How to Capitalize on the Crypto Bull Market in 2025

Key Insights

- During a crypto bull market, accumulating proven assets like BTC, ETH, and SOL through methods such as Dollar-Cost Averaging (DCA) can yield long-term value growth.

- Utilizing decentralized finance protocols for liquid staking or lending can boost returns on accumulated crypto assets, combining price appreciation with APR-based yields.

- Early-stage project participation and high-yield DeFi investments offer significant returns but carry higher risks, requiring careful evaluation and risk management.

According to numerous analyst forecasts and the expectations of crypto enthusiasts, the bullish trend in the cryptocurrency market is set to continue into 2025. This growth is anticipated to lead to significant price increases for crypto assets, enhanced profitability of investment strategies, and new opportunities for investors.

However, to succeed in a crypto bull market, it’s essential to follow a well-thought-out strategy, maintain proper risk management, and apply sound financial principles. The SimpleSwap team has compiled several tips to help you preserve and grow your crypto assets in the coming year, presenting strategies suitable for investors with varying risk tolerances and investment horizons.

Crypto Bull Run Basic Strategy: Accumulating Core Crypto Assets

This strategy is the simplest and easiest to implement during crypto bull market. It involves accumulatingfundamentally strong assets that have already proven their market resilience and are in demand among institutionaland retail investors. In addition to Bitcoin (BTC), assets like Ethereum (ETH), Solana (SOL), Avalanche (AVAX), XRP, and Near Protocol (NEAR) are considered reliable.

When implementing this accumulation strategy, chosen assets are purchased on the spot market and stored in wallets or exchange accounts.

Methods of Asset Purchase during Crypto Bull Market

Targeted Buy Zones

Identify price levels where you’re interested in buying a specific asset and act when the price approaches these zones. This method works well in an uptrend with occasional corrections, providing opportunities to buy during dips.

Dollar-Cost Averaging (DCA)

This popular investment strategy minimizes volatility risks by purchasing assets regularly for a fixed amount, regardless of the current price. You can choose the frequency of purchases, such as weekly or monthly. DCA is ideal for long-term investors with a low-risk profile.

By following these investment strategies, you’ll build a portfolio of core cryptocurrencies that can increase in valueduring a crypto bull market. However, be prepared for potential drawdowns during periods of high volatility or trend reversals, which may extend the investment horizon to a year or longer.

Enhancing Returns with DeFi on a Crypto Bull Run

To boost the profitability of your accumulation strategy, consider using purchased cryptocurrencies like ETH, BTC, or SOL in the decentralized finance (DeFi) sector.

Liquid Staking

Earn additional returns by staking assets in protocols like Lido Finance, offering an APR of 3% for ETH.

Lending Protocols

Lend assets through platforms like AAVE, which offers a 2.14% APR for ETH.

With these investment strategies, your total returns can include asset price growth plus the APR from DeFi protocols. This approach makes crypto assets comparable to dividend stocks, which offer price appreciation alongside dividend payouts. However, remember that DeFi carries additional risks, such as protocol reliability, smart contract vulnerabilities, and potential hacks.

Delta-Neutral Strategies

Delta-neutral strategies allow you to generate income regardless of market direction. These strategies depend on price stability for the underlying asset and involve hedging market exposure using derivatives like perpetual futures.

Hedging Positions

Open simultaneous positions on the spot and futures markets in opposite directions. The spot position acts as a long bet, while the futures position serves as a short bet. This creates a market-neutral position, where the asset's value remains unaffected by market fluctuations.

Earning Yields

Deposit the spot asset in DeFi protocols to generate returns while maintaining a hedged position.

For investors with substantial capital, opening market-neutral positions in the crypto market can serve as a standalone investment strategy. In the cryptocurrency futures market, funding rates are paid to maintain the price paritybetween futures and spot markets. Typically, holders of long positions pay funding fees to holders of short positions.

During periods of sustained asset growth, funding rates can reach significant levels, creating a lucrative source of income for short position holders.

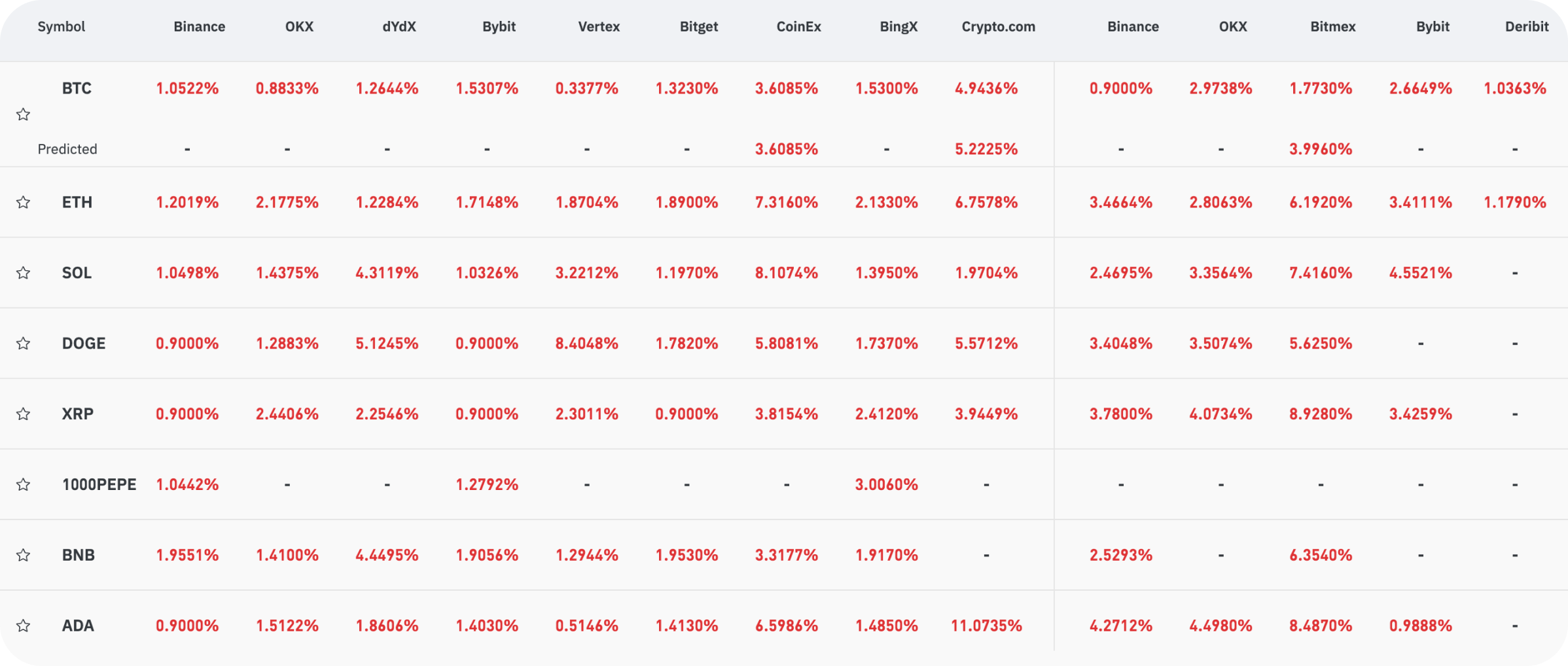

Funding rates on leading CEX over the last 30 days. Source: CoinGlass

Stablecoin Investment Strategies

Stablecoin strategies can be considered a subset of delta-neutral strategies. The price of stablecoins remains stable and is not subject to market volatility, allowing these strategies to forgo hedging mechanisms.

Earning Yield with Stablecoins

There are numerous DeFi protocols where you can deposit your stablecoins to earn yield. These protocols vary in terms of return rates and risk levels.

Newer protocols with lower Total Value Locked (TVL) may offer higher returns but come with increased risks.

Established DeFi projects tend to provide lower yields but are generally more reliable.

Current Opportunities in Stablecoin Yield

At present, the market offers interesting opportunities to earn yield on stablecoins in DeFi, with annual percentage rates (APRs) ranging from 15% to 30%. For instance:

The Save lending protocol on the Solana blockchain offers an annual yield of approximately 25% on the stablecoin USDS (previously DAI).

Another major protocol, Pendle, provides a fixed yield of 41% APR on the stablecoin USDO++ from the Usual protocol.

Tools for Monitoring Yield

To track stablecoin yield and other assets across various DeFi protocols, you can use services like DefiLlama, which aggregates data from numerous projects.

Airdrop Hunting and Non-Hedged Strategies

Participating in project activities to earn future token airdrops can be a highly profitable strategy, especially during a crypto bull market. The essence of this strategy lies in identifying early-stage projects that plan to launch their own tokens. These projects typically offer users various activities to participate in, such as:

Social campaigns

Liking posts, creating content, or completing quizzes.

Testnet participation

Engaging with the project during its testing phase.

Early deposits

Contributing assets to the project.

When depositing funds, users often accumulate project points — placeholder credits that are later converted into project tokens once the token is listed on exchanges. Returns from early asset placement in these protocols can be significant, often reaching 70-80% APR or more.

However, this investment strategy is not suited for conservative investors due to the difficulty in estimating exact APRs and timelines. Additionally, early-stage projects carry inherent risks, including:

Hacks and exploits

Dishonest project teams

Potential failure of the project

Non-Hedged DeFi Strategies

Another option during a crypto bull market is investing in DeFi projects with high APRs without employing hedging mechanisms. These strategies involve accepting the risk of asset price depreciation, which could result in negative returns.

A prominent example of this approach is investing in liquidity provider (LP) tokens of derivative DEXs. For instance, the LP token of Solana’s largest derivatives exchange, Jupiter (JLP), offers an APR of 43.4%. The yield is derived from:

Performance of a basket of assets (Including SOL, BTC, and ETH)

PnL of traders

Trading fees generated on the platform

While JLP demonstrates strong performance in a crypto bull market, prolonged bearish trends can significantly reduce its returns or even lead to losses.

We’d like to remind you that you can get any cryptocurrency for fiat or crypto on SimpleSwap.

Summary

We have reviewed several strategies for navigating the crypto bull market in 2025, each offering varying levels of profitability and risk. Some investment strategies deliver returns regardless of market direction, while others are tailored for a bullish trend.

A crucial part of investing is identifying your risk profile and selecting an investment strategy that aligns with your capital size and risk tolerance. It is important to remember that all investments carry the risk of loss. Given the volatile nature of crypto assets and the industry's relatively lower level of regulation compared to traditional investment instruments, the risks of loss are significantly higher.

Always conduct your own research and never risk more than you are prepared to lose.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.