Long-term Crypto Portfolio With Flexible Buying Strategies

Key Insights

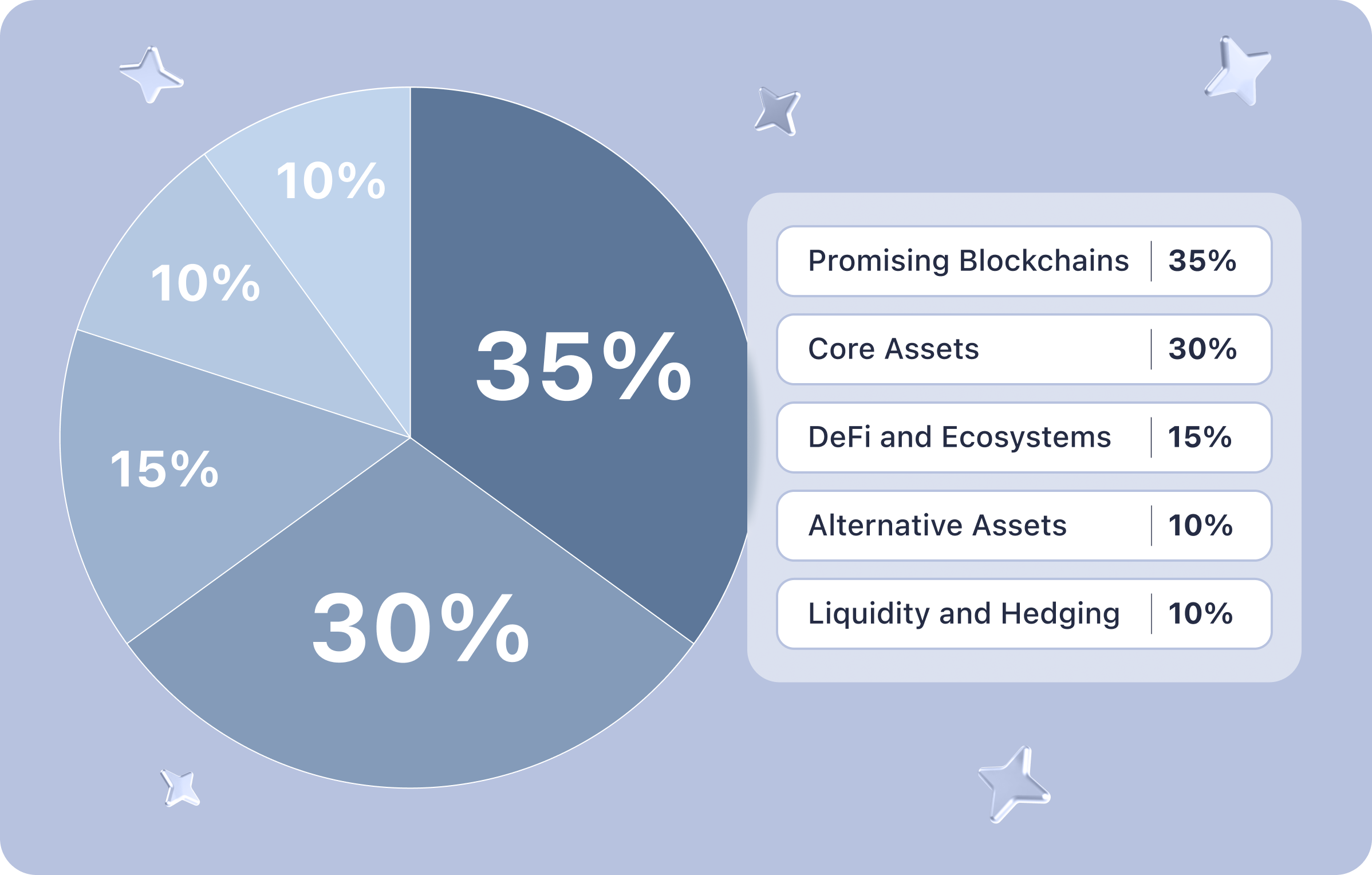

- Strategic diversification splits investments across established cryptocurrencies (40%), emerging blockchain platforms (35%), and innovative financial applications (25%), creating a balanced risk-reward profile.

- Dollar Cost Averaging and buy the dip strategy allow the investor to smooth out the purchase price over time, reducing the risk associated with timing the crypto market and enabling more predictable growth through methodical accumulation of assets.

- By maintaining a portion of the portfolio in stablecoins and liquid assets, the strategy ensures readiness for opportunistic purchasing during market dips, which maintains a buffer that enhances the portfolio's adaptability to sudden crypto market movements, supporting both immediate opportunistic purchases and overall long-term growth objectives.

This optimized portfolio is built with long-term capital accumulation and growth in mind. Two proven strategies are used to achieve this goal: Dollar-Cost Averaging (DCA) and buy the dip strategy. They allow for efficient risk management, minimization of the impact of volatility, and acceleration of the portfolio growth.

Crypto Portfolio Composition and Allocation

This optimized crypto portyfolio is spread from core assets like BTC and ETH to promising DeFi and Web3technologies and projects.

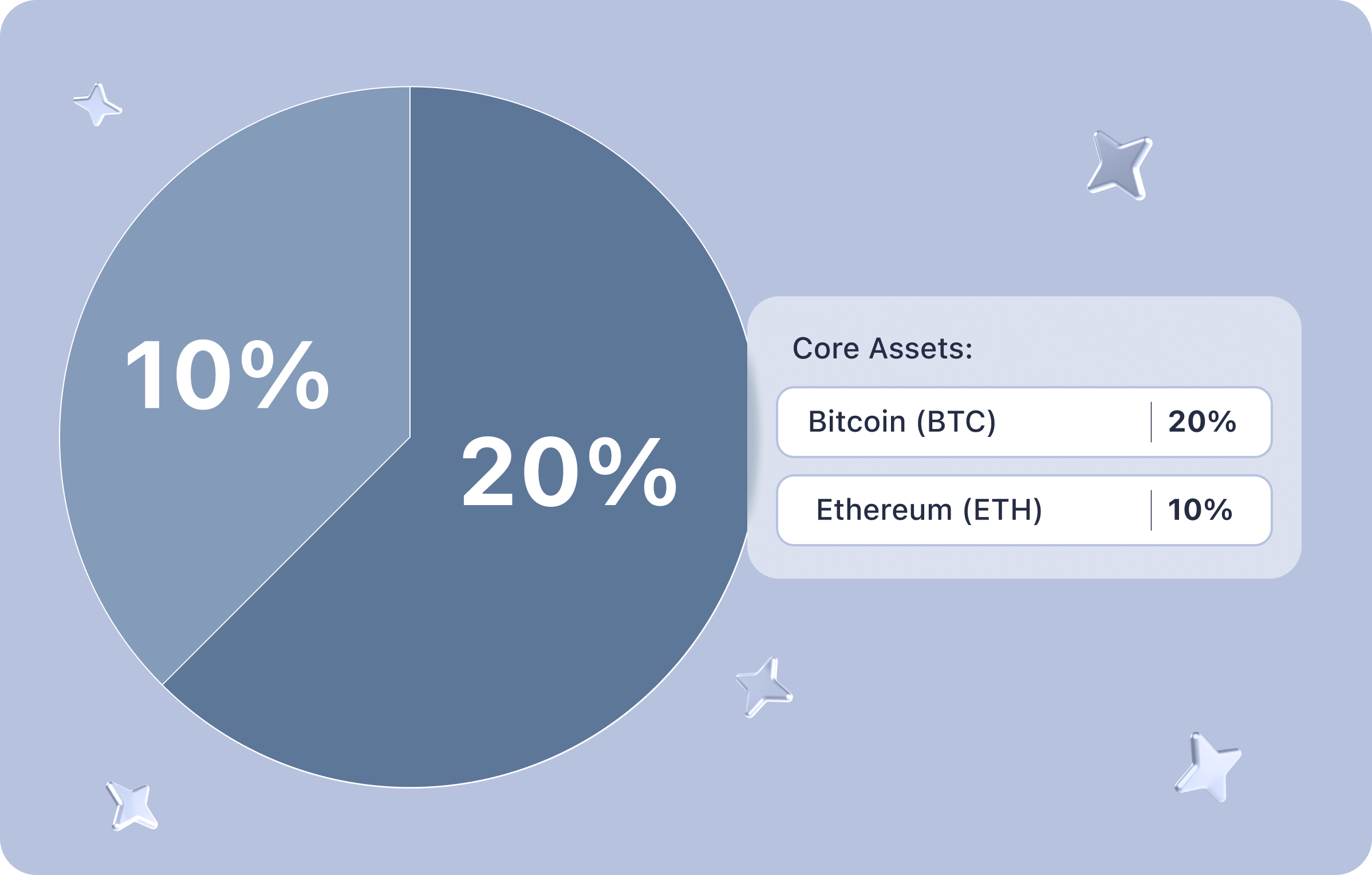

Core Assets (30%)

These are fundamental cryptocurrencies that have high capitalization, reliability and growth potential.

Bitcoin (BTC) - 20%

Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, is credited as the first decentralized cryptocurrency. Utilizing a peer-to-peer network to verify transactions via a process called mining, Bitcoin operates on a blockchain that is secure, transparent, and immutable. It serves as a digital alternative to traditional currencies and aims to eliminate the reliance on financial institutions.

Ethereum (ETH) - 10%

Ethereum, launched in 2015 by Vitalik Buterin, is an open-source blockchain platform that enables developers to build and deploy decentralized applications. Unlike Bitcoin, Ethereum features a programmable blockchain that can execute scripts using an international network of public nodes. The native token, ETH, is used to pay for transaction fees and computational services on the Ethereum network.

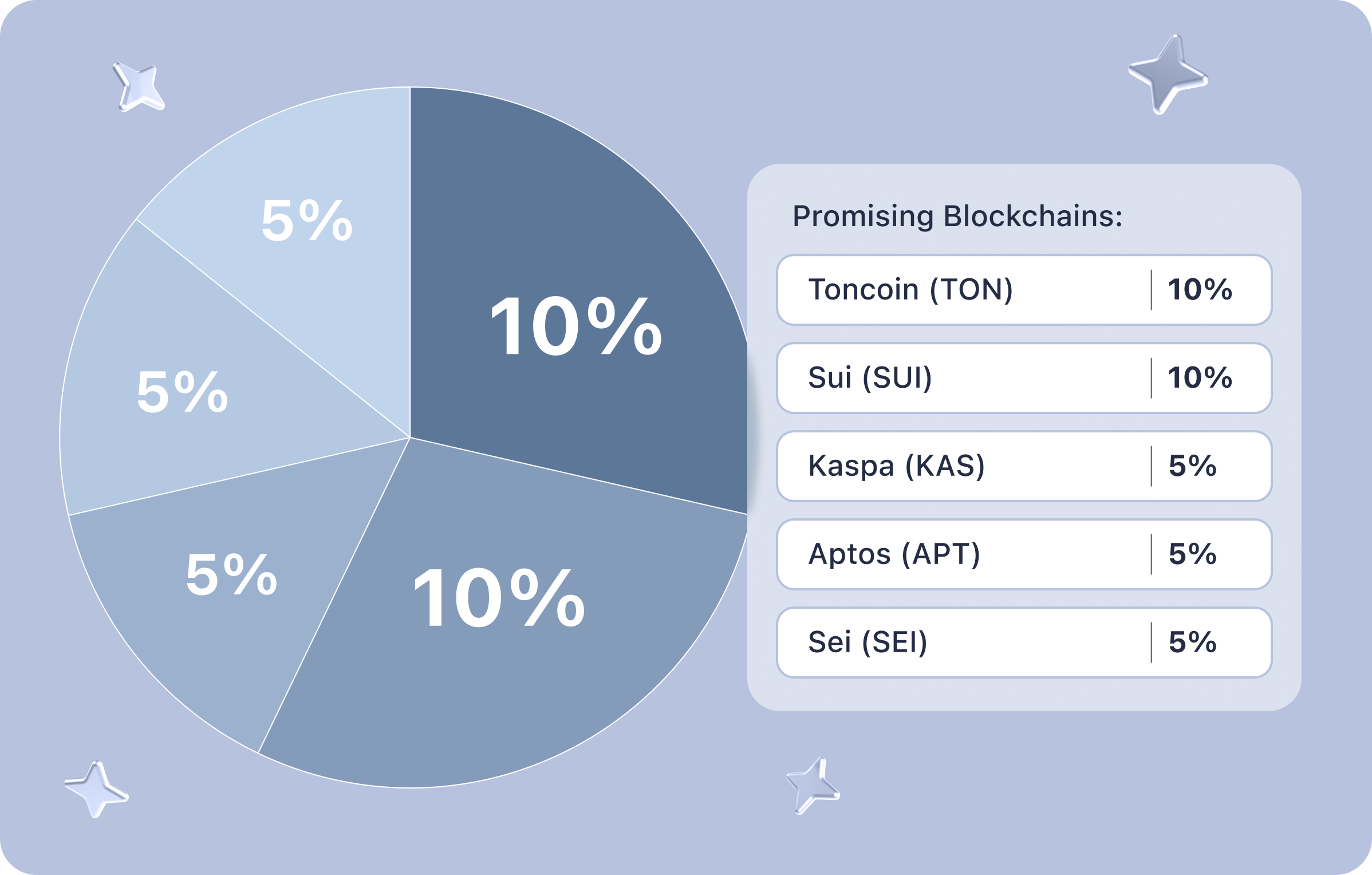

Prospective Blockchains (35%)

These assets represent next-generation ecosystems focused on performance and scalability.

Toncoin (TON) - 10%

Toncoin is the cryptocurrency associated with The Open Network (TON), originally designed by Telegram but now maintained by the open-source TON Community. TON aims to provide a highly scalable and user-friendly platformfor decentralized applications, and Toncoin serves as the utility token within this ecosystem, facilitating transactions and incentivizing validators and developers.

Sui (SUI) - 10%

Sui is a novel blockchain platform developed by Mysten Labs to support scalable decentralized applications with high throughput. Its unique consensus mechanism and object-centric approach allow for rapid state changes, making it suitable for gaming, social media, and finance applications. SUI, the platform's native token, is used for transaction fees, staking, and governing the network.

Kaspa (KAS) - 5%

Kaspa is a decentralized blockchain that implements a novel form of Directed Acyclic Graph (DAG) architecture to improve on scalability and speed. Its aim is to facilitate near-instantaneous transactions at high throughput. Kaspa uses a proof-of-work mechanism, and its native cryptocurrency, KAS, serves to reward miners and secure the network.

Aptos (APT) - 5%

Launched in 2022, Aptos is a blockchain platform focused on delivering high transaction throughput and reliable safety features, created by former developers from Meta's Diem project. Its architecture is designed to enable scalable and upgradeable dApps. APT, the native token, is used primarily for governance, transaction fees, and as a means of incentivizing participants.

Sei (SEI) - 5%

Sei is a Layer 1 blockchain known for its focus on DeFi applications, particularly in trading. It features a unique order-matching engine on-chain and prioritizes latency and throughput to cater to trading platforms. SEI, the native token, is used within the ecosystem for transactions, staking, and governance.

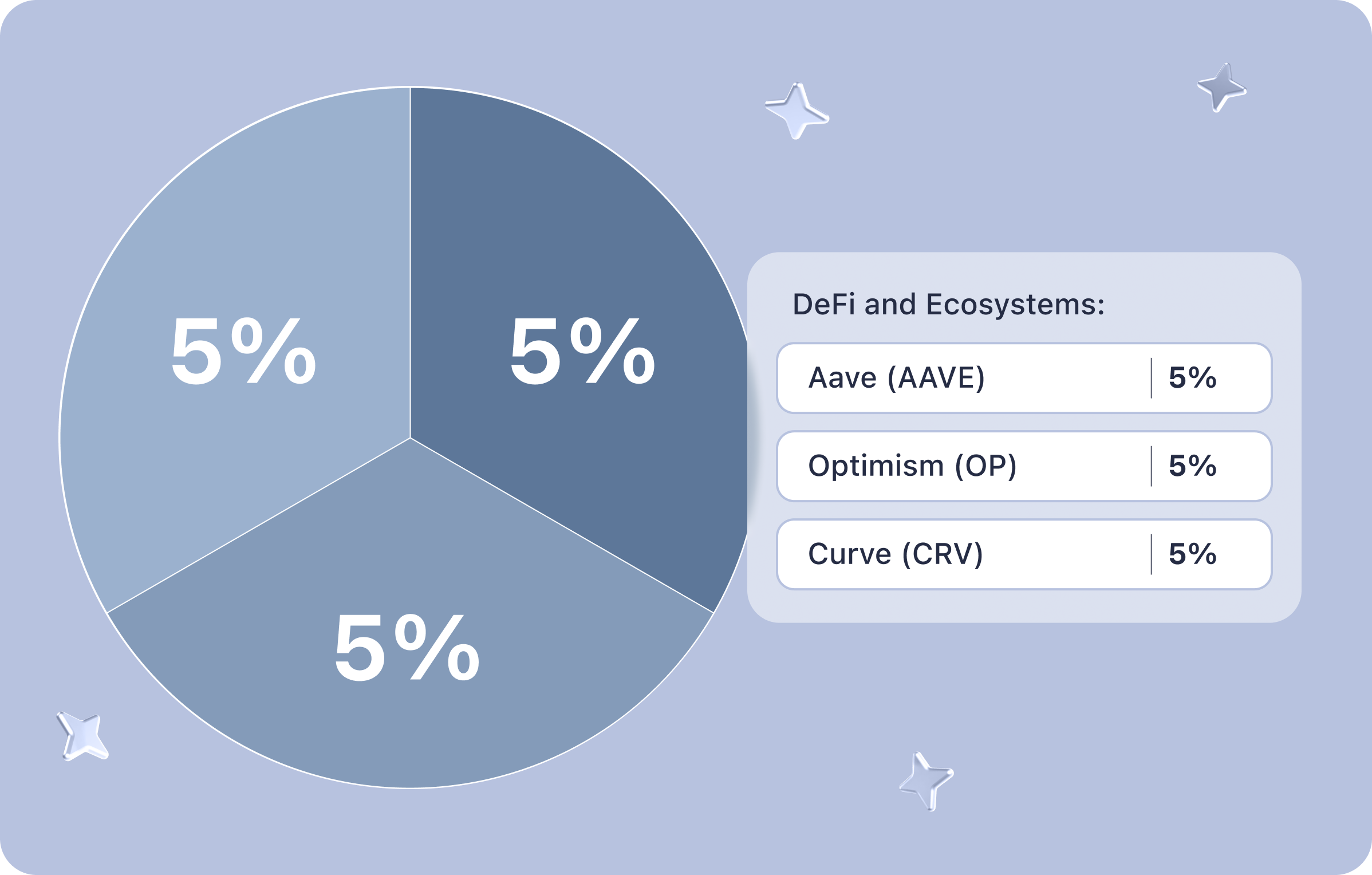

DeFi and Ecosystems (15%)

Tokens from DeFi and Web3 ecosystems focused on innovation and liquidity.

Aave (AAVE) - 5%

Aave is a decentralized finance protocol that allows people to lend and borrow crypto assets without going through a traditional financial intermediary. It features a variety of assets and offers innovative functions such as flash loans. The AAVE token is used within the platform for governance, as well as for fee reductions on the platform.

Optimism (OP) - 5%

Optimism is a Layer 2 scaling solution for Ethereum that aims to enhance Ethereum's scalability and reduce gas fees by handling transactions off the main Ethereum chain. The OP token facilitates governance and pays transaction fees within this ecosystem, and rewards users and developers who contribute to its network.

Curve (CRV) - 5%

Curve is a decentralized exchange (DEX) for stablecoins that uses an automated market maker (AMM) to manage liquidity. Launched in 2020, its main focus is to allow users to trade volatile assets with minimal slippage. CRV, its governance token, also incentivizes liquidity providers and offers voting rights on changes to the protocol.

Alternative Assets (10%)

Ideas from Web3 and new directions in the crypto industry.

Chainlink (LINK) - 5%

Chainlink is a decentralized oracle network that aims to connect smart contracts with data from the real world. Launched in 2017, it helps ensure that smart contracts on the blockchain have reliable access to external, accurate data sources. LINK, the ecosystem's cryptocurrency, is used to pay for services within the network.

Render Token (RNDR) - 5%

Render Token is a distributed GPU rendering network built on the Ethereum blockchain, which aims to connect artists and studios in need of GPU computing power with mining partners willing to rent their GPU capabilities. RNDR tokens are used as a digital currency within the platform to facilitate transactions between parties.

Liquidity and Hedging (10%)

USDC - 5%

USD Coin (USDC) is a stablecoin pegged 1:1 to the US dollar, combining the stability of fiat currencies with the benefits of digital currency. It operates across multiple blockchains and is used widely in the cryptocurrency ecosystem for trading, lending, and other financial services where volatility is a concern.

DAI - 5%

DAI is an Ethereum-based stablecoin that is pegged to the US dollar, but unlike other stablecoins, it's overcollateralized with cryptocurrency assets rather than fiat reserves. Managed by the MakerDAO protocol, DAI maintains its stable value through dynamic management of its collateralized reserves and decentralized governance.

Asset Purchase Strategies

Here we look into two prominent and logical strategies that can be both implemented separately and in combination in the crypto portfolio at hand.

Dollar Cost Averaging (DCA)

The essence of DCA: You regularly invest a fixed amount in selected assets, regardless of their current market price. This is ideal for cryptocurrencies, where high volatility can make it difficult to choose the best time to enter.

Why it's important:

Volatility smoothing

You buy assets on both rises and falls, which avoids crypto market timing errors.

Average price

You end up accumulating assets at an average price, which is lower than if you were trying to “guess” the best times.

Example portfolio application:

Invest $1,000 monthly, allocating it to core assets (BTC, ETH) and promising blockchains (TON, SUI).

If BTC is worth $90,000 one month and $85,000 the next, you'll buy at different prices, forming an average value of, say, $87,500. This reduces the risk of significant losses when fluctuations occur.

Long-term effect of DCA:

Continuous asset accumulation regardless of crypto market conditions.

Preparing for bull cycles: When crypto market recovers, assets purchased at the average price provide higher gains.

Buying the Dip

The essence of the strategy: Buying assets at times when the crypto market is experiencing localized downturns allows you to increase the share of your portfolio faster.

Why it's important:

Increasing the rate of capital appreciation

Assets bought on dips have a higher upside potential when the crypto market recovers.

Flexibility

By utilizing some of the liquidity in stablecoins, you can react quickly to corrections.

Example portfolio application:

Hold 10% of your portfolio in stablecoins (USDC, DAI) to buy assets during downturns.

Set triggers: buy BTC when it drops by 20-30% or ETH.

For example, if the price of BTC drops by 20%, you can increase your exposure to this asset while maintaining abalanced portfolio.

Long-term effect of buy the dip strategy:

Accelerating capital growth by buying more assets at a reduced price.

Increase the overall ROI of the portfolio during the growth period.

Combination of DCA and Buy the Dip Strategies

These strategies complement each other perfectly:

DCA provides underlying growth

Constant investing allows you to accumulate assets at an average price.

Buying the dip accelerates growth

Flexibility during periods of crypto market declines allows you to grow positions more profitably.

Example portfolio application:

Regularly invest $800 per month (DCA).

Set aside $200 in case of “dips” so you can build up positions in key assets, such as BTC or SUI, when the time comes.

Benefits of a combining DCA and buying the dip:

Reliability of DCA

Constant capital accumulation at an average price provides stability.

Flexibility on corrections

The ability to increase the proportion of assets at a reduced price accelerates overall portfolio growth.

Long-term success

These approaches minimize the impact of emotional decisions and withstand even long bear cycles.

The combination of DCA and buying on corrections makes the portfolio balanced and prepared for both market ups and downs.

Summary

This article outlines a well-structured cryptocurrency investment strategy that emphasizes a balanced mix of asset diversification, systematic investment techniques, and liquidity management.

Central to this strategy is the division of the crypto portfolio between high-capitalization cryptocurrencies, promising new blockchain platforms, and dynamic DeFi and Web3 projects.

This blend not only mitigates risk through diversification but also targets growth by tapping into both established and emerging segments within the crypto market.

Using Dollar Cost Averaging (DCA) and buy the dip strategies, the investment approach aims to minimize the adverse impacts of price volatility while enhancing capital accumulation.

This disciplined investment methodology coupled with a tactical liquidity reserve designed to exploit market opportunities ensures the portfolio remains robust and responsive to crypto market conditions, fostering sustained growth and stability over time.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.