Ethena.fi: A New Generation DeFi Protocol

Key Insights

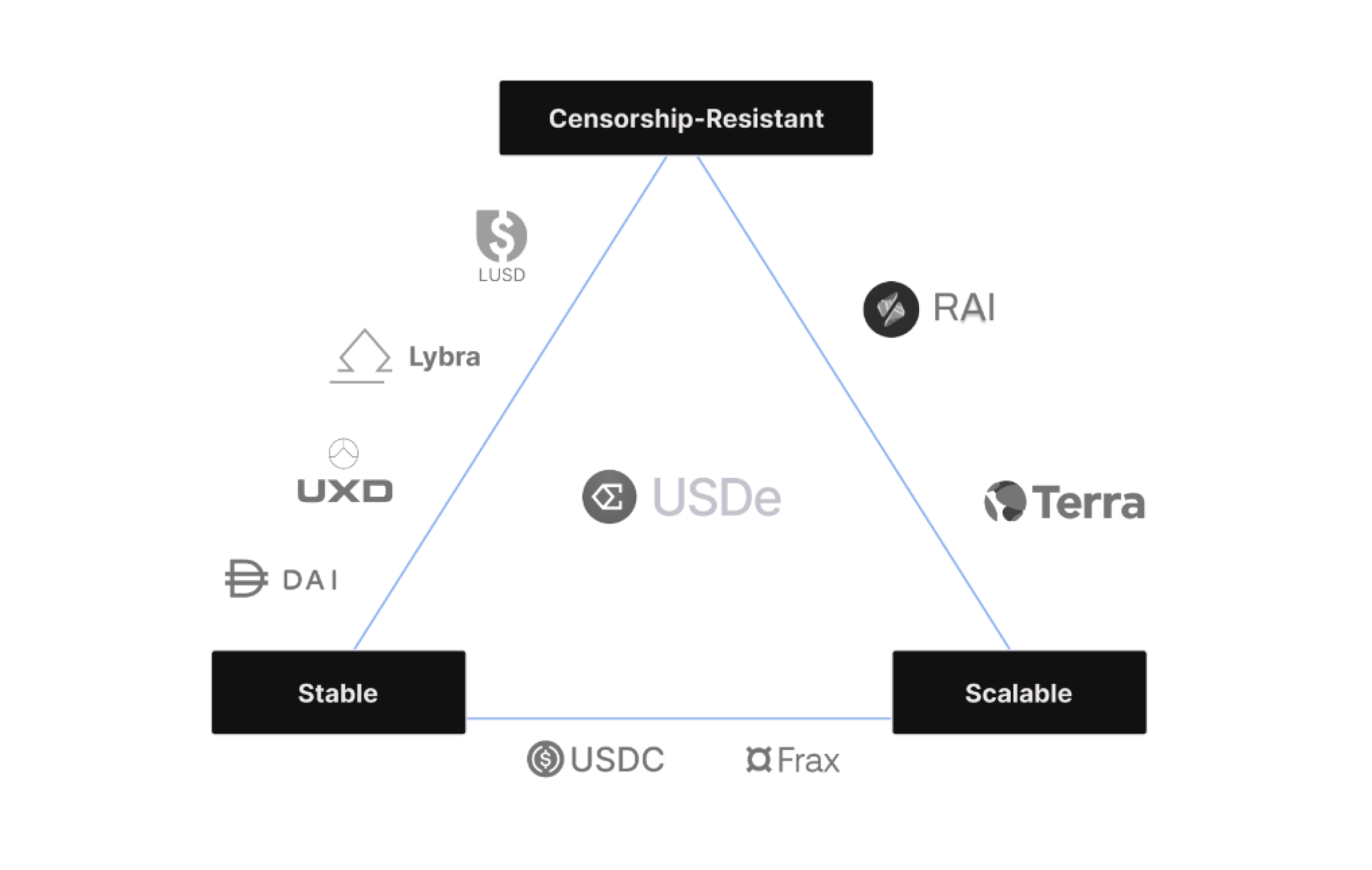

- Ethena introduces a groundbreaking approach to stablecoins with its synthetic USDe dollar, which operates independently of traditional fiat reserves and centralized financial systems.

- This DeFi protocol employs a unique stability mechanism for USDe, leveraging crypto assets and hedging strategies to maintain its value. This system ensures that USDe is backed by a 1:1 collateralization with other crypto assets, which are verifiable through smart contracts, providing transparency and trust.

- Despite its innovative approach, Ethena is transparent about the potential risks associated with its operations, such as funding, liquidation, custodial, and collateral risks.

What Is Ethena

Ethena solves the problems of traditional stablecoins, it is a next-generation DeFi protocol designed to create synthetic assets. Synthetic assets are tokenized instruments that mimic the value of real assets such as currency, gold, stocks or commodities. They allow users to access a variety of financial products, bypassing traditional intermediaries such as banks or brokers.

Ethena DeFi protocol focuses on creating a synthetic USDe dollar, which has a unique decentralized architecture and high reliability. Unlike traditional stablecoins such as USDT or USDC, USDe does not depend on fiat reserves, banking systems or centralized issuers, making it resistant to censorship and financial risks.

Ethena's main goal is to provide users with access to stable assets that can be easily used to store value, conduct transactions, or generate passive income through crypto staking. This solution opens up new opportunities for people around the world, especially those who face the limitations of the traditional financial system.

With the advancement of technology, Ethena DeFi protocol is making a significant contribution to the popularization of synthetic assets by offering innovative tools for wealth management and access to global financial markets.

Ethena DeFi protocol solves the main problems of traditional stablecoins:

Centralization

These assets are managed by centralized entities, dependent on banking infrastructure, and subject to regulatory intervention, making them vulnerable to blockchain funds.

Censorship risks

Users' assets have been known to be frozen by centralized issuers, depriving owners of full control over their funds.

In contrast, Ethena DeFi protocol offers an innovative solution, the USDe synthetic dollar, which:

Is independent of fiat reserves

Its stability is ensured by smart contracts and decentralized mechanisms, without the use of bank deposits.

Protects users

Funds cannot be frozen or confiscated, ensuring freedom of ownership and transactions.

Resistant to inflation

USDe remains stable even in the face of aggressive monetary policies of central banks.

Globally accessible

Anyone with internet access can easily exchange their crypto assets for USDe.

USDe Stability Mechanism

USDe is backed by assets from the market using hedging to maintain its stability.

Here's how it works:

Crypto assets are leveraged to create USDe, which are stored in a decentralized vault.

These assets are used to provide value to the tokens, creating stability for the USDe.

Hedging is used to issue USDe, protecting the assets from changes in value.

This is done by using a short position that compensates for fluctuations in the price of the asset. This strategy keeps the USDe stable even if the value of the underlying assets changes.

Issuing USDe requires 1:1 collateralization.

That means that the assets backing the token are always equivalent to the number of USDe issued. This ensures that each token has a strong collateralization.

All assets securing USDe are stored in smart contracts that are available for verification.

This provides transparency and assurance to users that the assets do support the value of the token, and it is possible to verify their availability and support at any time.

Statistics and Growth of the Ethena Crypto Protocol

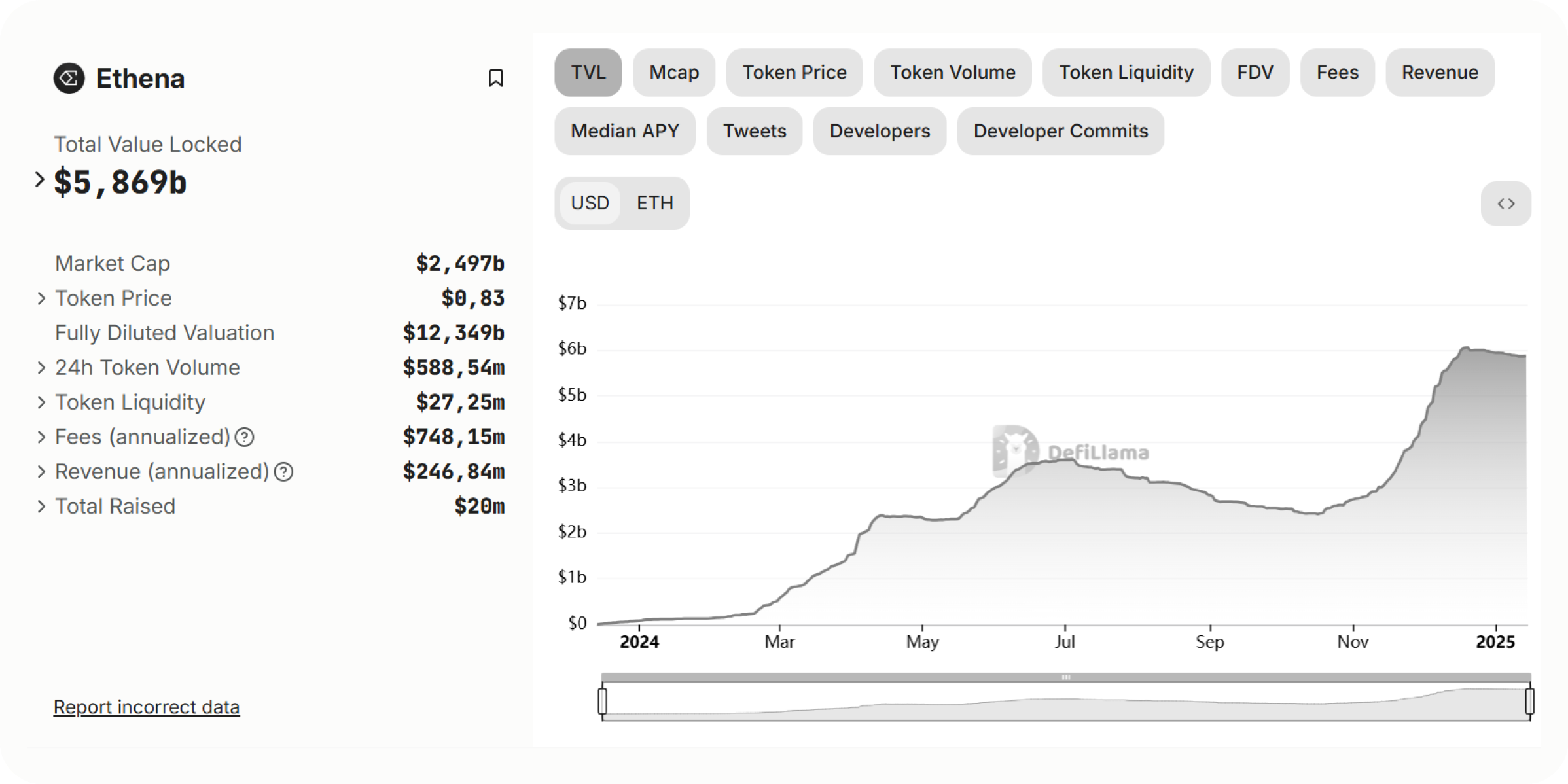

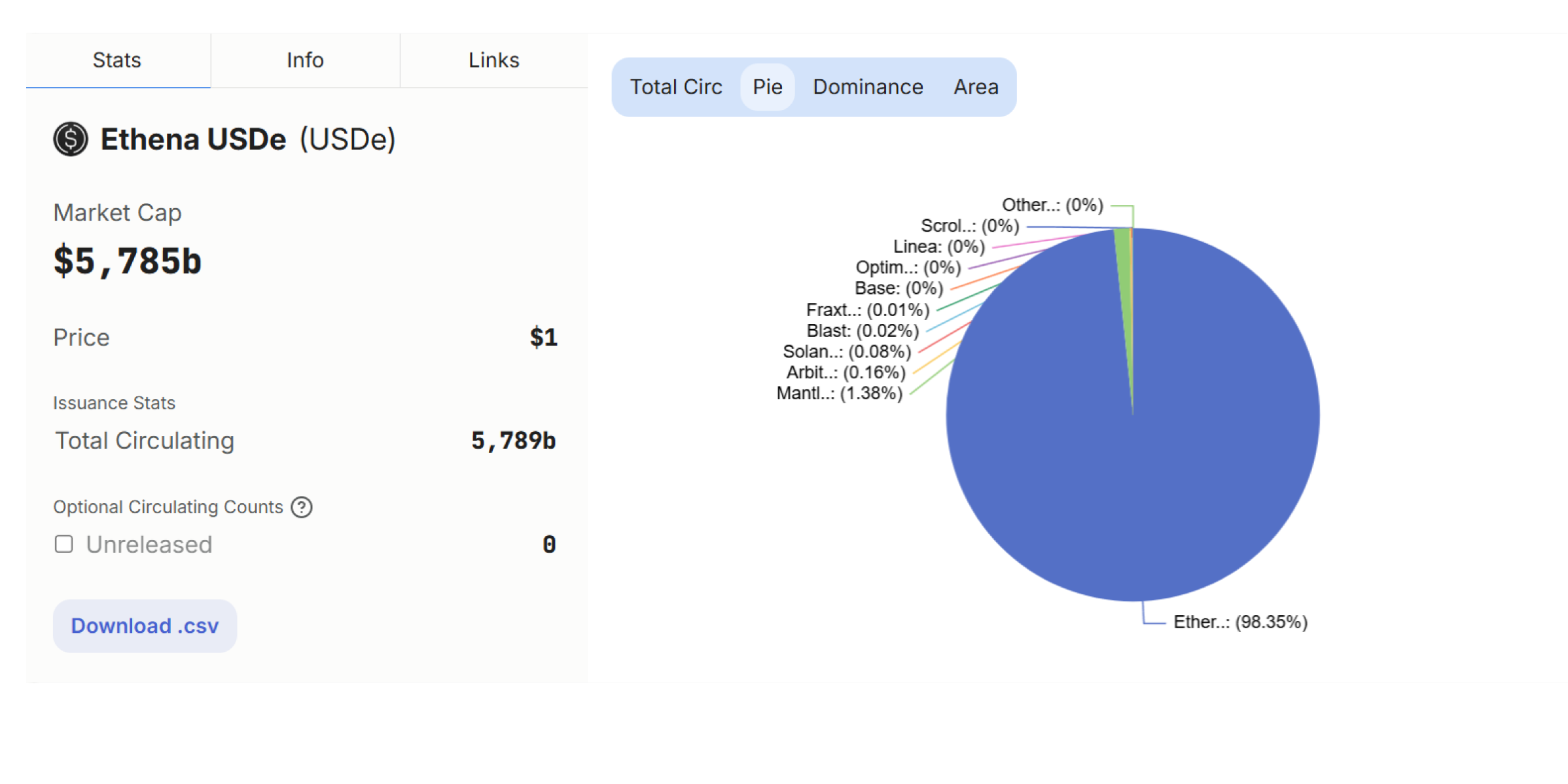

Ethena is showing impressive results. According to DeFiLlama data as of 1/14/2025, the protocol ranks 7th among all DeFi platforms in terms of Total Value Locked (TVL) at $5.8 billion.

This growth indicates a high level of trust from both the community and large investors.

The main asset used in the Ethena DeFi protocol is USDe. Users can earn up to 11% per annum by sending their USDe to the staking via the protocol's smart contracts.

How it works

You send USDe to the staking pool.

The protocol gives you sUSDe - bonds that confirm your stake in the staking pool.

Your sUSDe automatically increase in value through accrued income.

You can withdraw your funds along with interest at any time by exchanging sUSDe back to USDe.

This model not only provides a stable passive income, but also highlights Ethena's core value in combining decentralization, security and convenience.

Staking and Earnings on the Ethena Crypto Protocol

Ethena DeFi protocol currently offers users an annualized return of 11% on USDe asset deposits. This section provides a step-by-step guide to help you get started using Ethena and earn from crypto staking.

Exchanging Asset to USDe

Step 1

Go to the official website and click on the ENTER ETHENA button on the homepage.

Step 2

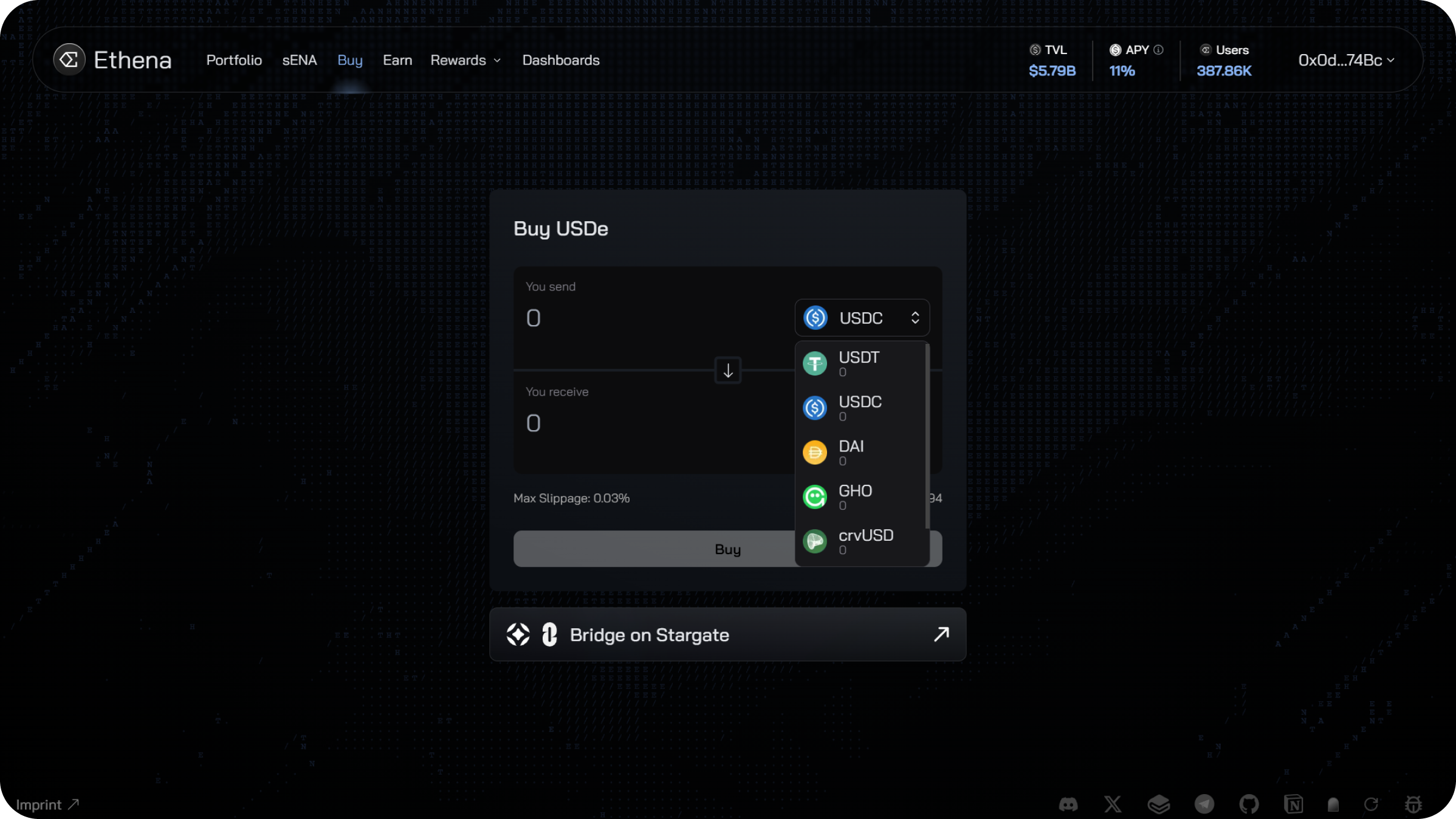

After navigating to the app on the USDe purchase page, connect your wallet. Make sure your wallet has assets supported for exchange, such as USDT, USDC and others. Ethena currently only supports the Ethereum network.

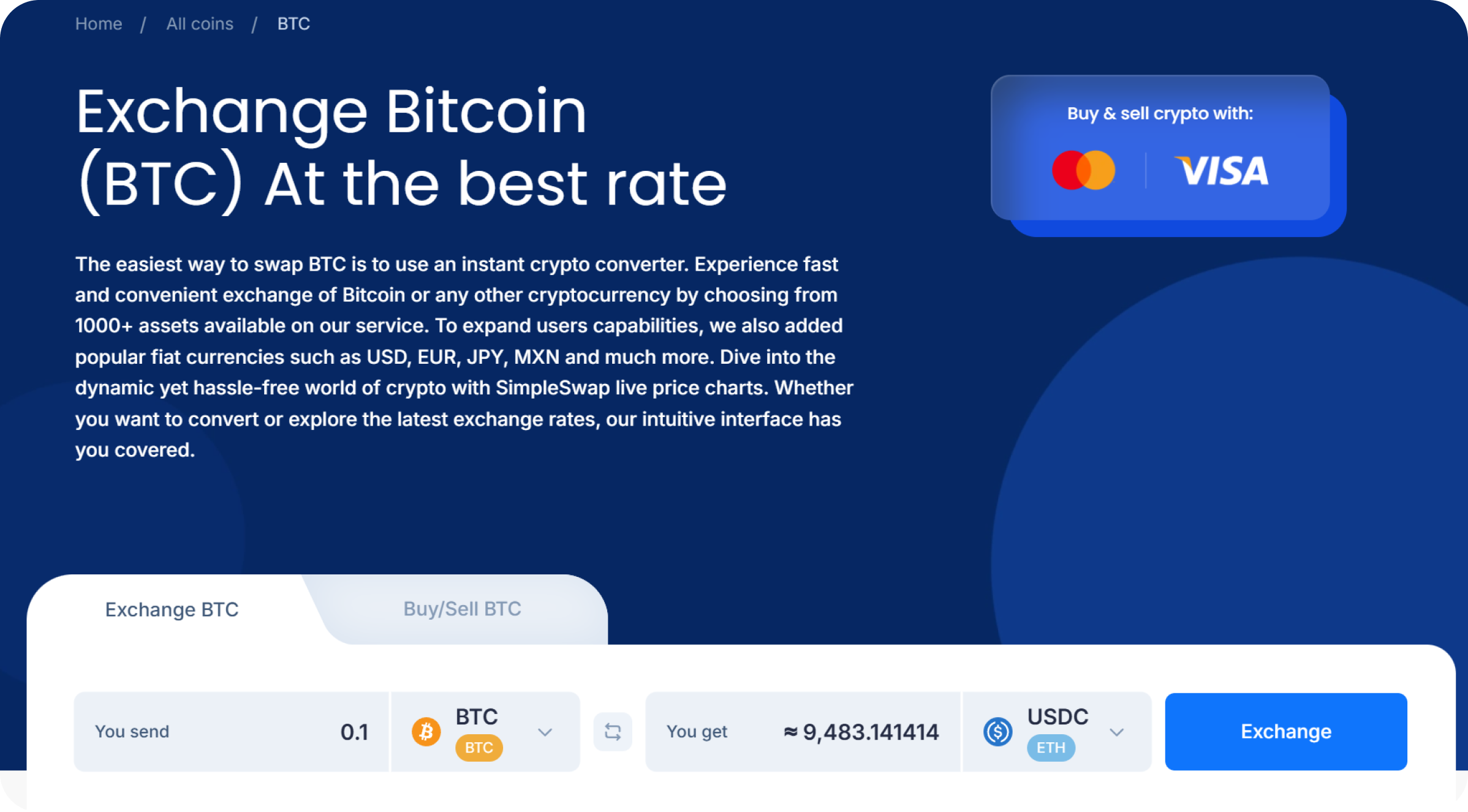

If your wallet does not have supported stablecoins on the Ethereum network, you can exchange assets through the SimpleSwap cross-network exchanger. For example, you can exchange BTC from the Bitcoin network for USDC on the Ethereum network.

Step 3

Specify the amount and select the asset you want to exchange for USDe, click Buy.

Step 4

Confirm the transaction in your wallet. After confirmation USDe will be transferred to your wallet.

Staking USDe on Ethena

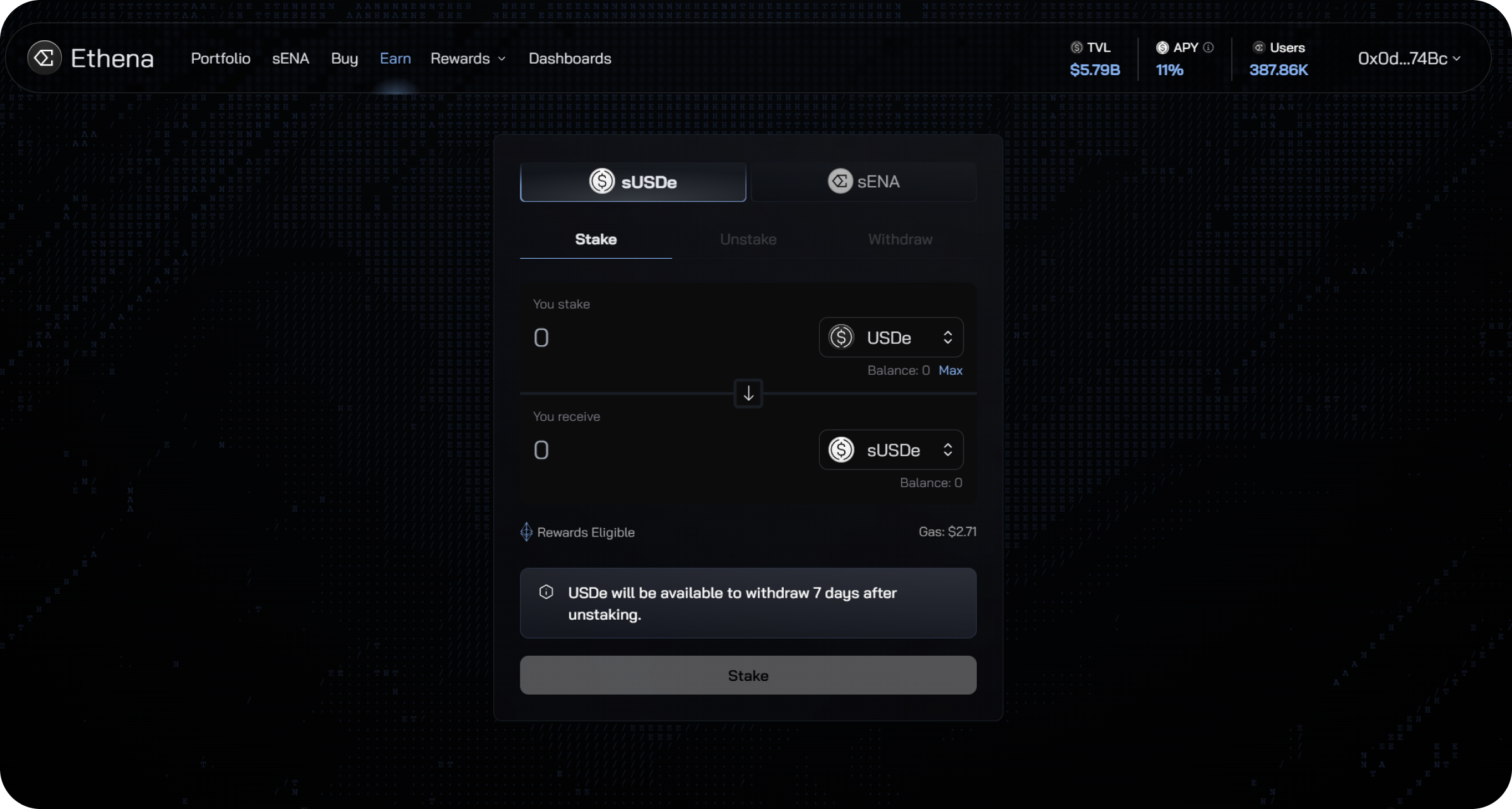

Go to the Earn section on the Ethena platform.

Specify the amount of USDe you want to send to stake and press Stake.

Confirm the transaction in your wallet.

After the transaction is completed you will receive sUSDe tokens to your wallet, this is a bond confirming your staking.

Important note: USDe will be available to withdraw 7 days after unstaking.

Benefits of Ethena Crypto Protocol

Unlike traditional stablecoins that rely on banks, Ethena crypto protocol takes a fully decentralized approach, giving users true independence.

All users who stake USDe qualify for airdrop rewards in the ENA token.

These airdrops can significantly increase your income, making staking on the platform more profitable and attractive.

Liquid staking with sUSDe bonds opens up additional earning opportunities as you can stake them in other protocols.

For example, Pendle Finance offers 20.58% APR for USDe and 18.99% APR for sUSDe staking.

Ethena is actively developing its ecosystem and there are currently many integrations with various DeFi protocols.

Risks Associated with USDe

Ethena is committed to maximum transparency and believes it is important to openly discuss the risks associated with the use of the USDe synthetic dollar. The following describes the main risks the protocol deals with, as well as measures to minimize them.

Funding Risk

Ethena uses derivatives to hedge the delta of the digital assets backing the protocol. This creates funding risk due to the possibility of negative funding rates that can temporarily reduce the protocol's returns.

However, historical data shows that such periods tend to be short-lived and are replaced by positive periods. Ethena regularly monitors rate trends and implements management strategies to minimize the impact of negative funding on the sustainability of the protocol.

Liquidation risk

Spot assets such as ETH and BTC are used to collateralize USDe, and 10% is collateralized by Ethereum asset staking (as of July 2024). This creates liquidation risk, which can occur when there is a significant difference between the asset price and the value of the derivative used for hedging.

Ethena reduces the likelihood of liquidation by using minimal leverage and conducting a thorough asset matching analysis. This DeFi protocol also ensures a low proportion of staking assets in the collateral mix, which further reduces risk.

Custodial risk

Ethena consciously avoids storing funds on centralized exchanges, using only proven solutions from trusted custodial providers. However, reliance on such providers comes with a risk to their operational reliability.

To minimize this risk, the Ethena crypto protocol selects only those companies whose business models are built on maximum asset security.

Risk of failure of exchanges

Protocol assets are never held on centralized exchanges, but protocol derivative positions are traded on them (e.g. Binance, Bybit, OKX). In the event of sudden exchange unavailability, there is a risk of exchanges failing.

Ethena minimizes this risk by using providers that provide off-exchange storage. This ensures that protocol assets remain protected even in the event of a sudden exchange unavailability.

Collateral risk

Ethena uses a portion of staking assets, such as stETH, to collateralize derivative positions. This creates collateral risk as the price of the asset used for collateral (such as stETH) may differ from the underlying derivative asset (ETH).

To minimize this risk, Ethena selects assets with high liquidity and minimal probability of depegging, and provides strict price deviation limits. Thanks to low leverage and strict standards, the probability of liquidation remains extremely low.

Summary

Ethena represents a revolutionary step in the world of DeFi, offering users stable assets that do not depend on fiat reserves or centralized issuers.

The DeFi protocol successfully solves the problems of traditional stablecoins by providing a decentralized, censorship and inflation-resistant alternative.

Liquid staking via sUSDe tokens provides stable income, and integration with other DeFi protocols opens up additional earning opportunities.

The level of trust, backed by a high TVL and community support, proves that Ethena has already taken a meaningful place in the DeFi ecosystem.

With its global accessibility, ease of use and attractive user experience, Ethena is well positioned to become the new standard in synthetic assets.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.