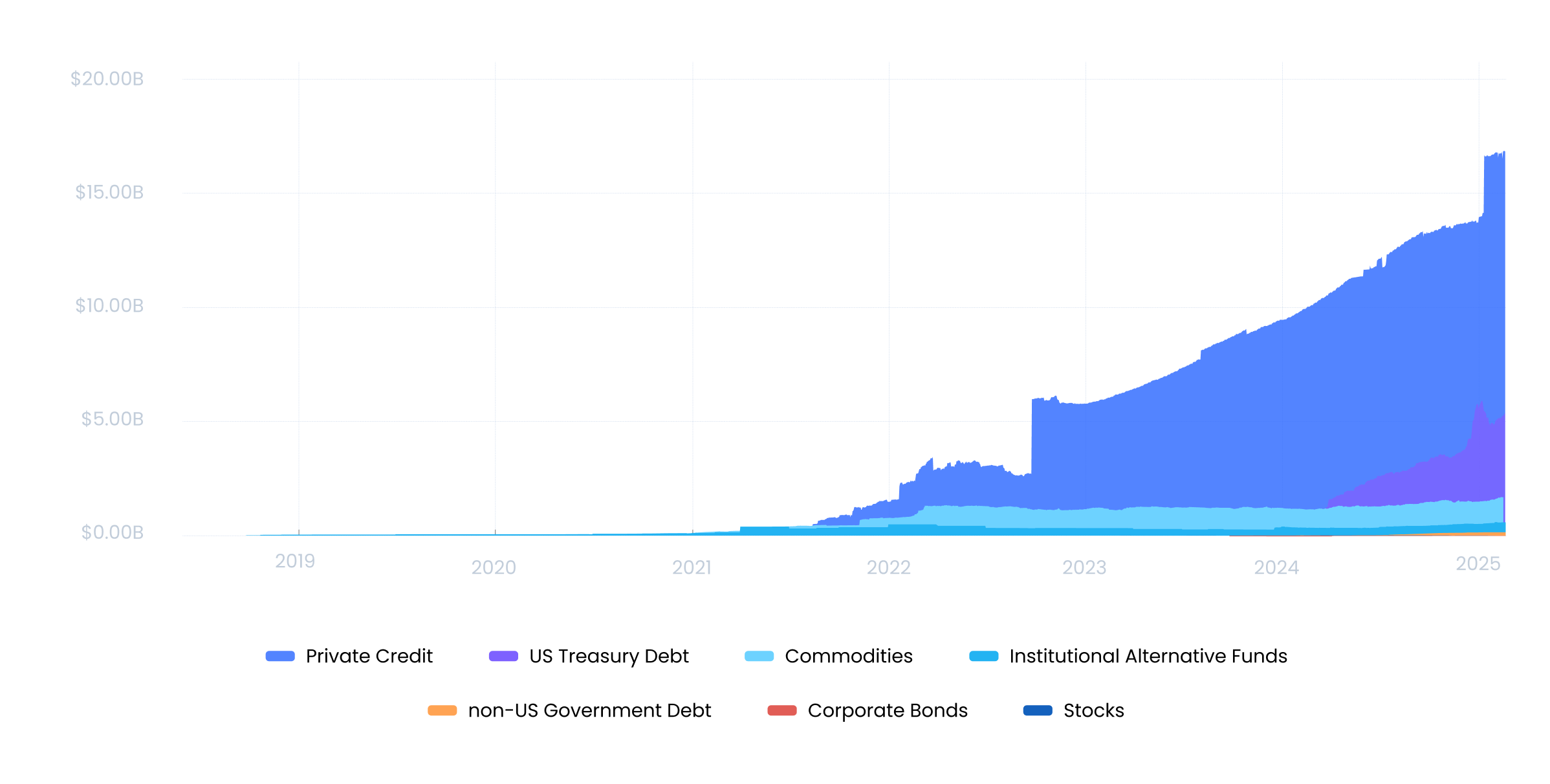

Currently, tokenized RWA assets in crypto are valued at approximately $16.7 billion, excluding tokenized real estate. Over the past year, the RWA market in crypto grew by 95%.

Total RWA Value. Source: rwa.xyz

Total RWA Value. Source: rwa.xyz

Key RWA Segments

RWA tokenization has expanded across multiple sectors, transforming how assets are issued, traded, and utilized in DeFi. Below we are describing the key segments.

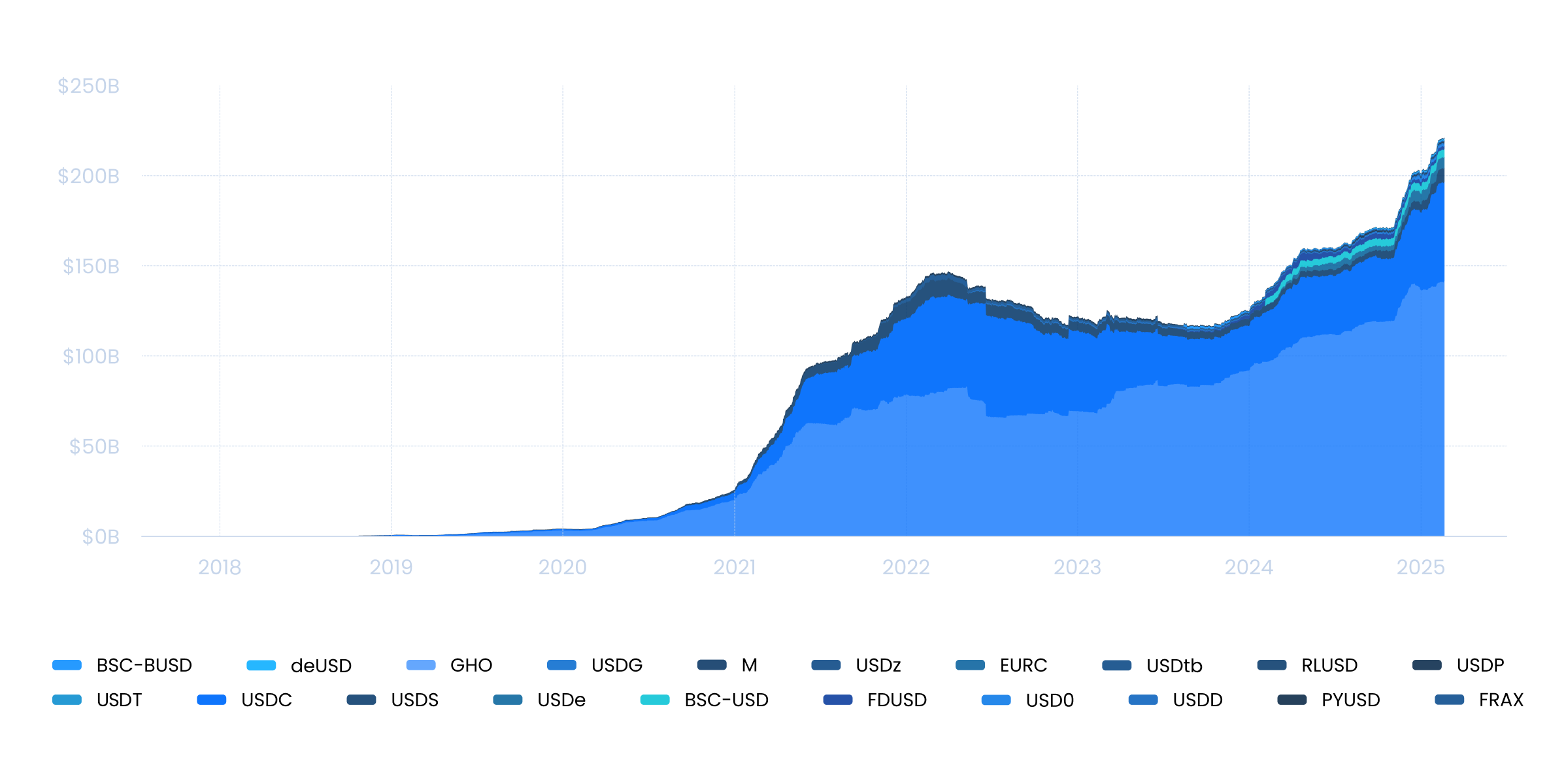

Stablecoins

Stablecoins are one of the key segments of the crypto economy, essentially performing the functions of money. They serve as a means of payment for goods and services, a medium of exchange, a unit of account, and a store of value. The stablecoin market cap is approximately $207 billion, having grown 58% in the past year.

The stablecoin market cap. Source: rwa.xyz

Stablecoins became one of the first examples of a link between the crypto economy and real-world assets, as most of them, including the largest ones, are backed by real assets such as treasury bonds, securities, bank deposits, and other traditional financial instruments.

While the RWA used by most stablecoins are not tokenized in the literal sense, they serve as collateral, maintaining the stablecoin’s price and ensuring its reliability. It is important to note that not all stablecoins on the market are backed by RWA: there are also other models for collateralization and maintaining an asset’s peg to a benchmark.

These are some of the most popular RWA-backed stablecoins:

USDT

The largest stablecoin with a market cap of $138 billion, USDT is issued and maintained by Tether Limited, a subsidiary of iFinex, which is associated with the Bitfinex exchange. USDT is a fully backed stablecoin, with reserves including fiat (USD), short-term corporate bonds, gold, and other assets. Third-party auditors verify USDT’s reserves and regularly publish the reports.

USDC (USD Coin)

USDC is the second-largest stablecoin by market cap with $48 billion; it is issued by Circle in collaboration with the US-based crypto exchange Coinbase. Like USDT, USDC is backed 1:1 by real financial assets, including fiat currencies, US Treasury bonds, and other highly liquid assets.

FDUSD

FDUSD is a centralized stablecoin with a market cap of $1.89 billion, issued and maintained by First Digital Labs, a subsidiary of First Digital Group. FDUSD is backed by fiat currency reserves and cash equivalents such as time deposits and US Treasury bonds.

USD0

USD0 is a new player in the stablecoin market, launched in 2024, with a current market cap of $1.53 billion. USD0 is a fully collateralized stablecoin backed by real assets, specifically short-term US Treasury Bills and reverse repo agreements.

To mint USD0, users must provide 1:1 collateral in RWA assets through the Usual Protocol, which issues USD0 and maintains its peg. Currently, RWA providers like Hashnote contribute collateral via USYC, an on-chain ERC-20 asset from Hashnote International Short Duration Yield Fund Ltd. (SDYF), which invests in reverse repo agreements and US Treasury bonds.

PYUSD (PayPal USD)

PYUSD is a centralized stablecoin issued by PayPal through Paxos Trust Company, with a current market cap of $559 million. PYUSD is backed by fiat currency reserves (USD) and US Treasury bonds.

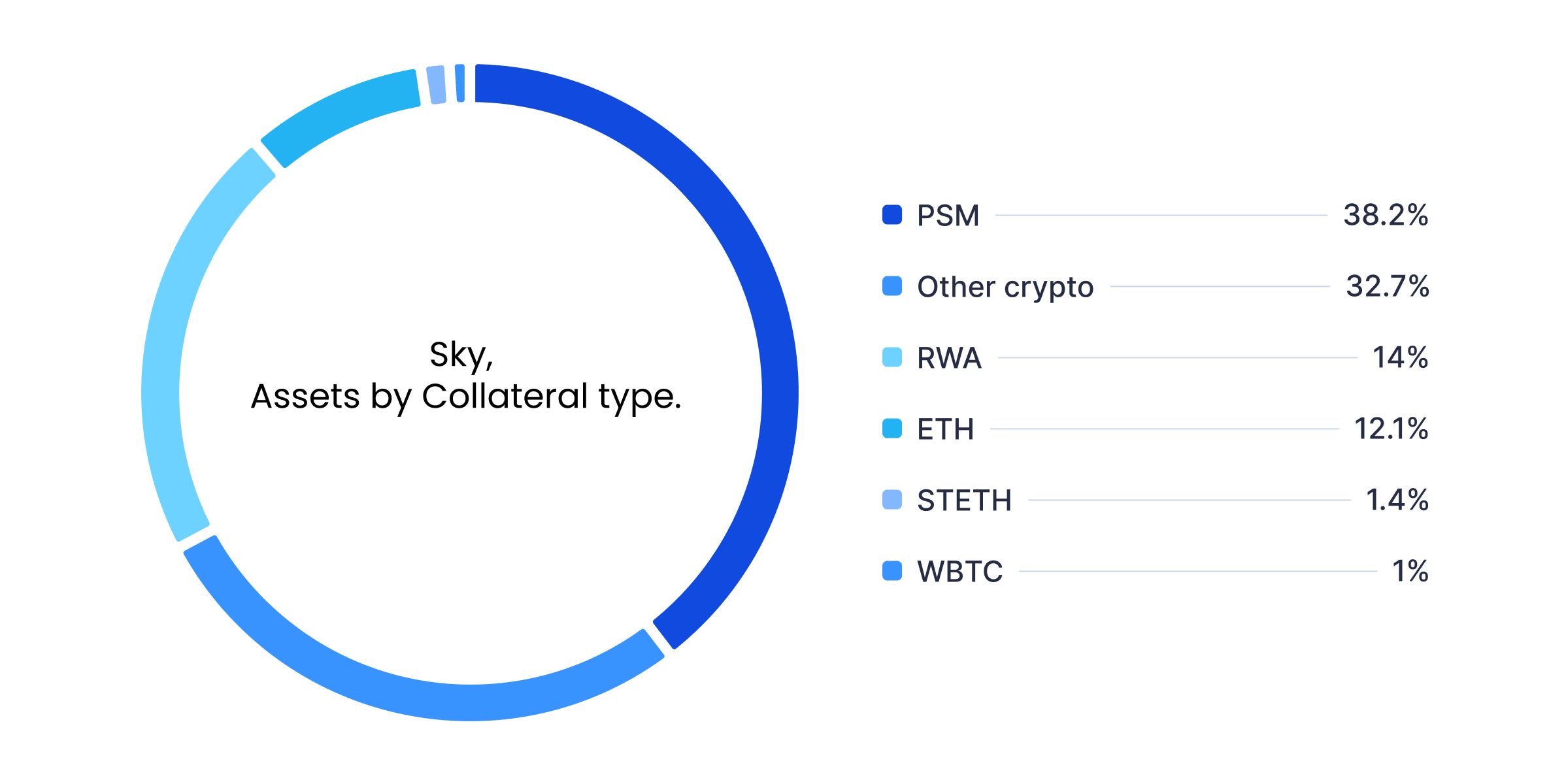

MakerDAO, or Sky is a notable mention here. It issues the stablecoins DAI and USDS, which is an improved version of DAI. These are soft-pegged stablecoins backed by various crypto assets such as ETH, BTC, and others. To mint DAI, users must provide collateral in the approved crypto assets. The value of the collateral always exceeds the amount of DAI issued to ensure stability and security.

Beyond crypto-backed collateral, MakerDAO has been integrating RWA since 2020, allowing DAI to be partially backed by traditional financial instruments. Currently, MakerDAO holds approximately $948 million in RWA-backed collateral, accounting for 14% of total reserves. Over the past 14 months, revenue from RWA assets has averaged $35.7 million, making up 10.9% of MakerDAO’s total revenue.

MakerDAO continues to expand its use of RWA, and in the future, these assets are expected to play an even larger role in the protocol’s operations and revenue generation.

Sky, Assets by Collateral type. Source: Dune.com

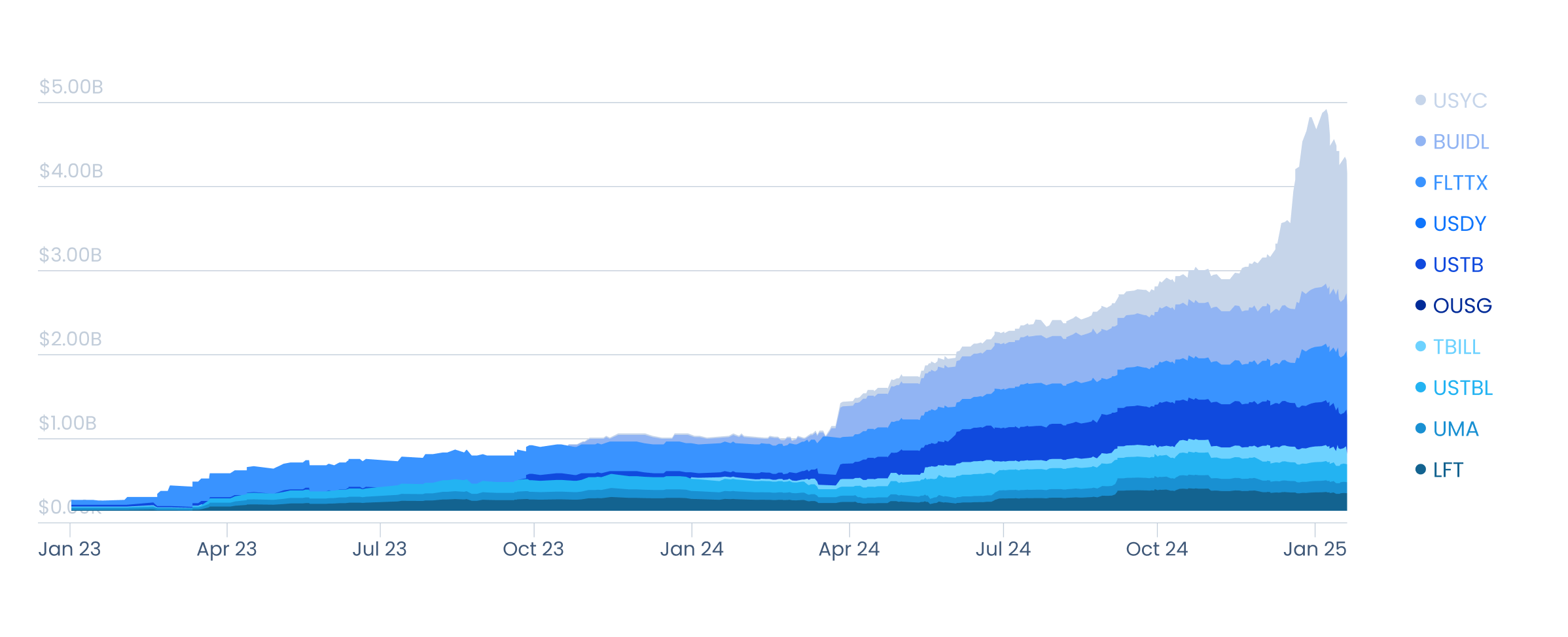

Tokenized Bonds

Bonds, primarily US Treasury bonds, are among the most popular assets for tokenization. In the traditional investment industry, US Treasuries are considered one of the most reliable investment instruments in the world. The tokenization of treasuries allows crypto investors to gain exposure to this investment instrument and use it in their strategies.

As of now, the market volume of tokenized US bonds is approximately $3.52 billion, showing an impressive 353% growth over the past year.

Tokenized US bonds market volume. Source: rwa.xyz

Hashnote

Hashnote is the largest issuer of tokenized US bonds, which manages $1.3 billion in assets. It provides qualified investors in the US and beyond access to US Treasury Bills through the Hashnote International Short Duration Yield Fund Ltd. (SDYF), which issues the on-chain asset, USYC token.

BlackRock

BlackRock is the world's largest investment company, with an AUM of $11.6 trillion, provides qualified investors in the US with the opportunity to invest in tokenized US bonds through the BlackRock USD Institutional Digital Liquidity Fund (BUILD). The tokenization process is facilitated by the Securitize protocol. BUILD's current AUM is $635 million.

Franklin Templeton

Franklin Templeton is an American investment company with an AUM of $1.63 billion. It allows retail investors from the US and other countries to invest in tokenized US bonds through the Franklin OnChain US Government Money Fund (FOBXX). The fund's current AUM is $524 million.

Ondo Finance

Ondo Finance positions itself as a decentralized investment bank, providing access to institutional investment products and services to everyone. In particular, they provide retail and institutional investors outside the US with access to tokenized US bonds through USDY (US Dollar Yield Token). The fund's current AUM is $385 million.

Non-US Tokenized Bonds

In addition to US Treasuries, investors can also access tokenized bonds from other countries. This market segment is significantly smaller compared to tokenized Treasuries, and its total volume is around $119 million.

The largest issuer of non-US tokenized bonds is SpikoFinance, a European investment company headquartered in Paris. Spiko allows investing in tokenized bonds of European Union countries through the Spiko EU T-Bills Money Market Fund (EUTBL). The fund's current AUM is $92.8 million.

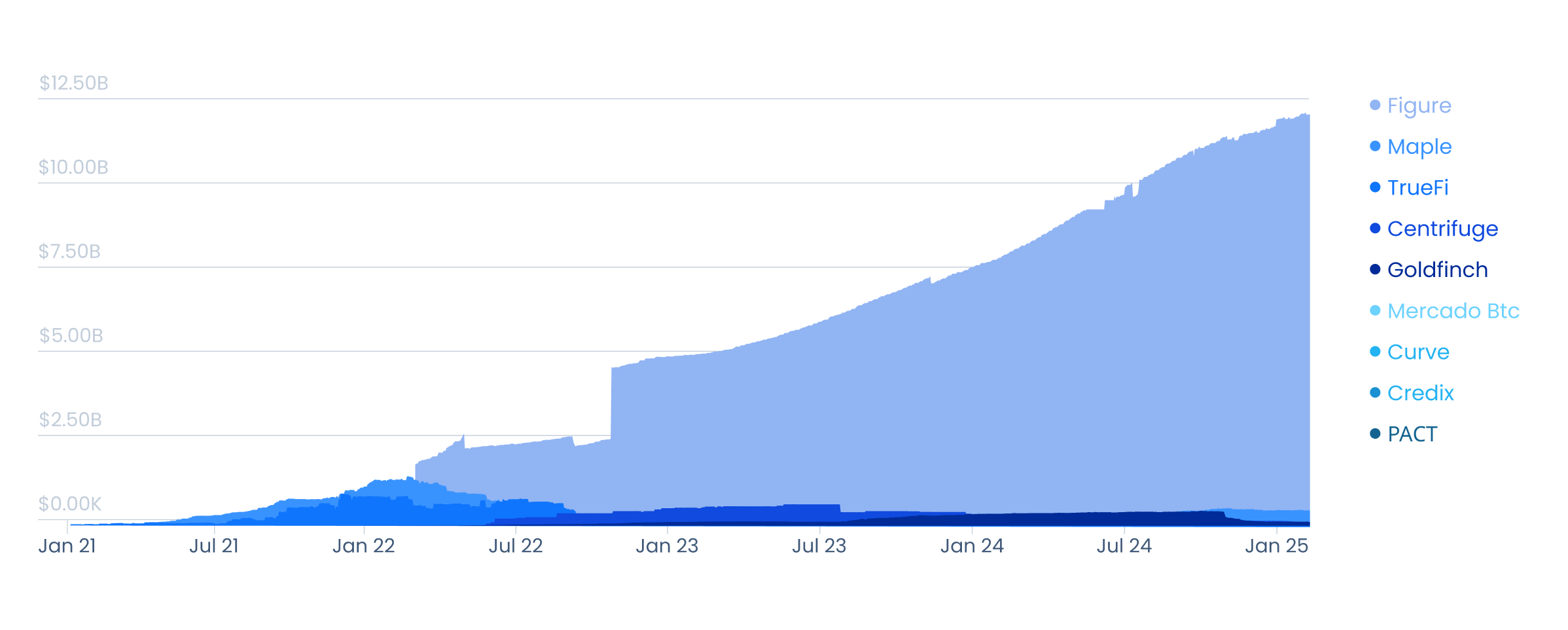

Tokenized Loans

The tokenized loan market allows on-chain lending to companies from the real sector of the economy, using RWA or crypto assets as collateral. In some cases, unsecured loans are also available, making credit more accessible to companies that either cannot access traditional banking services or prefer to use on-chain financing. As of now, the tokenized loan market stands at approximately $11.5 billion, showing a 74% increase over the past year.

Tokenized loan market volume. Source: rwa.xyz

Major players in the tokenized loans market include:

Figure

Figure is a blockchain-based marketplace that connects borrowers and lenders. It streamlines and accelerates getting loans by standardizing applications and key loan parameters, making credit more accessible to institutional borrowers.

Tradable

Tradable is a platform for asset tokenization and institutional lending. Selected companies, called originators, offer various strategies for which they want to receive a loan. Investors, in turn, consider the submitted applications and, if interested, apply to participate in the project as a lender, receiving interest during the loan term and the principal investment after the loan is repaid. The current volume of loans issued on Tradable is $3.8 billion.

Maple

Maple is a protocol for issuing on-chain loans to institutional borrowers. Loans are secured by other assets, mainly crypto assets, with pre-defined conditions. To obtain loans, borrowers must register on Maple, undergo a due diligence procedure, and agree on loan terms off-chain with Maple representatives. Once approved, the loan is recorded on-chain, and the borrower receives funds while making interest payments until the loan matures. The current volume of loans issued on Maple is $2.4 billion.

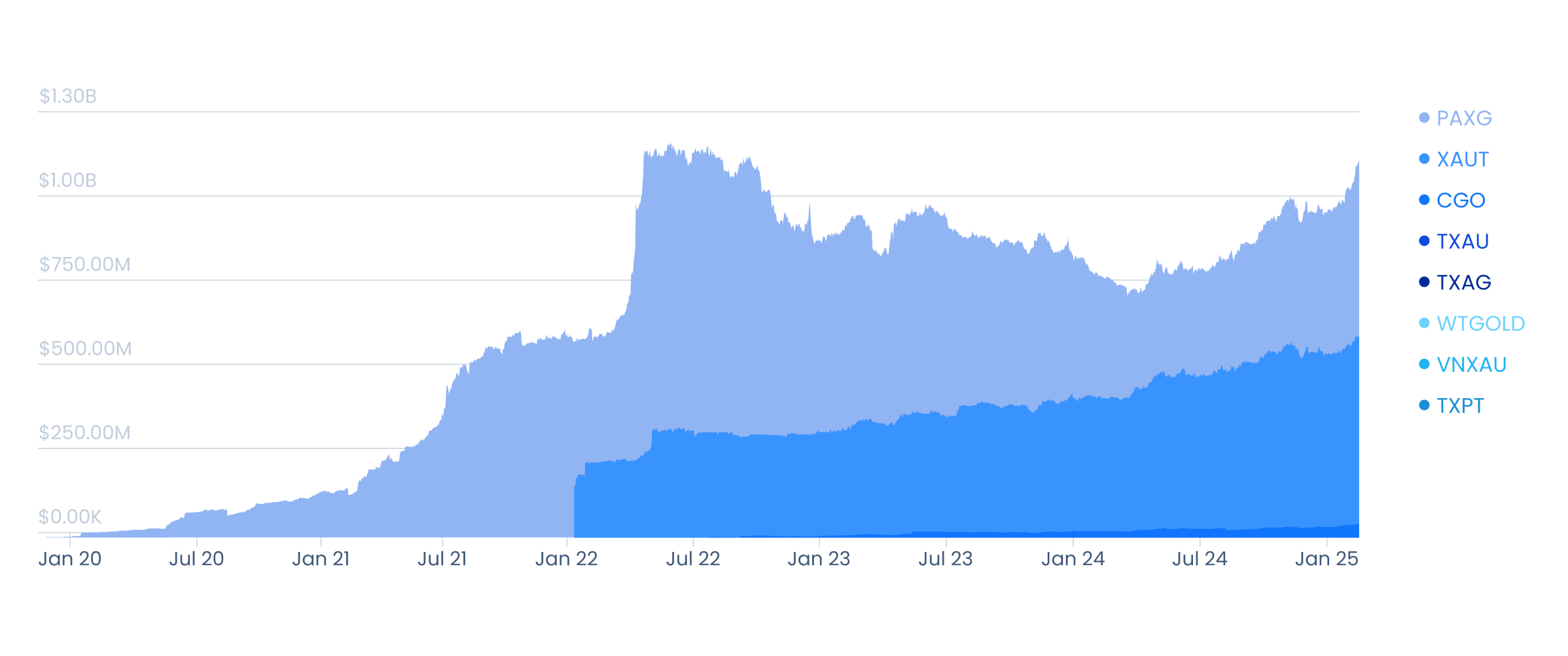

Commodities

Physical commodities, such as precious metals, oil, and agricultural products, can also be tokenized and used as liquid on-chain assets for investment and exchange. Currently, the most popular tokenized commodities are precious metals, particularly gold. The tokenized commodities market is valued at approximately $1.08 billion.

Tokenized commodities market volume. Source: rwa.xyz

Paxos

Paxos allows investment in gold through the Pax Gold (PAXG) token, which is fully backed by physical gold held by Paxos Trust Company. Each PAXG token represents one troy ounce of gold. The token can be purchased on leading centralized exchanges such as Binance, Kraken, and others. The current market capitalization of PAXG is $540 million.

Tether Gold

A competitor to PAXG, Tether Gold (XAUT) offers investors exposure to physical gold without having to purchase the metal. XAUT is backed by real gold reserves held in custodian vaults. Each token is equivalent to one troy ounce of gold. The current market cap of XAUT is $525 million.

Tokenized Funds

Tokenized funds enable investors to gain exposure to digital assets and blockchain technology without directly purchasing crypto assets or participating in DeFi protocols. Investors acquire fund assets denominated in ERC 20 standard tokens and gain exposure to investments made by professional fund managers. The tokenized funds market is valued at $1.08 billion.

An example of a tokenized fund is the Blockchain Capital III Digital Liquid Venture Fund from the venture fund Blockchain Capital. The fund invests in blockchain technologies and crypto projects; the participants can gain exposure to the fund's investments through the BCAP token with a minimum investment of 20,000 USD. The fund's current AUM is $148 million.

Tokenized Stocks

Tokenized stocks are tokens that provide ownership of shares in real companies without the need to purchase them directly on the stock exchange. Due to regulatory complexities, the tokenized stock market has not yet achieved widespread adoption in the crypto industry. However, it has significant growth potential. Some projects already offer access to this asset class to certain types of investors, mainly institutional or qualified individual investors.

Backed is an example of a protocol involved in stock tokenization. The platform converts company shares into ERC-20 standard tokens, each backed 1:1 by a specific stock as the underlying asset. These tokens can be exchanged for the cash equivalent of the stock's value. The advantages of tokenized stocks include their liquidity, transferability, and the opportunity to use them in DeFi protocols. Currently, the total volume of tokenized assets on Backed stands at $52 million.

Tokenized Real Estate

Real estate tokenization represents one of the most promising avenues for integrating RWA with blockchain technology. By 2030, the tokenized real estate market could reach $3 trillion. Tokenizing real estate involves assessing the value of a property and transferring that value on-chain in the form of tradable tokens or NFTs.

This addresses low asset liquidity, one of the key challenges in the real estate sector. The tokenization process significantly simplifies transactions in real estate, making properties more liquid and easily transferable. As a result, buying and investing in real estate becomes much more accessible. Another concept closely tied to real estate tokenization is fractionalization. It means dividing a tokenized property into multiple parts, each of which can be sold separately.

For developers, realtors, and landlords, tokenization offers a way to attract more investors in less time. Meanwhile, real estate investors can enter the market with much lower capital requirements, primarily due to fractional ownership.

Examples of Protocols in Tokenized Real Estate

RealT

RealT is one of the pioneers in the tokenized real estate market. It allows users worldwide to invest in US real estatewithout the need to purchase physical property. Investing is made possible through tokenization and fractionalization, with a minimum investment of just $50, making real estate accessible to almost anyone.

Parcl

Parcl is a decentralized exchange for trading synthetic derivatives tied to real estate. Parcl enables investors to speculate on real estate prices worldwide by opening margin positions on price increases or decreases based on investor expectations. Parcl indexes and updates real estate prices daily, providing accurate and up-to-date market data, including prices per square foot/meter of listed properties across different regions. To trade on Parcl, users only need to connect a decentralized wallet to the Parcl Dapp, with no KYC verification required.

Parcl offering. Source: Official Parcl Web-site

Conclusion

In 2024, decentralized finance continued to demonstrate significant growth and transformation, despite market fluctuations and regulatory challenges. Key trends of the year, such as institutional adoption, the expansion of RWA tokenization, and the evolution of derivative DEXs, highlight the sector’s long-term potential.

DeFi is no longer just a tool for retail investors; it is becoming an integral part of the global financial system. Institutional players are increasingly incorporating DeFi into their strategies, and the growing liquidity and user base confirm its sustained demand. Regulation, once seen as a threat, is now playing a role in integrating DeFi into traditional finance, creating a legal framework for major players.

Looking ahead to 2025-2030, we can expect further convergence between DeFi and TradFi, along with deeper RWA integration, enhanced security, and improved scalability. New financial instruments and hybrid solutions that combine the strengths of decentralized and centralized systems are also likely to emerge.

Ultimately, DeFi will continue to evolve, becoming a more mature, reliable, and widely adopted technology, the one that shapes the future of the global financial ecosystem.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.