THETA Fundamental Analysis

Key Insights

- Key Theta advantages are the unique caching tech, partnerships, engaged community, and use of blockchain for security.

- Theta risks include scalability issues, possible security vulnerabilities, regulations, and strong competition.

- Financial stability of Theta is supported by market cap, trading volume, staking rewards, and support from Theta Labs.

The Theta Project is a blockchain platform and decentralized network for video streaming. Theta was created with the aim of addressing issues related to centralized video hosting platforms such as YouTube and improving content delivery quality for users.

What Is Theta

- Theta: History and Founders

Theta was created by a team from the renowned crypto company which is now theta.tv. The project's founders are Mitch Liu and Jieyi Long.

Theta was launched in 2018, and in 2020, the project introduced its own token, THETA.

- Theta: Goals and Objectives

The primary goal of Theta is to create a decentralized platform for video streaming that provides more efficient video content delivery and enhanced interaction among content creators, viewers, and advertisers.

The project aims to reduce storage and delivery costs for videos while improving the user experience.

- Theta: Mission and Vision

Mission of Theta is to establish an open infrastructure for video streaming, where users can easily create, broadcast, watch, and earn from content.

The project's vision is to make video streaming more decentralized, secure, and accessible to all participants of the Theta network.

- Theta: Technology and Innovations

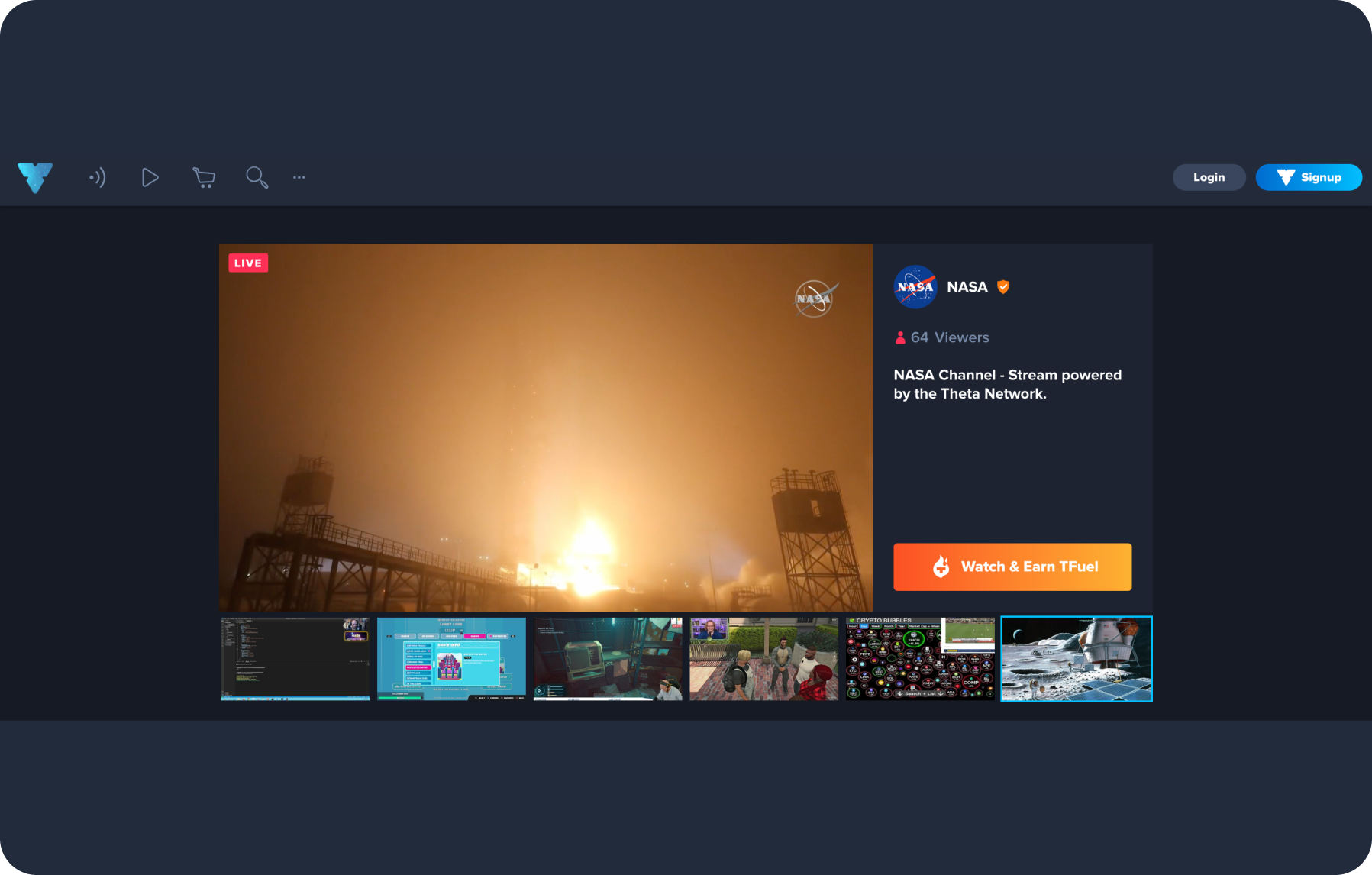

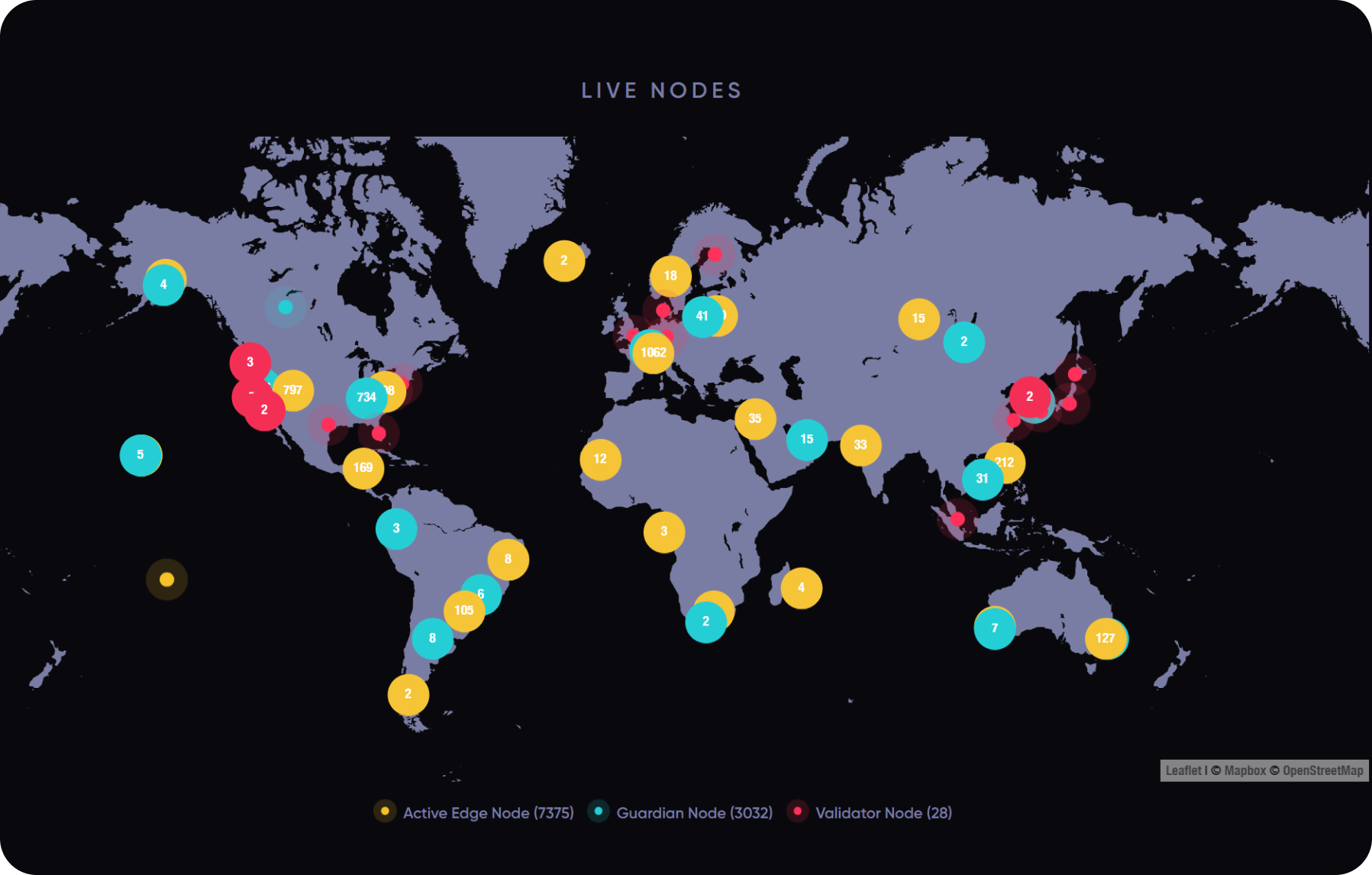

One of the key technologies employed by Theta network is peer-to-peer caching, which enables network users to store and deliver video content to other users in a decentralized manner.

The Theta project also utilizes blockchain for managing the THETA token, ensuring security, and authorizing transactions.

THETA Token and THETA Wallet

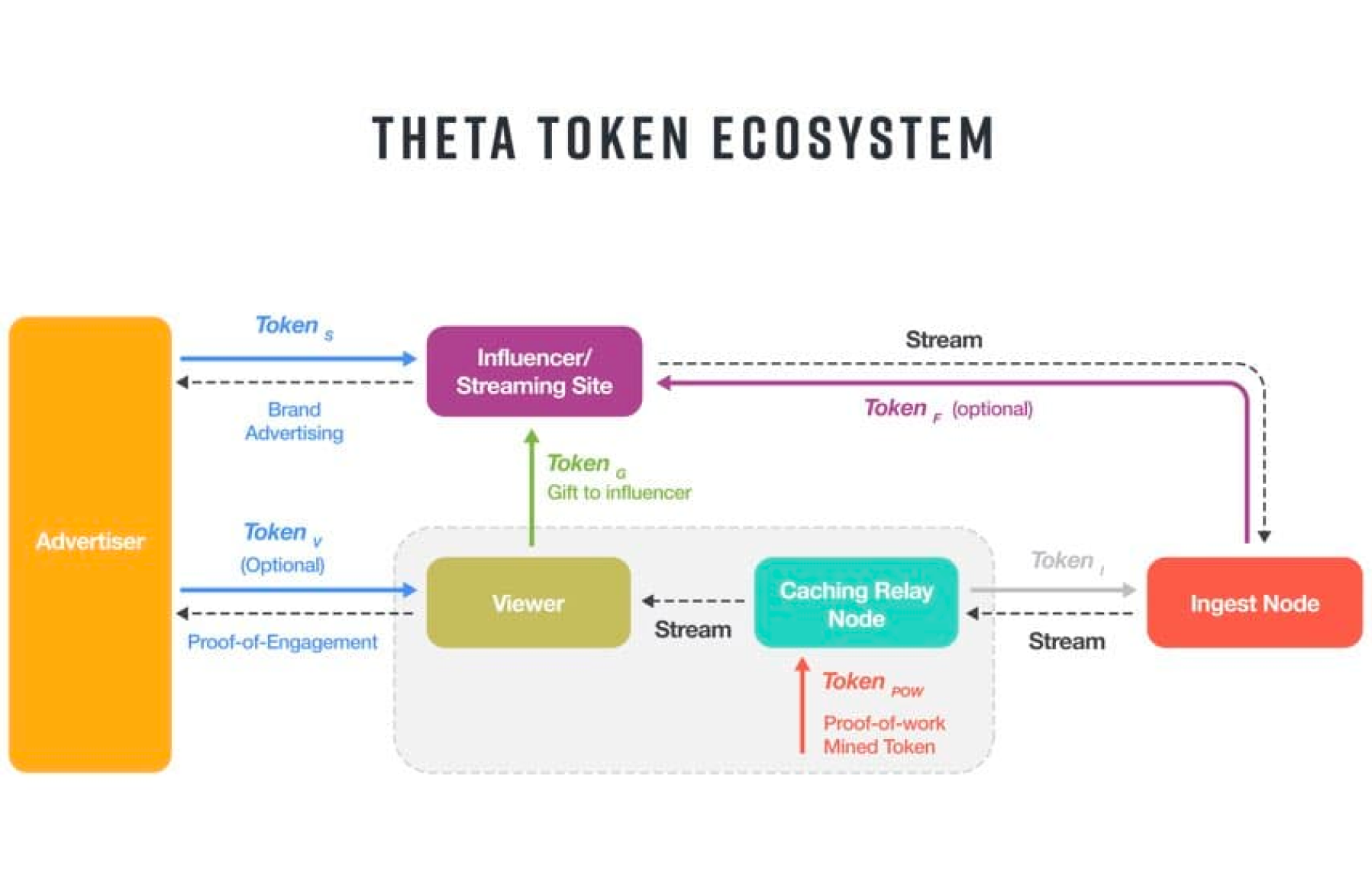

The Theta network relies on two essential cryptocurrencies: Theta Token (THETA) and Theta Fuel (TFUEL).

Theta Token is central to the Theta network, facilitating transactions and encouraging users to share their surplus bandwidth and computing power. Users who actively engage with the Theta community can earn THETA coin, enhancing the network's overall performance and reliability.

Theta Fuel (TFUEL), the second native cryptocurrency of the Theta network, is vital for executing on-chain operations and covering gas fees. Holding and using TFUEL allows users to engage with the Theta ecosystem, supporting its expansion and advancement.

The Theta wallet stores THETA coin and TFUEL on the Theta blockchain. It allows users to send and receive THETA tokens and interact with Theta crypto platform applications. The THETA wallet is solely under user’s control, with no external influence or access.

With the Theta wallet, user anonymity is maintained. Ownership remains private, and transactions are conducted through an address encoded as a sequence of numbers and characters.

THETA Competitive Environment Analysis

- Livepeer

Livepeer is a blockchain platform for decentralized video encoding and streaming. It offers an open protocol, flexible customization, and integration with various applications.

However, Livepeer may have a limited user base and a smaller community development compared to Theta.

- VideoCoin

VideoCoin is a blockchain platform for cloud video infrastructure.

It provides low-cost storage and delivery of video content, as well as various cloud providers. However, VideoCoin may have a limited network of participants and may be less known compared to Theta.

- DLive

DLive is a video streaming platform built on the TRON blockchain. It offers low fees, rewards for content creators, and an active user community.

DLive, though, may have limited integration with other blockchain platforms and a smaller user base compared to Theta.

- YouNow

YouNow is a video streaming platform that utilizes tokens. It offers rewards for content creators and active community engagement.

However, YouNow may have limited integration capabilities with blockchain platforms and less recognition compared to Theta.

- Lino Network

Lino Network is a blockchain platform for media content that offers rewards for content creators and microtransactions. It aims to reduce fees and improve conditions for content creators.

Lino Network may have limited partnerships and a smaller community development compared to Theta.

Advantages of THETA

- Unique Peer-to-Peer Caching Technology

Theta offers an innovative technology that enables more efficient delivery of video content using a decentralized peer-to-peer network, reducing network load. Theta holds a significant advantage thanks to this unique technology.

- Wide Range of Partnerships and Collaborations

Theta actively collaborates with leading companies and partners, including Samsung VR, MBN, and Pandora fostering development and attracting new users. This helps the project expand its ecosystem.

- Strong Community and Active User Engagement

Theta network boasts a large and active user community that actively interacts with the platform, creating and consuming content while earning from it. This creates a favorable environment for project development and growth.

- Use of Blockchain for Security and Transparency

Theta utilizes blockchain technology to ensure transaction and content security, as well as to establish a transparent and reliable environment for all participants.

Disadvantages of THETA

- Competition from Major Platforms

Theta faces competition from large video streaming platforms such as YouTube and Twitch, which have a vast user base and wide audience reach. To overcome this competition, Theta crypto platform must continue innovative developments and attract new users.

- Limited Integration with Other Blockchain Platforms

Unlike some competitors, Theta network may have limited integration capabilities with other blockchain platforms, which can hinder asset portability across different networks. This may create barriers to interact with other ecosystems and limit potential opportunities.

- Need for a Dedicated Peer-to-Peer Network

To ensure efficient delivery of video content, Theta requires the establishment of a dedicated peer-to-peer network, which may require additional resources and infrastructure.

THETA Technology Assessment

- Technical Maturity

Theta crypto network has gone through several stages of development and has reached a significant level of technical maturity. It has a working blockchain and functional applications that are used by users for video streaming and participation in the ecosystem.

Theta Mainnet was launched in March 2019, which signifies considerable progress in development.

- Technological Solutions and Innovations

Theta offers a range of technological solutions and innovations that set it apart from competitors. One of the Theta key achievements is the peer-to-peer caching technology, which enables efficient delivery of video content through a decentralized network.

This technology reduces Theta network load, improves performance, and decreases delays for users.

- Development Process and Future Plans

Theta has an active community of developers and regularly updates and improves its protocol and applications. The development team is focused on scalability, enhancing security, and expanding user capabilities.

Additionally, Theta conducts testing and engages the community for feedback and participation in the development process.

Theta has ambitious plans for the future, including ecosystem expansion, attracting new users, and partnering with major companies in the media and entertainment industry. They also aim to improve scalability, provide more flexible developer capabilities, and continue innovative developments.

THETA Project Team

- Founders

Theta was founded by Mitch Liu and Jieyi. Both founders have significant experience in technology and business. Mitch Liu has over 20 years of experience in managing technology companies, including working at Akamai Technologies and Tapjoy. Jieyi Long brings expertise in computer science and business to the Theta network.

The Theta team consists of developers, engineers, blockchain experts, marketers, and other professionals. They have diverse experience in the technology and blockchain field, providing a well-rounded approach to Theta project development and management.

- Teamwork Efficiency

Theta has demonstrated effective teamwork. The development and specialist teams work synchronously to achieve project goals. They actively exchange ideas, hold discussions, and make decisions based on consensus. This enables the THETA team to make quick decisions and respond to industry changes.

- THETA Project Management Efficiency

Theta has shown good project management quality. The founders and team take a leadership role in the development and implementation of the Theta project's strategy. They actively engage with the community and partners, provide regular updates, and develop the Theta ecosystem. The team also strives for transparency and open communication with the community.

Economic Model Analysis of THETA

- THETA Token Distribution Mechanisms

Theta has a unique token distribution system that incentivizes network participants. Theta token is distributed through several mechanisms, including peer-to-peer caching, staking, and engagement as network listeners.

Participants who provide computational resources for caching and transmitting video content receive rewards in the form of Theta token. This incentivizes active participation and contribution to the Theta ecosystem.

Credits chipin.com

- Economic Incentive Models and Inflation

Theta applies an economic incentive model where participants who provide computational resources and support the network receive rewards in the form of Theta coin. This incentivizes activity within the network and helps maintain its stability.

As for inflation, Theta has a limited token supply, and the issuance is controlled through the protocol and economic parameters. This helps manage inflation and maintain THETA price stability.

- Governance and Decision-Making Process

Theta has a team of founders and developers actively managing the project and making strategic decisions. They engage with the community, provide updates, and seek input and proposals from participants.

Theta also incorporates mechanisms for voting and consensus among token holders to ensure broad transparency and participation in decision-making.

The Theta network team possesses high qualifications and experience in the technology and blockchain field, enabling effective project management. They actively develop and enhance Theta's technological solutions, collaborate with partners, and expand the Theta ecosystem.

Theta also has clear plans for the future, including the development of new functionalities and attracting new users and content.

Risk Assessment

THETA Technical Risks

- Scalability

Blockchain platforms, including Theta, face scalability challenges as the number of users and transactions increases. Ensuring high throughput and low latency can present technical complexities.

- Security

Security is a critical aspect of Theta blockchain. Risks include the possibility of smart contract hacks, theft of private keys, and other vulnerabilities within the system.

THETA Competition and Innovation Risks

There is a risk of competition from similar blockchain platforms offering similar capabilities and functionalities. Competitors of Theta may attract developers and users, which can impact the popularity and adoption of Theta as the preferred platform.

Besides, blockchain technologies evolve rapidly, and there is a risk that new innovative solutions and protocols may lead to competition or render existing solutions obsolete.

THETA Regulatory Risks

- Regulatory Constraints

Blockchain platforms, including Theta, may face risks associated with regulations and restrictions imposed by governments and regulatory bodies. Changes in legislation and regulatory requirements can impact the operation and acceptance of the blockchain platform.

- Geographical Limitations

Different jurisdictions have varying approaches to blockchain technologies and cryptocurrencies. This can create risks regarding the usage and recognition of Theta in different countries.

It is also important to monitor the competitive landscape and carefully analyze competitive advantages and disadvantages in order to position Theta successfully in the market.

THETA Community Analysis

Analysis of the Theta crypto project community reveals a high level of activity and engagement among participants. The Theta community encompasses developers, users, streamers, investors, and video content enthusiasts.

- Growing Number of Users and Content Creators

The Theta network is attracting an increasing number of users who actively consume and create video content on the platform. This creates a dynamic ecosystem and stimulates community development.

- Active Forums and Social Networks

The Theta community actively engages and exchanges information on various platforms such as Reddit, Telegram, Discord, and others. Theta network participants discuss technical aspects, news, issues, and suggestions, fostering interaction and community growth.

- Partnership and Industry Support

Theta Labs provides tools, resources, and support to developers so they can create innovative applications and integrate Theta into their projects. This contributes to ecosystem growth and the attraction of new participants.

Besides, Theta partners with leading companies in the media, technology, and entertainment industries, enhancing project visibility and attracting new participants. There is also support from major investors and funds who recognize the Theta project's potential and value.

- Community Involvement in Protocol Improvement

Theta community members can propose and discuss protocol improvements through Theta Improvement Proposals (TIPs). This allows participants to contribute to the development and enhancement of the project.

Future plans of the Theta community include developing additional features and tools, expanding Theta ecosystem, attracting new users and partners, as well as improving protocol scalability and security. The Theta Labs team actively works on project development, based on feedback and community needs.

Overall, the Theta community demonstrates a high level of activity, engagement, and support, which is a crucial factor for further project development and success.

Theta community members play an important role in shaping strategy, making decisions, and promoting Theta in the video content and blockchain technology market.

THETA Project's Financial Stability

Evaluating the financial stability of the Theta crypto project is an important factor in assessing its potential and stability. While Theta is not a corporation, several financial indicators can be considered to evaluate its financial stability.

- Liquidity and THETA Market Cap

Theta's liquidity can be assessed by analyzing the trading volumes on crypto exchanges. High trading volume indicates sufficient demand and supply in the market, enhancing liquidity of Theta.

Market cap reflects the current value of all Theta tokens in circulation multiplied by the current THETA price in the market. A higher market cap suggests a relatively more financially stable Theta project.

- Yield for the Theta Ecosystem Participants

Participants who engage in validation, staking, or token delegation within the Theta network may receive rewards in the form of TFUEL tokens. High yield indicates the attractiveness of Theta for participants and can contribute to its financial stability.

- Activity and Popularity of the Theta Community

The more active users, content creators, and developers within the Theta ecosystem, the more stable the project can be considered. An active community signifies growing interest and appeal of Theta to various participants.

- Financial Support and Resources Provided by Theta Labs

Theta Labs, the founder and operator of Theta, plays a crucial role in the development and support of the Theta project. They provide funding, resources, and an ecosystem for the development and promotion of Theta.

Overall, the financial stability of the Theta project is assessed as high, supported by its market cap, active participation of community members, and the support from Theta Labs. These factors contribute to the financial stability of the Theta project and its potential for further development and success.

THETA: Decision Making

Drawing conclusions and making a decision on whether to invest in the project and determining an acceptable level of investment is one of the main goals of this analysis. Based on the analysis conducted, conclusions can be drawn regarding the potential and prospects of the Theta project.

Factors to be considered when making investment decisions in Theta include:

- Technological Potential

Theta offers innovative technology, including blockchain-based video streaming technology that improves performance and reduces storage and content delivery costs.

This can attract the attention of content creators, platforms, and users, ultimately leading to the growth in popularity and utilization of the Theta network.

- Community and Partnerships

Theta has an active and engaged community that supports the project's development and contributes to its growth. Additionally, Theta has strategic partnerships with leading companies in the entertainment and media industry, which can further contribute to its expansion and adoption within the industry.

- Market Competition

Competition in the entertainment and media industry is significant, and Theta faces competitors such as YouTube, Netflix, and other blockchain projects. When making investment decisions, it is important to consider the competitive landscape and the ability of Theta to attract and retain users and partners.

- Risks and Regulation

Like any blockchain-related field, risks associated with regulation and security should also be taken into account when evaluating the Theta project. Changes in legislation and negative regulatory attitudes towards cryptocurrencies and blockchain could impact the development and utilization of Theta.

Users can buy THETA, TFUEL, and other currencies for fiat or crypto on SimpleSwap.

Summary

Theta presents an enticing investment opportunity due to its innovative technological capabilities, active community engagement, and strategic industry partnerships.

Theta network enjoys significant advantages due to its unique technology, partnerships, and active community. However, to achieve further project success, it is necessary to continue developing and expanding the Theta ecosystem, attracting more users, and overcoming competition from major platforms.

The Theta project team consists of experienced professionals with diverse backgrounds in technology and blockchain. They have demonstrated good qualifications, project management skills, and teamwork efficiency.

This contributes to the successful development and growth of Theta in the blockchain and video streaming industry.

Theta's economic model is based on incentivizing network participants and maintaining stability through Theta token distribution mechanisms and economic incentives.

The governance and decision-making process in Theta actively involves the project team and the community, ensuring broad transparency and participation from all stakeholders.

Theta has demonstrated a high level of technical maturity with a functional blockchain and applications. It offers unique technological solutions such as peer-to-peer caching and is actively evolving and improving.

Future plans for Theta include ecosystem expansion, enhanced developer capabilities, and attracting new users.

Risk assessment and management are crucial aspects for the Theta project. The project team needs to develop strategies to mitigate and manage risks, ensure the security and reliability of technical solutions, and monitor regulatory changes and adapt accordingly.

However, it’s important to take into account the competitive landscape and the potential regulatory challenges that the project may encounter. Conducting comprehensive research and analysis is essential for making well-informed investment decisions regarding Theta or any other project.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.