Staking at 200% APR Using Usual and Hyperliquid

Key Insights

- The article outlines an approach combining Usual crypto platform (a decentralized stablecoin platform with $1.55B TVL) and Hyperliquid crypto protocol (a specialized Layer 1 blockchain) to achieve potential returns of up to 200% APR through a coordinated staking and hedging strategy.

- The hedging is conducted through opening a short position in futures, which is critical to protect the staker from potential downturns in the market value of the Usual token, while the details provided suggest that effective hedging requires careful monitoring of margin levels.

- The explanation on how to engage with the Usual platform for staking highlights the practical steps involved, from buying the tokens to selecting and confirming staking options, which is vital for investors looking to exploit the earning potential reaching up to 200% APR.

This instruction will help you generate yield on Usual token staking using a hedging strategy to minimize risks. We will cover the process of buying a token, opening a short position in futures using Hyperliquid, and placing tokens into staking. Note that dealing with futures requires careful margin control to avoid liquidating the position.

As we will deal with Usual crypto platform and Hyperliquid crypto protocol below, let’s first get to know both.

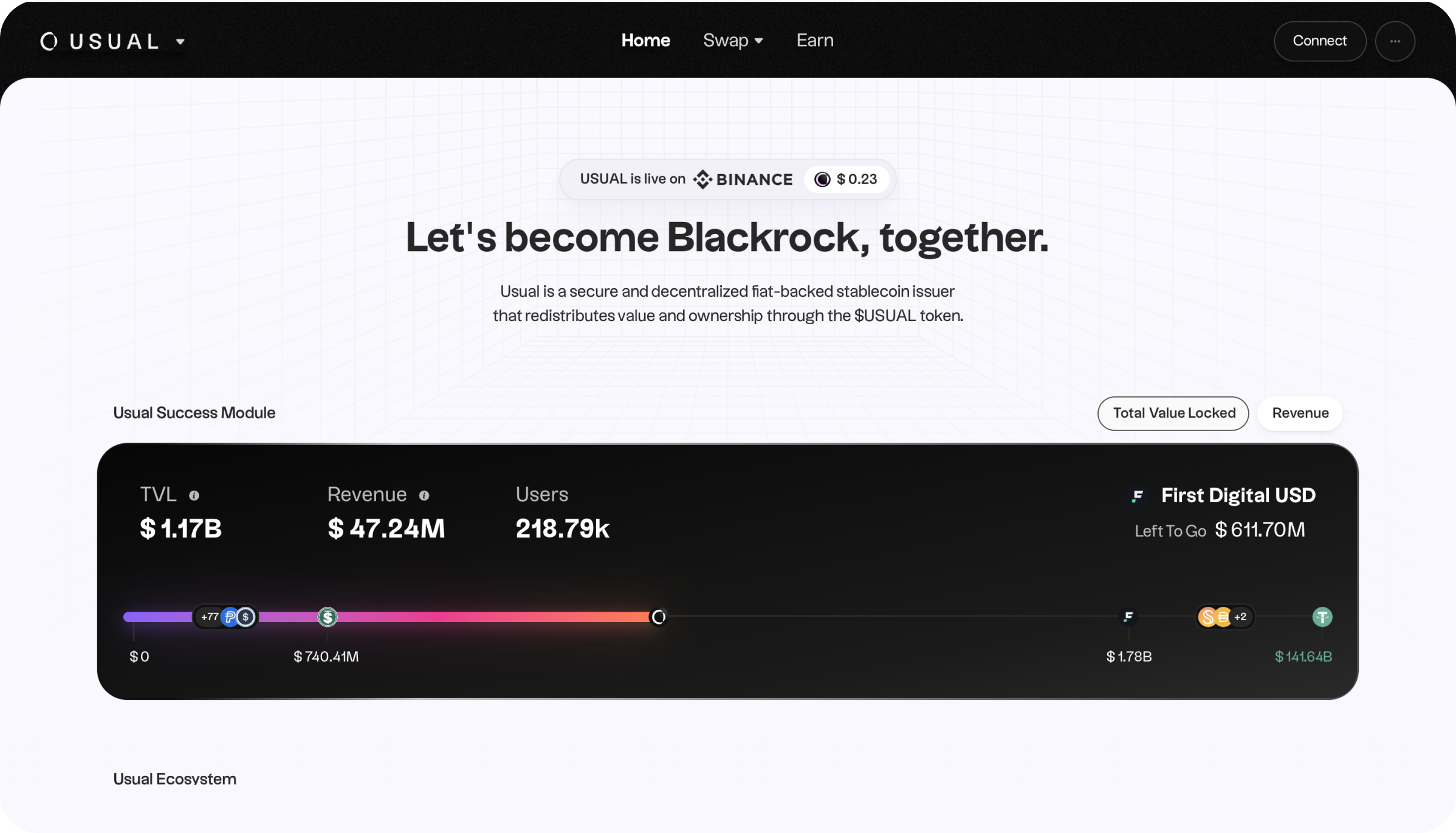

Usual Crypto Platform

Launched in 2024, Usual represents an emerging player in the cryptocurrency space with its novel fiat stablecoin backed by real world assets. The project positions itself as an alternative to Tether, the dominant USDT issuer, with a key distinguishing feature being its focus on building a completely decentralized framework for stablecoin issuance and administration.

This governance structure of the Usual crypto platform operates directly on the blockchain through the platform's native USUAL token, which empowers holders with decision-making authority.

The Usual crypto protocol has achieved significant metrics, with its Total Value Locked (TVL) reaching $1.55B and its USDO stablecoin achieving a market value of $1.88B, securing its position as the seventh-ranked stablecoin in the cryptocurrency ecosystem.

The project differentiates itself from major fiat stablecoin providers by avoiding traditional banking intermediaries for collateral storage, thus minimizing exposure to conventional financial system risks. Instead, Usual implements an innovative model where real world assets serve as direct collateral without bank intermediation.

Furthermore, the protocol emphasizes community empowerment by transferring control of its infrastructure, treasury management, and protocol governance to USUAL token holders, reinforcing its commitment to true decentralization.

Hyperliquid Crypto Protocol

Hyperliquid stands as a distinctive Layer 1 blockchain platform that utilizes its custom-developed consensus mechanism known as HyperBFT. At its heart, Hyperliquid features a decentralized derivatives trading platformbuilt around an on-chain order book system.

What sets Hyperliquid apart from conventional multipurpose blockchains is its specialized architecture, specifically engineered to support its core offering - a high-efficiency derivatives exchange. The platform's HyperBFT consensus protocol is designed to deliver minimal latency in transaction processing and blockchain communication.

The Hyperliquid crypto platform demonstrates remarkable throughput capabilities, processing up to 100,000 orders per second, positioning it among the most efficient Layer 1 solutions in the market.

The platform's oracle infrastructure serves as a crucial element of its derivatives exchange. This system continuously imports cryptocurrency price information from external data sources to facilitate trading operations and maintain accurate market pricing. The responsibility for this vital function falls to Hyperliquid validators, who update derivative contract prices at three-second intervals.

And now we present a step-by-step crypto strategy of how to reach an APR of up to 200% using the abovemnetioned Usual crypto platform and Hyperliquid crypto protocol.

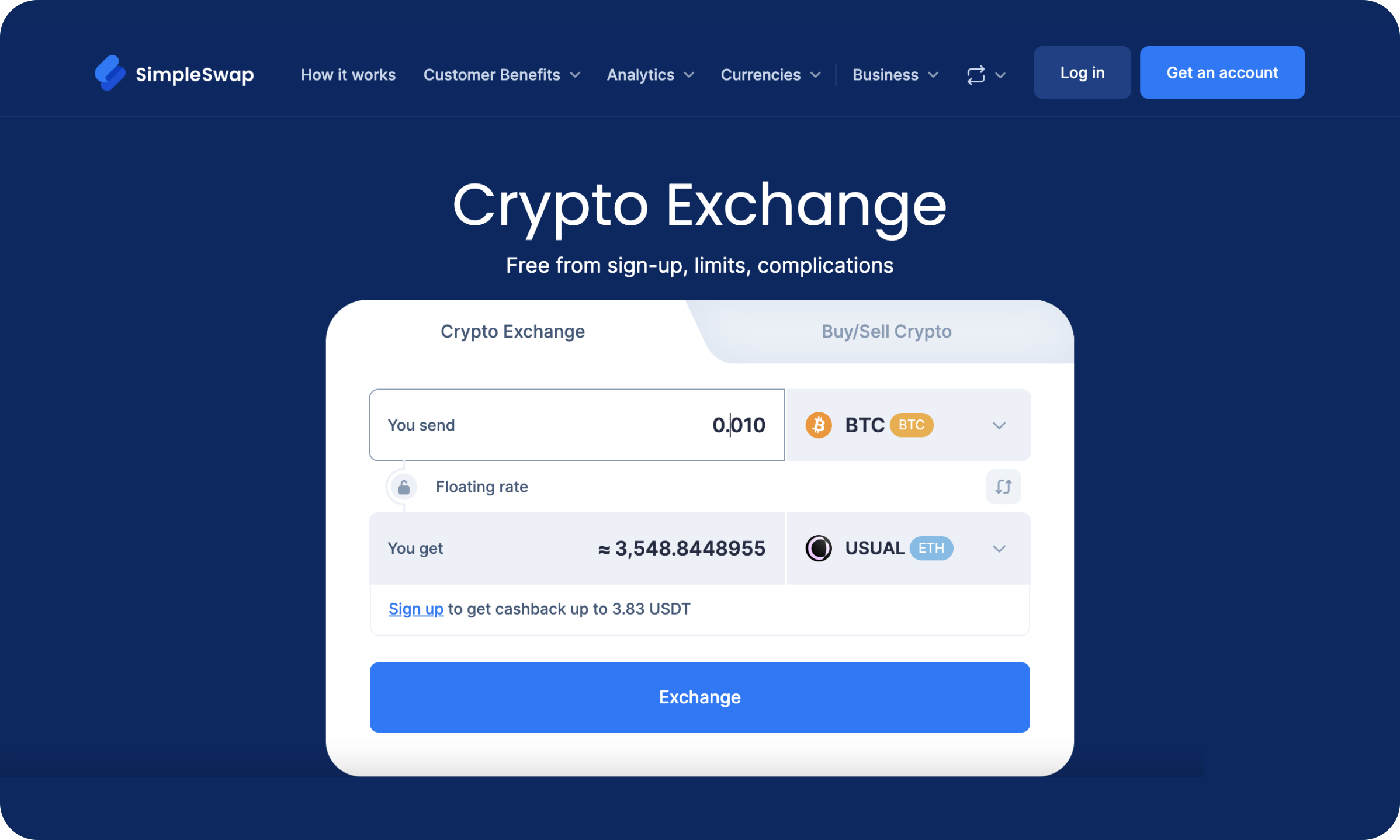

Step 1: Buying Usual on SimpleSwap

Select a currency to exchange

On the SimpleSwap main page, select the currency you want to exchange to Usual (e.g. Bitcoin or Ethereum).

Specify exchange amount

Enter the amount you plan to exchange. Make sure you check the current exchange rate.

Finalize the transaction

Click the Exchange button and follow the instructions to complete the transaction. Once the exchange is complete, you will receive Usual tokens in your wallet.

Step 2: Hedging a Position on Hyperliquid

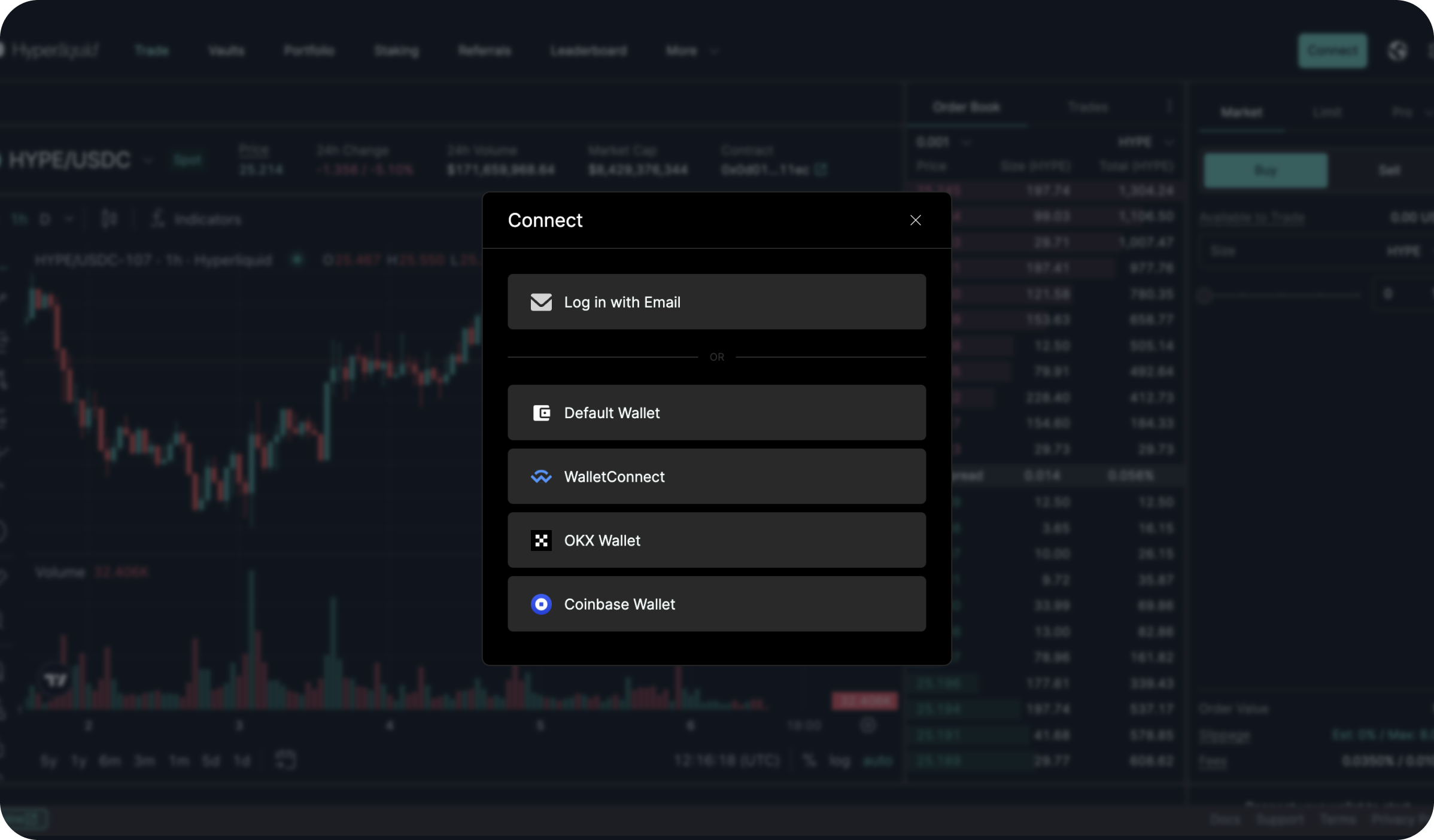

Using the Hyperliquid DEX

Go to Hyperliquid and connect your wallet. No registration is required.

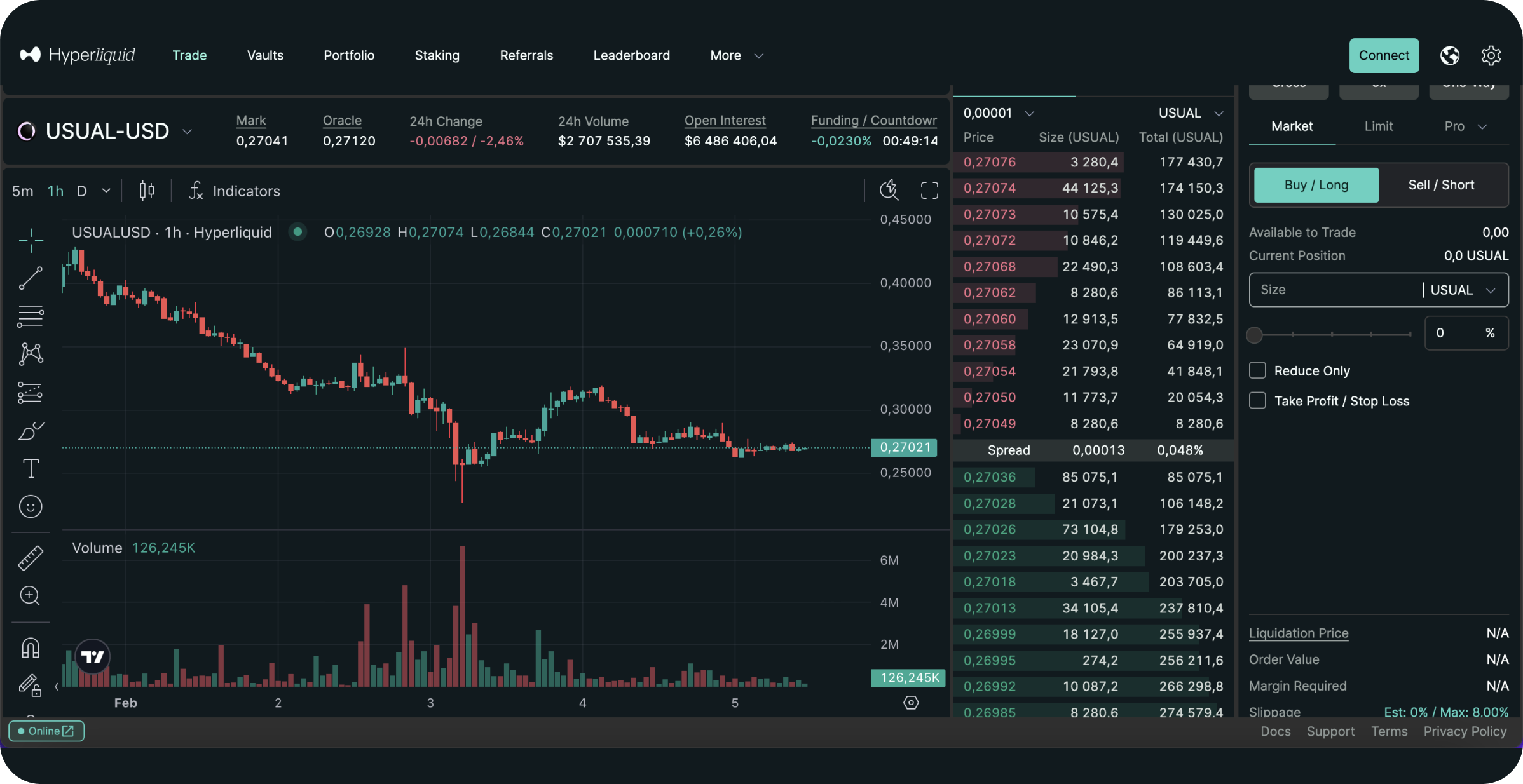

Opening a futures position

Go to the Futures (Trade) section and select Usual/USDT as the asset to trade. Open a short position (selling futures)to hedge the value of your spot position.

Determining the size of the position

If you bought $1000 USUAL, you can open a $1000 short for a full hedge or $500 USUAL for a partial hedge. Choose leverage (e.g., 5x) if you want to maximize potential profits. However, be aware of the risks associated with leverage.

Control the margin level

It is important to keep an eye on the margin level, which is the percentage between the free margin and the amount of margin locked in to maintain open positions.

If the margin level falls below the set value, you will receive a Margin Call. To avoid liquidation, deposit additional funds. In this case the situation is possible in case of USUAL price growth. In this case you need to calculate the amount to sell USUAL and sell the necessary amount to replenish the hedge position.

Confirming the transaction

Check all the details of the trade and confirm the opening of the short position.

Step 3: Staking Usual

Switch to the Usual crypto platform

Go to Usual for token staking.

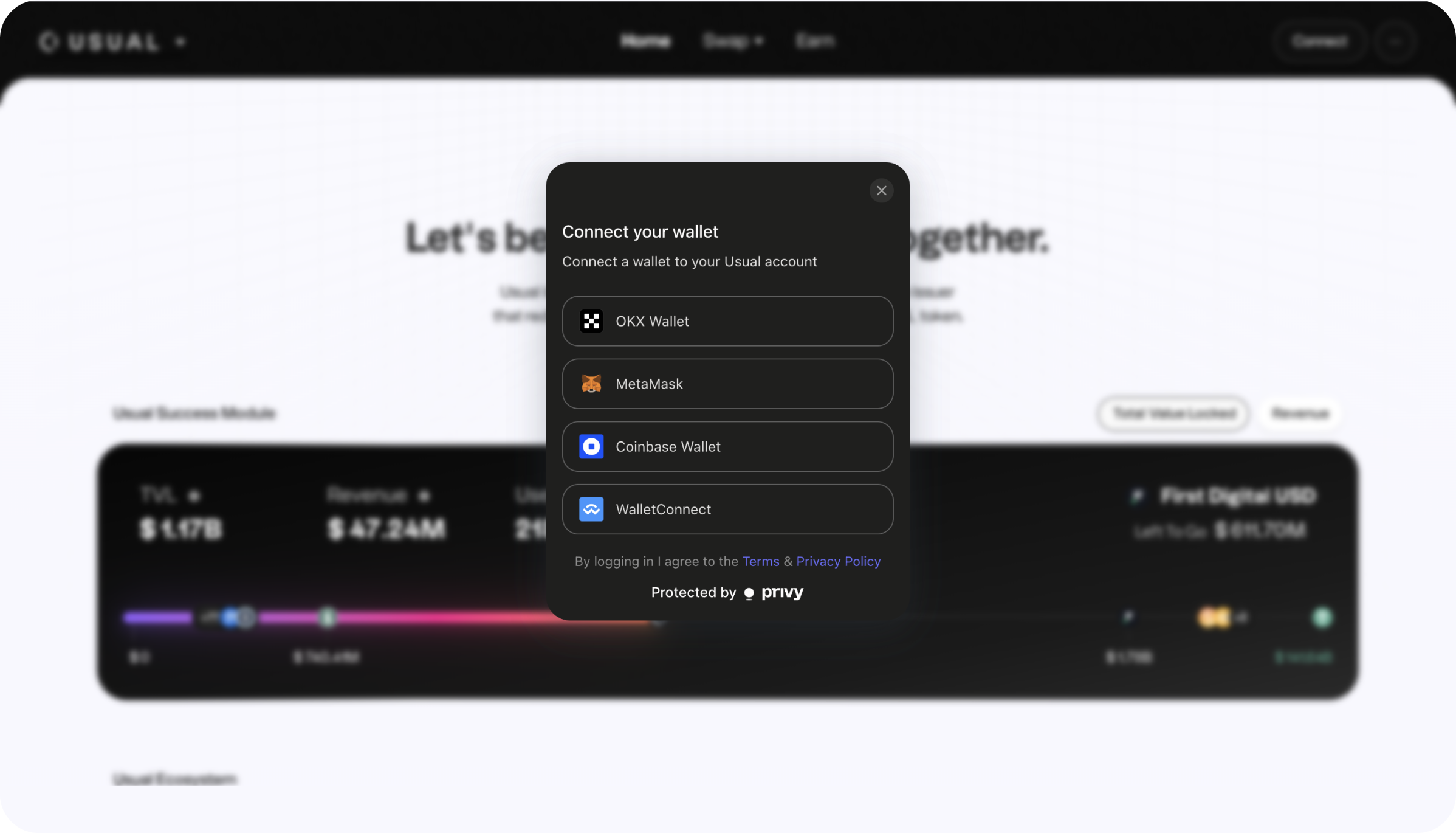

Connect a wallet

Connect the wallet that holds your Usual tokens.

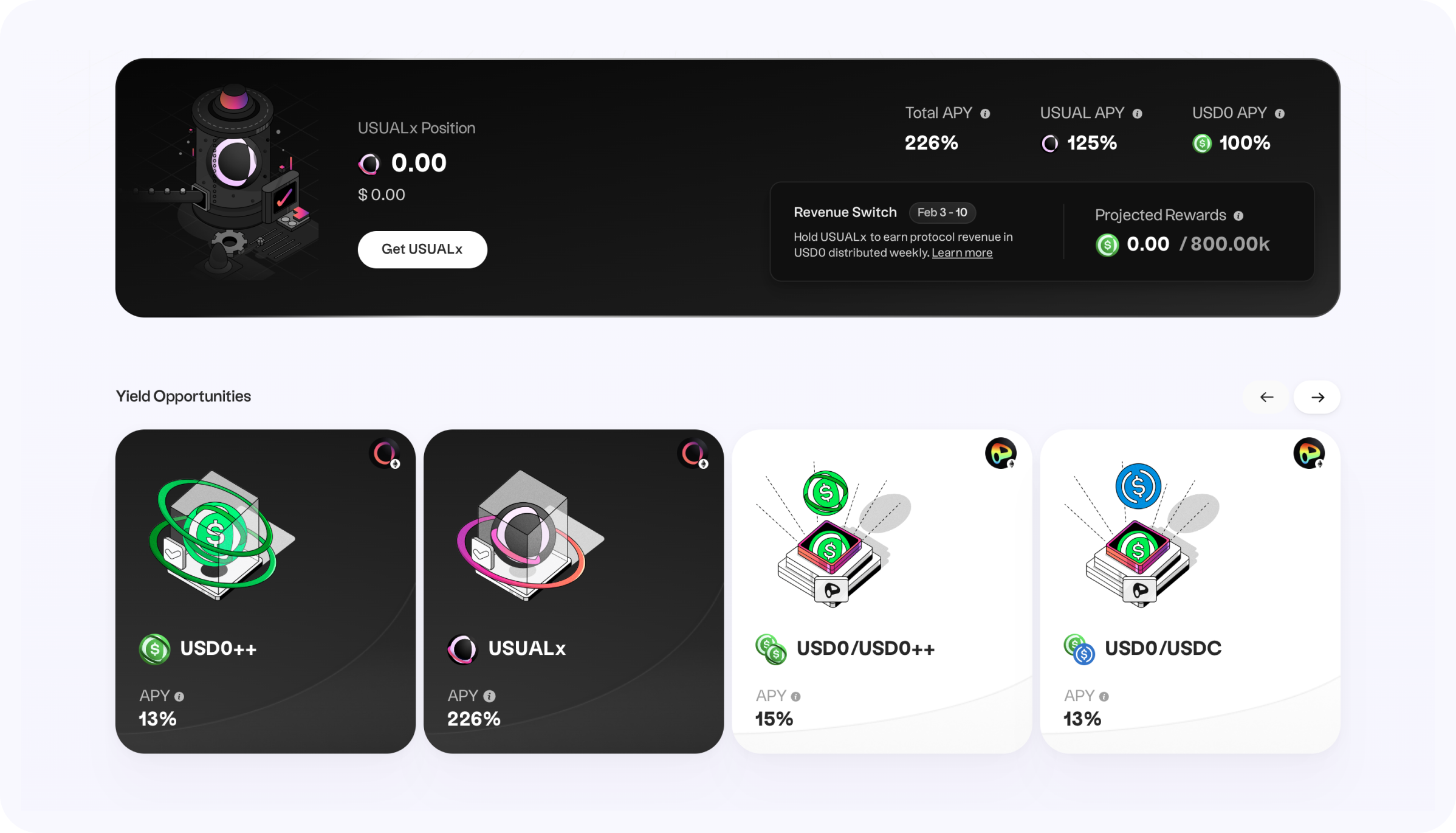

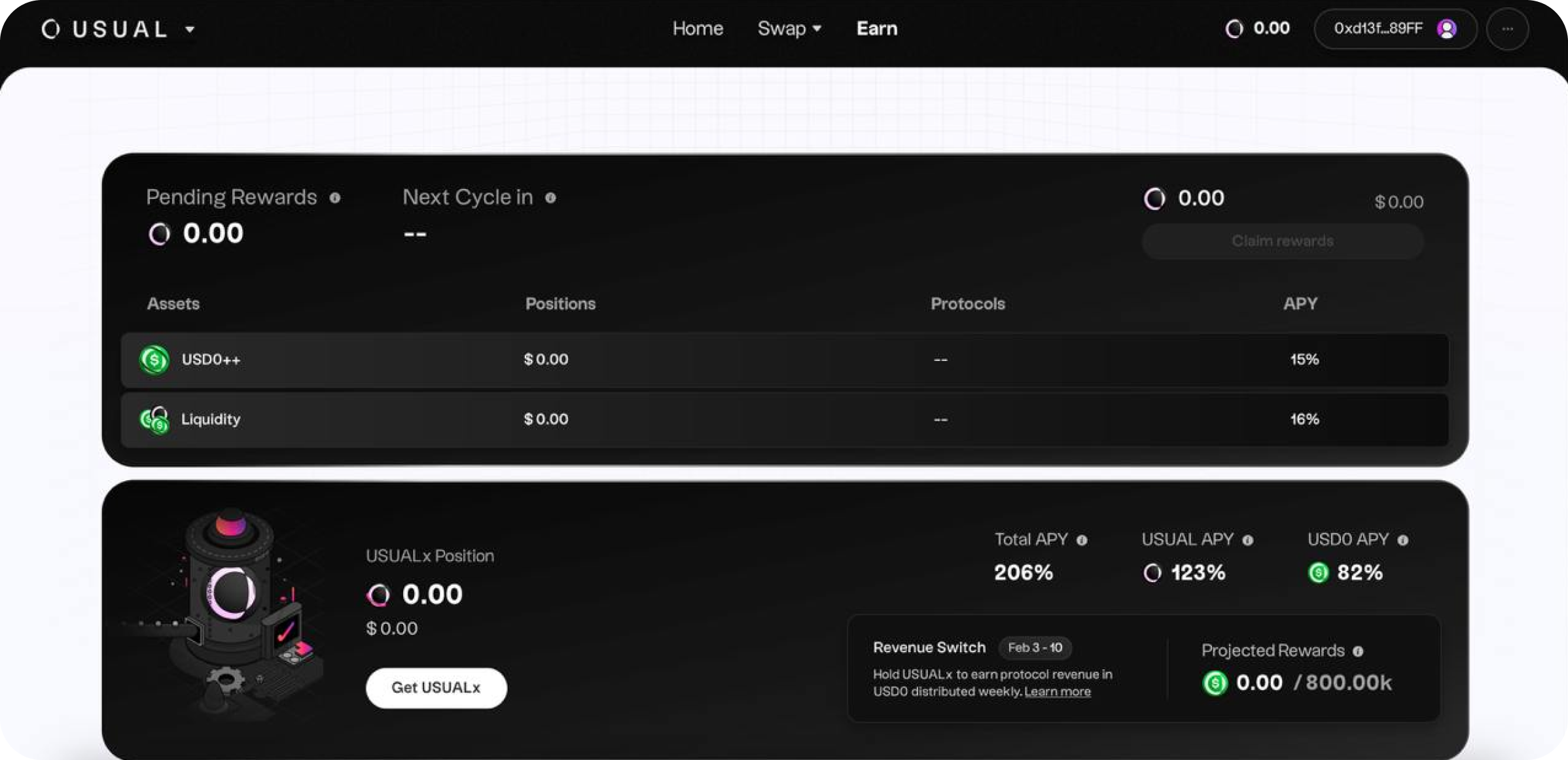

Select a staking option

Find the Earn section and select the option to place your Get Usual tokens.

Specify the amount to be staked

Enter the number of USUAL tokens you want to stake and confirm the transaction.

Wait for rewards

Once the tokens have been staked, expect rewards to accrue, which can reach over 200% APR.

Summary

The article provides a detailed guide on how to leverage the emerging capabilities of both the Usual crypto platfrom and Hyperliquid crypto protocol to maximize profits while minimizing risks in cryptocurrency investments.

We offer a crypto strategy that revolves around buying Usual tokens, using Hyperliquid DEX for hedging through futures, and staking tokens to earn significant returns. This approach capitalizes on Usual's decentralized and innovative stablecoin system and efficient derivatives trading framework of Hyperliquid.

By carefully managing investments and employing hedging strategies to protect against market volatility, investors can potentially achieve high yields, up to 200% APR.

Remember to keep an eye on your margin level when dealing with futures to avoid liquidating positions. Always consider the risks and do your own analysis before making investment decisions.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.