Sei Network Overview

Key Insights

- Unlike general-purpose blockchains, Sei Network is specifically designed to enhance digital asset trading through fast transaction finalization, order-matching mechanisms, and single-block trade execution.

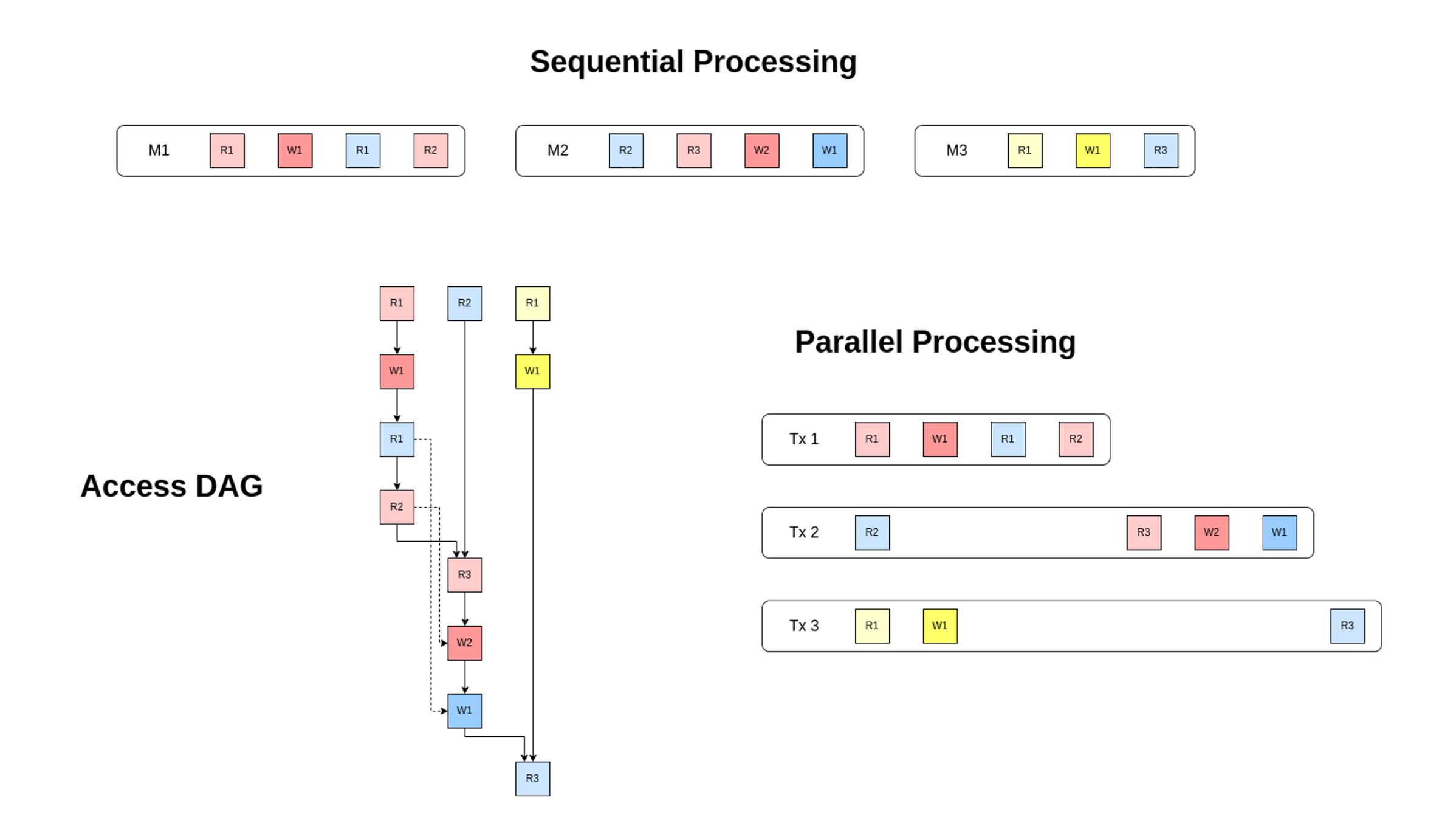

- The network employs Twin-Turbo Consensus (which reduces latency through Intelligent Block Propagation and Optimistic Block Processing) and Parallel Processing (which increases throughput using a Directed Acyclic Graph (DAG) execution model).

- With over 270 active applications, strategic investments, and rapid growth in Total Value Locked (TVL) from $10M to $220M in 2024, Sei Network is positioning itself as a dominant blockchain for DeFi, institutional trading, and high-frequency transactions.

Sei Network is a specialized Layer 1 blockchain designed to meet the demands of the rapidly growing decentralized finance (DeFi) and trading markets. Unlike general-purpose blockchains like Ethereum or Solana, Sei Network focuses on optimizing processes related to digital asset trading by offering unique solutions that enhance speed, scalability, and security.

Through innovative technologies such as Twin-Turbo consensus and parallel transaction processing, the Sei Ecosystem aims to become the foundation for the next generation of decentralized exchanges, marketplaces, and high-performance applications.

Founders of Sei Network

Sei Network was founded in 2022 by Jeff Feng and Jayendra Jog under the development company Sei Labs.

Jeff Feng

With a bachelor's degree in business administration from the University of California, Berkeley, Jeff Feng began exploring cryptocurrencies in 2014 but also pursued interests in education and healthcare startups. Jeff gained experience as an investment banker at Goldman Sachs, where he developed expertise in technology and corporate structures. In 2020, he joined the venture firm CO2, investing in fintech, software, and crypto projects, contributing to the growth of companies like Fireblocks and Alchemy.

Jayendra Jog

He has a strong background in technology and entrepreneurship. Before founding Sei Network, he worked on various tech startups and blockchain projects, specializing in software development and decentralized systems. His deep understanding of blockchain infrastructure and commitment to innovation played a crucial role in shaping the vision and strategy of Sei Ecosystem.

Their combined expertise in technology, finance, and entrepreneurship laid the foundation for Sei Network.

Sei Network Architecture: Optimized for Trading

Sei Network is a blockchain specifically built for trading applications. Trading is one of the most scalable and widely adopted use cases for cryptocurrencies, even beyond finance, with sectors like gaming and NFTs heavily relying on trading functionalities.

The primary goal of Sei Ecosystem is to provide a high-speed, scalable, and reliable infrastructure for exchanges, DeFiapplications, and other trading platforms. Sei Network overcomes the limitations of traditional blockchains, such as:

Limited scalability and low transaction speed.

Challenges in handling high transaction volumes, restricting mass adoption.

Sei Network Solution

Twin-Turbo Consensus

Accelerates block processing and minimizes latency.

Parallelization

Increases transaction throughput for improved efficiency.

Customization

Enables tailored user experiences to meet the needs of specific applications.

Twin-Turbo Consensus: The Core of Sei Network Performance

To enhance performance, Sei Network employs a unique consensus mechanism called Twin-Turbo Consensus. This system introduces two key innovations: Intelligent Block Propagation and Optimistic Block Processing.

Intelligent Block Propagation

One of the most critical aspects of consensus is the efficient propagation of transactions across network nodes. Sei Network optimizes transaction distribution to minimize latency and maximize efficiency through the following process:

A full node receives a transaction from a user and broadcasts it randomly to other nodes in the Sei Network. Validators verify the transaction’s validity and add it to their local memory pool.

The proposing validator creates a block proposal using the current state of its memory pool, referencing unique transaction identifiers rather than transmitting the full transaction data.

The block proposal is first sent as a single message to validators, followed by the full block, which is broken into segments and distributed across the Sei Network.

If a validator already possesses all the transactions in the proposal, it reconstructs the full block from its local memory pool. If any transactions are missing, the validator waits for the missing data to arrive through the Sei Network.

This method significantly reduces the waiting time for validators, ensuring faster block processing and a more efficient consensus mechanism within the Sei Ecosystem.

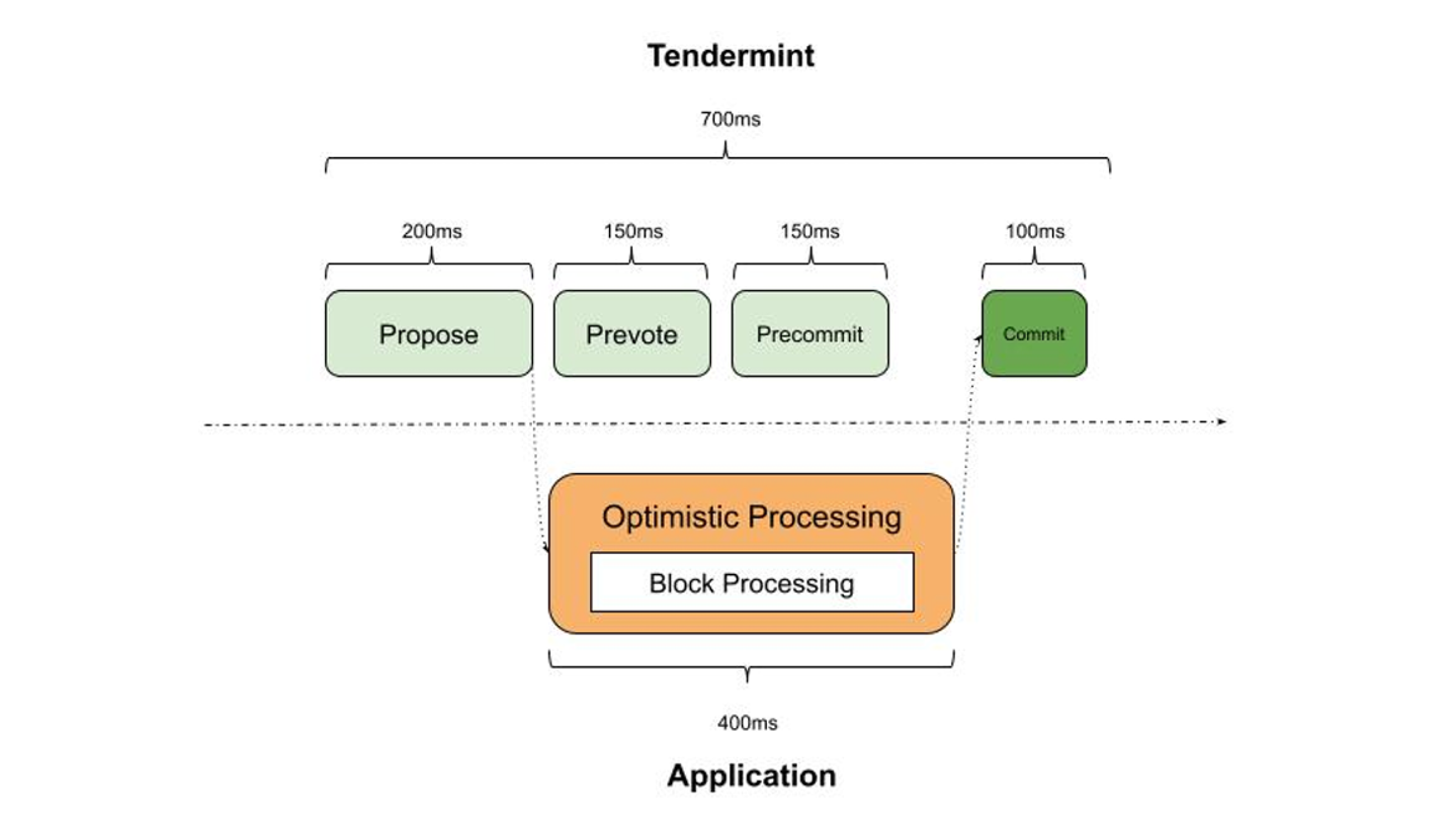

Optimistic Block Processing

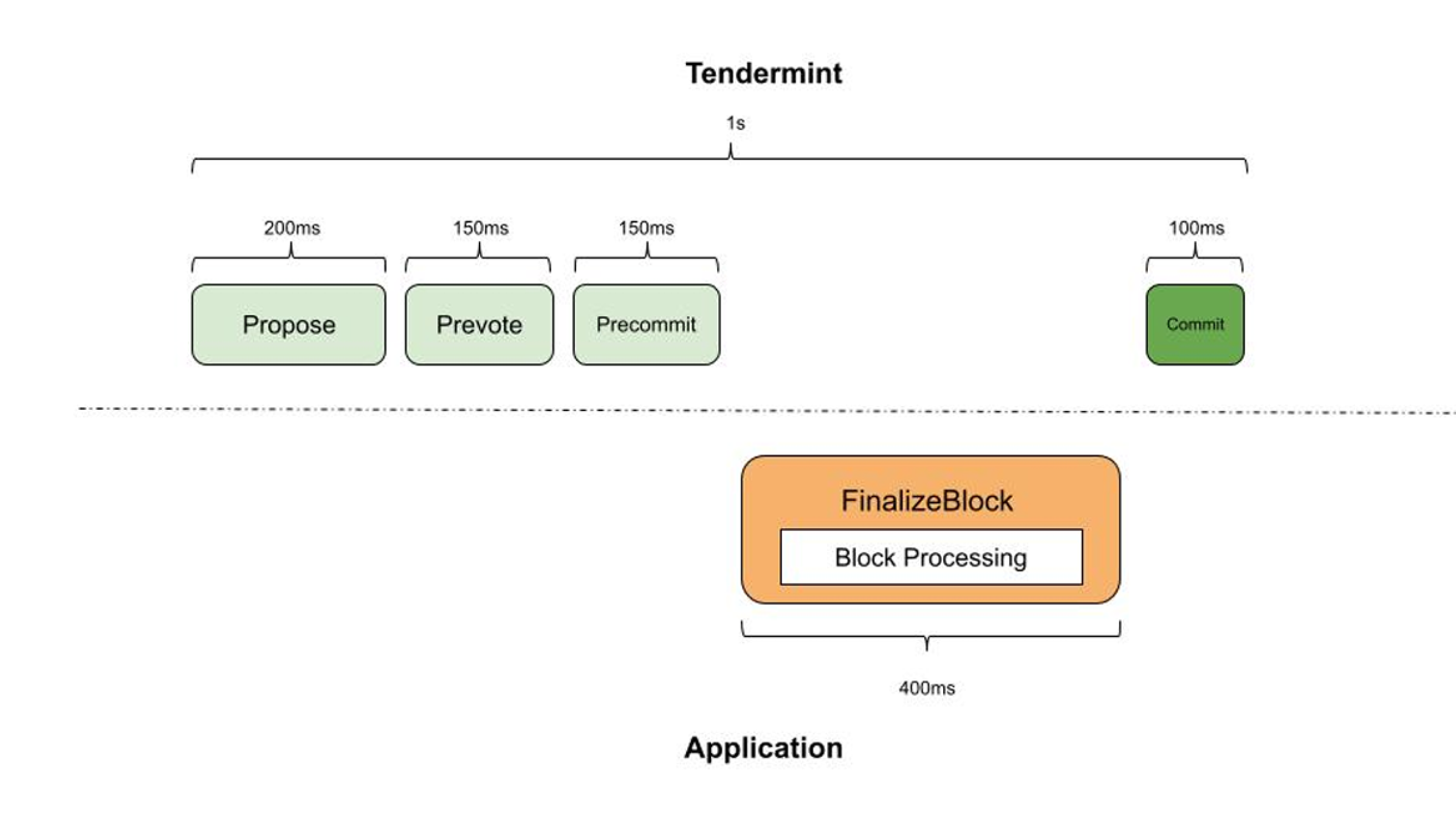

In standard Tendermint consensus, validators verify a block and move to the pre-vote phase. Only after pre-voting and pre-commitment do they begin transaction processing, introducing additional delays.

Standard Tendermint Processing. Source: Sei Network Whitepaper

How Sei Network optimizes this process:

Validators start processing transactions from the first proposed block in parallel with the pre-vote phase.

The processed data is stored in a candidate cache. If the block is confirmed, the cached state is finalized. If the block is rejected, the cache is cleared, ensuring data integrity.

This Sei Network parallel processing approach reduces consensus latency to 700 milliseconds, compared to the standard 1-second delay in traditional Tendermint processing.

Sei Network Optimistic Processing. Source: Sei Network Whitepaper

Twin-Turbo Consensus provides Sei Network with an unparalleled combination of speed, reliability, and high throughput, making it an ideal foundation for applications requiring fast and scalable transaction processing within the Sei Ecosystem.

Parallel Processing in Sei Network

Sei Network is built on the Cosmos SDK framework, which provides developers with flexible tools for customizing block processing. The Cosmos SDK is specifically designed for creating tailored blockchains, making it an ideal choice for Sei Network, which focuses on trading and decentralized finance (DeFi).

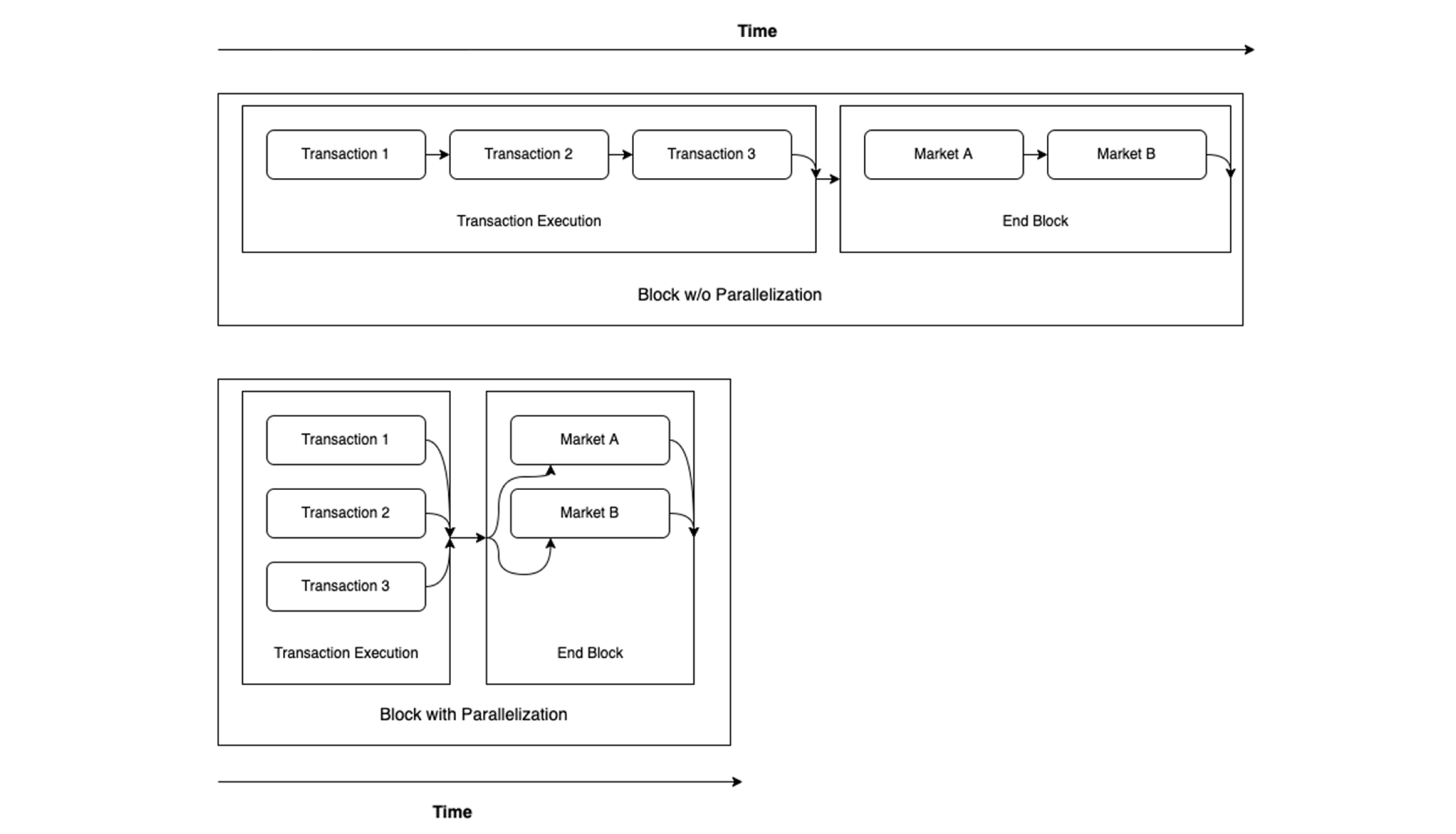

In standard blockchains, validators execute the BeginBlock (block initialization), DeliverTx (transaction processing), and EndBlock (final state updates) phases sequentially. However, in Sei Network, these processes run in parallel.

Thanks to the Cosmos SDK, Sei Network has implemented parallel transaction processing and the Twin-Turbo mechanism, significantly enhancing the network's speed and throughput. You can read more about the Cosmos SDK in our overview of the Cosmos ecosystem.

Block Processing With and Without Parallelization. Source: Sei Network Whitepaper

How Parallel Processing Works in Sei Network

Sei Network employs parallel execution in the DeliverTx and EndBlock phases. The key innovation in Sei Network is its hybrid transaction execution system:

Independent transactions are processed in parallel, accelerating execution.

Dependent transactions that modify the same data are executed sequentially to avoid conflicts.

Additionally, smart contract developers can define transaction dependencies when deploying contracts. If dependencies are not specified, contracts will execute sequentially, increasing gas costs. In cases where dependency settings are incorrect, the smart contract may be blocked, but the rest of the Sei Network will continue to operate without disruption.

Directed Acyclic Graph (DAG) Execution in Sei Network

To efficiently manage dependencies, Sei Network constructs a Directed Acyclic Graph (DAG) that determines the execution order of transactions within a block. Transactions that interact with different keys execute in parallel, while those modifying the same key are processed sequentially in the order they were received.

Key Principles of DAG Execution

Before processing a block, Sei Network builds a dependency graph where nodes represent transactions, and edges indicate dependencies between them.

Transactions operating on different data sets execute in parallel.

Transactions that modify shared data points are dependent on one another and execute sequentially.

For example, token transfers between wallets in the Sei Ecosystem.

Consider a block containing three transactions:

T1

Modifies the balance of Wallet A.

T2

Modifies the balance of Wallet B.

T3

Transfers assets from Wallet A to Wallet B.

DAG Construction in the Sei Ecosystem

T1 and T2 execute simultaneously, as they do not depend on each other.

T3 depends on T1 and T2, so it executes only after both transactions are completed.

By leveraging DAG execution, Sei Network maximizes parallel processing capabilities, accelerating block processing and reducing network load.

Access DAG for Parallel Processing. Source: Sei Network Whitepaper

Thanks to innovations like Twin-Turbo consensus, parallel processing, and DAG-based execution, Sei Network has achieved remarkable speed, reliability, and scalability. These advancements allow Sei Network to compete with centralized exchanges in trade execution speed while maintaining a fully decentralized architecture.

Unique Features of Sei Network

In this section, we will explore the key features of Sei Network that distinguish it from competitors and position it as one of the most promising blockchain solutions for trading applications.

Order Matching Mechanism in the Sei Ecosystem

Sei Network provides developers with the ability to create systems with a central limit order book (CLOB), a mechanism traditionally used by centralized exchanges (CEX). Unlike automated market maker (AMM) algorithms that dominate the DeFi sector, CLOB offers a more flexible and efficient way to manage liquidity and execute orders.

Advantages of CLOB:

More precise pricing through limit order execution.

Support for advanced trading strategies, including high-frequency trading.

Compatibility with institutional traders accustomed to CLOB-based systems on traditional exchanges.

Sei Network allows the implementation of both CLOB and AMM systems, giving developers the freedom to choose the best approach based on their application's needs. These functionalities are integrated at the protocol level, making development more efficient and streamlined.

Single-Block Order Execution in Sei Network

A unique feature of Sei Network is its capability to place and execute orders within a single block. This is particularly valuable for traders engaged in high-frequency trading, where every millisecond counts.

How it works within the Sei Ecosystem:

Traders can submit orders that are immediately processed and executed within the current block, ensuring seamless transactions within the Sei Ecosystem.

This eliminates delays associated with waiting for confirmation in subsequent blocks, making trading faster and more efficient.

Benefits:

Reduced slippage risk, enhancing the overall efficiency of the Sei Ecosystem.

Increased competitiveness compared to centralized exchanges.

Order Bundling for Efficient Trading in the Sei Ecosystem

For market makers and large-scale traders, Sei Network introduces an order bundling feature, allowing price updates across multiple markets within a single transaction. This optimizes trade execution and liquidity management.

Use case:

A market maker can simultaneously update quotes for multiple trading pairs, reducing gas costs and enhancing efficiency.

Batch Auctions: Preventing Front-Running in Sei Network

A common challenge in modern blockchains is validator manipulation, such as front-running. Sei Network addresses this issue through batch auctions.

How it works within the Sei Ecosystem:

All orders at the end of a block are combined and executed at a uniform clearing price.

This eliminates opportunities for manipulation and ensures fair order execution.

Benefits:

Protection against Miner Extractable Value (MEV) and front-running.

Increased trust among users.

Native Price Oracle Integration in the Sei Ecosystem

Sei Network has integrated a native price oracle at the protocol level, ensuring accurate and reliable pricing — a crucial component for trading applications.

How it works within the Sei Ecosystem:

Validators must agree on prices before a block is added to the blockchain.

This guarantees that all Sei Network participants work with up-to-date and precise data.

Benefits:

Enhanced data reliability for smart contracts and other modules within the Sei Ecosystem.

Simplified integration with other DeFi applications.

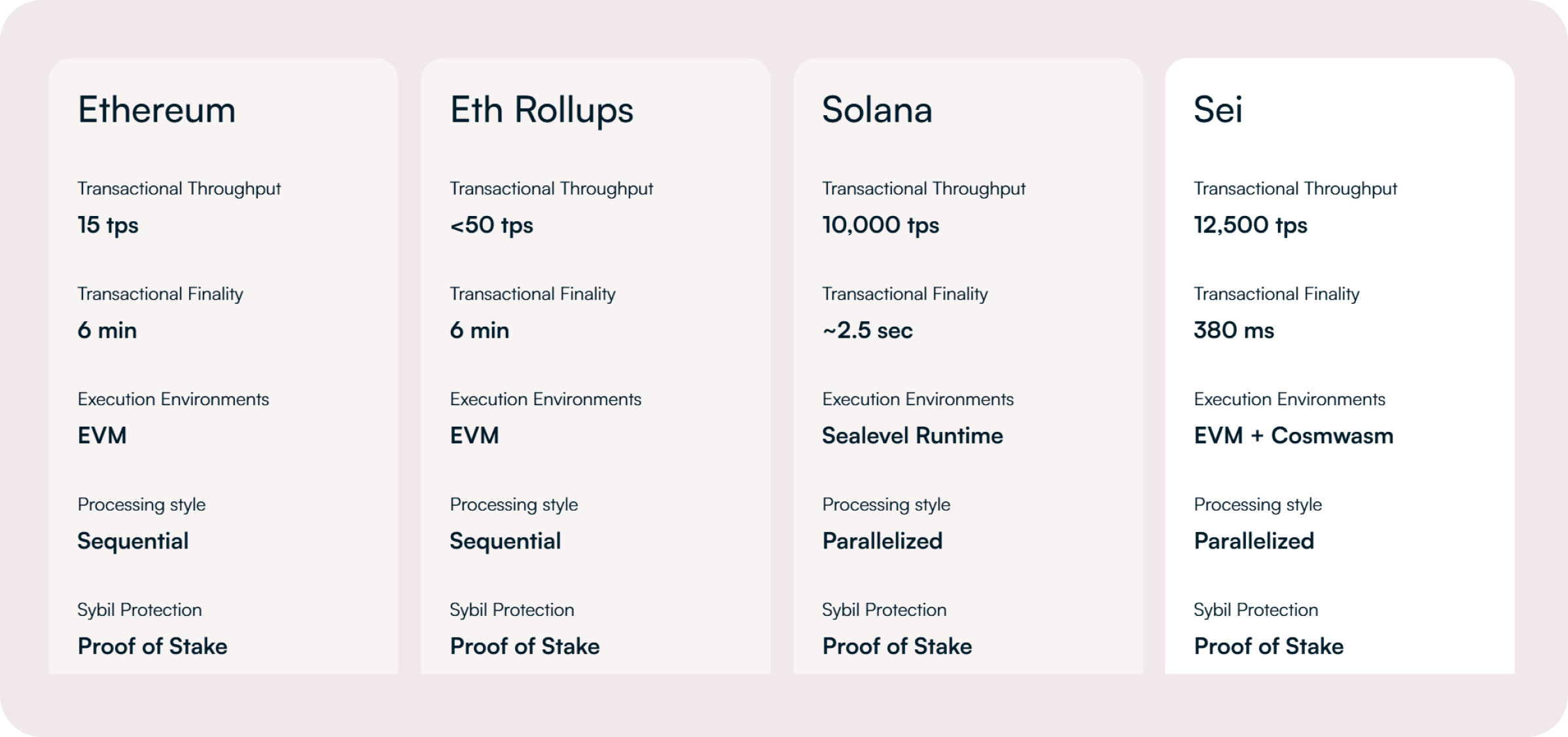

Comparing Sei Network with Competitors

Sei Network stands out among high-performance blockchains like Solana due to its specialized focus on trading. While other platforms aim to be general-purpose, Sei Network concentrates on solving specific challenges related to digital asset trading.

TPS measures the number of transactions a network can process per second, directly impacting scalability and usability for applications like decentralized exchanges and trading platforms. Below is a comparison of Sei Network with other leading blockchain networks:

Sei vs. Other Chains. Source: sei.io

Thanks to its unique technological solutions, Sei Network can achieve 12,500 TPS. In comparison, Solana, one of the fastest blockchains, reports a throughput of 10,000 TPS. Ethereum, despite its popularity, has a significantly lower TPS of just 15. While Layer 2 solutions improve Ethereum’s scalability, their TPS remains relatively low, typically under 50.

With 12,500 TPS and a transaction finalization time of 380 milliseconds, Sei Network stands out among its competitors. Its high speed and reliability make it an ideal platform for trading applications and other use cases where fast transaction processing is crucial.

Sei Ecosystem

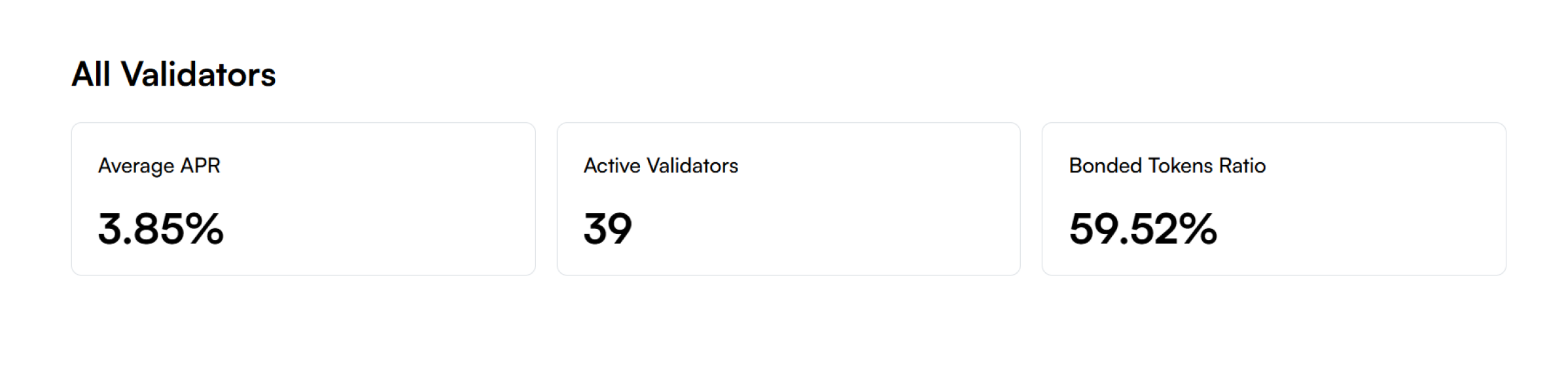

As of now, the Sei Network operates with 39 active validators, responsible for block production and consensus maintenance. This relatively small number reflects the early stage of network development. While increasing the number of validators enhances decentralization, an excessive number can slow down consensus, which is critical for Sei Network high-performance goals.

Staking and Validator Participation

The annual percentage rate (APR) for staking is currently 3.85%, subject to fluctuations based on the percentage of staked tokens, validator activity, and overall network economics.

59.52% of all SEI tokens are staked, indicating strong holder engagement in network security and a commitment to long-term Sei Ecosystem growth.

Growth of the Sei Ecosystem

The Sei Ecosystem has demonstrated significant expansion in 2024. At the beginning of the year, the total value locked (TVL) stood at approximately $10 million, but it has now surpassed $220 million. This growth reflects increasing user trust and broader Sei Network adoption.

Leading Projects in the Sei Ecosystem

Key projects driving Sei Network success include:

Yei Finance (Lending protocol)

SiloStake (Liquid staking protocol)

TVL Dynamics. Source: DefiLama

Additionally, over 270 applications are actively deployed across various sectors, including DeFi, AI, Consumer Apps, Custodians, Data & Analytics, Gaming, Infrastructure, Liquidity Alliance, NFTs, and Wallets, solidifying Sei Network presence as a major player in the crypto space.

Sei Foundation and Venture Capital Expansion

On January 29, 2025, the Sei Foundation launched the Sapien Capital Venture Fund with an allocation of $65 million to support DeSci (Decentralized Science) startups leveraging Sei blockchain technology. This initiative aims to attract projects beyond DeFi, fostering innovation and expanding Sei Network applications.

By integrating scientific research and blockchain technology, Sei Network strengthens its position as an attractive platform for investors and developers, paving the way for advanced use cases and institutional adoption.

Sei Ecosystem Wallet Support and Staking

Sei Network is EVM-compatible, allowing seamless interaction with multiple wallets, making it easier for users familiar with Ethereum and other EVM chains to engage with the Sei Ecosystem.

Steps to participate in Sei Network:

Add Sei Network to your MetaMask or other EVM-compatible wallets using official instructions.

Stake SEI tokens to contribute to network security and earn rewards.

Swap assets on Sei Network using SimpleSwap, a cross-chain exchange ensuring fast and convenient transactions.

Investment and Tokenomics of Sei Network

Sei Network has garnered substantial investor interest, securing $85 million in funding across multiple investment rounds. This highlights the project's strong value proposition, its necessity in the trading sector, and its technological potential.

Key investors in Sei Network:

Multicoin Capital

Coinbase Ventures

Foresight Ventures

Jump Capital

OKX Ventures

These investments have enabled the development of a specialized blockchain for trading, establishing a robust Sei Ecosystem tailored for DeFi and trading applications.

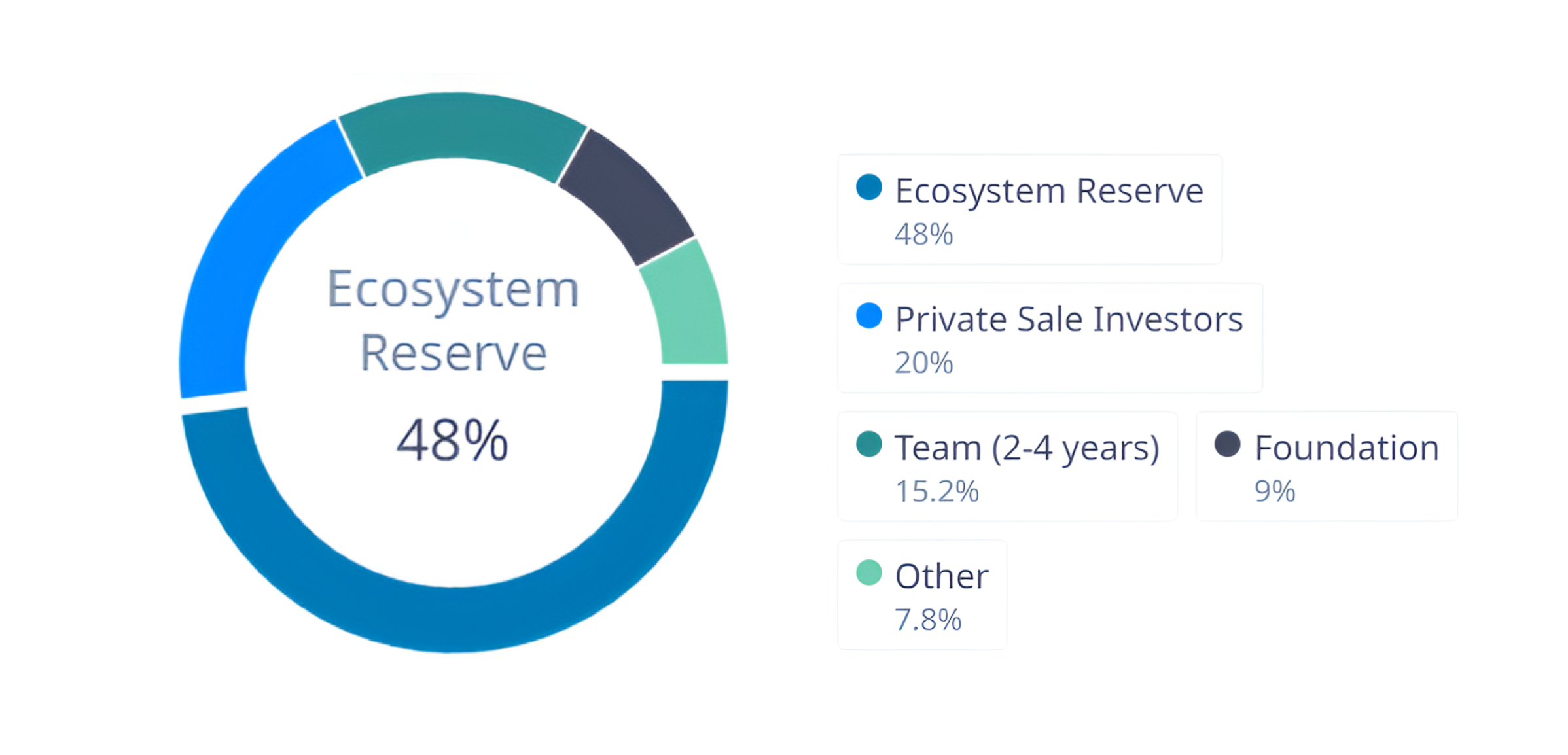

The tokenomics of Sei Network is carefully designed to maintain a balance between long-term project growth, early investor rewards, and user incentives within the Sei Ecosystem.

Token Allocation in Sei Network

Ecosystem Reserve – 48.00%

A significant portion of SEI tokens is allocated to the development of the Sei Ecosystem. These funds are used to finance grants, developer support programs, user incentives through loyalty programs, and the integration of new projects and partnerships.

Team – 15.2%

These tokens are reserved for the core development team and founders of the Sei Ecosystem. They are subject to a long vesting period to ensure the team remains committed to the project’s success over the long term.

Private Sale Investors – 20.00%

Tokens allocated to early investors who supported the project during its initial stages. These investors play a crucial role in funding and strategic development of Sei Network.

Foundation – 9.00%

Funds allocated to the Sei Foundation, which is responsible for ecosystem support, educational initiatives, and infrastructure development.

Other – 7.8%

The remaining tokens are available for marketing activities, partnerships, or other strategic purposes.

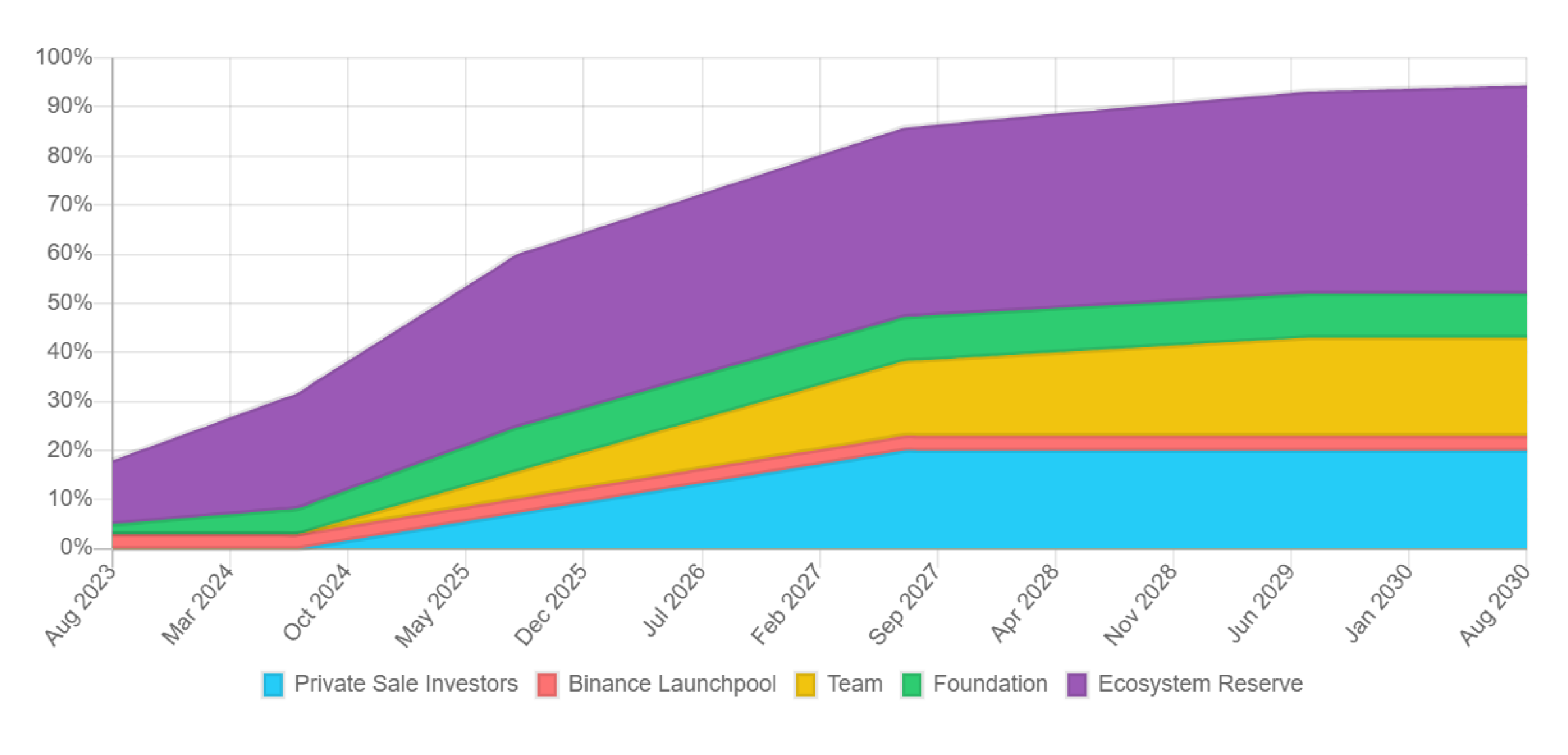

SEI Token Emission and Vesting Schedule

A total of 10 billion SEI tokens have been issued. As of today, 4.43 billion SEI are in circulation. The vesting process for all token distribution participants is ongoing and is set to be completed by August 2030, when 94.37% of the total supply will be unlocked. The remaining 5.63% from the Ecosystem Reserve will be used as needed after 2030.

Source: Binance

The gradual unlocking of tokens occurs at a rate of approximately 0.05% of the total supply per day, reducing the risk of sudden market pressure.

A substantial portion of SEI tokens is allocated for the Sei ecosystem growth, which is a positive factor for the long-term development of the project.

Summary

Sei Network unique technological solutions — including parallelization, consensus mechanisms, and order-matching algorithms — position it as one of the most promising blockchain ecosystems for trading applications.

Unlike generic high-speed blockchains, Sei Network is specifically optimized for trading, making decentralized exchanges (DEXs) more competitive with centralized exchanges (CEXs). Features like single-block trade execution, order batching, and native price oracles ensure an efficient and robust infrastructure for traders, developers, and institutional participants.

However, Sei Network must prove its long-term sustainability amidst fierce competition from high-performance chains like Sui and Aptos. The network's continued success depends on its ability to attract developers, expand its user base, and enhance infrastructure. If Sei Network sustains its rapid development and innovation, it has the potential to solidify its position as a leading blockchain for trading and DeFi applications.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.