BTC Analysis August 2023

Key Insights

- The Grayscale Investments' legal victory over the SEC led to an increase in the number of active addresses to the 1,049,062 level. There is growing interest in Bitcoin and optimism about its long-term prospects.

- The number of transactions decreased due to the falling value of BTC and the limited effect of positive news — the reaction of crypto market participants is cautious.

- The BTC market reacts to external factors and news, but the reaction can be slow. Long-term investors remain in the market, while new entrants prefer to sell coins after short-term holdings.

Grayscale vs. SEC

In late August 2023, a significant court ruling was issued, in favor of Grayscale Investments in their legal battle against the U.S. Securities and Exchange Commission (SEC). This victory for Grayscale follows Ripple's recent triumph, marking the second consecutive win for the cryptocurrency sector in court.

The case began in October 2021 when the SEC rejected Grayscale's application to list an exchange-traded fund (ETF) that would track BTC price movements. Grayscale aimed to convert its existing Bitcoin trust into an ETF, a proposal that the SEC denied.

The SEC had similar rejections for other companies, based on concerns about investor protection and potential market manipulation, despite approving Bitcoin futures ETFs.

Grayscale argued that the safety measures applied to Bitcoin futures ETFs, particularly the market oversight by the Chicago Mercantile Exchange (CME), should also be sufficient for their spot ETF.

They contended that both ETFs rely on the underlying price of Bitcoin and that CME's regulatory oversight would provide adequate investor protection.

This argument ultimately convinced the court, leading to a favorable ruling for Grayscale.

The ruling underscores the judiciary's growing recognition of the legitimacy and importance of the crypto industry.

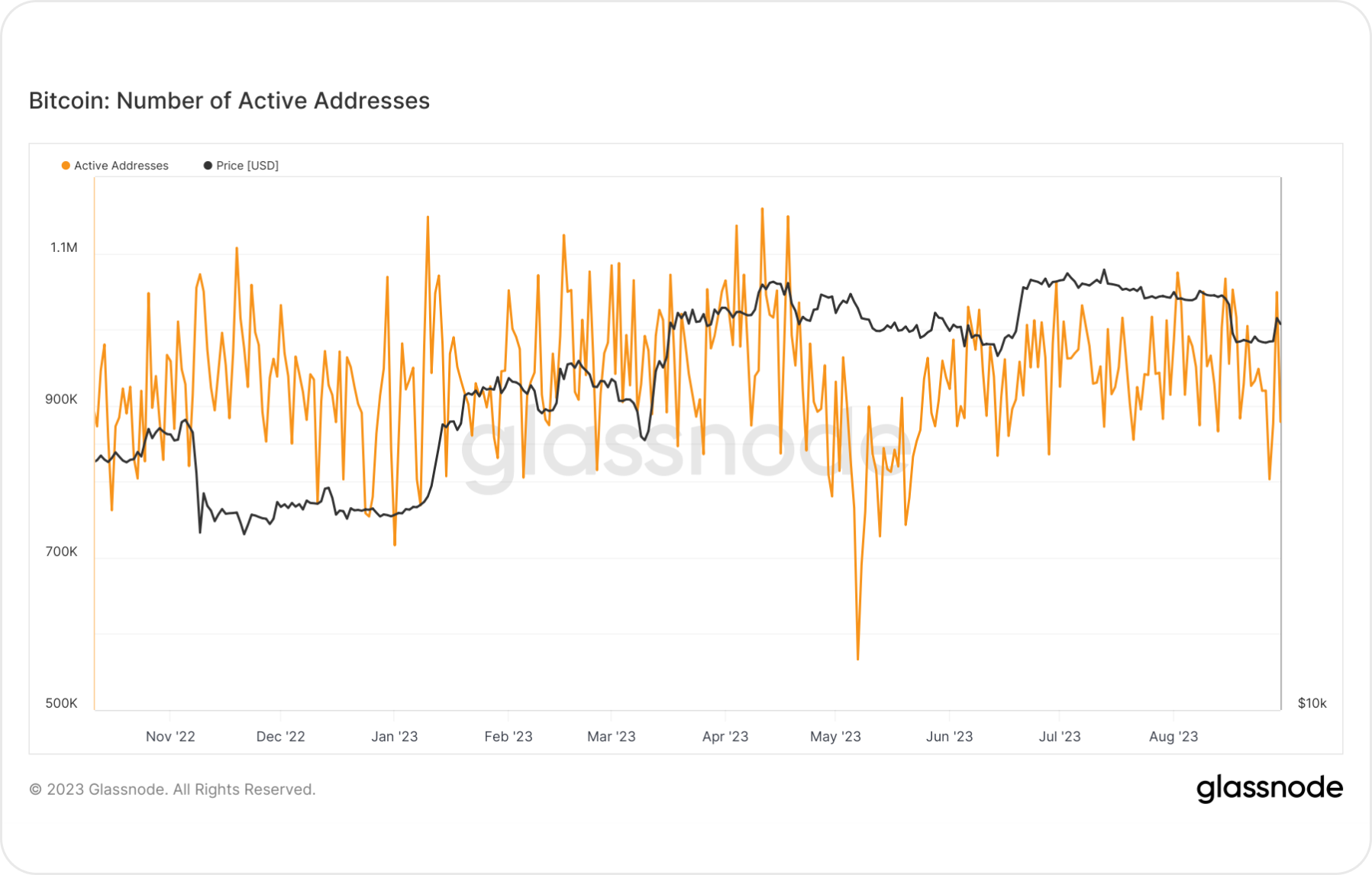

Number of Active BTC Addresses

The number of active BTC addresses decreased to 803,152 in line with the decline in BTC's value. However, latest updates about Grayscale Investments shifted this trend.

Grayscale Investments secured a legal victory against the SEC regarding their proposed Bitcoin ETF based on CBTC. This legal success led to a rise in the number of active addresses, which returned to 1,049,062.

The increase in active addresses following this news could be interpreted as an indicator of heightened interest in Bitcoin. It may also signal optimism regarding long-term prospects of Bitcoin.

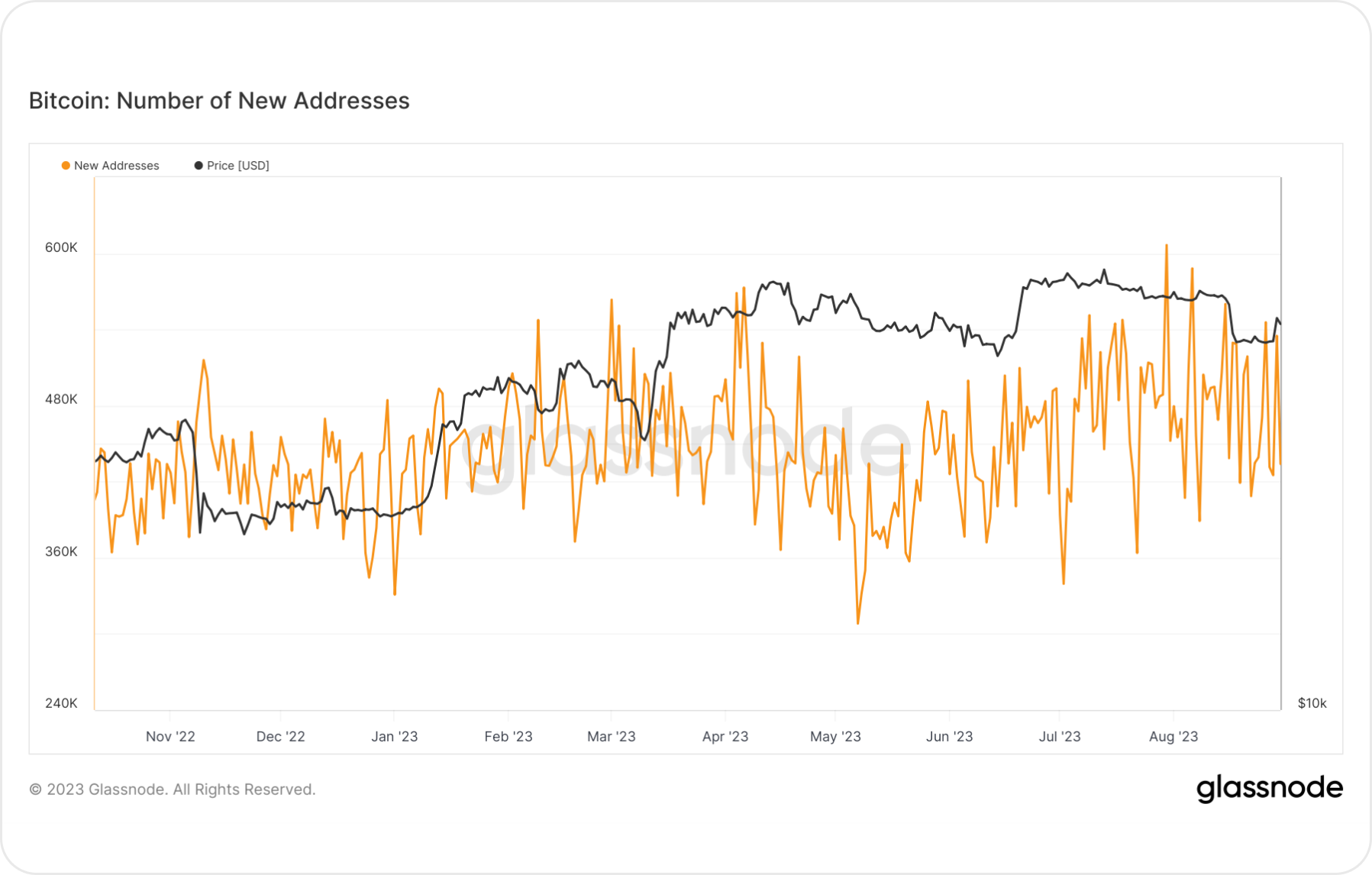

Number of New BTC Addresses

Under similar circumstances of BTC price decrease and positive news from Grayscale Investments, the number of new addresses in the Bitcoin network initially dropped from 605,000 to 408,000.

Despite the positive events affecting other aspects of the Bitcoin network, the number of new addresses couldn't fully recover to its previous levels. The maximum growth in new addresses reached only 534,000, which represents a relatively modest increase.

While positive updates could have influenced the growth of new addresses in the Bitcoin network, other factors could also impact this number. Achieving a return to previous values might require time and additional stimulating factors.

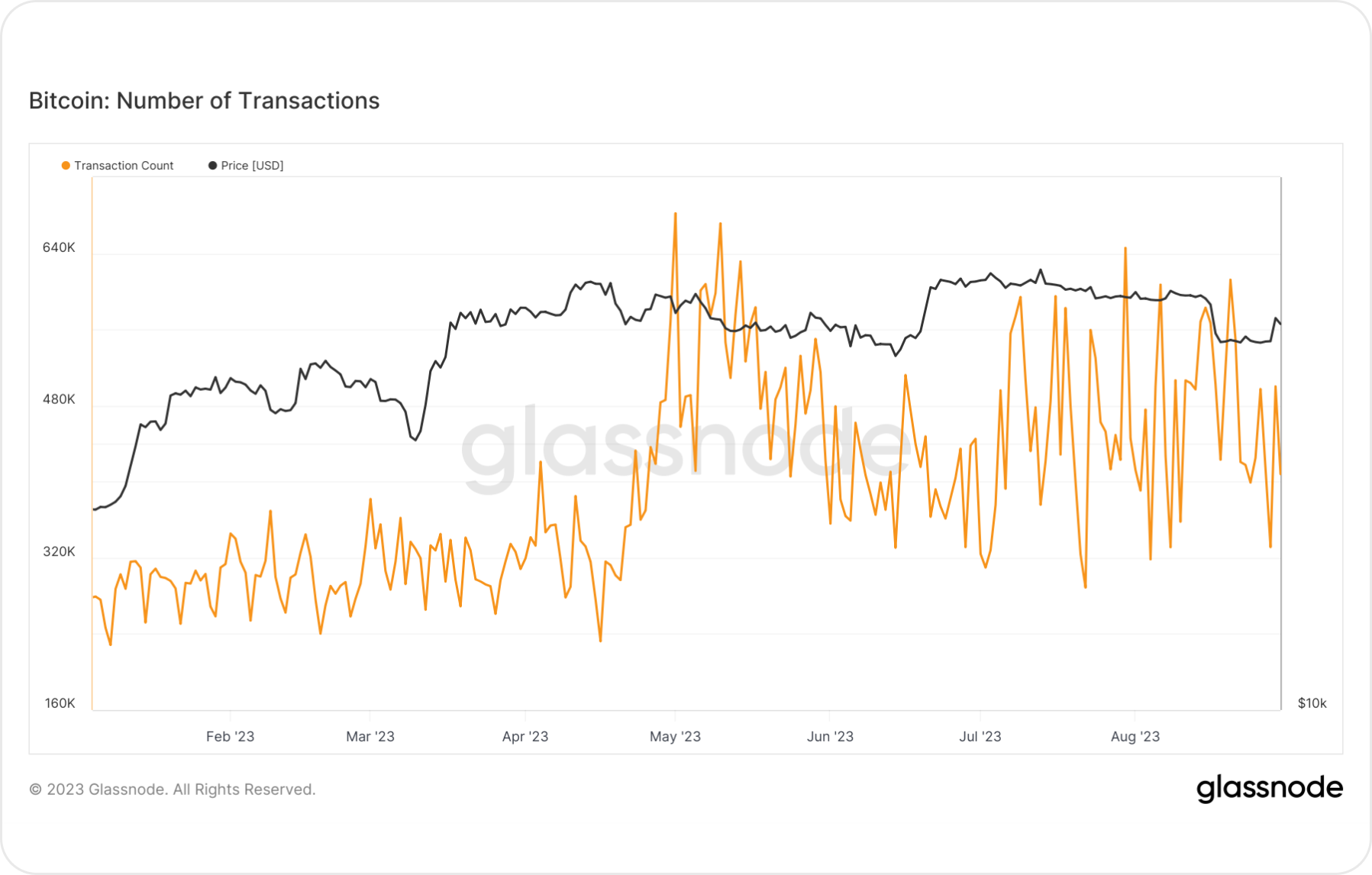

Number of Bitcoin Transactions

The number of Bitcoin transactions decreased from 650,000 to 330,000 due to the decline in BTC's value. Positive news had a limited effect, only increasing the transaction count to 500,000.

These observations underscore the importance of understanding that crypto market participants' reaction to events can be relatively slow and cautious.

Activity may recover gradually even after positive news or events.

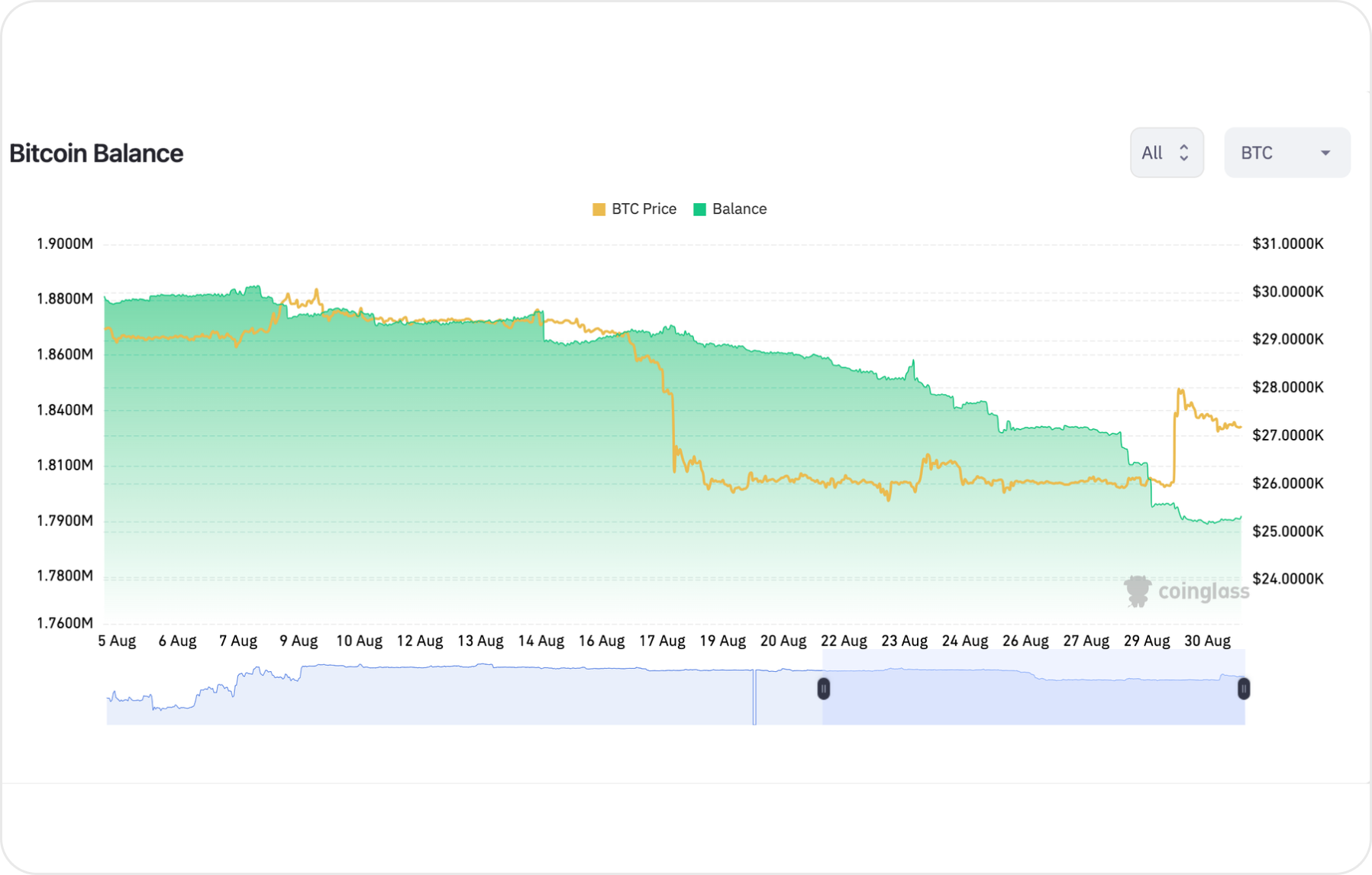

BTC Balances on Exchanges

In anticipation of Grayscale Investments' results, Bitcoin balances on exchanges rapidly declined. This downward trend in balances continued after the emergence of positive news.

The reduction of Bitcoin balances on exchanges prior to and following news about Grayscale could suggest that some investors opted to withdraw their Bitcoin from exchanges for long-term storage in personal crypto wallets.

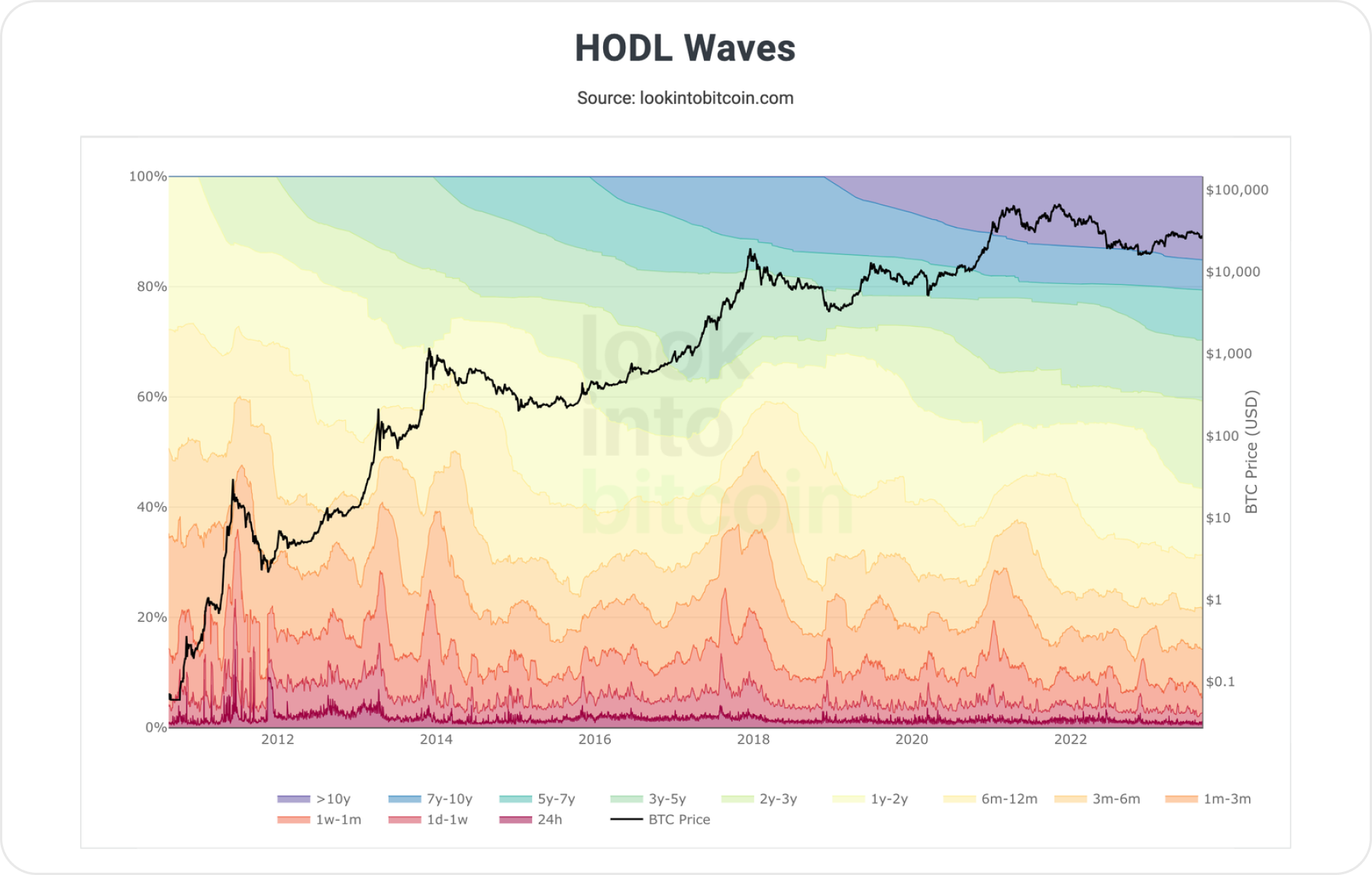

Bitcoin Analysis: HODL Waves

An interesting phenomenon is evident in the current HODL waves chart. The number of Bitcoins held by owners for extended periods, ranging from 1 year to 10 years, is gradually increasing.

This could indicate that long-term investors are confident in their positions and are staying in the crypto market.

Simultaneously, the number of Bitcoins held for shorter periods, from 24 hours to 6 months, is decreasing. This might suggest that new crypto market participants prefer to sell their coins after short-term holdings, possibly reacting to price dynamics.

Users can get BTC for fiat or crypto on SimpleSwap.

Summary

Analyzing various aspects of Bitcoin, including active addresses, new addresses, transaction counts, exchange balances, and HODL Waves, provides valuable data about the current state of the crypto market.

The impact of positive news from Grayscale Investments on active and new address counts demonstrates that the Bitcoin market is sensitive to external factors and news. This could indicate increased interest in the crypto and optimism about its long-term prospects.

The decrease in transaction counts after BTC price drops and their partial recovery following positive news highlights that market participants' reaction can be slow and cautious. This is vital for understanding the dynamics of activity in the Bitcoin network.

The reduction in exchange balances ahead of and after positive news from Grayscale Investments suggests that some investors prefer to hold Bitcoin in personal wallets, indicating a long-term perspective.

The observation in the HODL Waves chart indicates that long-term investors are confident in their positions and hold onto Bitcoin for extended periods. Meanwhile, new market participants might lean towards short-term holding and reacting to price changes.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.