Ether.fi: An Innovative Delegated Staking DeFi Protocol

Key Insights

- Etherfi revolutionizes Ethereum staking security by implementing a unique validator key management system, where users maintain complete control over their validator keys while still enabling delegation through encrypted IPFS storage and ECIES technology, fundamentally differentiating it from traditional staking protocols.

- Collaboration with EigenLayer enables stakers to repurpose their staked ETH to support additional services like rollups and oracles, thereby diversifying and increasing potential revenue streams beyond traditional staking rewards.

- Beyond basic staking functionality, Etherfi creates a comprehensive DeFi ecosystem where users can leverage their staked assets (eETH/weETH) across multiple revenue streams - from automated Liquid Vaults managed by Seven Seas to EigenLayer restaking opportunities and even real-world spending through their crypto-native credit card system.

Etherfi is a decentralized, non-castodial delegated staking protocol with a Liquid Staking (LST) token. A key feature of Etherfi is that stakers retain full control over their keys, making the protocol more secure and transparent.

One of the unique features of Etherfi is the mechanism that allows the creation of a market for node-based services. In this marketplace, stakers and node operators can interact to register nodes, provide infrastructure services, and optimize revenue.

In addition, Etherfi is integrated with EigenLayer, one of the most innovative platforms in the Ethereum ecosystem. EigenLayer opens up new opportunities for staking by repurposing already staked ETH to support third-party systemssuch as rollups, oracles or other infrastructure solutions. This significantly increases revenue for stakers while improving the economic security of the entire Ethereum network.

Etherfi Protocol Products

Etherfi DeFi Crypto Protocol: Stake

Staking on Etherfi

On the Etherfi platform, users can stake their ETH or stETH to earn income from staking. In return, they receive eETH or weETH tokens. These tokens can be used in various DeFi protocols for additional strategies such as securing loans, participating in yield farms or trading on DEX. In this way, staking on Etherfi combines stable income with the ability to flexibly utilize assets in the DeFi ecosystem.

Restaking on Etherfi

eETH and weETH from Etherfi are native tokens that support restaking and allow users to generate income from staking and additional protocol-level features. Unlike other liquid restaking solutions such as stETH, which require an asset lock-in and a 7-day withdrawal period, eETH and weETH provide liquidity and the ability to move tokens to DeFi without delay. Users are rewarded for both staking and restaking at the protocol level.

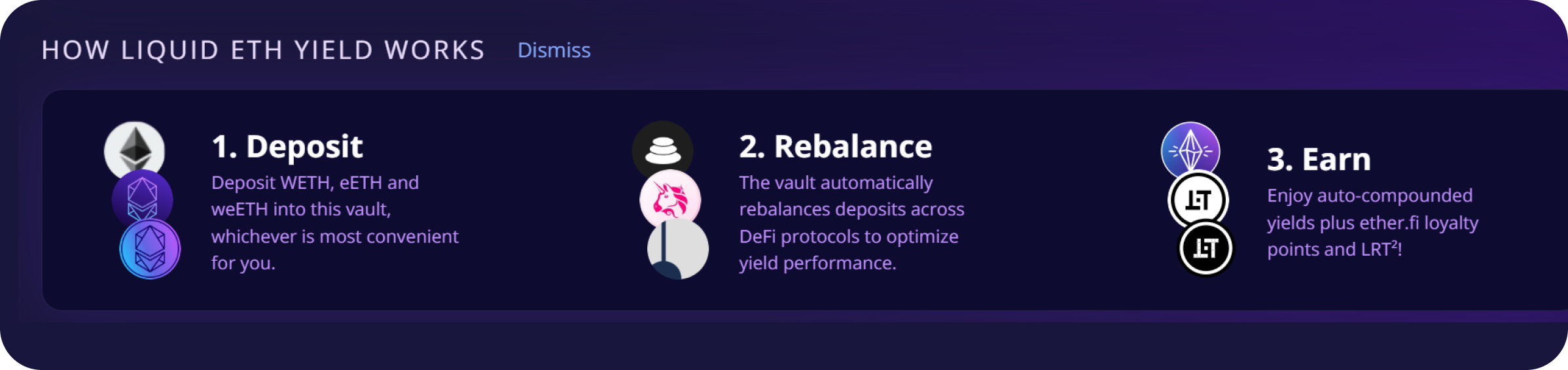

Etherfi DFi Crypto Protocol: Liquid

Liquid Vaults are automated strategies in DeFi that allow users to easily leverage their tokens in the DeFi ecosystem. Contributed funds are automatically allocated to different positions, making it easy to participate in DeFi.

In the future, as the ecosystem grows, more integrations will be added to stay competitive in the market. Strategies for these vaults are being developed by Seven Seas, one of DeFi's leading teams, providing liquidity through DEX and leverage. You can contribute eETH, weETH or other assets for maximum convenience. Vaults will find yield through the best protocols at DeFi.

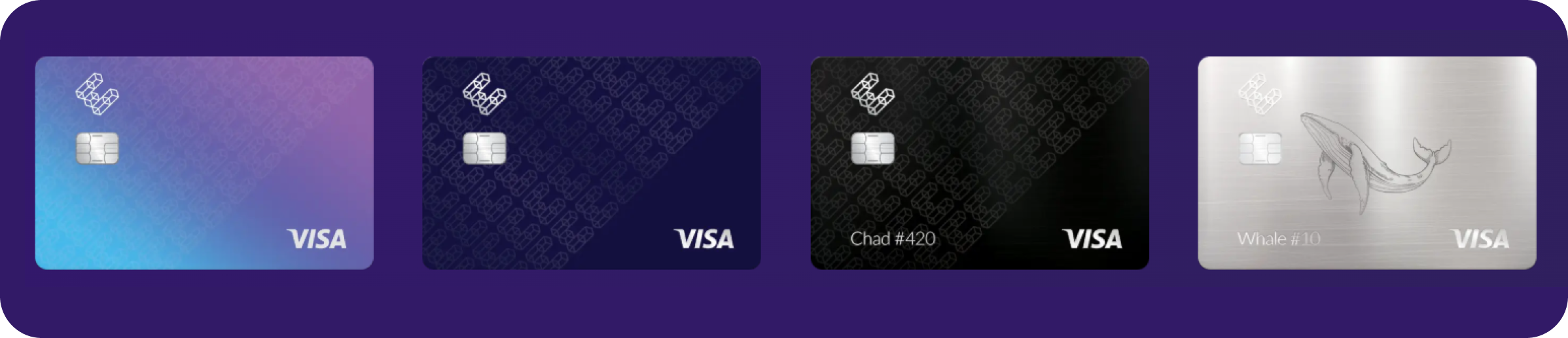

Etherfi DeFi Crypto Protocol: Cash

Cash is a crypto-native credit card that allows users to borrow and spend from their Etherfi balance in the real world, including purchases and bookings. Through a mobile app linked to an Etherfi account , users can top up their Visa cardand use the cryptocurrency for real-world spending, earning cashback and other rewards. This project is currently in beta state.

Technological Innovation of Etherfi

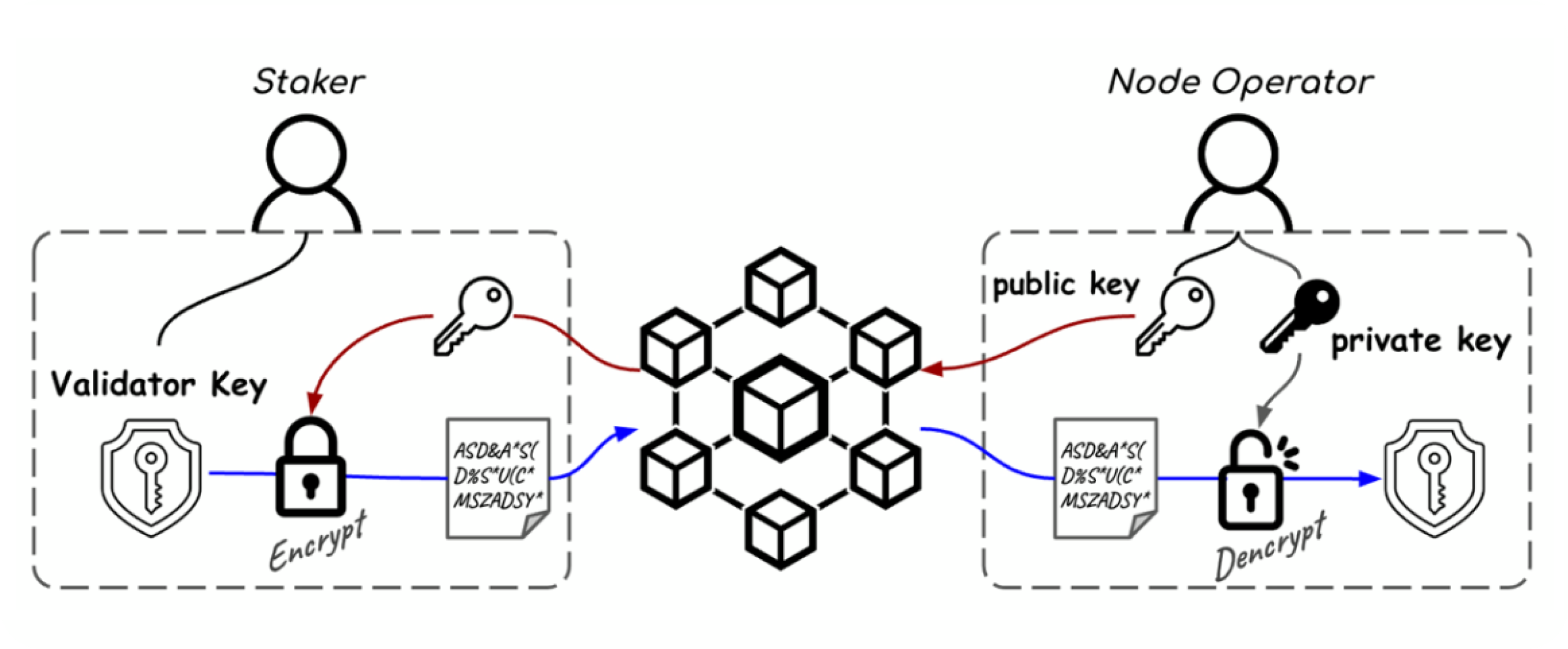

Etherfi is a delegated staking protocol that differs from Lido, Rocket Pool, etc. in that it gives stakers full control over their validator keys. These keys are necessary and sufficient to trigger the output of validator nodes.

In order for a node operator to run a validator node on behalf of a staker, it must have access to the validator keys of the staker. That is, the validator keys generated by the stakers must be provided to the corresponding node operator. However, if validator keys are compromised, validator nodes are subject to slash attacks and potential losses.

Etherfi uses a system to securely exchange validator keys between validator stakers and node operators using ECIES. In this process, the stakers generate validator keys that are encrypted using the public keys of the node operators. Theseencrypted keys are stored in IPFS and hashes are loaded into the chain for additional security. Node operators can decrypt the keys using their private keys to run validator nodes. The diagram below shows the secure exchange of validator keys from a staker to a node operator.

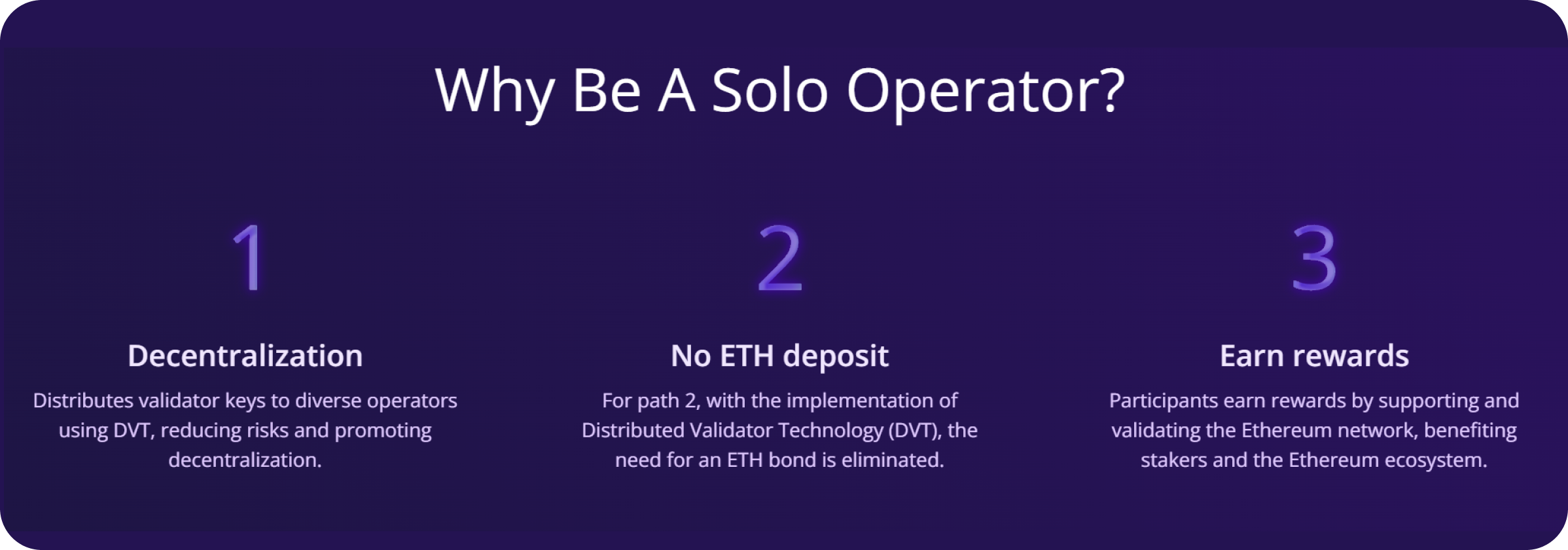

Etherfi Solo Stakers and Expansion of the Ethereum Decentralization

Ethereum continues to face the challenge of centralization as the majority of nodes are concentrated in the US, including large data centers. The main barriers to starting a node remain a minimum deposit of 32 ETH and the complexity of setting up hardware, causing users to often opt for centralized solutions such as Lido.

Etherfi removes these barriers by allowing users to run their own nodes and retain full control over validator keys. The Operation Solo Staker program invites everyone to contribute to the decentralization of Ethereum.

The main aspects of this program are as follows.

There is no need for 32 ETH

Etherfi uses participant deposits to create validators. Every 32 ETH generates a new validator key that is distributed to node operators, including solo stakers. This makes participation available to more users.

Affordable equipment

Etherfi offers long-term equipment payment plans funded by staking rewards, lowering the financial threshold for running nodes.

Simple node setup

Participants start with a test network (testnet) where they go through equipment setup. After successful testing, they receive keys for the main network and begin validating blocks.

This program reduces dependency on large operators by increasing the number of independent nodes, which strengthens decentralization and network resilience.

Staking and Earning on Etherfi

Staking on Etherfi

If you want to participate in the Etherfi protocol and earn extra income, follow these steps:

Step 1

Go to the official website and click STAKE.

Step 2

Connect your wallet (e.g. MetaMask). Make sure your wallet has supported assets such as ETH, stETH or others for restaking. The protocol supports the Ethereum network and several Layer 2 solutions such as Base, Linea, Scroll, and Blast. If necessary, exchange assets through the SimpleSwap cross-network exchanger.

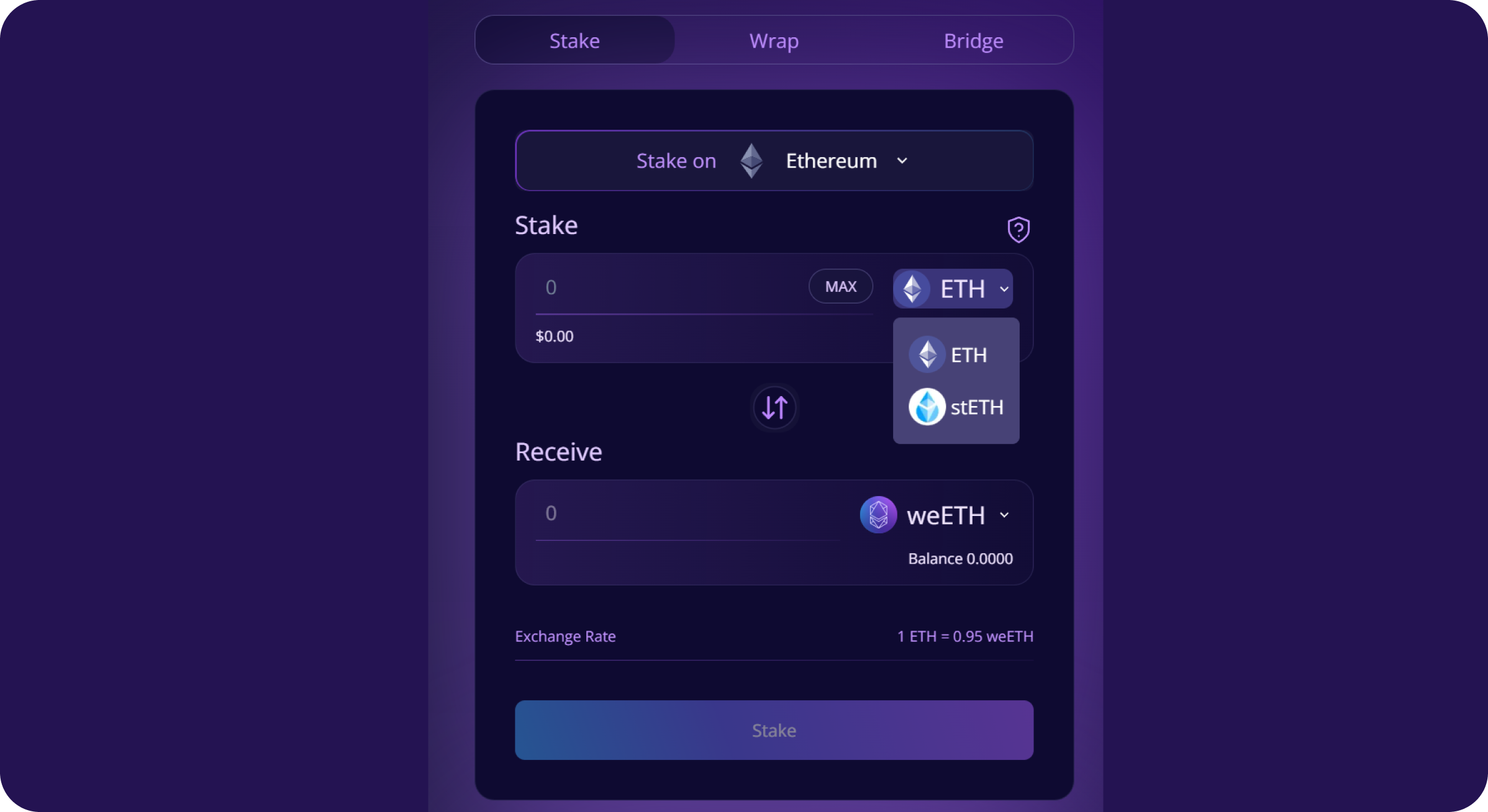

Step 3

Select the network in the Stake on section, specify the amount and the asset you want to send to staking (ETH or stETH for the Ethereum network). After that, select the asset to receive (eETH or weETH) and click Stake.

Step 4

Confirm the transaction in your wallet. After that, your wallet will receive eETH or weETH, which confirms your right to the staked assets. These assets can be used in various DeFi protocols.

Liquidity Provision on Etherfi

Step 1

Go to the official website and click on STAKE.

Step 2

Select the Liquid section at the top of the site.

Step 3

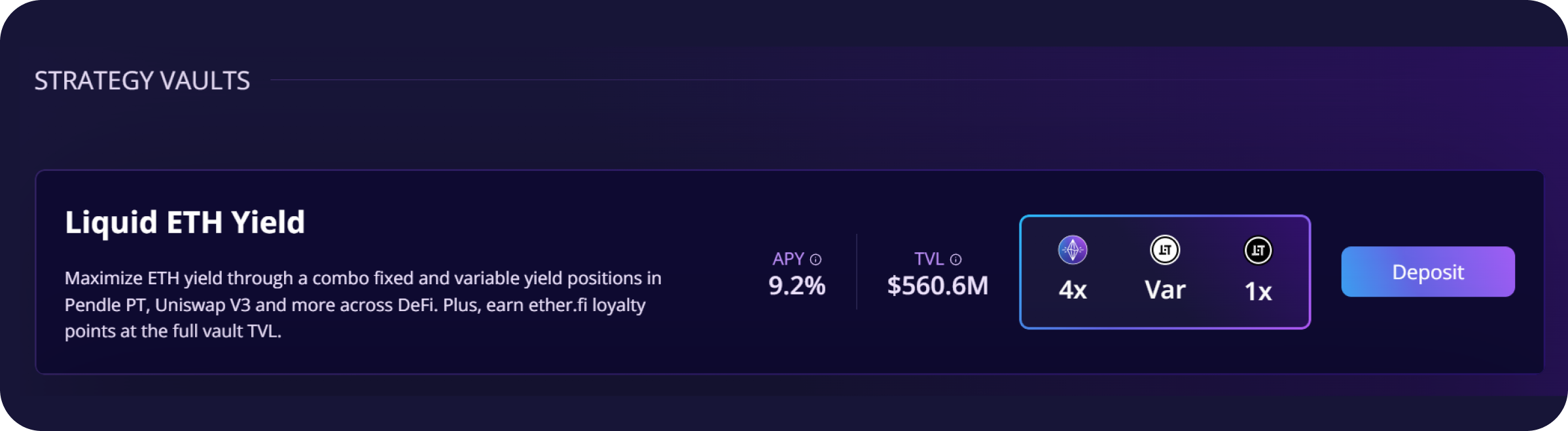

Scroll down to the STRATEGY VAULTS section, select Liquid ETH Yield and click the Deposit button.

Step 4

In the dashboard that opens, in the YOUR PERFORMANCE section, click Deposit, select an asset (WETH, eETH or weETH) to deposit, enter the amount and confirm the transaction.

Assets are converted to weETH and automatically deposited into the DeFi basket, generating variable returns. The custodian periodically rebalances positions to maximize returns while adhering to risk policies. Rewards earned on positions are traded for more weETH and are reallocated across strategies.

Etherfi Crypto Protocol: Risks

Every project that strives to provide a high level of trust and security is thoroughly audited by leading experts in blockchain technology. Etherfi has undergone thorough audits with recognized security leaders such as Omniscia, Nethermind, Solidified, Certik and Hats Finance. These organizations have conducted a comprehensive review of the system's code and architecture, which confirms a high level of reliability and a commitment to minimizing risk. All audit results are open and available for review.

Nevertheless, it is important to remember that 100% security is impossible. The project actively shares information about the measures taken to minimize risks and strives to protect users, but the ultimate responsibility lies with the stakers themselves.

Summary

The Etherfi protocol is an innovative solution for delegated staking on the Ethereum network, where security, decentralization and transparency come to the forefront.

By giving stakers full control over their validator keys, Etherfi overcomes the limitations of traditional staking protocols such as Lido, Rocket Pool.

Integration with EigenLayer and the availability of products such as Liquid Vaults opens up new opportunities for users to not only participate in staking, but also generate additional revenue through flexible DeFi strategies.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.