Usual Crypto Protocol Review

Key Insights

- Usual represents a paradigm shift in stablecoin architecture by implementing a fully decentralized infrastructure where real world assets (specifically US Treasury Bonds and reserve REPO) serve as direct collateral, eliminating traditional banking intermediaries.

- The protocol's economic framework operates through a three-tiered system: USD0 (the base stablecoin), USD0++ (a yield-generating bond instrument with a 4-year maturity), and USUAL (the governance token) - with each component serving distinct functions while being interconnected through the protocol's revenue and management mechanisms.

- Stakeholders holding the USUAL token have significant influence over how the Usual crypto protocol operates, including decision-making roles in determining collateral options and managing revenue distribution. This governance model ensures that users are not only participants but also benefactors and decision-makers within the ecosystem.

What is Usual Crypto Protocol

Usual is a young project that entered the market in 2024 and it offers an innovative solution: a new fiat stablecoinlinked to real world assets. Usual is positioning itself as a competitor to the largest issuer of USDT fiat stablecoin - Tether, with the difference that Usual is developing a fully decentralized infrastructure for issuing and managing fiat stablecoin.

As envisioned, the community will play a key role in managing all of Usual's critical processes: risk management, selection of stablecoin collateral options, and liquidity incentive programs. Governance takes place onchain via the main utility token USUAL, which gives its holders management rights.

Currently, Usual's TVL is $1.55B and the market capitalization of the USDO stablecoin issued by Usual is $1.88B, making it the 7th largest stablecoin in the crypto market.

TVL Usual. Source: DefilLama

Usual aims to create a fair financial system that meets the key principles of decentralized finance. Unlike the largest issuers of fiat stablecoins, which hold a portion of their collateral in traditional banks, thereby taking all the risks of the traditional financial system, Usual is introducing a new model of a stablecoin backed by real world assets not held by intermediaries in the form of banks.

Usual crypto protocol also aims to hand over to the community the ability to control the infrastructure, treasuries and protocol management through the USUAL token, as mentioned above.

Differences of the Usual model from other fiat stablecoins. Usual Documentation

Key Features of the Usual Crypto Protocol

Ownership rights and revenue sharing

100% of the protocol's revenues are allocated to the treasuries and 90% of the rights to these revenues are allocated to the community via a utility token (USUAL).

Management rights

USUAL holders are granted management rights over key protocol parameters such as revenue distribution, collateral management and risk management.

Utility Rights

Holding USUAL also enables staking, and “bribe” strategies similar to Curve mechanics, allowing users to manage liquidity and increase the utility of USUAL.

Mechanics of the Usual Crypto Protocol

Usual's mechanics are based on three interrelated solutions:

Stablecoin (USD0)

A new fully RWA backed stablecoin pegged to the US dollar. By design, it is analogous to a bank deposit, where you keep your money, but it remains liquid, meaning you can use it in various DeFi strategies. In addition, stablecoin is intended for any operations similar to those of a fiat currency: payments, trading or usage as collateral.

Usual LST (USD0++)

A mechanism that allows you to turn your stablecoin into a yield generating one, analogous to a deposit in a bank (saving account). Users who want to earn extra yield can block their USD0 stablecoin and get USD0++, a yield generating token in return. According to the Usual team, the minimum risk-free yield of USD0++ is 5-7% per annum.

Management token (USUAL)

A basic utility token with a deflationary issuance model, giving the right to manage the Usual crypto protocol. In addition, USUAL can also generate yield through a staking mechanism, which will depend on the growth of TVL Usual.

Usual Model. Source: Usual Documentation

Main Components of the Usual Crypto Model

USD0

A fiat stablecoin backed by real world assets, namely tokenized short-maturity US Treasury Bonds, also called US Treasury Bills and reverse REPO.

USD0 stablecoin can be mined in two ways. The first is to deposit the necessary collateral directly into the protocol in the form of RWA and receive the corresponding amount of USD0 in the amount of 1:1. This method is not available to ordinary users.

The second way involves a simple exchange of USD0 for other stablecoins on the Usual website or through decentralized exchanges. In this case, a third party called Collateral Provider deposits the required amount of collateral in the form of RWA for the user.

USD0 mint mechanism. Source: Usual Documentation

According to the Usual crypto protocol documentation, USD0 aggregates real world assets for collateral from different issuers. However, to date Usual has cooperated with only one issuer, Hashnote. Thus USD0 is so far collateralized by only one type of RWA, namely USYC from Hashnote. USYC is an ERC-20 standard onchain asset ofHashnote International Short Duration Yield Fund Ltd. (“SDYF”), which invests in reverse REPO and US Treasuries.

USD0++

Is a 4-year USD0 stablecoin staked by users, essentially a liquid staking token or bond on USD0 that generates a yield for users. Users can choose between two options to receive a yield: in the form of USUAL, depending on the price of tokens on the market, or a risk-free yield at least equal to the yield of the real world assets used as collateraland paid in the form of USD0. There are several ways to exit USD0++ before the bond matures:

USUAL burning redemption

Exchange in the ratio of 1:1 to USD0 stablecoin in exchange for burning a part of USUAL tokens accumulated during the holding period of USD0++.

Price floor redemption

Exchange at the current USD0/USD0++ rate.

Parity arbitrage right

A measure for USD0++ depeg case to be initiated by the protocol DAO.

For a long time, the USD0++ exchange rate was similar to the USD0 stablecoin, meaning users could exchange it for USD0 at a 1:1 ratio. However, on January 9, 2025 the Usual team published a roadmap of the protocol for the next 4 years, in which it was stated that the floor pirce of USD0++ will be set at 0.87 USD0, which means that it cannot be instantly exchanged to the USD0 stablecoin at a 1:1 ratio.

In fact, USD0++ is now closer to its intended purpose and fair price, as it is not declared by the project as a stablecloin and works on the principle of a USD0 zero coupon bond fully redeemable in 4 years.

However, due to the fact that USD0++ rate was equal to USD0 for a long time, users have misconceptions about its value. In addition, the use of USD0++ in various DeFi protocols and strategies with the assumption of a floor price equal to 1 USD0 has put some USD0++ pools at risk. Currently, the price of USD0++ on Curve is 0. 938 USD0.

USUAL

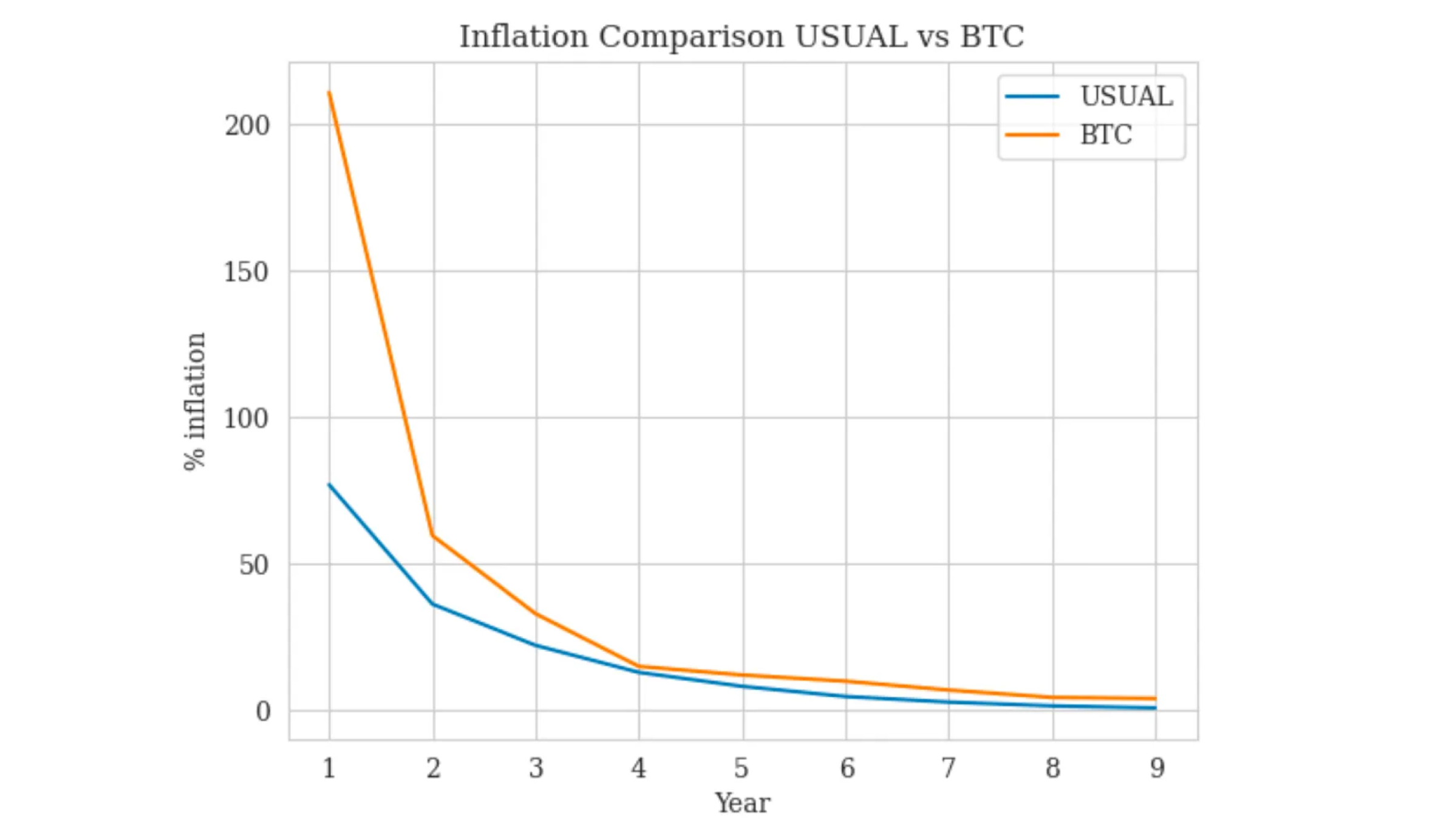

The main utility token of the Usual crypto protocol, giving holders the right to control key parameters of USUAL. USUAL's issuance model is tied to the protocol's revenue and issuance will always be lower than revenue growth, which should increase the value of the token over time. USUAL's deflationary model is comparable to that of Bitcoin. Most of the tokens were distributed on the primary airdrop of the token to the users of the protocol and its issuance will decrease over time.

BTC and USUAL emission curve. Source: Usual Documentation

In addition to management rights, USUAL holders can receive a portion of Usual's revenues through a staking mechanism. Staking allows to receive 10% of future token issuance as yield. After USUAL staking, users receive USUALx, a token representing a staked USUAL and entitling them to receive revenue in the form of USUAL tokens accrued daily. The current APY on USUAL staking is 278%.

Users can get USUAL or any other cryptocurrency for fit or crypto on SimpleSwap.

Summary

Let's give a short outline to better understand mechanisms of the Usual crypto protocol:

USD0

It is the protocol's main stablecoin, pegged 1:1 to the US dollar, backed by real world assets (reverse REPO and Treasury Bills). Used as a medium of exchange, payments and savings, it remains liquid and can be used in DeFi protocols and various DeFi strategies. USD0 does not generate yield for holders.

USD0++

A USD0 liquid staking token, received for blocking USD0 for 4 years and generating a yield at least equal to or exceeding the yield of the collateral used by increasing the price of the USUAL token. Can be exchanged for USD0 earlier than the 4 year maturity, but under certain conditions. USD0++ is not a stablecoin and has a current exchange rate of 0.938 USD0.

USUAL

A protocol management token that also allows you to earn income from its staking with a current APY of 278%. The staking yield depends on the price of USUAL and token issuance, tied in TVL growth and protocol revenue.

As it can be seen, Usual has really presented to the market a new interesting stablecoin model with the use of real world assets and a complex mechanism of redistribution of returns.

The success of the protocol will depend on the growing use of USD0, which will ensure the growth of TVL, and thus the protocol's revenues. However, the team still has a lot of work to do, such as ensuring aggregation of collateral from multiple providers, improving the protocol's risk management, and moving towards a truly decentralized management of the protocol through DAOs.

These processes will be interesting to follow in 2025, so we encourage you to keep Usual on your radar in the new year.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.