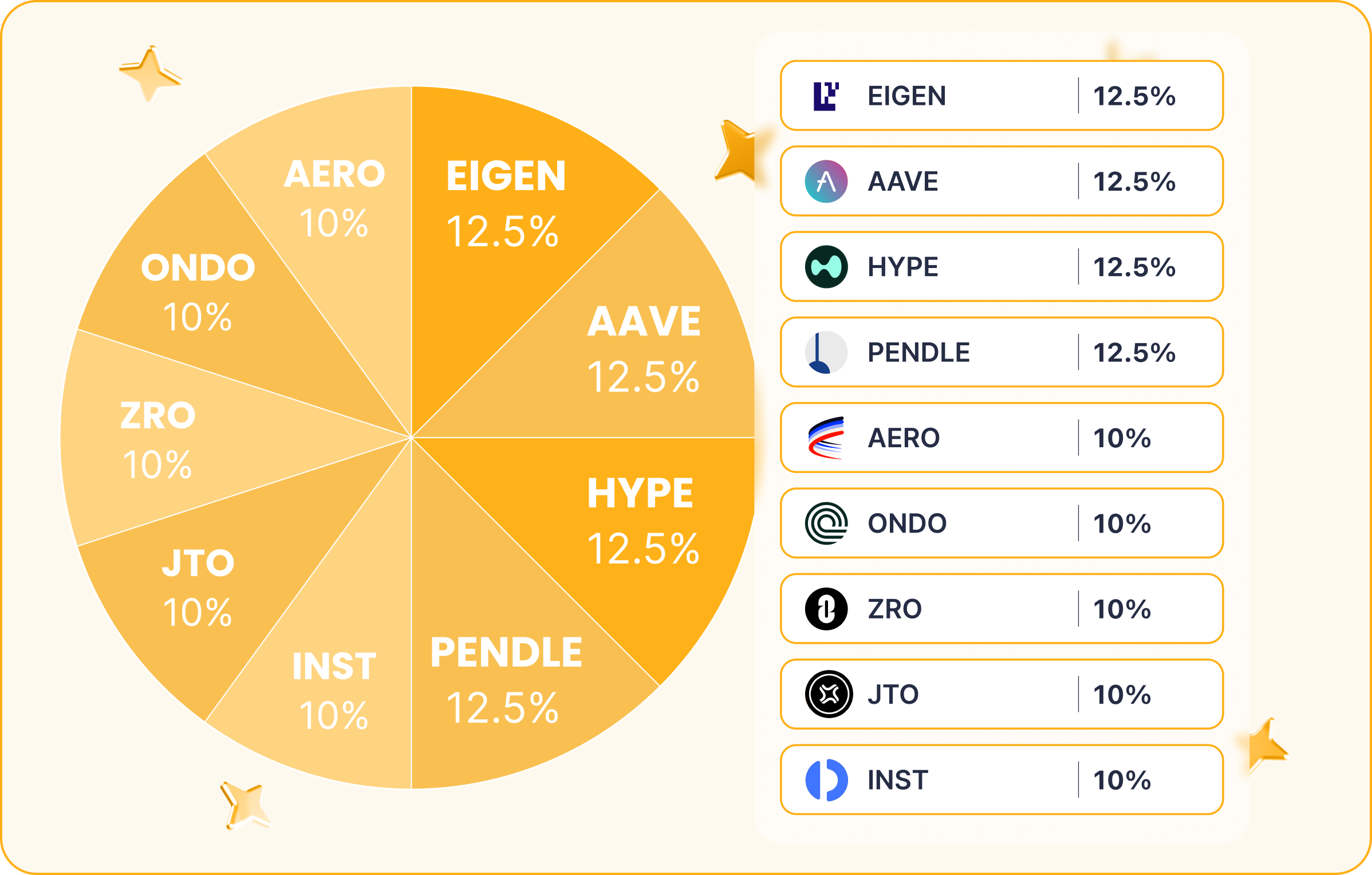

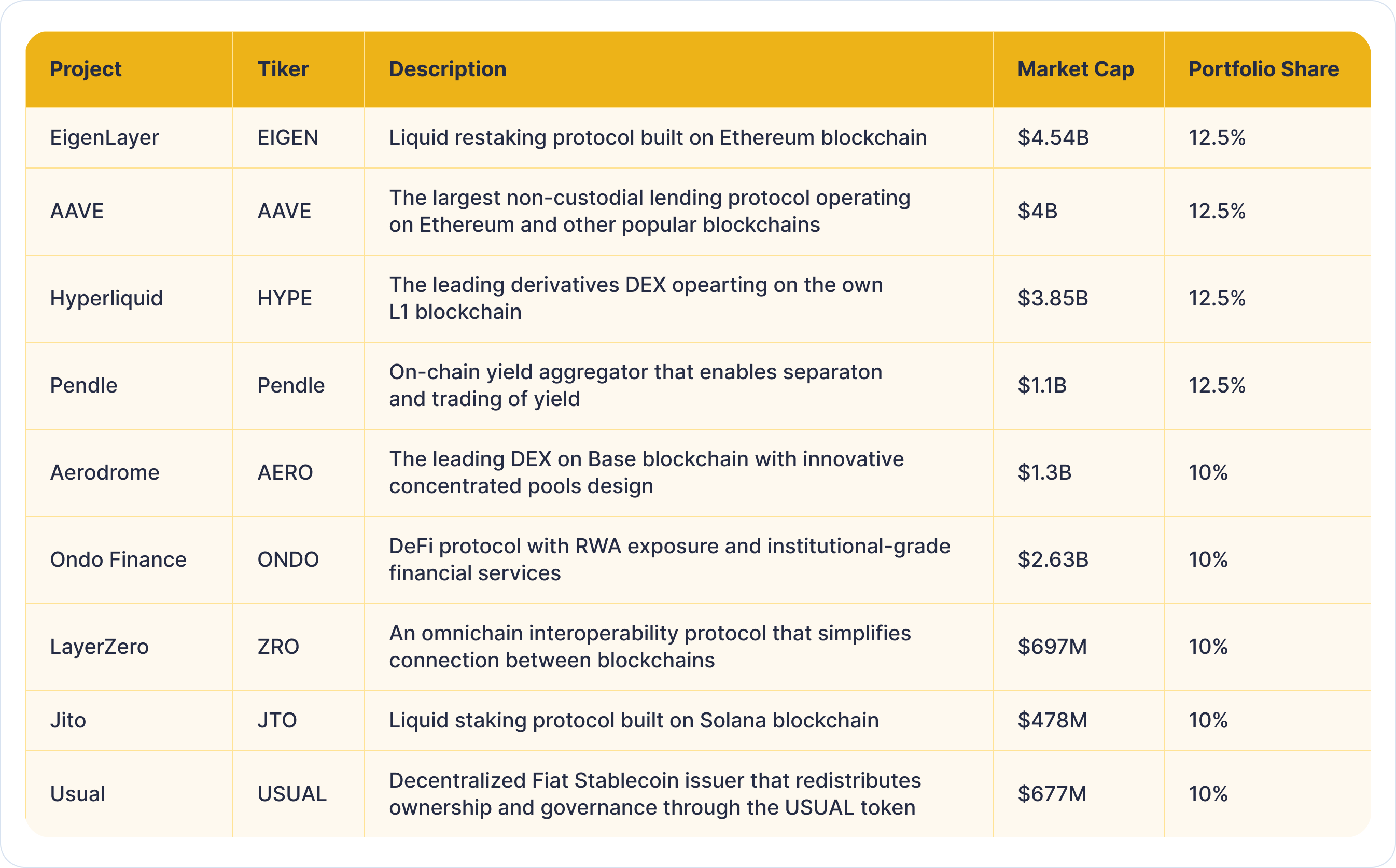

Promising DeFi Projects Portfolio

Key Insights

- Diversification within the DeFi sector is noted through various innovative protocols, ranging from liquidity staking and lending to derivative exchanges and real world assets incorporation, each contributing to the complex ecosystem of DeFi solutions for diverse investor needs.

- Specific DeFi projects, for example EigenLayer, AAVE, and Hyperliquid, are highlighted for their pioneering roles in their respective areas—liquid restaking, lending, and derivatives trading.

- Each listed project, including newer entrants and established platforms, demonstrates potential for substantial growth, hinging on their unique offerings and integration within the broader DeFi and blockchain ecosystems.

DeFi remains one of the key sectors of the cryptocurrency industry and by the end of 2024 shows strong growth, expressed both in asset inflows and in the growth of tokens of DeFi projects.

The total TVL of DeFi protocols at the time of writing is $268B, showing an increase of 142% since the beginning of the year. Given the crypto community's and analysts' positive expectations for 2025 and the continuation of the bull market next year, DeFi will be one of the key sectors for investors to pay attention to.

We have compiled a crypto portfolio of DeFi projects that seem promising for 2025 and from which we expect continued growth next year.

This crypto portfolio acts as a useful index for investors looking to gain exposure to the DeFi sector and underscores the ongoing evolution and sophistication of DeFi as critical components of the future financial landscape.

EigenLayer (EIGEN) - 12.5%

The leader of the liquid restaking segment and one of the most high-profile crypto projects of 2024. Developing a solution to improve capital efficiency of ETH holders and stakers and address crypto-economic security protocols.

Current TVL of $19.5B makes EigenLayer the third DeFi protocol by this metric. EIGEN's current capitalization is$4.56B and FDV is $6.82B. With the development of the liquid restaking segment, EIGEN could do well in 2025 and become one of the leaders of the DeFi sector.

AAVE (AAVE) - 12.5%

One of the major BlueChips of the DeFi sector, the largest lending protocol with a TVL of $36.4B. AAVE allows for borrowing in crypto assets against other assets to improve capital efficiency.

In addition to lending, investor can become a capital provider and earn interest for assets deposited into loan pools such as stablecoins, ETH or BTC. AAVE is available on most popular EVM blockchains, and the current yields in the pools are quite high, with APRs of up to 12% on stablecoins.

With the growing interest in crypto assets and investing in crypto projects, lending protocols will be ones of the beneficiaries of the market. AAVE as the leading lending protocol could be the growth driver for this segment in 2025. The current token capitalization of AAVE is $4.01B and FDV is $4.27B.

Hyperliquid (HYPE) - 12.5%

The absolute leader in the derivatives DEX segment, which became the discovery of 2024.

Hyperliquid was launched in the Fall of 2023 and in a year already takes 40% of the trading volume on derivative DEX. The project's success is due to its unique technology, a proprietary blockchain designed specifically for the needs of a derivatives exchange with a theoretical speed of up to 200K transactions per second.

Hyperliquid has an intuitive and user-friendly trading interface and provides traders with a level of service comparable to the leading CEXs. The project's TVL is already at $1.57B, with daily futures trading volume of $1.5B - $1.8B.

According to these indicators Hyperliquid not only outperforms other DEXs, but can also compete with the leading L1 and L2 networks. Therefore, the current valuation of the project at $11.5B does not seem overstated and HYPE has a great potential for growth next year.

Pendle (PENDLE) - 12.5%

One of the most interesting DeFi protocols that introduces the concept of yield tokenization.

With Pendle, investors can trade yields as well as speculate on the yields of various instruments such as yield-bearing stablecoins, LST and LRT tokens.

Pendle also offers fixed returns on these assets, which helps in executing long-term strategies and reduces the risks of uncertainty and difficult predictability of returns when investing in DeFi strategies.

Integration with many leading DeFi protocols makes Pendle one of the most interesting tools for creating various DeFi strategies.

Aerodrome (AERO) - 10%

A leading project in the Base blockchain ecosystem with a TVL of $1.61B (30% of Base's total TVL) and $32M in commissions over the last month.

Aerodrome utilizes an innovative model of concentrated liquidity pools, providing better capital efficiency and low trading slippage.

The AERO token also plays a key role in Aerodrome's operation, as it is the primary form of rewarding through different mechanisms for market participants, that is liquidity providers and AERO holders.

Overall, Aerodrome looks to be one of the fundamentally strong DeFi protocols that could perform well in the 2025 market.

Ondo Finance (ONDO) - 10%

One of the leading DeFi protocols in the Real-World Assets (RWA) segment with a TVL of $641M.

Ondo Finance has positioned itself as the next generation financial infrastructure to improve capital efficiency, investment transparency and RWA accessibility. Ondo offers investors exposure to real world assets, such as tokenized US Treasuries, one of the most trusted investment instruments in the world. ONDO coin is the protocol’s native token.

With growing interest in integrating RWA into blockchain and the development of investment strategies based on the use of RWA and DeFi, protocols operating in this sector will show steady growth.

LayerZero (ZRO) - 10%

An interoperability protocol that allows the transfer of assets between different networks and uses innovative technologies to connect different blockchains.

The method used by LayerZero uses on-chain nodes (light nodes) in a much more cost-effective way: decentralized oracles are used to stream block headers on demand, so there is no need to store all block headers sequentially. So, cross-chain exchanges of crypto-assets become cheaper and more accessible to users.

Jito (JTO) - 10%

A liquid staking solution on the Solana blockchain that improves capital efficiency for SOL stakers and delegators. Jito's liquid staking token, JitoSOL, gives it the ability to be used in other protocols to generate yield.

With a TVL of $3.3B, Jito is leading Solana's DeFi ecosystem. In addition, the project is among the top 10 crypto projects in terms of commissions received since the beginning of the year. Strong fundamental metrics and the rapid development of the Solana ecosystem allows to forecast growth of JTO in the medium to long term.

Usual (USUAL) - 10%

Decentralized protocol issuing a new stablecoin, USD0. USD0 is pegged to the US dollar and backed 1:1 by real assets such as US Treasuries with short maturities.

USD0 provides its holders with a minimum yield equal to that of US Treasuries and can be used as a payment solution, medium of exchange and collateral in various DeFi protocols.

The USUAL token is a Usual management token and allows holders to receive a portion of the real returns generated by the protocol. The issuance of the token is directly dependent on the future profits generated by Usual.

Usual's model and the use of RWA as the collateral for a revenue-generating stablecoin provides DeFi users with new opportunities, and with the influx of funds into the protocol, the USUAL token can be predicted to grow in the coming year.

Summary

The article evaluates a curated crypto portfolio of DeFi projects, forecasting significant growth within the sector in 2025.

It emphasizes diversification across different functionalities such as liquidity staking, restaking, lending, derivatives trading, and real world assets incorporation, which serve varying investor needs.

Notable projects like EigenLayer, AAVE, and Hyperliquid are distinguished for their pioneering contributions and potential for substantial growth, given their innovative solutions and integration into the broader DeFi and blockchain ecosystems.

Collectively, these projects underscore a bullish perspective for the DeFi sector against the backdrop of its current performance and projected expansion, positioning it as a critical area for strategic investment in the near future.InstaDapp (INST) - 10%

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.