Hyperliquid Overview

Key Insights

- Hyperliquid L1, powered by the HyperBFT consensus algorithm, delivers ultra-low latency (0.2-0.9 seconds) and processes up to 100,000 orders per second, making it ideal for derivatives trading.

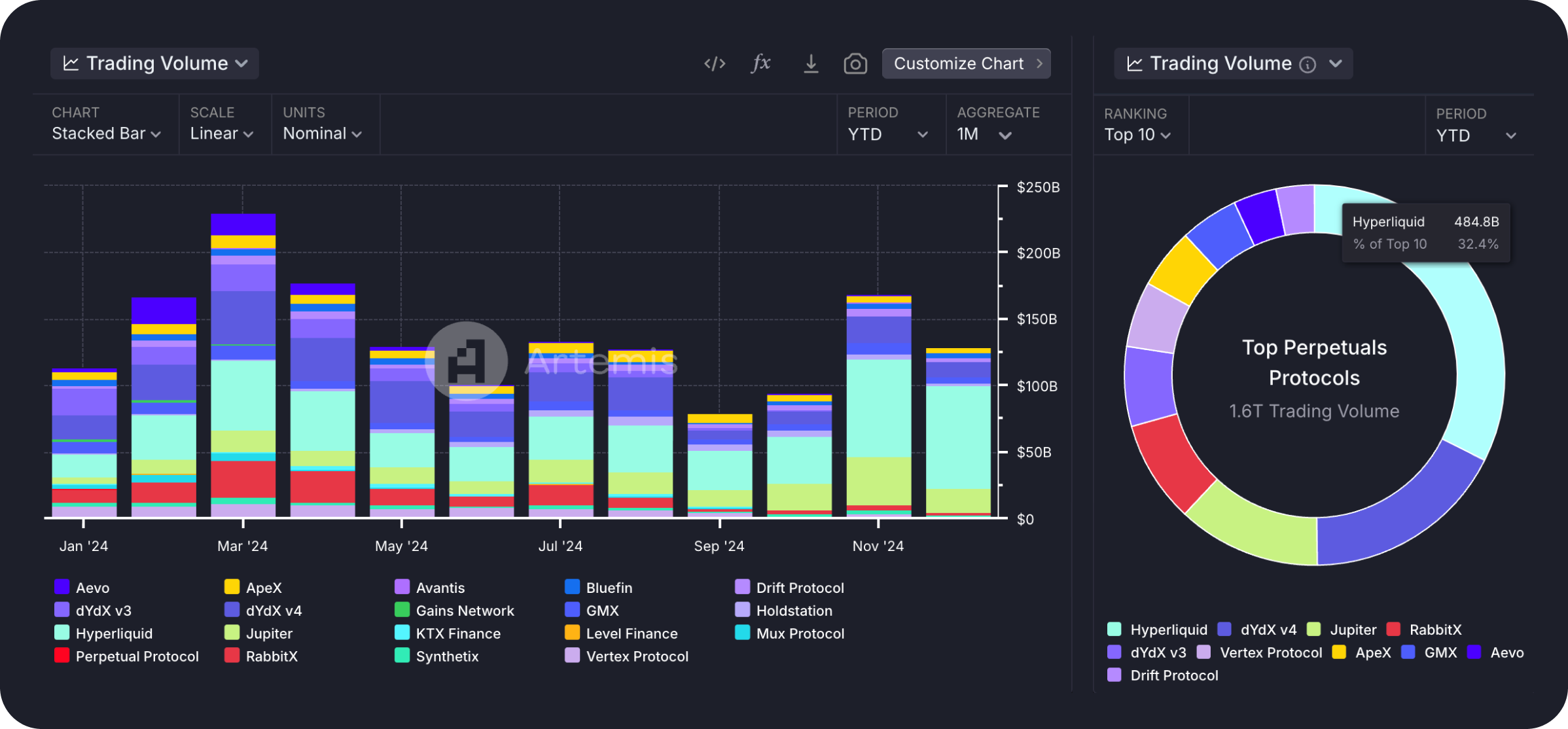

- Hyperliquid's decentralized derivatives exchange, with an on-chain order book, captured 32.4% of the trading volume across all derivatives DEX platforms in 2024, achieving $77.7 billion in December trading volume alone.

- Beyond its flagship DEX, Hyperliquid is expanding its ecosystem with projects like HyperLend, HyperSwap, and Kinetiq, positioning itself as a leading blockchain for DeFi innovation.

Hyperliquid is an L1 blockchain operating on its proprietary consensus algorithm, HyperBFT. It powers a new financial system where all user actions occur on-chain, ensuring security and transparency. A cornerstone of the Hyperliquid ecosystem is its fully decentralized derivatives exchange, built on an on-chain order book.

As of now, Hyperliquid holds a dominant position in the derivatives DEX sector, boasting a trading volume of $77.7 billion in December — four times that of its nearest competitor. Since the beginning of the year, Hyperliquid has accounted for 32.4% of all trading volume across derivatives DEX platforms.

Hyperliquid L1: Optimized Blockchain for Derivatives Trading

Unlike general-purpose blockchains, Hyperliquid L1 is specifically optimized for its flagship application — a high-performance derivatives DEX. It employs the HyperBFT consensus algorithm, which minimizes latency for sending requests and receiving blockchain responses. HyperBFT's latency ranges from a median of 0.2 seconds to 0.9 seconds, enabling near-instantaneous order execution without delays or significant slippage.

Currently, Hyperliquid L1 can handle up to 100,000 orders per second, making it one of the fastest L1 solutions available.

Oracle Mechanism in Hyperliquid

A vital component of the Hyperliquid derivatives DEX is its oracle system. Oracles fetch cryptocurrency price data from external sources to support exchange operations and provide market prices for trading. Hyperliquid validatorsare responsible for this process, publishing spot prices for each derivative contract every three seconds.

The oracle price is crucial for calculating funding rates on futures contracts. Validators determine spot prices as the weighted median price from exchanges such as Binance, OKX, Bybit, Kraken, Kucoin, Gate IO, MEXC, and Hyperliquid. These prices are then used by the Clearinghouse to calculate the final weighted median value, ensuring accuracy and transparency.

Clearinghouse: Backbone of Hyperliquid’s Trading System

The Clearinghouse in Hyperliquid plays a key role in managing the margin balances of each address, which include both balances and open positions. By default, all positions on Hyperliquid operate under a cross-margin mode, but users can opt for isolated margin to reduce liquidation risks for specific positions.

In the spot market, the Clearinghouse also manages user assets, including balances and purchased assets.

Hyperliquid On-Chain Order Book: Efficiency and Transparency

Hyperliquid provides an on-chain order book for each asset, functioning similarly to centralized exchanges. Orders are prioritized by price and time. All positions and trading margins are managed by the Clearinghouse, which verifies margin requirements when opening and executing orders.

This system ensures efficient management of margin positions, even with price fluctuations derived from oracle data during order execution.

Hyperliquid Improvement Proposals (HIPs)

In addition to its L1 blockchain optimized for derivatives trading, Hyperliquid develops other innovative solutions, such as its proprietary token standard and native liquidity mechanisms.

HIP-1: Token Standard for On-Chain Order Books

HIP-1 introduces a fungible token standard that supports interoperability with on-chain order books. Users can launch HIP-1 tokens on the Hyperliquid blockchain and create spot order books for trading them on Hyperliquid DEX. The first token under the HIP-1 standard launched on Hyperliquid’s spot market is the meme token Hypurr (PURR), currently valued at $312 million.

HIP-2: Liquidity for Early-Stage Tokens

Hyperliquid addresses liquidity for HIP-1 tokens in the early stages of price discovery through HIP-2. This system continuously allocates liquidity to HIP-1 tokens on the spot market and integrates it with user-provided liquidity in order books.

HIP-2 is a fully decentralized, on-chain strategy that maintains a 0.3% spread for trading pairs every three seconds. Unlike smart contract-based pools on general-purpose blockchains, Hyperliquidity does not require user transactions for maintenance. Active liquidity providers can join at any time, enabling markets to adapt to growing liquidity demands.

Features of Hyperliquid

The flagship product of the Hyperliquid ecosystem is its derivatives DEX, designed to rival top centralized exchanges (CEXs) like Binance. Hyperliquid offers a wide range of cryptocurrency futures contracts with up to 20x leverage.

Traders can place market and limit orders, set stop-loss and take-profit conditions, and use the TWAP (Time-Weighted Average Price) strategy for token purchases. The interface closely resembles that of leading CEXs, and near-instant order execution makes it an attractive alternative for traders.

Vault Strategies on Hyperliquid DEX

Hyperliquid DEX also features vaults, which implement various trading strategies created by market participants or the Hyperliquid team. For instance, the Hyperliquidity Provider (HLP) vault uses a market-making strategy for Hyperliquid assets, currently yielding a 36% APR. Anyone can participate in the HLP vault or other vaults with different strategies.

HYPE Token: The Native Asset of Hyperliquid

The HYPE token is Hyperliquid’s native cryptocurrency, used to pay transaction fees within HyperEVM. With a total supply of 1 billion tokens, 76.2% are allocated to the community, while 6% is reserved for the Hyper Foundation budget.

The token generation event (TGE) took place on November 29, with 310 million HYPE token distributed as a retroactive airdrop to active protocol participants. Valued at $7.9 billion at the time of distribution, this airdrop is one of the largest in crypto history.

Since its launch, HYPE token has surged by 616%, making it one of 2024’s most successful token listings. Notably, the listing avoided centralized exchanges, investor allocations, and token vesting, marking a unique milestone in the crypto world.

The Expanding Hyperliquid Ecosystem

Beyond its derivatives DEX, the Hyperliquid blockchain supports a growing ecosystem of projects spanning various financial protocols.

Key Ecosystem Components

HyperLend

A lending protocol aiming to become the primary money market platform in the Hyperliquid ecosystem, offering credit and passive income opportunities.

HyperSwap

A native DEX built on Automated Market Maker (AMM) and Dynamic Liquidity Market Maker (DLMM)technologies.

Kinetiq

A liquid staking protocol designed to enhance the blockchain’s security, decentralization, and performance.

Hyperliquid Names

A protocol for creating, exchanging, and managing tokenized names on the Hyperliquid blockchain, simplifying counterparty interactions.

stHype

Another liquid staking solution within the Hyperliquid ecosystem.

We’d like to remind you that you can get any cryptocurrency for fiat or crypto on SimpleSwap.

Summary

Hyperliquid is a rapidly evolving ecosystem with its flagship derivatives DEX emerging as a leader in its segment just one year after launch. Features such as fast transaction execution, a user-friendly interface, and mechanisms for launching and ensuring liquidity for proprietary token standards make Hyperliquid a strong competitor to leading CEXs.

The development of DeFi protocols within the Hyperliquid ecosystem sets the foundation for a comprehensive financial system built on the Hyperliquid L1 blockchain.

As interest in DeFi grows and more users enter the crypto space, Hyperliquid is poised for significant growth in 2025. It is undoubtedly a project worth watching closely.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.