ENS Technical Analysis

Key Insights

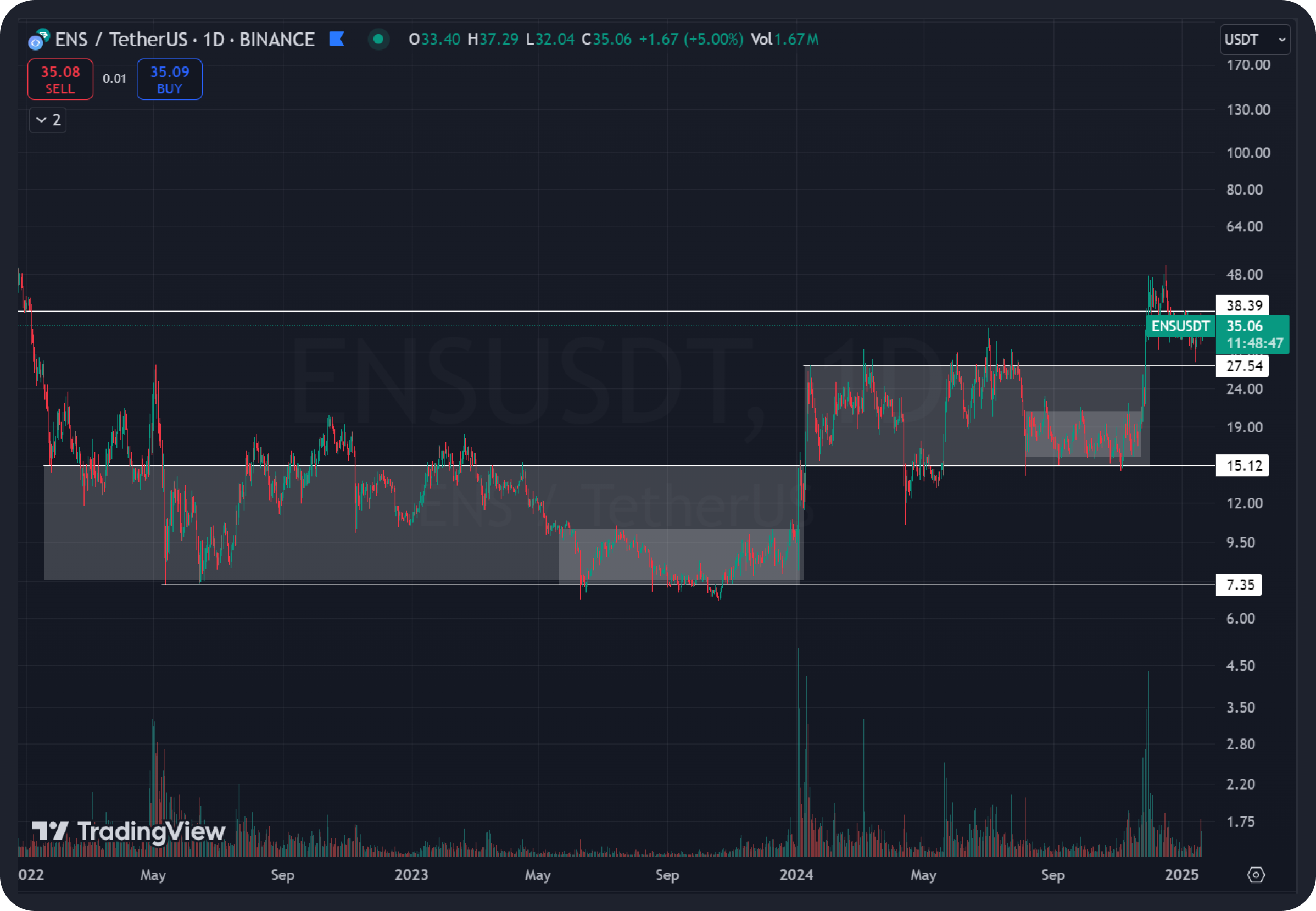

- Listing of ENS in November 2021 happened during the end of the bull market, and subsequent shift to the bear cycle resulted in a prolonged downtrend.

- Over the past three years, ENS has been primarily in a consolidation phase, which is marked by two accumulation zones.

- In the coming months, ENS is expected to experience moderate volatility, fluctuating between key levels of $27.54 and $38.4.

As of writing, Ethereum Name Service (ENS) ranks 87th on CoinMarketCap with a market capitalization of $1.24 billion.

ENS Tech Analysis

ENS started trading in the first half of November 2021 and immediately after listing reached its all-time high (ATH) at $120. However, the asset entered the market during the end of the bull cycle and transition to the bear cycle, which predetermined its weak dynamics.

As a result, a downtrend was formed, which lasted half a year, and the first significant support was found at $38.4. Further key support levels were $15.12 and $7.35, where the asset was able to stop the downtrend and move into a sideways phase, which can be considered as accumulation.

In October 2023, ENS reached an all-time low (ATL) at $6.66 after another false breakdown of $7.35. After that, the buyers became active, confirming the importance of $7.35 as a key support level and the asset showed strong growth, reaching $27.54.

ENS has been in a consolidation phase for three years, conditionally divided into two accumulation zones. In both of them, the exits outside the ranges for liquidity gathering were noted. This confirms the significance of the established boundaries and the validity of the previously identified levels. Exits outside of accumulation ranges are often used forliquidity harvesting.

The asset initially formed a trading range between the $15 and $7 levels. In the summer of 2024, after exiting this accumulation, the price moved into a new range of $15-$27. There were also narrow sideways movements within both accumulation zones, which are marked on the chart.

ENS Price Prediction

In November 2024, amid the general positive sentiment in the crypto market, ENS showed a powerful upward momentum, increasing by more than 200% and reaching the resistance level of $47.47. The growth was accompanied by a noticeable increase in trading volumes, indicating increased interest from investors and speculators.

However, after the growth the asset corrected, having broken down through the historical level of $38.4, which now acts as resistance. Buyers activated above the level of $27.54, which acts as a key support level.

Taking into account the ongoing accumulation phase and expectation of growth after its completion, moderate volatility between the levels of $27.54 and $38.4 is expected in the near term.

In case the buyers activate and the price returns above the level of $38.4, we can expect the continuation of the upward impulse with the nearest targets at the levels of $47.47.

If the asset goes to test the level of $27.54, we should expect a buyers' reaction and formation of a set-up for entry. The breakdown of $47.47 level may become the basis for long-term growth of the asset.

Users can get ENS or any other cryptrocurrency for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.